Morning Note: Market news and updates from Shell and Barrick Mining.

Market News

US equities fell last night – S&P 500 (-1.2%); Nasdaq (-1.6%) – dragged down by tech stocks. Amazon slumped 10% post-market after flagging $200bn in annual spending on data centres and equipment, stoking fears its AI push will dent profits. The contrast with Alphabet is stark – the Google owner also announced a massive hike in spending but its shares finished flat on the day as investors see evidence of existing AI monetisation following a 48% rise in cloud revenue.

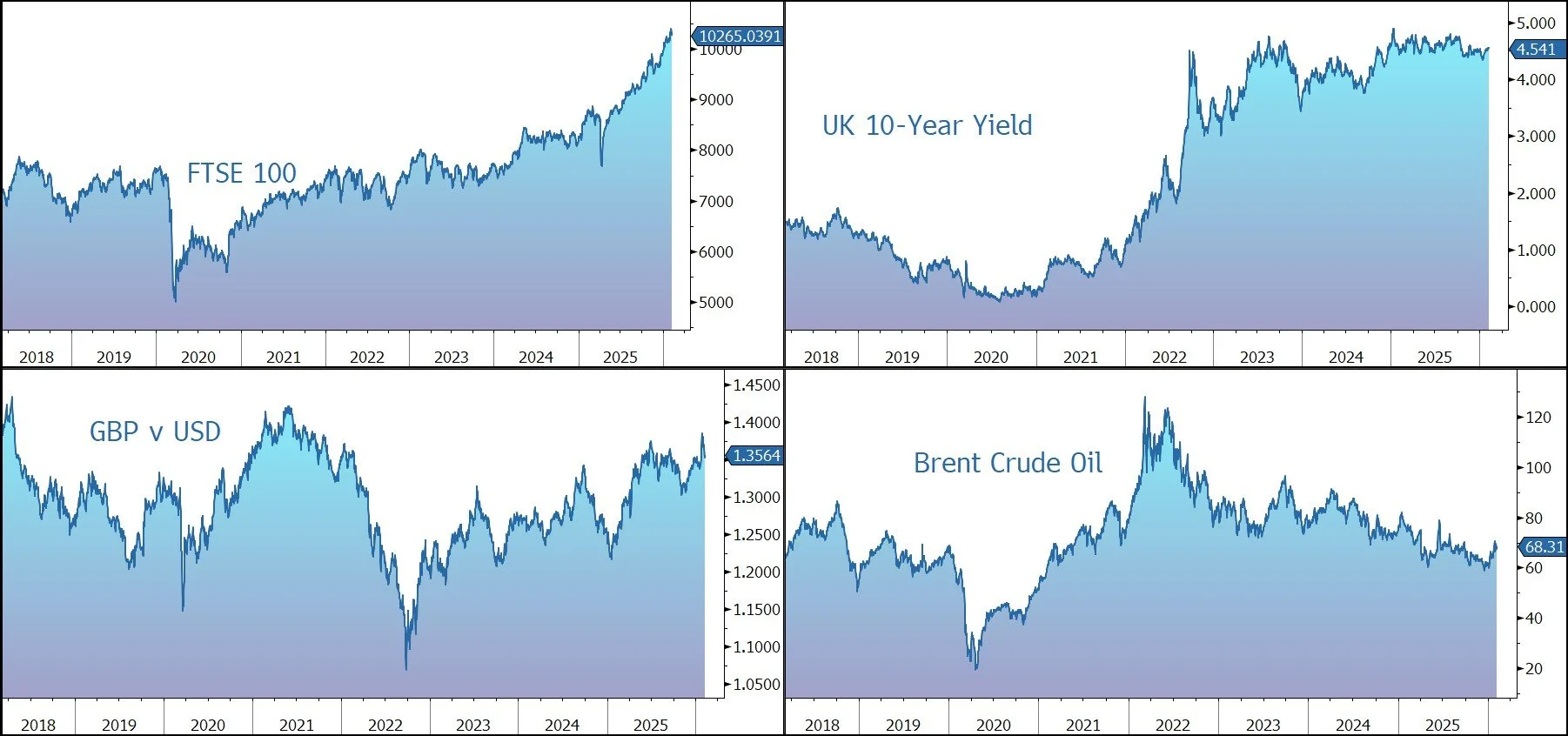

In Asia this morning, markets generally followed the US lead: Hang Seng (-1.2%); Shanghai Composite (-0.3%). The outlier was Japan – Nikkei 225 (+0.8%) – as investors focused on this weekend’s national election. The FTSE 100 is currently 0.3% lower at 10,265, while Sterling trades at $1.3565 and €1.1505 following yesterday’s rate decision.

Rio Tinto is no longer considering a merger with Glencore as the parties were unable to reach agreement on the terms of a combination. The key terms were Rio Tinto retaining both the Chairman and CEO roles and delivering a pro-forma ownership of the combined company which, in Glencore’s view, significantly undervalued its underlying relative value contribution to the combined group, even before consideration of a suitable acquisition control premium. The deal did not reflect Glencore’s view on long term, through the cycle relative value, including not adequately valuing its copper business, and its leading growth pipeline, and apportioning material synergy value potential. Glencore has fallen back by 7% to 470p but still sits well above the 413p level it traded at on the day before the 8 January initial approach. We believe the Glencore standalone investment case is strong.

Brent Crude moved up to $68 a barrel as Iran indicated talks with the US in Oman are unlikely to yield a quick deal, framing them instead as an initial step in a longer diplomatic process. The US virtual embassy in Iran is advising American citizens to leave the country, CNBC reported. Gold trades at $4,870 per ounce, reversing earlier losses as markets navigated heightened volatility. Bitcoin traded as low as $60k, before recovering somewhat to $64k – it traded at $126k last October.

Source: Bloomberg

Company News

Yesterday Shell released fourth-quarter results which were slightly below market expectations. However, the group has raised its dividend by 4% and announced another $3.5bn buyback, a positive given the fears over recent days that the size of the buyback would be reduced. The shares were down 2% due mainly to the slight decline in the oil price.

Shell is a global integrated energy company with expertise in the exploration, production, refining, and marketing of oil and natural gas, and the manufacturing and marketing of chemicals. The group is also allocating capital to low and zero carbon products and services including wind, solar, advanced biofuels, EV charging, hydrogen, and carbon capture & storage. According to Brand Finance Global 500, Shell is the most valuable brand in the industry, valued at around $50bn.

The business is divided into five segments:

· Upstream (i.e. E&P) explores for and extracts crude oil, natural gas and natural gas liquids. Shell has best-in-class deepwater assets complemented by resilient conventional assets in the Gulf of Mexico, Brazil, Nigeria, UK, Kazakhstan, Oman, Brunei, and Malaysia.

· Integrated Gas includes liquefied natural gas (LNG), conversion of natural gas into gas-to-liquids (GTL) fuels, and other products. Shell is the global leader in LNG (achieved through the 2016 acquisition of BG), a critical fuel for the energy transition, with a business that spans upstream, liquefaction, shipping, marketing, optimising, and trading.

· Chemicals & Products is made up of a focused set of assets – there are currently five energy and chemicals parks (i.e. integrated refining and chemicals sites) and seven chemicals-only sites.

· Marketing includes mobility, lubricants, and decarbonisation. In addition to the service stations with their EV charging footprint, Shell is the global number one lubricants supplier and operator of assets in renewable natural gas, sugar cane ethanol, and biofuels.

· Renewables & Energy Solutions includes Shell’s production and marketing of hydrogen, integrated power activities (solar and wind), carbon capture & storage, and nature-based projects. The assets are helping to reduce the carbon intensity of the group’s hydrocarbon product sites. The group is however stepping back from new offshore wind investments – it is returning a 3GW offshore wind lease back to the UK government – and is splitting its power division following an extensive review of the business.

The company has set out several operational and financial targets including:

· an increase in the structural cost reduction target from $2bn-$3bn by the end of 2025 (already achieved) to a cumulative $5bn-$7bn by the end of 2028, compared to 2022. In 2025, the company generated $2.0bn of reductions, with the cumulative total standing at $5.1bn. Around 60% of the savings will come from non-portfolio actions (i.e. not as a result of disposals). The company is actively exploring and harnessing AI to transform workflows and enhance business outcomes.

· Invest for growth while maintaining capital discipline, with capital expenditure lowered to $20bn-$22bn p.a. for 2025-2028. The company continues to divest non-core assets and step back from projects with limited returns.

· Grow free cash flow per share by more than 10% p.a. through to 2030 and generate a return of more than 10% across all business segments.

· Shareholder distributions of 40%-50% of cash flow from operations (CFFO) through the cycle (this was 30%-40% previously), continuing to prioritise share buybacks, while maintaining a 4% p.a. progressive dividend policy.

To deliver more value with less emissions Shell will aim to:

Reinforce its leadership position in LNG by growing sales by 4-5% per year through to 2030.

Grow production across the combined Upstream and Integrated Gas business by 1% per year to 2030, sustaining 1.4m barrels per day of liquids production to 2030 with increasingly lower carbon intensity.

Drive cash flow resilience and higher returns in the Downstream and Renewables & Energy Solutions businesses where around 20% of the company’s capital employed currently generates a negative return. This will be achieved through focused growth in the high-return Mobility and Lubricants businesses, directing up to 10% of capital employed by 2030 across lower carbon platforms, and through unlocking more value from the portfolio of Chemicals assets by exploring strategic and partnership opportunities in the US, and both high-grading and selective closures in Europe.

Now, back to the results. In the three months to 31 December 2025, adjusted earnings fell by 11% to $3,256m, slightly below the market forecast of $3.5bn. Compared to the previous quarter, earnings declined by 40%, reflecting unfavourable tax movements, including the annual (non-cash) reassessment of deferred taxes, lower Marketing margins, lower realised prices, and higher operating expenses. For the full year, earnings fell by 22% to $18.5bn.

Oil and gas production fell by 1% to 2.8bn barrels a day. The underlying indicative refining margin rose from $12/barrel to $14/barrel, while the indicative chemicals margin slipped from $160/tonne to $140/tonne.

By division, Q4 adjusted earnings were Upstream (-7% year on year), Integrated Gas (-23%), Marketing (-31%), Chemicals & Products (a small loss), while Renewables made a small profit.

The balance sheet is very strong, both in absolute terms and relative to the peer group, and the company targets AA credit metrics through the cycle. This provides resilience regardless of the industry or operational backdrop. In Q4, the group spent $6.0bn on capital expenditure, and $20.9bn in the full year, versus guidance of $20bn-$22bn – the same is expected in 2026. The group generated $4bn of free cash flow (and $26bn in the year) to leave net debt of $45.7bn, with gearing at a comfortable 20.7%.

As highlighted above, Shell’s current policy is to return 40%-50% of cash flow from operations (CFFO) to shareholders through the cycle through a combination of dividends and share buybacks. The group’s dividend breakeven is around $40 per barrel (vs. Brent currently at $68) and the group is targetting 4% growth annually. At $50 a barrel, share buybacks will be undertaken as a priority to debt reduction and capital investment as management believe the shares are undervalued. In fact, the company made this point again in the middle of last year when it denied it was in takeover talks with BP, highlighting that buying back its own shares would create more value than large-scale M&A.

With these results, a Q4 dividend of 37.2c a share was declared, 4% above the same quarter last year, to give a total yield for 2025 of 4%. With the latest $3.5bn share repurchase programme completed, a new $3.5bn buyback has been announced to be completed by the end of April 2026. Total shareholder returns in 2025 were around 10% of the current market cap and 52% of cash flow, slightly above the target range.

We believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, and natural decline rates, are increasingly leading to constrained supply.

In common with all the oil majors, Shell is looking to reduce emissions in a way that delivers attractive returns for shareholders at a time of macroeconomic and geopolitical uncertainty. The company does this from a position of immense financial strength. The shares remain on an undemanding valuation, both in absolute terms and relative to its US peers, which fails to discount the potential for free cash flow generation and shareholder returns. We believe they also provide something of a hedge against inflation.

Source: Bloomberg

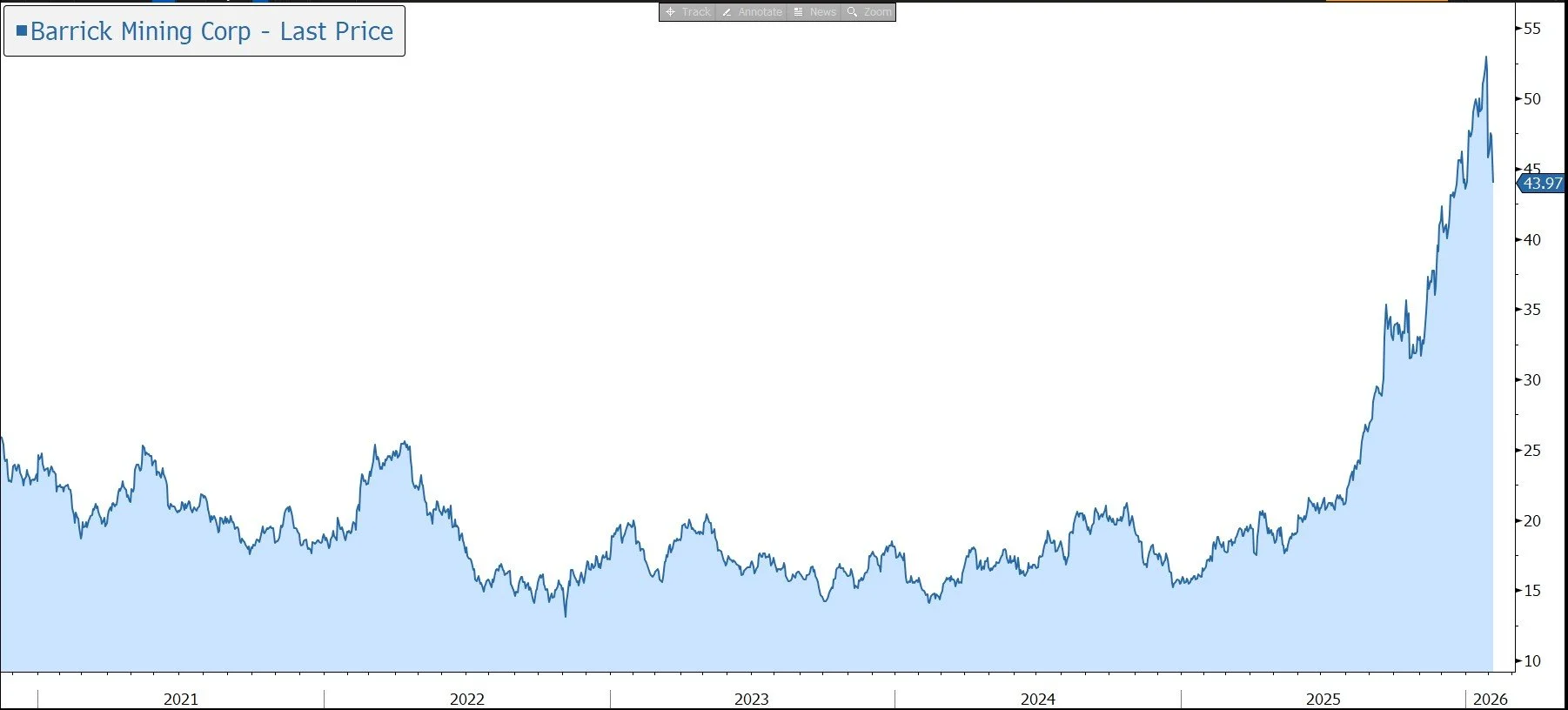

Yesterday lunchtime, Barrick Mining Corporation released Q4 results which were well ahead of market expectations. Strong commodity prices and controlled costs generated record cash flow despite lower gold production. This allowed the company to significantly increase its dividend and share repurchases, while also making progress on key growth projects. The shares have been a very strong performer over the last year, albeit have seen profit taking of late on the back of the falling gold price.

Barrick Mining Corp. is the world’s second largest gold producer. The company was created following the 2018 merger of Barrick Gold and Randgold Resources. In addition, in 2019, the group improved its portfolio through the formation of the Nevada Gold Mines joint venture with Newmont, providing exposure to the single largest gold-mining complex in the world.

As a result, the group operates mines and projects in 17 countries in North and South America, Africa, Papua New Guinea, and Saudi Arabia. It now owns six of the world’s Top 10 Tier One gold assets with the largest reserve base among its senior gold peers. At the end of 2025, attributable gold reserves were 85m ounces, with 10-year mine plans based on reserves and geologically understood resource extensions. The group doubled the gold resource at the Fourmile project in Nevada with further increases expected in 2026. Non-core assets are being sold – in June, the group completed the $1bn disposal of its 50% interest in the Donlin Gold Project.

The company has named its interim CEO Mark Hill as the permanent CEO and President. In order to unlock further shareholder value, the company is moving forward with preparations for an IPO of its North American gold assets, expected to be completed by late 2026. The separate unit would house Barrick’s interests in Nevada Gold Mines, Pueblo Viejo, and its wholly owned Fourmile project in Nevada. Barrick plans to retain a controlling stake in the new entity following the listing.

Overall, Barrick provides an attractive way to gain exposure to the gold price, albeit with the operational and political risks that come with a production company. The company is also well positioned to capitalise on global decarbonisation trends driving the long-term fundamental strength of copper with two world-class projects set to deliver into a rising price and demand market.

In the final quarter of 2025, revenue grew by 45% quarter on quarter to $6.0bn. Full-year revenue was up 31% to $17bn, split between gold (89%), copper (9%), and other (2%). Q4 adjusted net EPS rose by 79% quarter on quarter to 104c, well above the market consensus of 85c, with the full-year result up 92% to 242c.

Gold production was down 5% quarter on quarter to 871k ounces. Full-year production was down 17% to 3.26m ounces, within the guidance range.

The gold price has rallied sharply over the last year, driven by global geopolitical and macro-economic uncertainty, exacerbated by the Trump administration, continued central bank bullion buying, and concern over fiat currency debasement. During the full year, Barrick realised a gold price up 46% to $3,501 per ounce.

Barrick has the lowest total cash cost position among its senior gold peers, although in the latest quarter, all-in sustaining costs were up 3% to $1,581/ounce.

Group copper production rose by 13% to 62k tonnes in the quarter and by 13% to 200kt for the full year, at the upper end of the guidance range. The realised price up 14% to $4.72/pound in the year, with all-in sustaining costs down 7% to $3.20/pound.

The group generated immense free cash flow during the year of $3,868m, up 194%, and ended the year with a net cash position of $2.0bn. This leaves the group with the flexibility to manage its business and take advantage of new opportunities independent of the vagaries of the capital markets. Capital investment rose by 27% in the year to $3.8bn.

A new dividend policy targets a total payout of 50% of attributable free cash flow, including a fixed quarterly base dividend to 17.5c per share, plus performance year-end top-up. Barrick is also undertaking a share buyback program to capture embedded value in business and growth pipeline. $1.5bn of shares were repurchased in 2025.

The company set out its guidance for 2026: gold production of 2.90m-3.25m ounces, with all-in sustaining costs of $1,760-$1,950 an ounce; copper production of 190kt–220kt, with all-in sustaining costs of $3.45-$3.75 a pound.

For 2026, the group is assuming an average gold price of $4,500/oz in 2026 – it is currently $4,800/oz. A $100/oz move has a $450m impact on cash flow. The group is assuming an average copper price of $5.50/pound – it is currently $5.81/pound – and discloses that a 25c/pound move has a $120m impact on cash flow.

Source: Bloomberg