Morning Note: A round-up of financial market news.

Market News

A broad rally across risk assets — from technology stocks to Bitcoin — lifted Asian equities to a record as gains from Wall Street on Friday carried into the new week.

In Japan, the Nikkei 225 Index rallied 3.9% to close at a record high of 56,364 after the ruling Liberal Democratic Party, led by Prime Minister Sanae Takaichi, secured a two-thirds supermajority in the lower house in a historic victory. Takaichi’s coalition won 352 of the 465 seats in Japan’s House of Representatives, according to figures collated by public broadcaster NHK, with the LDP alone securing a majority of 316. The outcome reinforced expectations for looser fiscal policy and possible tax cuts, while Takaichi promised that her stimulus plans will not strain the country’s finances further. The yen strengthened to around 156.5 per dollar, rebounding from two-week lows. Japanese officials also said they are closely monitoring the FX market, keeping traders on alert for possible intervention.

Elsewhere in Asia the main indices rose this morning: Hang Seng (+1.8%); Shanghai Composite (+1.4%). Chip stocks rose after the Nvidia rally and Samsung’s HBM4 Report. China urged banks to curb US Treasury exposure, citing concerns over concentration risks and market volatility.

Gold bounced back above $5,000 an ounce, the highest level in over a week, supported by a weaker US dollar as traders awaited key US economic data that could offer clearer insights into the Federal Reserve’s interest rate outlook. The January jobs report, scheduled for Wednesday and expected to show signs of stabilization in the labour market, as well as inflation data due on Friday, will be closely watched. San Francisco Fed President Mary Daly said last Friday that it may be necessary to cut rates once or twice to address weakening labour market conditions. In addition, China’s central bank extended its gold purchases for the 15th consecutive month in January, signalling sustained institutional demand. Separately, US Treasury Secretary Scott Bessent cited Chinese traders as a reason behind last week’s wild swings in the gold market.

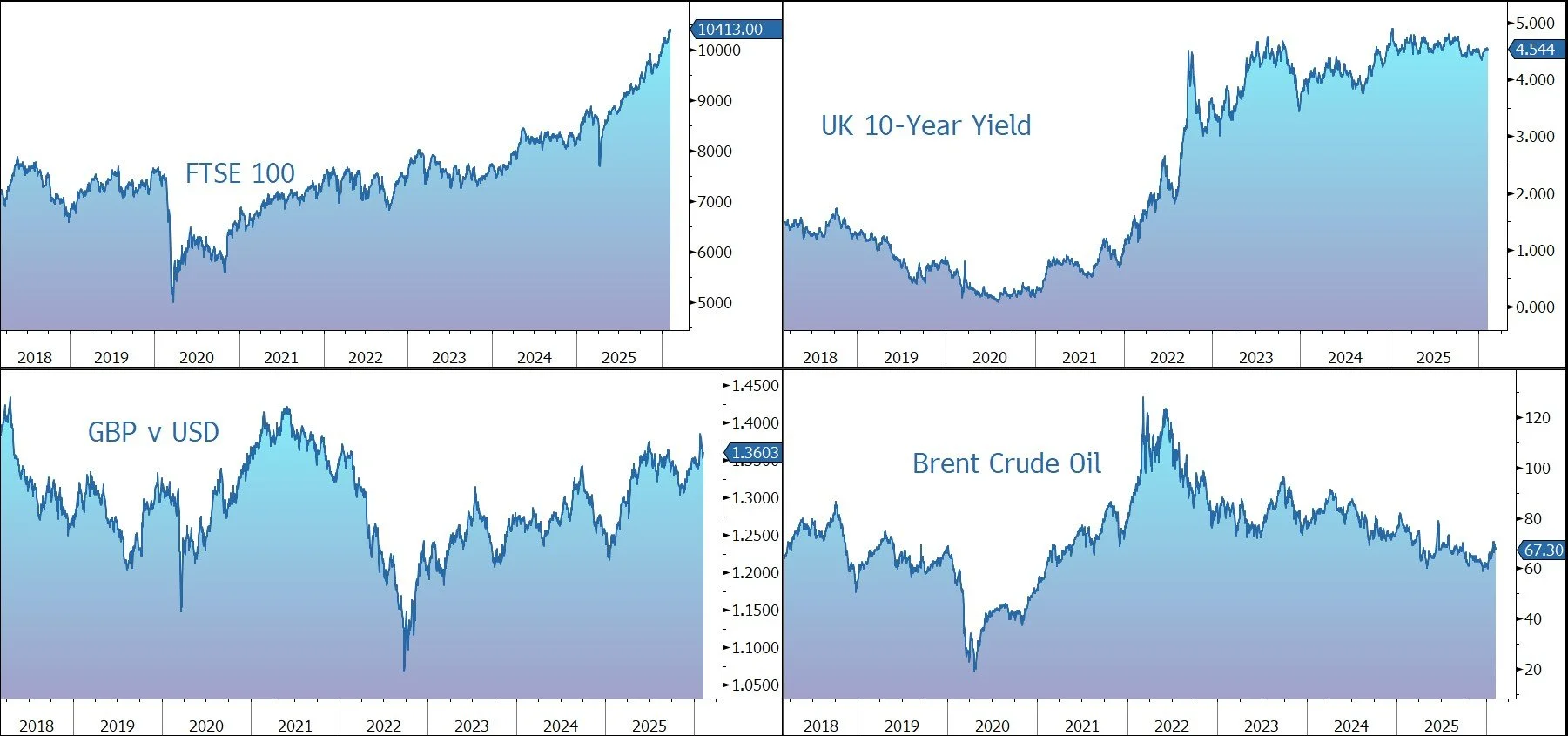

The FTSE 100 is currently 0.4% higher at 10,413. NatWest Group is trading 4% lower following the £2.7bn acquisition of Evelyn Partners, the UK Wealth Management business. The company has also announced a share buyback of £750m.

Prime Minister Keir Starmer remains under heavy pressure amid speculation that he could resign or face leadership challenges in coming days. To trigger a challenge, candidates would need support from 20% of the parliamentary Labour Party – 81 MPs. UK bond spreads have increased at the long end while sterling is coming under modest pressure ($1.3590 and €1.1460).

Source: Bloomberg