Morning Note: Market news, gold & silver, and Glencore

Market News

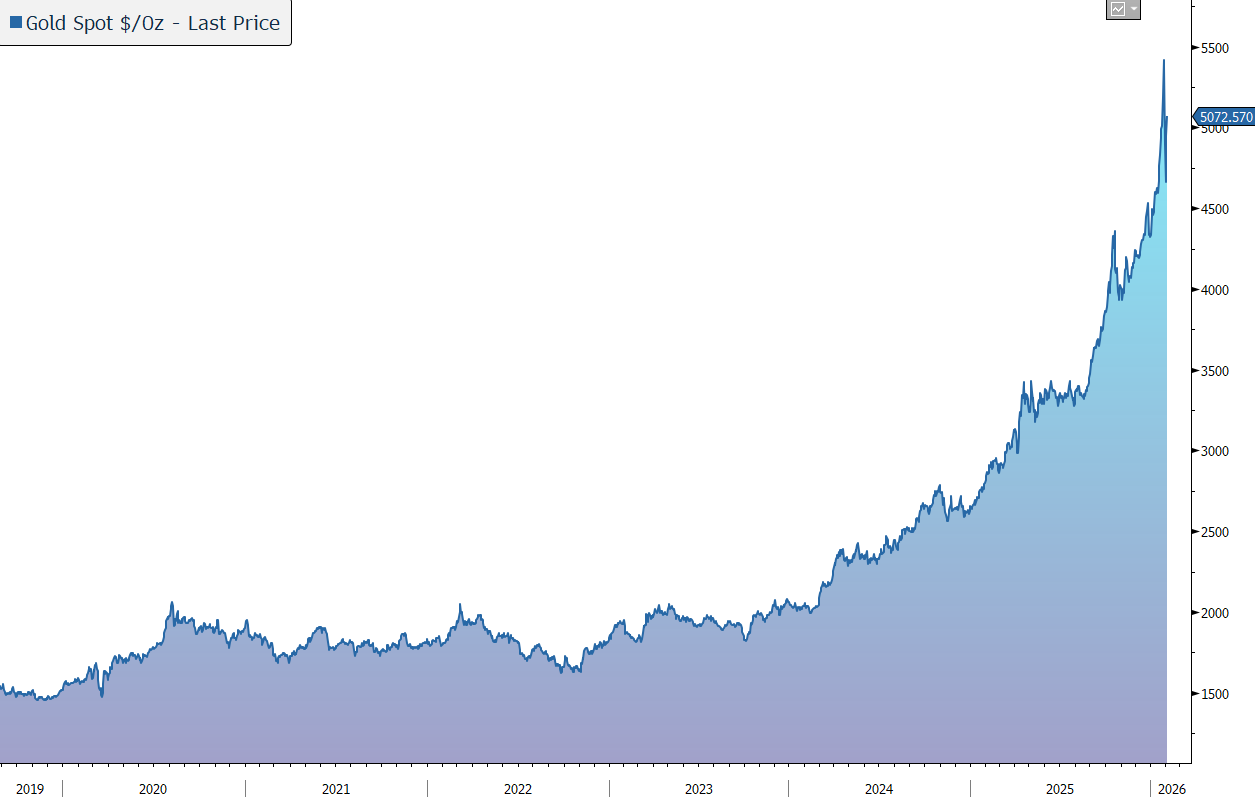

Gold has climbed back above the key $5,000 per ounce level, building on a more than 6% surge in the previous session, the biggest daily gain since 2008, as dip buyers stepped in following a sharp pullback earlier in the week. Geopolitical tensions also lifted the metal’s safe-haven appeal after US forces downed an Iranian drone near an aircraft carrier in the Arabian Sea. President Trump has signaled diplomacy remains active, with talks scheduled for Friday. We set out our thoughts on gold and silver below.

US equities fell last night – S&P 500 (-0.8%); Nasdaq (-1.4%) – with technology and software stocks down on the back of AI disruption fears. This follows a brutal day for some of the biggest data and analytics companies on the back on a major product launch from the US-based AI firm Anthropic. In particular, the company released a suite of ‘Agentic AI’ plugins for its Claude Cowork platform, including a specific legal productivity tool designed to automate contract reviews, navigate compliance, and triage NDAs. This could impact Relx’s most profitable division, LexisNexis, sending its shares down 14%. The news also hit other information ‘middlemen’ such as Experian (-8%), LSE (-13%), Wolters Kluwer (-13%), Sage (-10%), and Pearson (-8%). The stocks have continued to drift this morning.

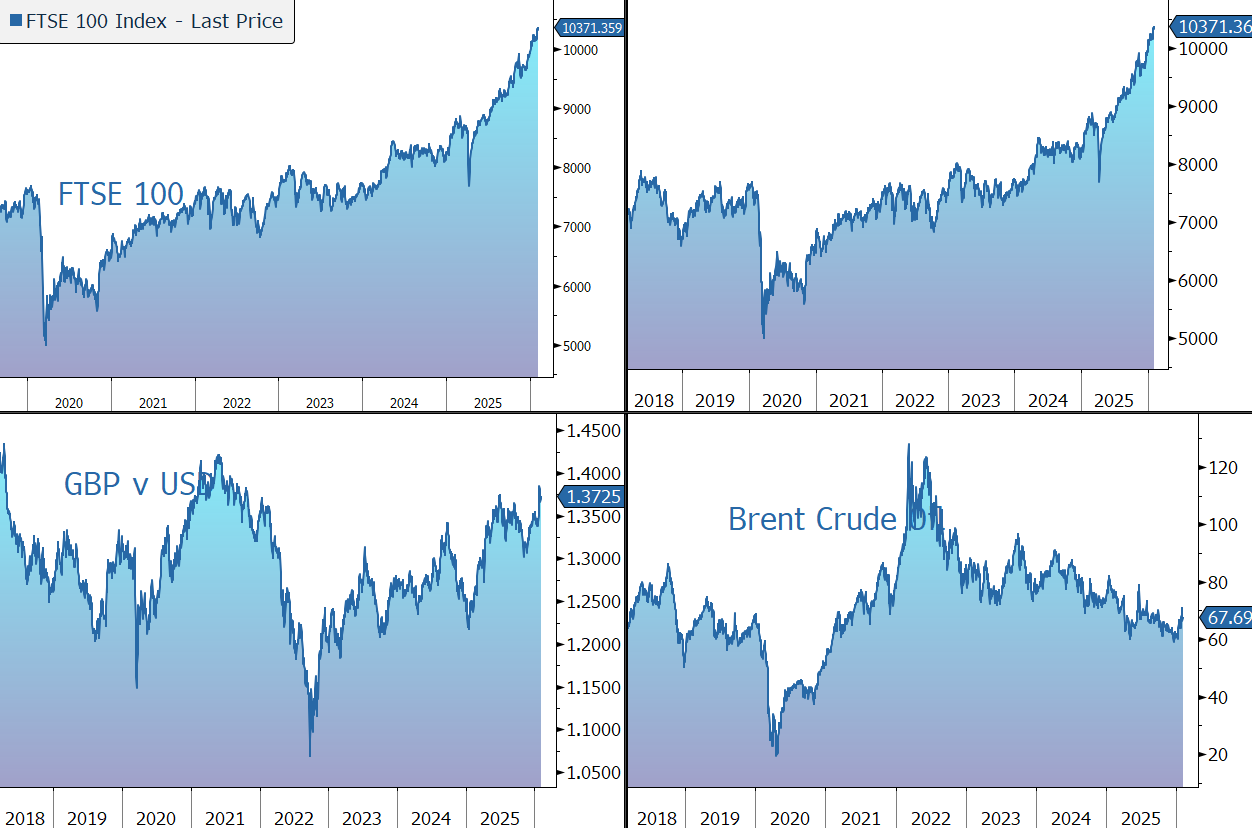

In Asia this morning, equities were mixed: Nikkei 225 (-0.8%); Hang Seng (+0.1%); Shanghai Composite (+0.9%). The FTSE 100 is currently 0.5% higher at 10,371, while Sterling trades at $1.3725 and €1.1610. Novo Nordisk is down heavily after the Wegovy drug maker said it expects its sales and operating profit in 2026 to fall year on year, driven in part by pricing pressure from the US government in its most important market.

Source: Bloomberg

Commodity Update – Gold & Silver

Given the recent wild gyrations, it is worth reminding ourselves of the important role that gold (primarily a monetary asset) and silver (primarily an industrial metal/real asset) can play in a well-diversified portfolio. The move in both metals has been parabolic in recent months and a reset was inevitable. Speculative flows had seeped into the recent moves making the prices vulnerable in the short term. This increased volatility can create psychological challenges for investors. Nevertheless, there are structural reasons (summarised below) that justify their inclusion in multi-asset portfolios as an important source of diversification.

Gold

Supreme Monetary Reserve Asset: Fully allocated physical gold is the only asset that is not someone else’s liability, to receive a 0% risk weight under Basel III (BIS rules). The only other 0% risk weighted assets are the currency and debt assets (both liabilities) of the domestic sovereign. This makes it officially recognised as a monetary asset and attractive for banks and central banks to hold as a reserve asset and means its value is derived from being a shadow reserve currency rather than a commodity. The “value” of outstanding gold is largely driven by changes in price rather than the amount of physical gold, unlike debt assets which are constantly being issued to finance deficits. Gold can be thought of as a zero-coupon bond of infinite duration and finite issuance. Debt is a yielding asset of finite duration and infinite issuance.

Record global investment demand: Global gold demand hit an all-time high in 2025, with significant inflows into gold ETFs and strong purchases of bars and coins, driven by investor concerns around geopolitical instability and weakening confidence in traditional fiat currencies. However, institutional investors in aggregate still have a virtually no allocation to gold (around 1%).

Safe-haven appeal persists: Surging geopolitical and economic uncertainty continues to push investors into gold. Analysts highlight ongoing macro risks that support the safe-haven thesis — including geopolitical tensions, inflation concerns, and central bank diversifications.

Central banks as major buyers: Many institutional analyses point to sustained central bank purchases as a key structural driver. Some forecasts expect continued strong accumulation as countries diversify away from single-currency exposures. This process was accelerated dramatically by the seizing of Russian foreign exchange reserves after the Ukraine invasion.

Negative or low real interest rates reduce the opportunity cost of holding gold, a non-yielding asset. Historically, this was viewed as the classic bull driver for gold, especially as global central banks navigate economic cycles. It is illuminating that despite the dramatic rise in real yields since policy normalisation in 2022, gold has continued to surge, indicating that meaningfully positive real yields are unsustainable given the existing global debt dynamics.

In Summary: An allocation to gold is an important component of wealth preservation and essential portfolio diversification.

Silver

Structural Fundamental Demand Growth: Solar energy demand is a core driver — silver consumption in solar panels has grown rapidly and, at scale, could exceed total new silver supply in the coming decade. Solar already accounted for around 20% of new silver demand and could grow to over 100% with continued solar build-out. Silver’s role in the energy transition means its demand isn’t just speculative, it comes from a tangible, industrial source that is itself growing rapidly.

Inelastic Supply and Structural Deficits: Global silver supply does not respond quickly to price, because much of it is a by-product of other mining (mainly copper, lead, and zinc) rather than mined on its own. This supply inelasticity could lead to prolonged deficits as demand grows. Supply constraints combined with demand shocks, especially from solar and broader electrification, create structural imbalance rather than short, cyclical deficits.

Embedded convexity: Small changes in solar and energy demand could have outsized impacts on silver due to supply constraints and increasing uses per unit of energy infrastructure. If even modest annual growth rates in demand can collide with very slow supply growth over years, the compounding can by significant. Given the lack of suitable substitutes and due to its tiny share of overall spending, the lack of impact that this will have of headline inflation rates, the upside potential is significant. This could be exacerbated by hoarding by those industrial players trying to get ahead of future shortages.

In Summary: While silver can be viewed as a “monetary adjacent” asset, the real story is one of building structural demand, inelastic supply and a shift in the macro-economic landscape driving money to flow into physical assets.

Source: Bloomberg

Company News

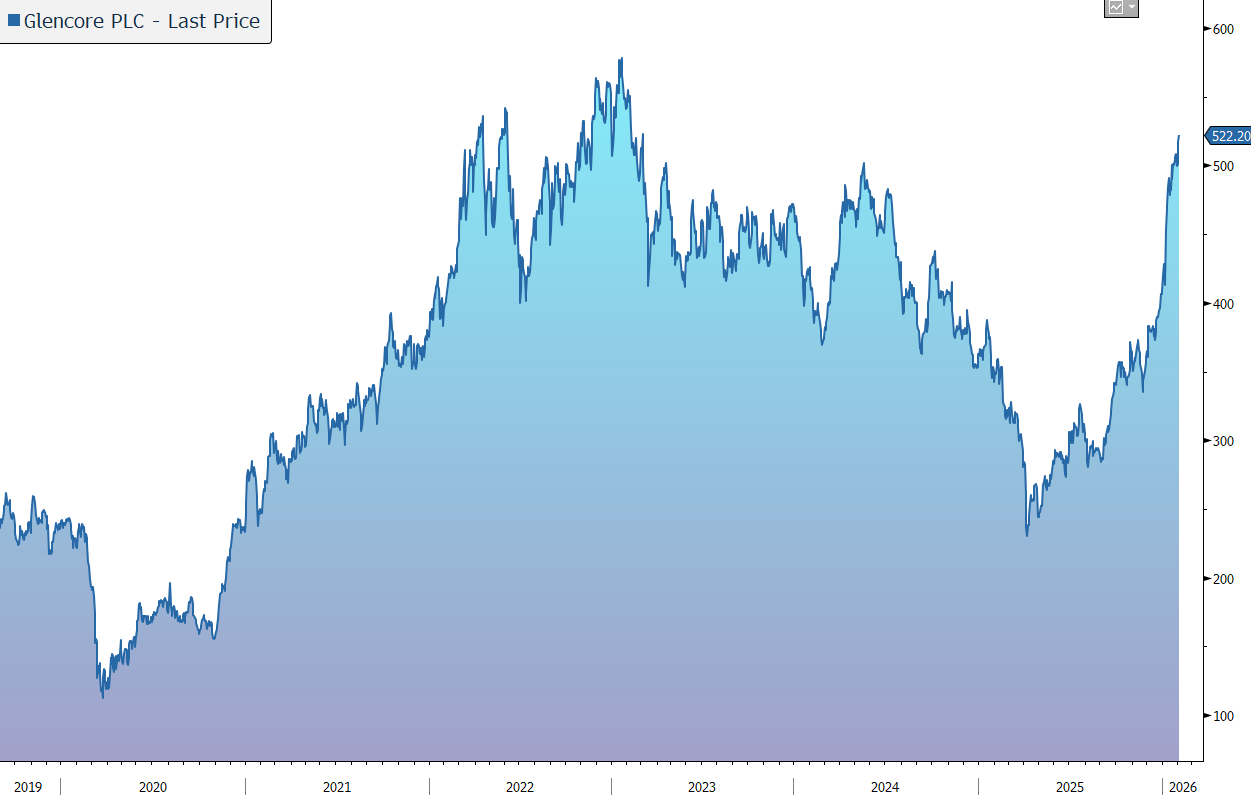

Glencore has announced a proposed acquisition by US-backed Orion Critical Mineral Consortium of a strategic stake in Glencore’s DRC assets. Given the key strategic importance of the copper and cobalt these assets produce, this announcement is very timely in light of the US government’s launch of its strategic critical mineral stockpile programme. It also derisks the political volatility associated with Glencore's African operations. The shares have been very strong of late, driven by the potential bid from Rio Tinto and the ongoing strength in the copper price. The shares responded with a further 3% increase following yesterday’s announcement.

Glencore is a vertically integrated commodities business, with a strong position in the production of copper, coal, nickel, zinc, cobalt, and precious metals, and a unique marketing business which markets and distributes commodities sourced from internal production and third-party producers to industrial consumers. The group’s strategy is to own large-scale, long-life, low-cost Tier 1 assets.

Yesterday afternoon, Glencore and the Orion Critical Mineral Consortium (Orion CMC) announced that they have entered into a non-binding Memorandum of Understanding in relation to a potential acquisition by Orion CMC of a 40% stake in Glencore’s interests in its Democratic Republic of Congo (DRC) assets, Mutanda Mining (Mumi) and Kamoto Copper Company (KCC).

Through this partnership, Glencore will be able to support the ambitions of the US government and private sector with the supply of two critical minerals – copper and cobalt.

KCC’s operations produce copper and cobalt hydroxide from its two open pit mines and one underground mine. Mumi’s operations produce copper and cobalt from its three open pit mines, providing raw ore feed for Glencore’s copper and cobalt production facilities.

Orion CMC is a mission-driven consortium designed to support the US and its allied and partner nations to develop secure, responsible, and resilient supply chains for the critical minerals that underpin future economic growth and security. This deal is the first major deployment of the US government's $12bn ‘Project Vault’ – a strategic stockpile initiative designed to decouple critical mineral supply chains from non-aligned influences.

Orion CMC will have the right to appoint non-executive directors in respect of the assets and direct the sale of the relevant share of production from the assets to nominated buyers, in accordance with the US-DRC Strategic Partnership Agreement, thereby securing critical minerals for the US and its partners.

Glencore and Orion CMC will also look for opportunities to expand and develop Mumi and KCC, working with the DRC government and Gécamines, Glencore’s existing partner in KCC, as well as to acquire additional critical mineral projects and assets in the DRC and the African copper belt more broadly.

The transaction is expected to imply a combined enterprise value for Mumi and KCC of around $9bn. This is positive news as it provides a ‘hard’ market valuation for Glencore’s most controversial assets. The market had previously applied a political discount to these mines, which will be partially removed as a result of this transaction.

That is important at a time when the company is negotiating merger terms with Rio Tinto and sends a

clear signal that its copper portfolio is highly valuable and won't be sold cheaply.

Last month, Glencore confirmed it is in preliminary discussions with Rio Tinto about a possible combination of some or all of their businesses, which could include an all-share merger between the two companies. With several corporate, strategic, and regulatory hurdles to overcome, there is no certainty a deal will occur. The parties’ current expectation is that any merger transaction would be affected through the acquisition of Glencore by Rio Tinto by way of a court-sanctioned scheme of arrangement. Under UK takeover rules, Rio Tinto must announce a firm intention to make an offer or walk away by 5pm on 5 February 2026.

In recent days, reports indicate that both parties are poised to seek an extension to the deadline and that Glencore is close to appointing Citi as its lead advisor to handle the potential $200bn merger. We also note that Rio Tinto’s largest shareholder, Chinalco, has backed a Glencore bid to gain copper access, potentially signalling Beijing is comfortable with the merger.

The primary sticking point is the takeover premium. Glencore is pushing for a valuation that reflects its massive copper growth pipeline, while Rio’s shareholders – particularly the conservative Australian base – are wary of overpaying at what might be the ‘top’ of the copper cycle.

Another major hurdle has been Glencore's coal business. However, the market expects that a deal would involve a simultaneous demerger or spin-off of the coal assets into a separate entity, allowing the ‘New Rio’ to remain a ‘green-metals’ pure-play.

Overall, the deal not only de-risks Glencore’s most complex jurisdiction but also improves its hand ahead of Thursday’s Rio Tinto deadline.

Source: Bloomberg