Morning Note: Alphabet (Google), Assa Abloy, and Compass Group.

Market News

Gold dropped back to $4,900 per ounce, giving back gains from a two-day recovery, pressured by renewed selling after Federal Reserve caution on rate cuts. Fed Governor Lisa Cook said she would not support additional cuts, prioritising persistent upside inflation risks over signs of a slowing labour market

Brent crude futures fell more than 2% below $68 a barrel, snapping a two-day advance after Tehran confirmed it would hold talks with Washington this week, easing concerns that a broader conflict could disrupt oil flows.

US equities were mixed last night, with the Dow Jones up 0.5%, while the S&P 500 (-0.5%) and Nasdaq (-1.5%) were dragged lower by technology stocks.

In Asia this morning, equity markets were also weak: Nikkei 225 (-0.9%); Hang Seng (-0.2%); Shanghai Composite (-0.6%). The MSCI’s gauge of Asian tech shares slid on Thursday for a fifth time in six sessions with Samsung Electronics and SoftBank Group among the losers.

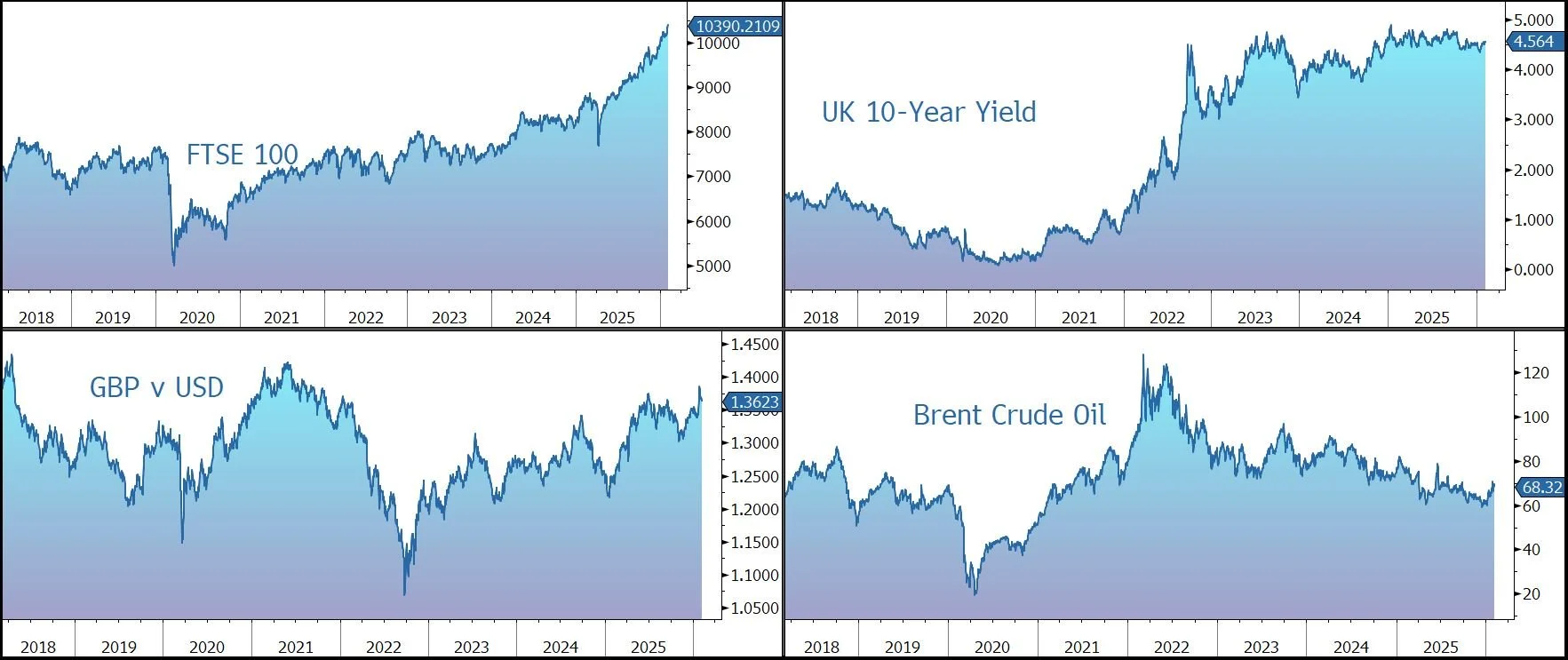

The FTSE 100 is currently 0.3% lower at 10,390, while Sterling trades at $1.3610 and €1.1530 ahead of today’s interest rate decision. The Bank of England is expected to hold rates at 3.75%.

Source: Bloomberg

Company News

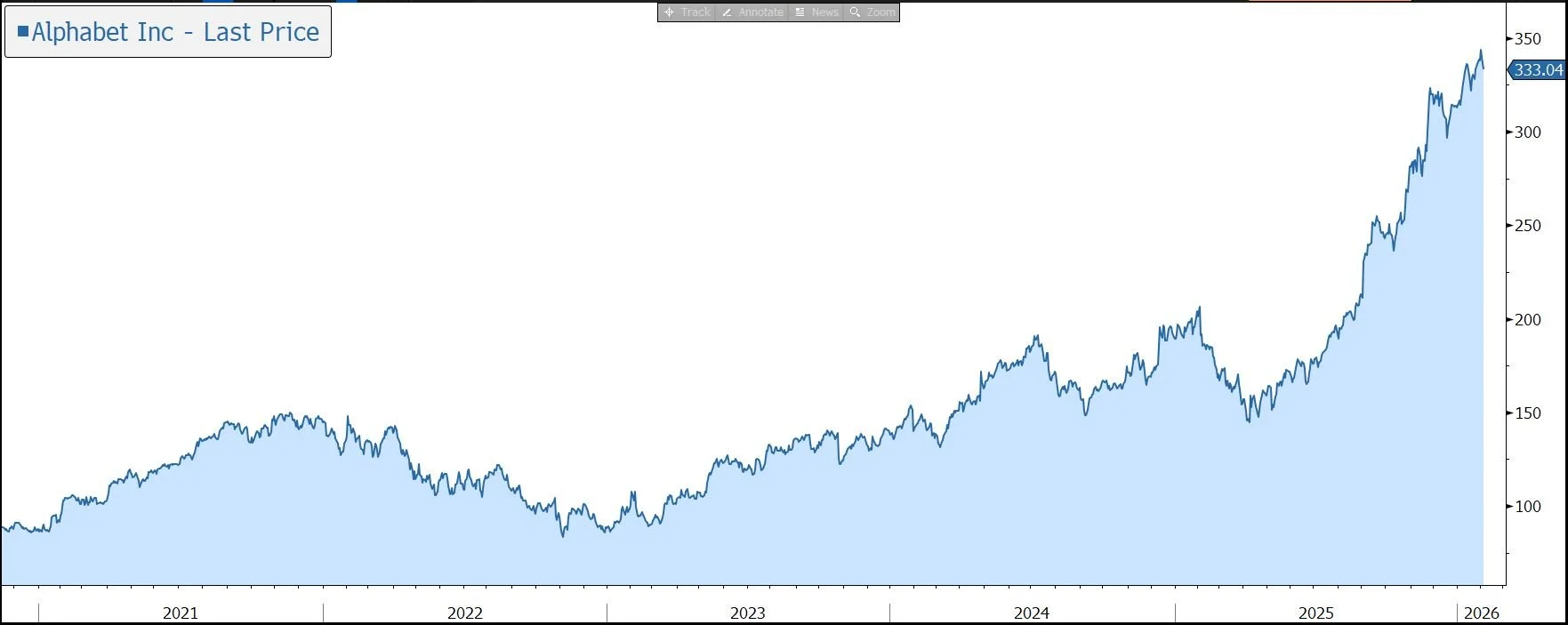

Last night, Alphabet released full-year results which were well ahead of market expectations, driven by an acceleration in search and cloud revenue. The massive step-up in capital investment in 2026 is 50% above market forecast but has been justified by existing monetisation in search and cloud and the significant increase in the group’s order backlog. Nevertheless, this came as a surprise and tipped the shares into a small loss in after-hours trading. The shares have been very strong over the last year, helped in part by a favourable court ruling, increased enthusiasm over the group’s competitive position in AI, and strong financial performance.

Alphabet is the public holding company for Google, one of the world’s most recognised and widely used brands. In addition to the core search engine, the group owns digital video platform YouTube, Google Cloud, web browser Chrome, mobile operating system Android, Gmail, Google Maps, AI personal assistant Gemini, Fitbit, autonomous driving company Waymo, drone delivery company Wing, among others.

The group has a strong track record of innovation, leaving it well placed to capitalise on a wide variety of technological themes, such as digital media, e-commerce, video advertising, the cloud, the internet of things, driverless cars, and AI.

The company has seven products with more than two billion users each and another eight with more than 500m users, most of which we believe are far from being fully monetised. The group’s structure allows it to own a portfolio of businesses with different time horizons, while its broad offering provides customer stickiness and a competitive edge. Capital allocation is spread across internal R&D, bolt-on M&A, and massive shareholder returns.

We believe Alphabet is very well placed for the world of AI – the company has been incorporating AI functionality into its search capabilities and other products for years. As a result of its vertically integrated ecosystem and immense financial strength, the company now holds several competitive advantages in the AI race.

· Google develops its large language models (LLMs) on its own semiconductors (Trillium) which are far more cost effective than comparable Nvidia models, providing it with a substantial cost advantage versus other AI players. The TPU v6 offers 4.7x better performance-per-dollar on LLM inference than Nvidia H100s. Overall, the company reduced Gemini’s serving costs by 78% in 2025.

· Google’s position in cloud services – it is one of the big three public providers, generating more than $60bn in annual revenue – leaves it well placed to provide the infrastructure and computing power needed for AI.

· Google owns the world’s largest and most robust personalised data and user histories from its scaled applications: YouTube, Maps, Gmail, Chrome, and traditional Search.

Last November, the company launched Gemini 3, the latest iteration of its family of AI LLMs, designed to be highly multimodal, built from the ground up to understand and operate across different types of information simultaneously, including text, code, audio, images, and video. External testing indicates Gemini 3 is the best publicly available model in terms of raw intelligence. It has been rolled out across Google’s distribution channels including AI Mode in Search and the Gemini App. In January, Apple and Google announced Gemini will power the next generation of Siri and Apple Foundation Models on iPhones. Although Gemini (with over 750m MAUs) still trails ChatGPT (with 800m MAUs), it is catching up and increased engagement is expected as Google’s pace of innovation continues.

Overall, following a period of investor concern regarding the threat to the company’s competitive position, we believe Google has begun to prove the doubters wrong and now has the infrastructure and application vehicles to fully monetise AI. This is supported by early data on AI Mode and AI Overviews which shows overall query growth, including increased user engagement and greater query depth, supporting both monetisation and advertiser return on investment.

Political and regulatory headwinds will always exist. However, in 2025 the US District Court issued its remedies order in the Google search monopoly case. The outcome was much less onerous than feared and removed a significant regulatory overhang. The break-up of the company was avoided (in particular, a forced sale of Chrome), the Apple distribution deal was largely untouched (although it must be re-bid annually), and the scope of data sharing was reduced (although it must share ‘click-and-query’ data). The Judge considered the potential impact on consumers and the rise of AI-driven rivals in reaching a decision.

Back to last night’s results. In the three months to 31 December 2025, revenue grew by 17% on a constant currency basis to $113.8bn, above the consensus forecast of $111.4bn, reflecting an acceleration of growth in both Google Services and Google Cloud. This compares to the 15% growth rate in the previous quarter and 15% expected by the market. Revenue for the full year grew 15% to $403bn.

The group reports its results across three segments: Google Services, Google Cloud, and Other Bets. Google Services is the largest division (84% of revenue), generating revenue primarily from digital advertising and the sale of apps, digital content products, hardware, and YouTube subscription fees. During Q4, Google Services revenue grew by 14% to $95.9bn, reflecting strong growth across all product areas.

Google Search (which accounts for 77% of ad revenue) increased by 17%, versus 15% last quarter (+13.4% expected). Advertising from Google Network Members’ websites (10% of ad revenue) fell by 2%. The group separates out YouTube, which accounted for 14% of ad revenue in the quarter and grew by 9% (+13% expected). According to ratings firm Nielsen, YouTube accounts for more than an eighth of all television usage in the US and there are currently more than 200bn daily views on YouTube Shorts.

Other sales within the Services division (known as Google Subscriptions, Platforms, and Devices) include Play, content products, hardware, service, licensing fees, Nest, and YouTube’s non-advertising revenue (which now accounts for a third of YT revenue). Google surpassed 325m paid subscriptions in Q3, led by growth in Google One & YouTube Premium. Revenue grew by 17% in Q4 to $13.6bn.

Traffic acquisition costs (TAC) are the fees Google pays to other companies (such as Apple) to carry its search service and adverts (i.e., cost of sales). During Q4 they grew by 12% and currently account for 20.2% of advertising revenue.

Google Cloud includes Google’s infrastructure and data analytics platforms, collaboration tools, and other services for enterprise customers. In Q4, the division grew by 48% to $17.7bn, well above the market forecast (35%) and a sharp acceleration versus the previous quarter (34%). Performance was led by growth in Google Cloud Platform (GCP) across core products, enterprise AI Infrastructure, and enterprise AI Solutions. The supply-demand balance remains tight – the backlog is up 55% quarter on quarter to $240bn – and the group continues to invest to grow the business. Despite this, Cloud quarterly profit grew from $2.1bn to $5.3bn, with a margin of 30%.

The group’s Other Bets division (less than 1% of revenue), which is effectively an incubator fund for new products and technologies, made a quarterly loss of $3.6bn, three times higher than last year. The group continues to wind down non-priority projects and focus investment on viable businesses like Waymo, the autonomous driving technology company, which has a potentially huge total addressable market – earlier in the week Waymo raised $16bn at a $126bn valuation.

Alphabet continues to ‘durably engineer’ its cost base to support its investment in long-term growth opportunities, most importantly AI. The number of employees rose by only 4% in the final quarter to 190k, while actions are being taken to optimise global office space and use AI to increase business productivity and efficiency. The group has previously highlighted that 25% of new code is being written by AI. The company reiterated its warning that the ramp up in capital investment (see below) is now feeding through to higher depreciation, which rose by 44% in Q4 and is expected to rise further in 2026.

In the latest quarter, efforts to improve efficiency continued, although the margin slipped from 32.1% to 31.6%, held back by a $2.1bn Waymo employee compensation charge. Excluding this, the 33.4% margin beat expectations. For the full year, margins held steady at 32%. EPS grew by 31% in the quarter to $2.82, well above the consensus forecast of $2.64. For the full year, EPS rose by 34% to $10.81.

As expected, capital expenditure rose sharply as the company continued to pour money into infrastructure for AI products – up 74% to $91.4bn in the year in line with guidance, split 60% servers and 40% of datacentres and network infrastructure. Capex will step up significantly again in 2026 to between $175bn and $185bn, well above the market expectation of $120bn, justified by the existing monetisation of previous investment across the business and the huge order backlog. On the call, the company highlighted that 95% of the top 20 SaaS companies now use Gemini, and the models are processing over 10 billion tokens per minute. The company also said that 40% of the spend is in longer duration assets like physical land and power infrastructure.

That said, there is concern regarding the level of spend and the potential risk of technological obsolescence and return on investment. However, the company highlighted that demand continues to exceed supply, justifying the continued ramp-up in investment. We also note the group has a strong track record for generating return on investment – together, Cloud and YouTube exited 2025 at an annual revenue run rate of $130bn.

Free cash flow generation was strong ($25bn in the quarter and $73bn in the year), despite ongoing spend on R&D and capex, while the group’s huge cash pile (including marketable securities and long-term debt) stands at $80bn. This has allowed the company to significantly increase its returns to shareholders. During the latest quarter, the company bought back $5.5bn of its shares, and in April the Board authorised the repurchase of up to an additional $70bn of shares. The company also pays quarterly cash dividends, putting the company on an equal footing with Microsoft and Apple in the minds of investors looking for yield.

Despite outperforming in 2025, the shares continue to trade on a reasonable valuation (30x ex-cash) relative to most of the other tech majors and at a level we believe is very attractive for a company exposed to several areas of long-term secular growth.

Source: Bloomberg

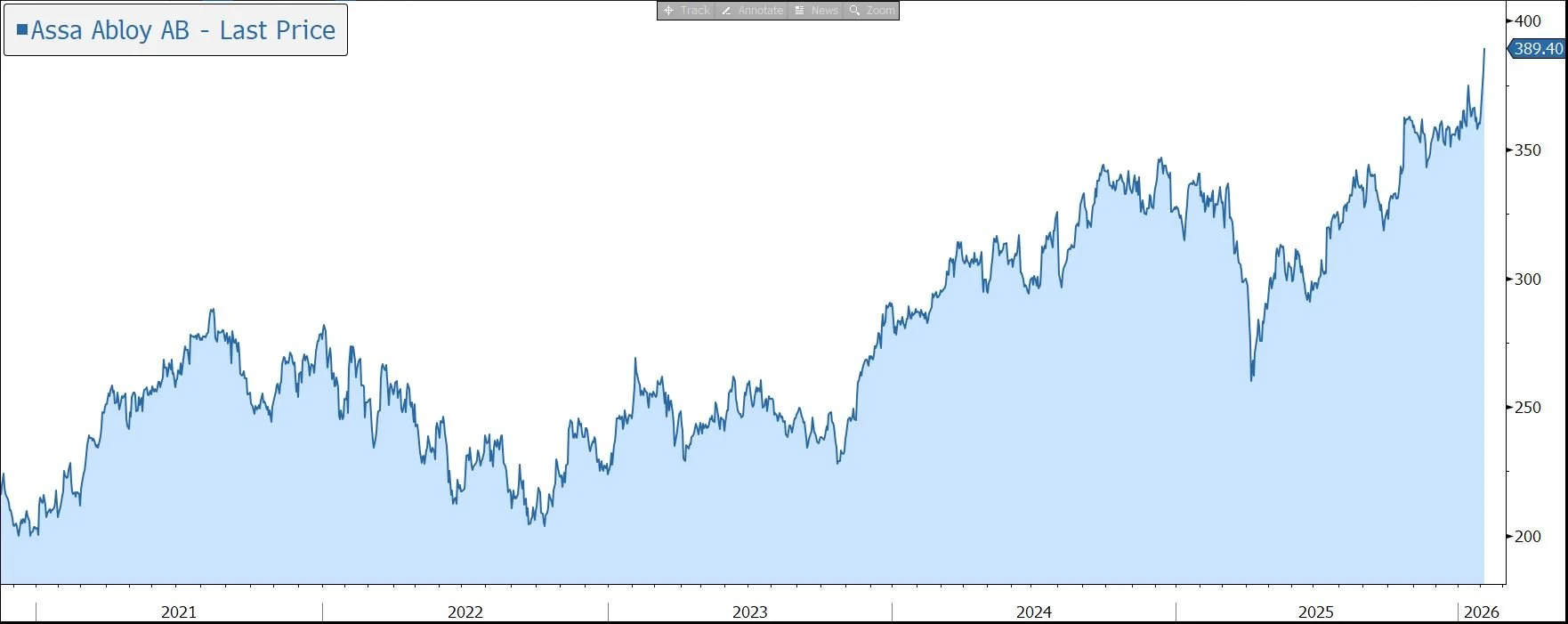

Assa Abloy has announced full-year 2025 results which were a touch below market expectations. However, stable organic sales in the North America Residential segment and a dividend above forecast are notable positives. Against a backdrop of mixed market conditions, the group’s decentralised structure and agile approach continues to be a great advantage. Ahead of this morning’s analysts’ call, the shares have been marked up by 3% in early trading.

Assa Abloy is the global leader in access solutions to physical and digital places, with a portfolio of well-known global and local brands, such as Yale, Union, HID, and Lockwood. Products include doors, sensors, locks, alarms, fencing, gates, and identity systems. Products are either offered on a standalone basis or combined to form a complete, full-service access offering.

The key long-term drivers of the $100bn industry are:

· increased demand for safety and security

· movement of people and demographic change

· increased wealth in emerging markets

· the shift to new digital and electronic technologies which have grown at 4.5x the rate of mechanical products over the last 10 years

· the development of sustainable buildings to meet climate change objectives

· the shift towards touchless (hygienic) activation points, automated doors, and location services

· constantly changing local market regulations which make it difficult for smaller operators to compete.

As the brand leader in most markets, with a large installed base, strong pricing power, and strong distribution channels, we believe Assa Abloy is well placed to take advantage of these trends. The strategy is to actively upgrade the installed base, generate more recurring revenue, increase service penetration, and expand exposure to emerging markets. The group’s broad offering is also well suited to address the fast-growing data centre market.

Assa Abloy has a strong track record of innovation and company aims to generate a quarter of sales from products launched in the last three years.

The company has a decentralised operating model and a strong track record on cost control. A new Manufacturing Footprint Programme, the group’s tenth, was launched last year, and is expected to generate annual savings of about SEK 1bn (equivalent to 60 basis points of margin) from 10 factory closures and 1,300 headcount reductions.

Overall, the long-term financial target is to generate annual sales growth of 10%, half organically and half from acquisitions. An operating margin of 16%-17% is the target over the business cycle, although the aim is to be towards the upper end of the range in the coming years. Management have previously said it needs to generate organic top-line growth of 3% to offset inflation and drive the margin forward. The group is on track to exceed its target to generate SEK 25bn of profit from SEK 150bn of sales by 2026, with new 2030 targets – SEK 41bn of profit from SEK 250bn of sales – outlined at the recent Investor Day.

Assa Abloy is a textbook example of late cycle business – locks are the last thing in a building and are changed when you’ve moved. In 2025, the macroeconomic environment was mixed, especially in the residential market that accounts for a third of sales. However, strong exposure to the aftermarket and operational agility continue to be a great advantage.

Net sales rose 1% to SEK 152.4bn, in line with the market forecast. In organic terms, which strips out the impact of acquisitions & disposals (+5%) and currency (-7%), sales rose by 3%.

During the final quarter, net sales fell by 3% to SEK 38.3bn, slightly behind the market forecast of SEK 38.6bn because of a 10% currency headwind. In organic terms, sales were up 4%, ahead of the market forecast of 2%-3%, with growth made up of a 1% volume and 3% price growth.

The group continues to actively upgrade the installed base by shifting customers from mechanical to electromechanical and digital solutions. Organic sales grew 8% in the final quarter, with growth driven by demographic changes, with a digital native younger generation and an aging generation in need of care, are accelerating the need for more convenient, reliable, and efficient electromechanical and digital solutions.

The company organised into three regional and two global divisions.

· Global Technologies (also a separate global division) reported strong organic sales growth of 9% in the final quarter with strong contribution from both HID and Global Solutions.

· Entrance Systems (a separate global division) achieved good organic growth of 2% with strong growth in the Pedestrian segment, while the other segments were good or stable.

· In the geographical divisions, Americas reported strong organic sales growth of 5%, with a continued strong North America Non-Residential segment and a stable North America Residential segment.

· The EMEIA region delivered organic sales growth of 4%, driven by strong development in the Nordics and Central Europe.

· Asia Pacific, fell by 2% despite good organic growth in Pacific & Northeast Asia, as the residential market in China remained very weak.

For the full year, operating income grew by 2% to SEK 24.7bn, with the adjusted operating margin holding steady at 16.2%, within the target range of 16%-17%.

In Q4, operating income slipped by 1% to SEK 6.45bn, a touch below the market forecast of SEK 6.50bn. The operating margin rose from 16.5% to 16.8%, supported by strong operating leverage of 39% driven by ongoing Manufacturing Footprint Programs savings, tariff-related price increases, and cost discipline. The margin includes the dilutive impact of acquisitions.

EPS rose by 2% to SEK 14.34 in the full year, and by 1% to SEK 3.85in the final quarter, a touch below the SEK 3.90 market expectation.

Operating cash flow fell by 2% in the year to SEK 22.7bn. Cash conversion was a healthy 1.06%. The group’s financial position remains robust, with net debt to EBITDA falling to 2.1x from 2.3x. Looking forward, gearing is expected to fall rapidly thanks to strong free cash flow generation. The group has declared a dividend up 8.5% for the full year to SEK 6.40. This equates to a yield of 1.7% and was ahead of market expectations.

M&A will continue to be a core driver of growth, with over 900 potential acquisition targets identified globally. The focus is on acquiring new customers in the core business, extending the core offering, access new technologies to deepen the group’s competitive position, and increased service capacity. However, there is some concern that recent M&A has been skewed towards lower value-added segments (e.g. DIY, window and door hardware components, fencing products, gates, padlocks, cylinders, etc). Although these acquisitions fit the purpose of growing earnings at lower multiples than the group average, they also dilute the group’s exposure to the fast-growing and structurally more attractive electromechanical and mobile segments, potentially posing a risk to the long-term valuation multiple.

The 2023 purchase of HHI for $4.3bn filled a strategic gap in the group’s US residential business. Although that market remains subdued, the business is performing well. Cost synergies have been achieved, though sales synergies have yet to be fully realised. The group still expects HHI to be a 16% margin business (vs. <10% at present) as volumes recover. A strategic review of the non-core HHI plumbing business is being undertaken, potentially fetching $1bn. Elsewhere, M&A activity remained buoyant with 23 deals in 2025 with combined cost of SEK 14bn. The pipeline remains strong, and the group still plans to make its usual 15-20 acquisitions per year.

Assa Abloy doesn’t usually provide guidance but highlights that it remains confident in the company’s ability to navigate varying market conditions. A continued focus on innovation, operational excellence, cost discipline, margin expansion, and strategic acquisitions, combined with a strong financial position, provides a solid foundation for continued profitable long-term growth and value creation.

The risk to this optimism is driven by a combination of interest rates, labour shortages, and tariffs. Management is dedicated to mitigating any impact from potentially negative changes in demand, through local agility and focus on cost-control. Assa has previously said that during both the global financial crisis in 2008/09 and the Covid-19 pandemic, its decentralised operational model and agile cost base provided flexibility. In addition, the group’s large exposure to after-market service and its structural pricing power leaves the business better positioned to navigate through uncertain times.

Structural tailwinds from the transition to electromechanical locks, increasing recurring and service revenue, data centre growth (collectively 60% of the business) and pricing should drive 5% organic growth. The current market expectation for organic sales growth is 4.7% in 2026 and 4.5% in 2027.

Source: Bloomberg

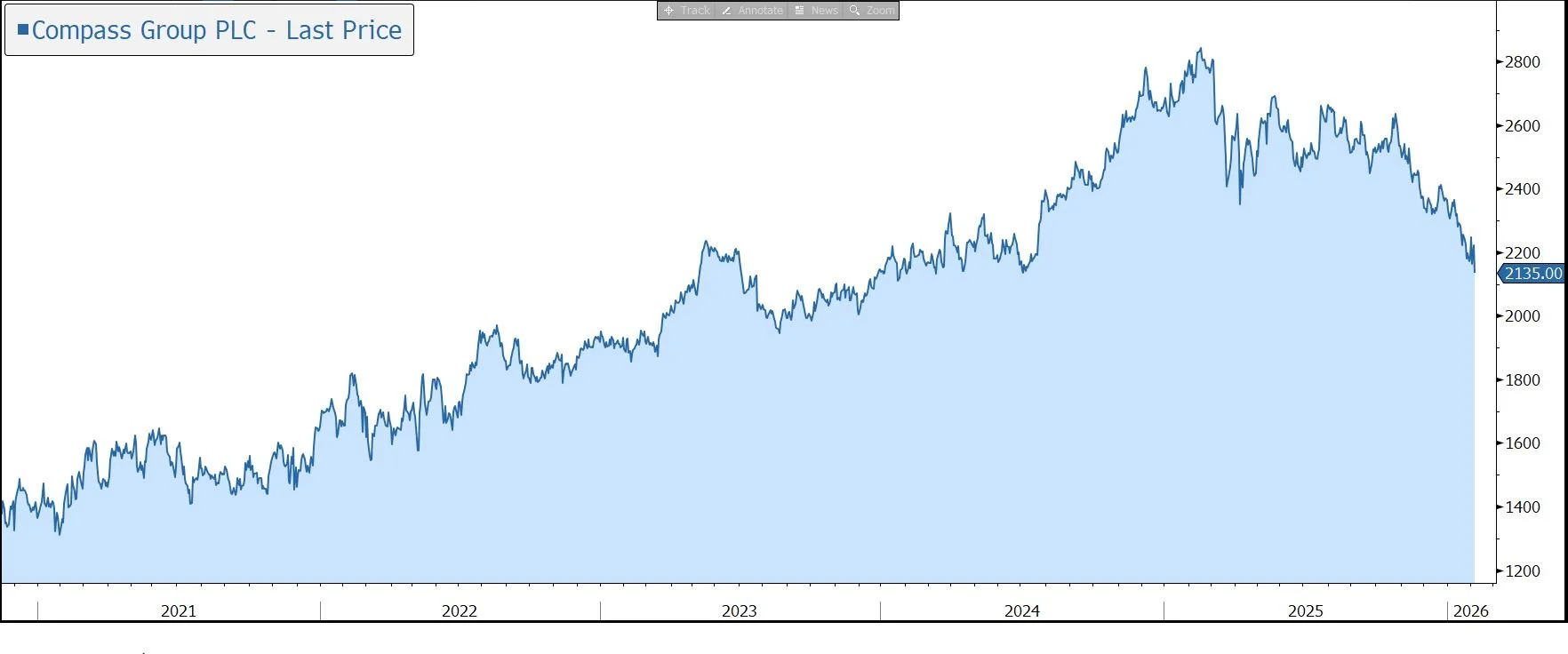

Compass Group has released a brief trading update which covers the first quarter of its financial year to 30 September 2026. The statement highlights a strong start to the financial year and the completion of the Vermaat acquisition in Europe. The company has reiterated its guidance for FY2026 – underlying operating profit growth of around 10%, driven by organic revenue growth of around 7.0% and ongoing margin progression. Although investors are unlikely to see a resumption of share buybacks any time soon, we believe the current strategy of reinvesting in the core business, both organically and M&A, is good capital allocation and will generate strong cash flow over time.

Ahead of this morning's analyst call, the shares are trading down 4%, a surprise given the results. This may be due to technical selling following the announcement of plans to change the trading currency of its shares from sterling to US dollars.

Compass is the world’s largest foodservice company, operating in around 30 countries, serving over 5.5bn meals a year. The group also operates a targeted support services operation, which accounts for 15% of revenue, and a third-party food purchasing business. The company reports in US dollars, but its shares are listed in the UK.

The company operates in a $360bn global market, which has expanded by a third in the last four years, despite exits from 15 countries, with the help of acquisitions in segments which increase its captive audience. As the largest player (albeit with less than a 15% share), the company’s scale provides a vital advantage over smaller players in terms of buying power. It is the fastest growing major operator, with the highest level of retention, and the highest margins in the industry

The scope for growth from first-time outsourcing and share gains is significant – nearly 75% of in-house catering is still self-operated or managed by regional players – and Compass has an excellent pipeline of new business. Companies and other institutions are open to outsourcing as they seek to reduce operating costs, improve health and safety protocols, and ensure resilient food supply chains. As a result, Compass is well placed to consolidate its position as a trusted, financially strong provider, able to offer clients and consumers safe and innovative solutions.

Management therefore believes net new business growth can be sustained at 4%-5%, above the historical level of 3%. This comes on top of like-for-like volume and price growth.

Although there are threats – permanently increased levels of working from home and online learning, rising unemployment (exacerbated by AI), and increased competition from delivery providers – we believe Compass is well placed to cope as a result of its diversified and defensive revenue mix, decentralised business model with predominantly local sourcing and supply chain, and a higher level of volume protection in contracts.

Compass Group may be a ‘physical reality’ beneficiary of the shift to AI. With 90% of operations in tangible services—like food prep and hospital sanitisation—its core business remains immune to digital replication. As ‘white-collar’ displacement expands the available labour pool, Compass should benefit from reduced wage inflation and improved margins. Strategically, Compass is using Agentic AI to slash middle-management and administrative overhead, deploying agents to manage logistics and scheduling for its 500,000+ global staff. Partnering with Google/Gemini, it has integrated AI kitchen managers that adjust inventory in real-time, cutting food waste by 15-20%.

In the near term, the shares have been impacted by concerns over falling inflation and the impact on pricing, the threat of lower US client retention and corporate layoffs, and the deferral of share buybacks following the Vermaat acquisition.

Overall, we believe the company has a significant runway for long-term growth. Management remains confident in sustaining mid-to-high single-digit organic revenue growth, ongoing margin progression, and profit growth ahead of revenue growth.

In the three months to 31 December 2025, the group continued to capitalise on dynamic market trends, using its proven competitive advantages to drive revenue growth.

Organic revenue – a combination of like-for-like volume growth, price, new business, and client retention – grew by 7.3%, a strong result against a tough year-on-year comparison.

The group continued to benefit from strong outsourcing trends, with net new business growth within the group’s 4%-5% target range, underpinned by strong client retention above 96%. Pricing moderated as anticipated in a lower inflation environment, while volumes continued to contribute positively to growth.

The group’s largest region, North America (68% of revenue), grew by 7.3% in organic terms, while the smaller International division was up 7.1%.

The company delivered strong performances across all sectors, with Sports & Leisure (S&L) and Business & Industry (B&I) remaining the fastest‑growing areas. B&I achieved double‑digit organic growth in North America, driven by robust first‑time outsourcing (FTO) wins and continued expansion within the technology sector.

Annualised new business wins totalled $4bn, up 10% year on year, with nearly half generated from FTO.

As expected, there is no update on profitability or the group’s financial position at this stage. The group’s flexible cost base has helped the margin to recover from pandemic lows despite re-opening expenses, the cost of mobilising new contracts wins, and inflationary pressures.

As Compass focuses on the significant structural growth opportunities in its core markets, it has stepped up its M&A activity to expand its portfolio of brands, focusing on digital innovation and delivered-in solutions. Over the last two years, it has spent $4.1bn (10% of current market cap), with potentially one more deal in the pipeline in Europe. The most recent deal, the $1.7bn acquisition of Vermaat, has been completed and the strategic integration is underway. This adds a leading premium food services business in Europe which will be used to create a strong growth platform in a region which has consistently underperformed North America on both organic growth and margins.

As a result, the company’s financial leverage has moved to the upper end of its medium-term target of 1.0x-1.5x net debt to EBITDA – including the Vermaat deal, Compass anticipates its leverage will be around 1.5x at the end of FY2026, before falling in FY2027. Although this clearly reduces the amount of excess cash flow available for share buybacks in the near term, we believe reinvesting in the core business is good capital allocation and will generate strong cash flow and returns over time. In the meantime, the company continues to pay an attractive dividend – the FY2025 payout was increased by 10.2% to 65.9c, equal to a yield of 2%.

Compass has reiterated its guidance for FY2026 – it expects constant currency underlying operating profit growth of around 10%, driven by organic revenue growth of around 7%, around 2% profit growth from M&A (including Vermaat), and ongoing margin progression. Although the revenue target appears conservative, the company does face some tough year-on-year comparatives in FY2026.

In today’s update, the company highlights that with effect from 1 April, it intends to change the trading currency of its ordinary shares on the LSE from sterling to US dollars. This transition aligns the group’s share price trading currency with its reporting currency, reducing FX volatility in the share price and simplifying the investment case for global investors. The change will not affect the group’s FTSE index inclusion or its LSE listing. Dividends will continue to be paid in sterling unless shareholders elect to receive them in US dollars.

The statement highlighted that if current currency spot rates were to continue for the remainder of the year, FX translation would positively impact revenue by $630m and operating profit by $33m.

Source: Bloomberg