Morning Note: Market news and an update on alternative investment fund BH Macro.

Market News

Investors are focused on upcoming US economic data, including the December jobs report, which could offer further clues on the Federal Reserve’s monetary policy outlook. FOMC member Neel Kashkari recently noted that rising unemployment could increase the likelihood of rate cuts. Markets are currently pricing in two rate cuts this year. The 10-year Treasury currently yields 4.16%, while Gold slipped back to $4,470 an ounce.

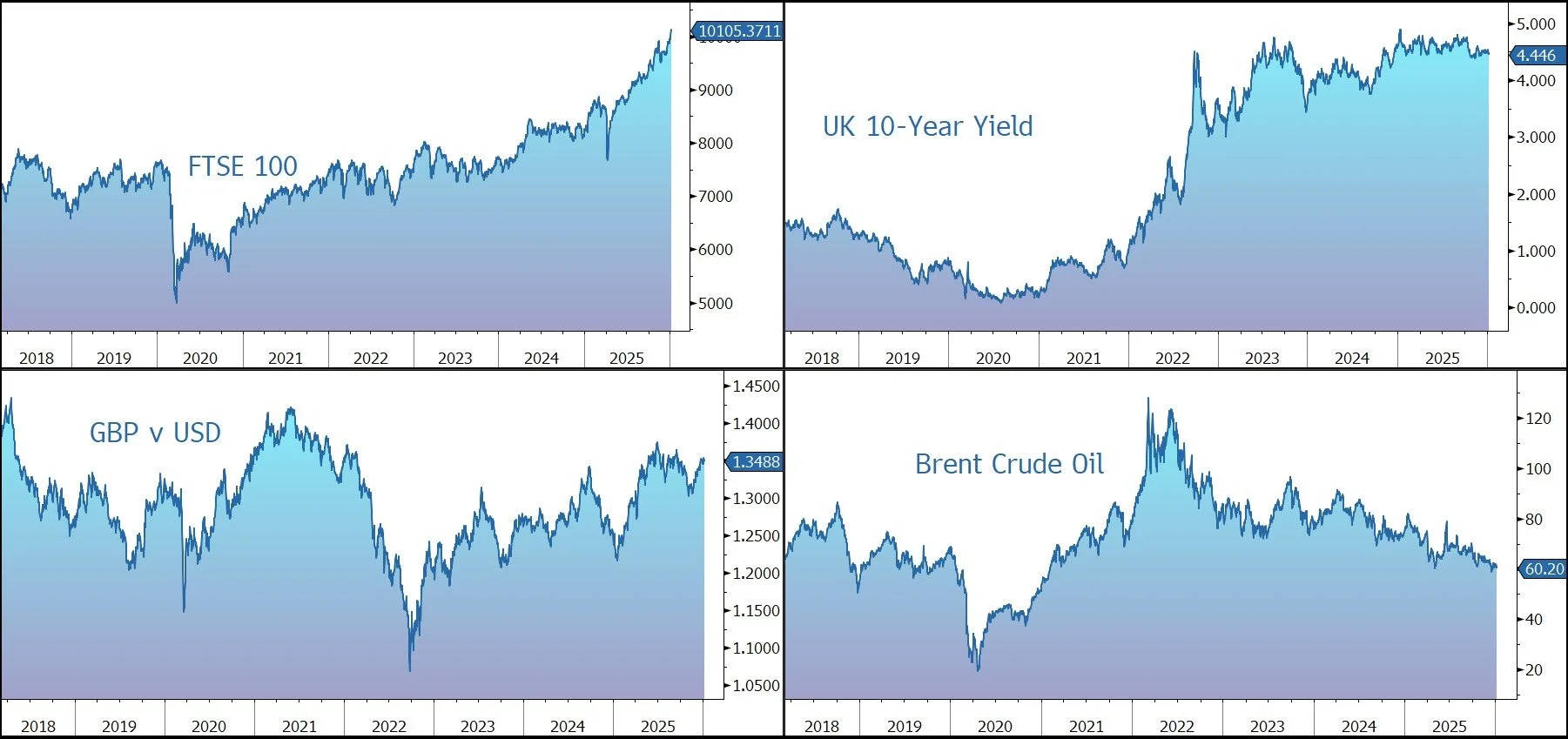

Brent Crude fell to $60 a barrel after Donald Trump said Venezuela will send up to 50m barrels of oil to the US. That’s worth roughly $2.8bn at the current market prices and represents about 50 days of Venezuelan oil production.

US equities last night – S&P 500 (+0.6%); Nasdaq (+0.7%) – and are expected to open little changed this afternoon. In Asia this morning, stocks fell back amid China-Japan trade tensions: Nikkei 225 (-1.1%); Hang Seng (-1.2%); Shanghai Composite (flat).

The FTSE 100 is currently 0.5% lower at 10,080, with BP and Shell showing notable weakness on the back of the subdued oil price. Reckitt Benckiser has announced a special dividend of 235p (£1.6bn) a share to be paid following the divestment of its Essential Home business. Sterling trades at $1.3510 and €1.1550.

Source: Bloomberg

Alternative Investment Update

Diversification across asset classes is a critical element of managing your investments. At Patronus, when we construct a portfolio, we look to allocate a proportion of capital to so-called ‘anti-fragile’ investments that provide shelter in difficult times when other (‘fragile’) asset classes (such as equities and bonds) are struggling to a generate positive return. We believe BH Macro is one such investment.

BH Macro is a London-listed closed-ended investment company that invests substantially all its assets in the ordinary shares of $12bn Brevan Howard Master Fund. This is BH’s longest running fund and one of the most successful hedge funds of all time in terms of the absolute amount of money returned to investors.

Following the 2021 merger with BH Global (Brevan Howard’s other listed investment strategy), a larger, more liquid, entity with the same investment policy was created. There are sterling and dollar classes available and total company assets currently stand at around £1.5bn. Fund fees are made up of a fixed component (management fee and operational services fee) of 2% and a 20% performance fee subject to a high-water mark.

The objective of the fund is to generate consistent long-term appreciation through active leveraged trading on a global basis. The fund pursues a multi-trader model that includes a combination of macro directional and macro relative value strategies which mainly focus on economic change, monetary policy, and market inefficiencies. Exposure is predominantly to global fixed income and currency markets, with peripheral exposure to other asset classes, such as equity, credit, commodities, and digital assets. The fund seeks to achieve positive returns, uncorrelated with other markets and with low volatility. The underlying philosophy is to construct strategies, often contingent in nature, with superior risk/return profiles, whose outcome will often be crystallised by an expected event occurring within a pre-determined period of time.

The decision to hold the shares depends on whether the fund will provide capital protection during periods of market stress. In this regard, it has a good track record when equity markets are falling and has shown correlation with market volatility. Since inception in 2007 to the end of 2025, in the 20 worst performing months for equities, the BH Macro NAV has produced 17 positive monthly returns. Over the same period, the annualised NAV return is 8.3%, with volatility (i.e., annualised standard deviation of returns) of 8.1%.

Risk management has helped reduce the number and extent of negative outcomes. Risks are minimised by diversifying exposures, sensible trade construction, and strict stop-losses. As a result, capital has been protected when things have gone against the manager and drawdowns have been significantly lower than other assets classes.

In 2020, the fund really proved its worth in the face of the challenges arising from Covid-19, with the NAV rising by 28% while the FTSE 100 fell by 11.6%. Again in 2022, when there was a marked pick-up in risk and volatility following Russia’s invasion of Ukraine, the fund generated another outstanding performance, rising by 22%, compared to an 8% decline in global equities in sterling terms and a 15% drawdown in UK bonds.

In 2025, the NAV was up only 1.4%, well behind the FTSE 100 total return of 22.8% and the UK bonds at 6.1%. However, despite the flat performance, the fund did its ‘job’ in April when the market was thrown around by President Trump’s ‘Liberation Day’ measures – the 4.4% increase in the Sterling NAV during the month once again illustrates the fund’s ‘anti-fragile’ characteristics.

The share price fell 1.8% over the year. We would highlight that over time the BH Macro share price has been more volatile than the NAV, with significantly larger drawdowns – a risk of the investment trust structure. There are several reasons why the shares have moved from a premium to a discount over recent years.

Firstly, in February 2023, and in response to persistent requests from its shareholders, the company placed £312m of new Sterling shares to increase the liquidity of the stock and spread the company’s fixed costs over a wider base. However, the move caused some indigestion and the shares moved from a 19% premium to a substantial 19% discount at its low point in March 2024.

The overhang was exacerbated by the merger of two of the company’s largest shareholders, Rathbones and Investec. Although The Takeover Panel has given clearance that the combined entity is not under any obligation to make sales of the stock, it has gradually reduced its holding from 29% at the start of 2024 to 20% on 4 August 2025. We note there have been no sales since then.

At the same time, BH Macro is buying back its shares, an accretive move given the discount. During 2024, the company increased its Annual Buyback Allowance (ordinarily 5% of the shares) in respect of the year, allowing it to repurchase further shares without incurring the additional fees ordinarily payable to the manager under the Management Agreement. Since the programme was initiated, and up until 31 December 2025, the company has bought back 62.5m shares, 17.3% of the total.

The buyback has been accretive to the NAV to the tune of 1.5%. It has also had a positive impact on the size of the discount – moving from 19% to 9% – and the share price, which is 23% above the March 2024 low point. However, with the shares still trading on a large discount, the board has said it recognises the need to attract new investors to the company.

Another discount control mechanism is the Class Closure Resolutions which can be triggered if the average month-end discount to NAV for a share class exceeds 8% over a calendar year.

At the EGM in February 2025, 98.22% of shareholders voted against the Sterling class closure (and 99.86% for the dollar class). Given where the discount has been this year, we expect another vote to be triggered in the coming weeks. However, the directors, having consulted regularly with the company’s broker, have no reason to believe at the current time that there would not be a similarly high level of shareholder support for the company as at the 2025 class closure meetings.

We remain very positive on the company given its portfolio diversification attributes at a time when the geopolitical and macro-economic outlook remain very uncertain and volatile. President Trump’s administration continues to pursue policies which have set it apart from the consensus of recent decades, while the geopolitical situation remains tense. We believe this all provides a rich opportunity set for macro trading. Furthermore, the current 9% discount to NAV provides an added incentive to purchase the shares at this level.