Morning Note: A round-up of today's financial market news.

Market News

Equity and commodity markets are rallying helped by a stabilisation in precious metals, positive US manufacturing data, and significant trade developments.

Gold (+5%) and silver (+10%) prices are recovering as investors step back in to ‘buy the dip’ after the initial panic selling appeared to have exhausted itself. President Trump is officially launching ‘Project Vault’, a $12bn strategic critical mineral stockpile program designed to counter China’s dominance in the sector.

Yesterday’s ISM Manufacturing PMI data came in at 52.6, the strongest in 41 months and the first expansionary reading (above 50) in a year. The prospect of a partial US government shutdown was averted.

President Trump announced the US and India had struck a deal on trade. While a formal agreement is yet to be reached, Trump claimed that the US would reduce its ‘reciprocal tariffs’ from 50% to 18%, while India would reduce its barriers to zero, promised to stop buying Russian oil, and would purchase $500bn of US goods.

US equities moved higher last night – S&P 500 (+0.5%); Nasdaq (+0.6%). Disney fell by 6% despite posting earnings ahead of market expectations. However, the market reacted negatively to the prospect of the increased cost of making films and new cruise ships. The company also warned of potential headwinds to international visitor numbers at its US theme parks.

Elon Musk is merging SpaceX with xAI in an all-stock deal valuing the new company at $1.25tn, people familiar said, bringing together two of the largest closely held companies in the world. SpaceX is still planning to do an IPO later this year. Alphabet’s Waymo raised $16bn at a $126bn valuation.

The MSCI Asia Pacific Index rose 3%, marking its strongest session since April. In Japan, the Nikkei 225 Index surged 3.9% to close at 54,721, marking fresh all-time highs as technology and financial stocks powered the rally. Elsewhere, the Hang Seng (+0.2%) and Shanghai Composite (+1.3%) both posted gains.

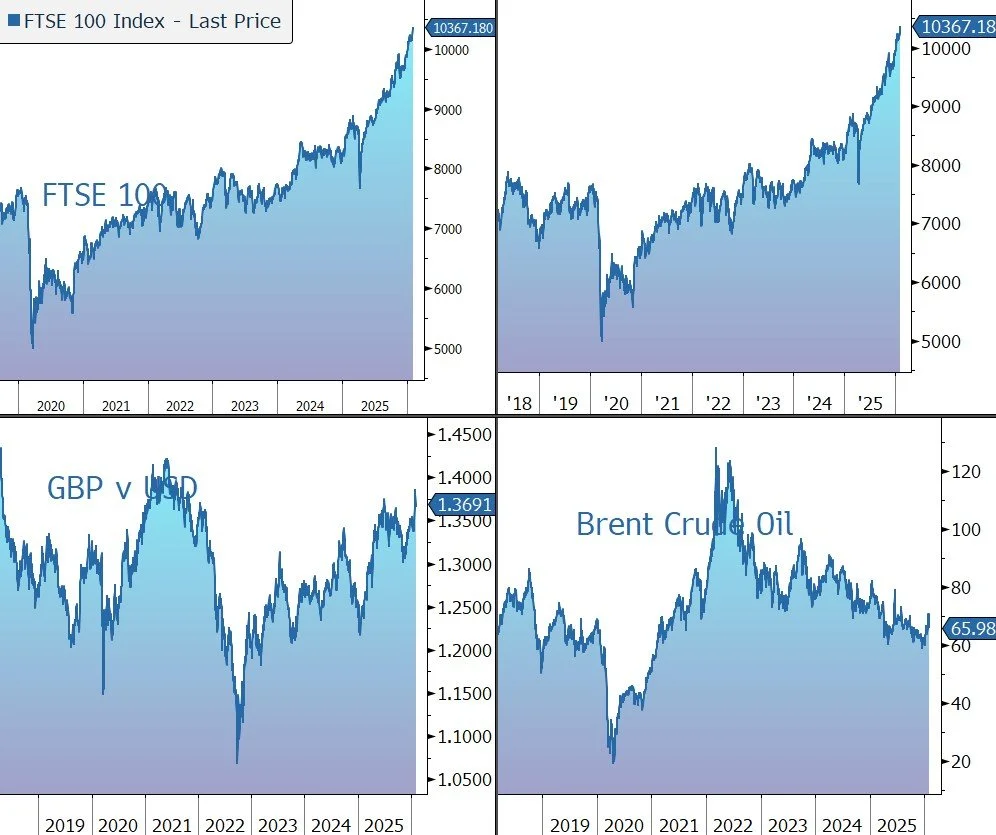

The FTSE 100 is currently 0.3% higher at 10,367, while Sterling trades at $1.3695 and €1.1590. Nationwide says the average price of a UK home rose by 0.3% last month after surprise fall in late 2025.

Source: Bloomberg