Morning Note: Market news and updates from Shell and Constellation Brands.

Market News

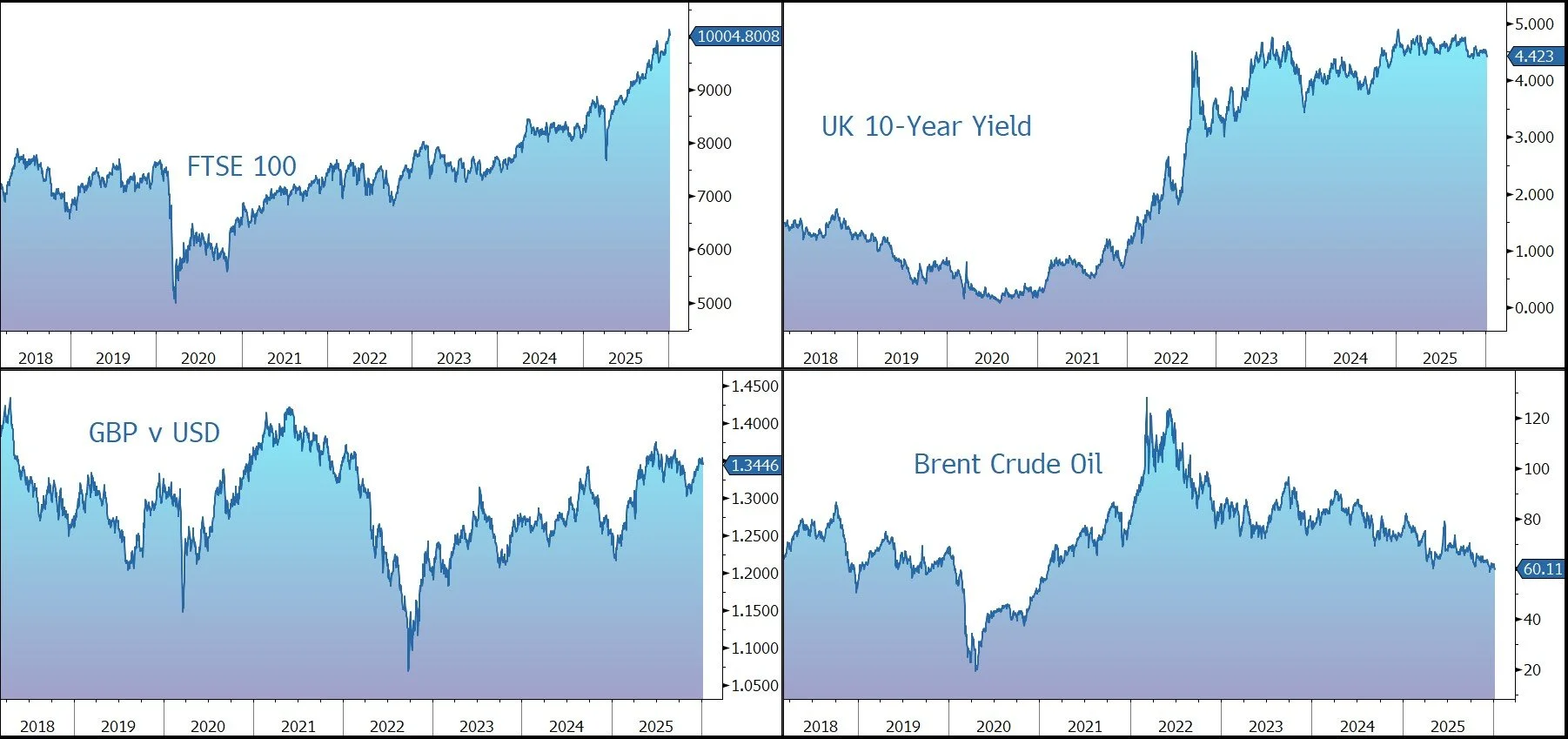

Global government bonds and Treasuries have rallied on weak US economic data and rising geopolitical tensions. The 10-year Treasury yield slipped to 4.14%, while the 10-year Gilt yield fell by seven basis points to 4.41%. Global bond sales had the busiest start to a year, with a record-breaking $245bn borrowed in the first seven days.

Precious metals experienced some profit taking – gold $4,432 an ounce; silver $75 an ounce – as traders brace for the annual adjustment of major commodity indices like the Bloomberg Commodity Index (BCOM). Gold will see a reduced weighting in the BCOM from 20.4% to 14.9% to comply with diversification rules that cap any single commodity at 15%. Silver’s weighting will also fall. Oil and natural gas will see an increased weighting.

Brent Crude slipped below $60 a barrel. Oil traders and US refiners are rushing to position for access to Venezuelan crude, with Chevron in talks to expand its operating license and Citgo considering resuming purchases from the country. However, US oil firms are seeking guarantees from Washington before making investments in the country.

President Trump called for a 50% increase in annual defence spending to $1.5 trillion in 2027. He also signed an order pressing defence contractors to spend less on buybacks and dividends and threatened to cut off Raytheon.

US equities were mixed last night – S&P 500 (-0.3%); Nasdaq (+0.2%). Blackstone sank with housing-related shares after Trump pushed to block institutional investors from buying homes in the US, a move that blindsided Wall Street. In Asia this morning, equities declined: Nikkei 225 (-1.6%); Hang Seng (-1.1%); Shanghai Composite (-0.1%). Samsung posted record profit thanks to surging global demand for AI servers. However, the shares slipped. The FTSE 100 is currently 0.4% lower at 10,004.

Source: Bloomberg

Company News

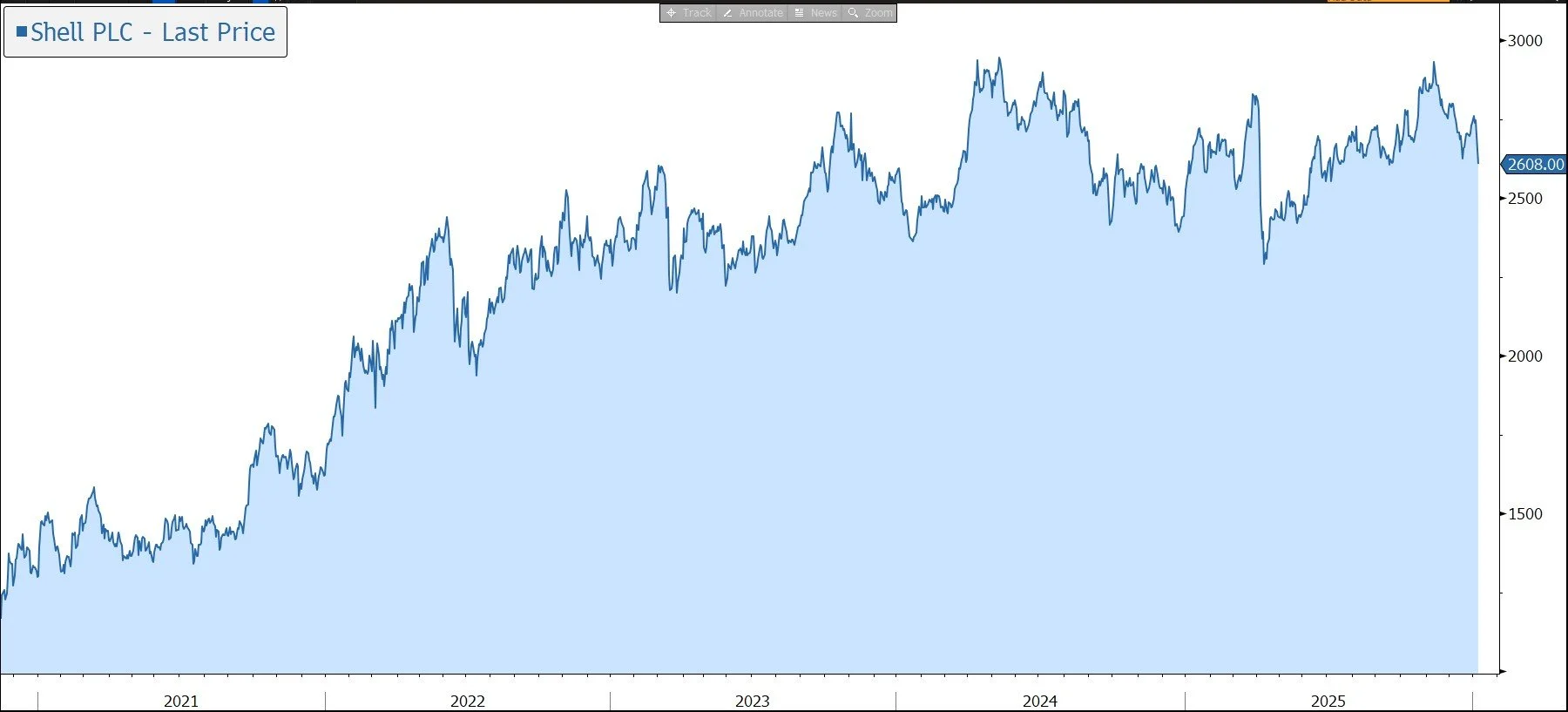

Shell has released an overview of its current expectations for the fourth quarter which highlights a mixed performance with a loss expected in the Chemicals division and a subdued trading result. Full details including news on the dividend and share buybacks will be published with the results on 5 February. In response, the shares have been marked down by 2% in early trading.

Shell is a global integrated energy company with expertise in the exploration, production, refining, and marketing of oil and natural gas, and the manufacturing and marketing of chemicals. The group is also allocating capital to low and zero carbon products and services including wind, solar, advanced biofuels, EV charging, hydrogen, and carbon capture & storage. According to Brand Finance Global 500, Shell is the most valuable brand in the industry, valued at around $50bn.

The business is divided into five segments:

· Upstream (i.e. E&P) explores for and extracts crude oil, natural gas and natural gas liquids. Shell has best-in-class deepwater assets complemented by resilient conventional assets in the Gulf of Mexico, Brazil, Nigeria, UK, Kazakhstan, Oman, Brunei, and Malaysia.

· Integrated Gas includes liquefied natural gas (LNG), conversion of natural gas into gas-to-liquids (GTL) fuels, and other products. Shell is the global leader in LNG (achieved through the 2016 acquisition of BG), a critical fuel for the energy transition, with a business that spans upstream, liquefaction, shipping, marketing, optimising, and trading.

· Chemicals & Products is made up of a focused set of assets – there are currently five energy and chemicals parks (i.e. integrated refining and chemicals sites) and seven chemicals-only sites.

· Marketing includes mobility, lubricants, and decarbonisation. In addition to the service stations with their EV charging footprint, Shell is the global number one lubricants supplier and operator of assets is renewable natural gas, sugar cane ethanol, and biofuels.

· Renewables & Energy Solutions includes Shell’s production and marketing of hydrogen, integrated power activities (solar and wind), carbon capture & storage, and nature-based projects. The assets are helping to reduce the carbon intensity of the group’s hydrocarbon product sites. The group is however stepping back from new offshore wind investments and is splitting its power division following an extensive review of the business.

The company has set out several operational and financial targets including:

· an increase in the structural cost reduction target from $2bn-$3bn by the end of 2025 (already achieved) to a cumulative $5bn-$7bn by the end of 2028, compared to 2022. In the first half of 2025, the company generated $0.8bn of reductions, with the cumulative total standing at $3.9bn. Around 60% of the savings will come from non-portfolio actions (i.e. not as a result of disposals). The company is actively exploring and harnessing AI to transform workflows and enhance business outcomes.

· Invest for growth while maintaining capital discipline, with capital expenditure lowered to $20bn-$22bn p.a. for 2025-2028. The company continues to divest non-core assets and step back from projects with limited returns.

· Grow free cash flow per share by more than 10% p.a. through to 2030 and generate a return of more than 10% across all business segments.

· Shareholder distributions of 40%-50% of cash flow from operations (CFFO) through the cycle (this was 30%-40% previously), continuing to prioritise share buybacks, while maintaining a 4% p.a. progressive dividend policy.

To deliver more value with less emissions Shell will aim to:

Reinforce its leadership position in LNG by growing sales by 4-5% per year through to 2030.

Grow production across the combined Upstream and Integrated Gas business by 1% per year to 2030, sustaining 1.4m barrels per day of liquids production to 2030 with increasingly lower carbon intensity.

Drive cash flow resilience and higher returns in the Downstream and Renewables & Energy Solutions businesses where around 20% of the company’s capital employed currently generates a negative return. This will be achieved through focused growth in the high-return Mobility and Lubricants businesses, directing up to 10% of capital employed by 2030 across lower carbon platforms, and through unlocking more value from the portfolio of Chemicals assets by exploring strategic and partnership opportunities in the US, and both high-grading and selective closures in Europe.

Today’s statement highlights that in the three months to 31 December 2025:

· In the Integrated gas division, production and LNG liquefaction volumes are expected to be within the guidance range. Trading & Optimisation is expected to be in line with the previous quarter.

· Upstream production is expected to be 1840-1940 kboe/d, including the impact of the Adura, and with the guidance range.

· Marketing adjusted earnings are expected to be lower than the previous year reflecting a (non-cash) deferred tax adjustment in a joint venture. Marketing sales volumes are expected to be 2,650 - 2,750, in the lower half of the guidance range.

· Chemicals & Products adjusted earnings are expected to be below break-even. Refinery utilisation is expected to be ahead of guidance at 93%-97%, with Chemicals manufacturing plant utilisation of 75%-79% at the top end of the range. Trading & Optimisation is expected to be significantly lower than the previous quarter.

· Renewables and Energy Solutions is expected to generate a result between a loss of $0.2bn and a gain of $0.2bn.

· The underlying indicative refining margin rose from $12/barrel to $14/barrel, while the indicative chemicals margin slipped from $160/tonne to $140/tonne.

The balance sheet is strong, both in absolute terms and relative to the peer group, and the company targets AA credit metrics through the cycle. This provides resilience regardless of the industry or operational backdrop. At the end of the September quarter, net debt stood at $41.2bn, with gearing at a comfortable 18.8%. Further details on the group’s Q4 gearing and capital expenditure (full-year target is $20bn-$22bn) will be provided with the results on 5 February.

As highlighted above, Shell’s current policy is to return 40%-50% of cash flow from operations (CFFO) to shareholders through the cycle through a combination of dividends and share buybacks. The group’s dividend breakeven is around $40 per barrel (vs. Brent currently at $60) and the group is targetting 4% growth annually. The Q4 dividend will be declared with the results in February.

At $50 a barrel, share buybacks will be undertaken as a priority to debt reduction and capital investment as management believe the shares are undervalued. In fact, the company made this point again earlier in the year when it denied it was in takeover talks with BP, highlighting that buying back its own shares would create more value than large-scale M&A.

The latest $3.5bn programme is expected to complete by the end of January and a new programme is likely to be announced with the Q4 results. Total shareholder returns in 2025 are expected to amount to more than 10% of the current market cap.

We believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without using hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, and natural decline rates, are increasingly leading to constrained supply.

In common with all the oil majors, Shell is looking to reduce emissions in a way that delivers attractive returns for shareholders at a time of macroeconomic and geopolitical uncertainty. The company does this from a position of immense financial strength. The shares remain on an undemanding valuation, both in absolute terms and relative to its US peers, which fails to discount the potential for free cash flow generation and shareholder returns. We believe they also provide something of a hedge against inflation.

Source: Bloomberg

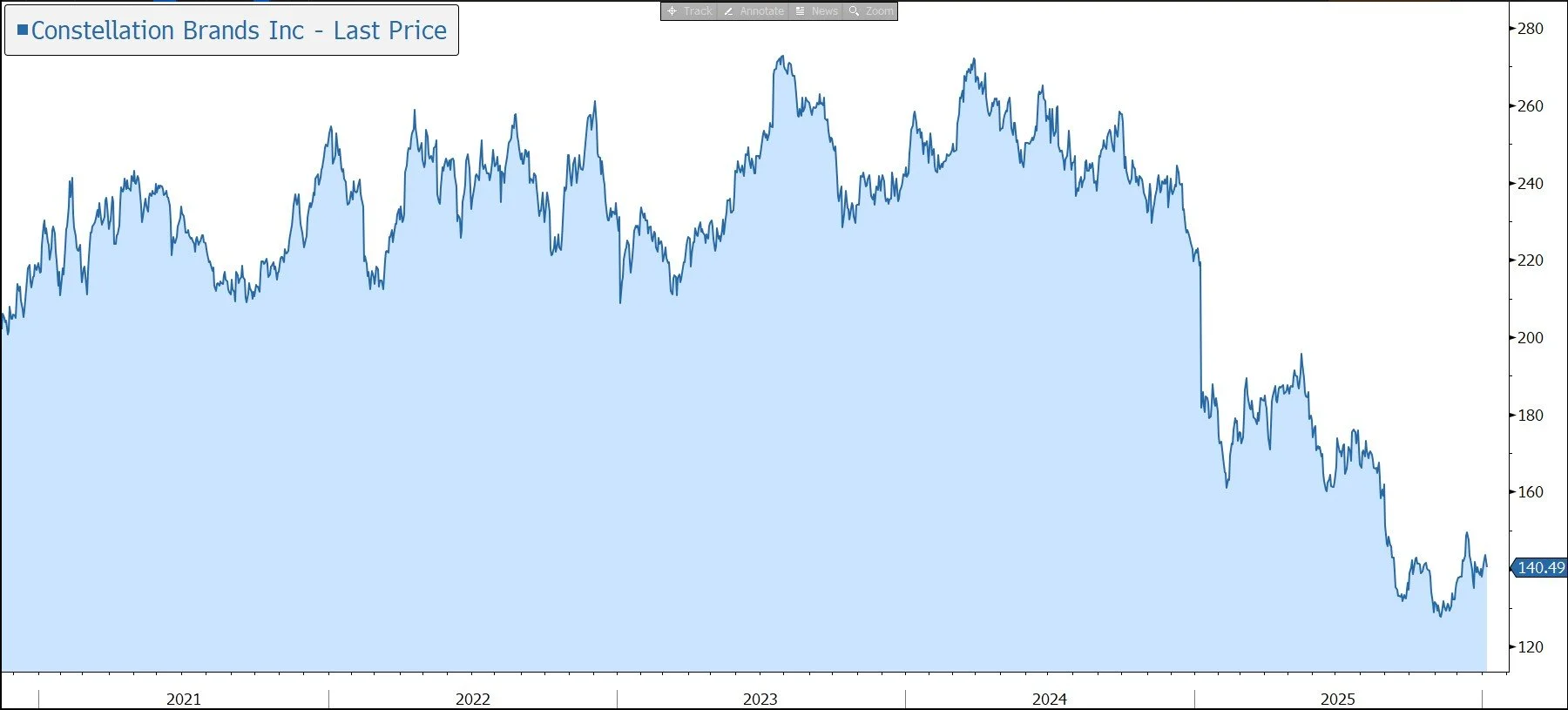

Last night Constellation Brands released results for the third quarter of its financial year ending 28 February 2026. Amid a continued challenging operating environment, the beer business performed better than expected. Guidance for the full year has been reiterated and in response the US-listed shares were marked up by 2%.

Constellation Brands is a leading international producer and marketer of beer, wine, and spirits, with a portfolio of higher-end brands including Corona, Modelo, and Robert Mondavi. Part of the group’s strategy is to supplement organic growth with bolt-on acquisitions, and to focus on premium, margin accretive, growth opportunities.

Last year the company suffered from high-end beer buy rate declines for Hispanic consumers that were more pronounced than general market declines, which had an outsized impact on the company’s beer business compared to the broader beer category. While the company continues to navigate a challenging socioeconomic environment that has dampened consumer demand, the results for the latest quarter were not as weak as expected.

During the three months to 30 November 2025, organic net sales fell by 2% to $2.22bn, slightly better than the market expectation of $2.16bn. Comparable EPS declined by 6% to $3.06, well above the market forecast of $2.63.

By division, the beer business only experienced a 1% decline in net sales to $2,010m, held back by an 2.2% decline in shipment volumes, partially offset by favourable pricing. This was a marked improvement versus the 7% decline seen in the previous quarter. Depletion fell by 3.0%, largely driven by a 4% decline in Modelo Especial and 9% at Corona Extra. Improving demand was seen for Pacifico, Victoria, Corona Sunbrew, and Corona Familiar, helped by lower prices and sharper marketing.

The beer business continued to outperform the industry, outpacing the beverage alcohol category by half a percentage point, and the beer category by one percentage point. The beer operating margin rose by 10 basis points to 38.0%, as favourable pricing and lower depreciation were partially offset by increased costs from aluminium tariffs and unfavourable fixed cost absorption from lower volumes.

In Wine & Spirits, sales fell 7% in organic terms (ex the SVEDKA divestiture) to $213m, driven by a decrease in shipment volumes, mostly driven by ongoing weaker consumer demand and continued retailer inventory destocking across most price segments in the US wholesale market. The unit outpaced the corresponding higher-end wine segment in both dollar sales and volume sales performance. During the latest quarter, depletion was flat.

The wine operating margin fell by 22.1% to a negative 15.8%, primarily due the impact of the SVEDKA divestiture and the 2025 wine divestitures, along with changes in financial and volume-related distributor contractual obligations.

The overall business is cash generative, with free cash flow of $1.45bn in the year to date and net debt gearing remains around the group’s target of 3.0x. The group has returned $824m to shareholders in share repurchases in the year to date and increased its quarterly dividend by 1% to $1.02.

The company is expanding its beer business in Mexico and expects to spend $3.0bn between FY2025 and FY2028 to support the future growth of the core, high-end Mexican beer portfolio with modular additions at existing facilities and a third brewery site at Veracruz.

Looking to the full year, beer net sales are still expected to fall by between 2% and 4%, while operating income is expected to fall by between 7% and 9%. Wine & spirits guidance is unchanged: sales to fall by 17%-20%, with operating income down 97%-100%. Group organic net sales are expected to decline by 4%-6%, with target comparable EPS of $11.30-$11.60 and free cash flow of $1.3bn-$1.4bn.

Source: Bloomberg