Morning Note: Market news and Glencore

Market News

Donald Trump directed Fannie Mae and Freddie Mac to purchase $200bn in mortgage bonds to bring down housing-loan rates. Mortgage debt and US home-lender stocks rallied. Scott Bessent said the plan to bar large firms from buying single-family homes won’t force sales of existing holdings.

Bessent said Trump is set to decide on a successor to Fed Chair Jerome Powell this month, possibly around the Davos forum. The president told the NY Times that he’s made up his mind.

A US Supreme Court ruling on Trump’s tariffs may come as soon as today, posing a major test for US stocks and bonds.

US equities were subdued last night – S&P 500 (flat); Nasdaq (-0.4%) – as traders await today’s payrolls report. In Asia this morning, equities moved higher: Nikkei 225 (+1.6%); Hang Seng (+0.3%); Shanghai Composite (+0.9%). TSMC’s revenue topped estimates, reinforcing hopes of sustained global AI spending.

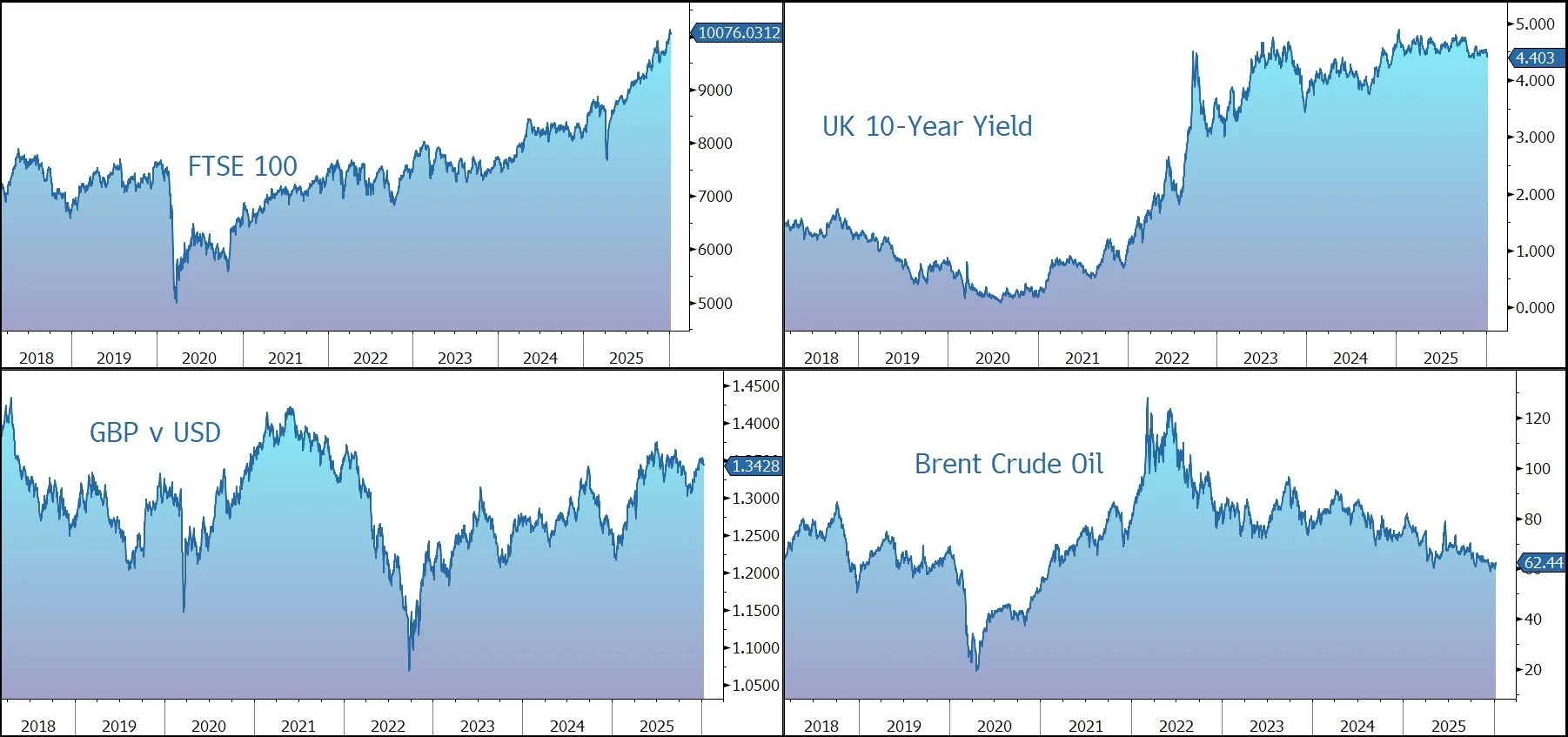

The FTSE 100 is currently 0.4% higher at 10,076, while Sterling trades at $1.3415 and €1.1515. Merger talks between Glencore and Rio Tinto (see below) have ignited the mining sector.

Gold remains firm at $4,470 an ounce, while Brent Crude moved back above $62 a barrel

Source: Bloomberg

Company News

Glencore has confirmed it is in preliminary discussions with Rio Tinto about a possible combination of some or all of their businesses, which could include an all-share merger between the two companies. With several corporate, strategic, and regulatory hurdles to overcome, there is no certainty a deal will occur. The response to the news has been mixed – Glencore has been marked up by 8%, while Rio Tinto is down by 2% as investors express concern about the complexity of the deal and the potential for overpayment.

The parties’ current expectation is that any merger transaction would be effected through the acquisition of Glencore by Rio Tinto by way of a Court-sanctioned scheme of arrangement. There is no certainty that the terms of any transaction or offer will be agreed, nor as to the terms or structure of any such transaction or offer, if agreed. Under UK takeover rules, Rio Tinto must announce a firm intention to make an offer or walk away by 5pm on 5 February 2026. A further announcement will be made as appropriate.

This is the second time in just over a year that the two mining giants have discussed a tie-up, following a failed attempt in late 2024 that collapsed over valuation disagreements.

If the deal proceeds, it would create the world’s largest mining company, with a combined market value exceeding $200bn (or $260bn including debt), potentially surpassing BHP Group.

The combined entity would have strong positions across a number of metals: Iron Ore (18% - Rio Tinto is currently the world’s leading producer); aluminium (5% - Rio Tinto is a top-tier producer); Zinc (6% - Glencore is a leading producer); and lithium (5% - Rio has a strong position).

However, the primary strategic motivation is copper. Both companies hold massive copper assets and are looking to capitalise on record-high prices fuelled by demand from the energy transition and AI infrastructure. The combined entity would become one of the top five global copper producers (7% share), with a significant pipeline of growth projects. Glencore aims to reach 1.6m tonnes annually by 2035. Combined with Rio Tinto’s target of 500,000 tonnes per year from Oyu Tolgoi alone by 2028, the new company would likely control over 2m tonnes of annual copper production within the next decade, around 10% of global production. If this merger and the recently completed Anglo American-Teck Resources deal are both factored in, just two entities would control roughly 16% of global copper supply. The concern of the authorities would be that the market is already very tight and if many smaller mining projects fail to materialise due to high costs or permitting delays, a Rio-Glencore entity that successfully delivers on its targets would likely see its relative market power increase even further than the percentages above suggest.

As a result, a merger would face several high-stakes regulatory challenges that could delay or block its completion. Competition authorities in China and the EU are expected to be the primary obstacles. China, in particular, may be wary of a single company controlling such a vast percentage of traded copper and iron ore. Both may demand massive asset divestments, reducing the strategic benefits of a deal.

Another major sticking point to a deal is Glencore’s extensive coal business. Rio Tinto exited coal in 2018 and may be reluctant to re-enter the sector. Given that some of the assets were sold to Glencore, Rio might effectively be buying back the same assets, likely at a higher price than it sold them for. As a result, Glencore might need to de-merge its coal assets before a sale. Glencore recently restructured its assets, transferring its global coal portfolio into an Australian entity, which could be easily spun off before the acquisition to satisfy Rio Tinto.

The culture of the companies is very different – Glencore has a background as an opportunistic commodity trading house, whereas Rio Tinto is a more traditional, risk-averse mining major. The integration of a massive marketing/trading operation, which markets over three times more copper than it produces, would mark a significant strategic shift for Rio Tinto.

As a result, the future of Glencore's marketing business is a key strategic question mark given that some investors have found it difficult to analyse and value. However, the most likely scenario is that the division would be integrated into the combined company. The business is considered “best in class” – it is a unique and valuable part of Glencore’s business model, generating significant earnings and expertise that Rio Tinto lacks. It could also offer substantial synergies, potentially adding an estimated $1–$2 per ton in value to Rio Tinto’s iron ore business. That said, there would be a case for an IPO of the unit post-merger to realise its full valuation which some believe could be $30bn. Clearly, Glencore understands the value of the business more than anyone else.

Any deal would require the approval major shareholders: Chinalco (14% of Rio Tinto) and Qatar’s Sovereign Wealth Fund (a major Glencore shareholder). Former CEO Ivan Glasenberg remains the largest individual shareholder of Glencore – he recently increased his stake to over 10% in a move widely viewed to ensure he has a seat at the table to negotiate a high enough premium to say “yes” to a deal.

The leadership change at Rio Tinto is a major reason these talks have restarted. Unlike his predecessor, who was famously cautious, Rio Tinto’s new CEO, Simon Trott (who took over in August 2025), has a mandate to be “stronger, sharper and simpler”. He recently identified $5–$10bn in non-core assets for potential divestment to fund growth in three growth “pillars” of copper, lithium, and iron ore. This makes an acquisition of Glencore’s copper portfolio a more natural fit for his aggressive strategy and reduces the threat to Rio Tinto’s competitive standing from the recent Anglo American-Teck Resources merger.

The deal may ultimately hinge on Simon Trott’s ability to convince Rio Tinto’s ESG-focused shareholders that the immediate cash flow from Glencore’s coal and marketing arms is a necessary price to pay for securing the 10% global copper share required to lead the energy transition into the 2030s.

Between now and the 5 February deadline, the “whisper numbers” on the exchange ratio will be the main event. Although Glencore has bounced 8% this morning, we would expect the company to hold out for a larger premium that reflects the value of its copper and marketing crown jewels.