Morning Note: Market News and Updates from BP and AstraZeneca.

Market News

Kevin Warsh may favour a gradual reduction of the Fed’s $6.6 trillion balance sheet to avoid rekindling money-market tensions, Citi strategists said.

The yuan surged to its strongest level since May 2023 after China was said to have asked banks to limit their holdings of US Treasuries. The 10-year bond currently yields 4.19%, while gold remains above the $5,000 an ounce threshold.

US equities rose last night – S&P 500 (+0.5%); Nasdaq (+0.9%) – as technology shares rebounded on easing concerns over outsized AI spending. Alphabet raised $20bn in its largest-ever US dollar bond sale after drawing $100bn of demand.

In Asia this morning, stocks also rose: Nikkei 225 (+2.3% to an all-time high); Hang Seng (+0.6%); Shanghai Composite (+0.1%). Donald Trump will go to Beijing in the first week of April to meet with Xi Jinping, Politico reported.

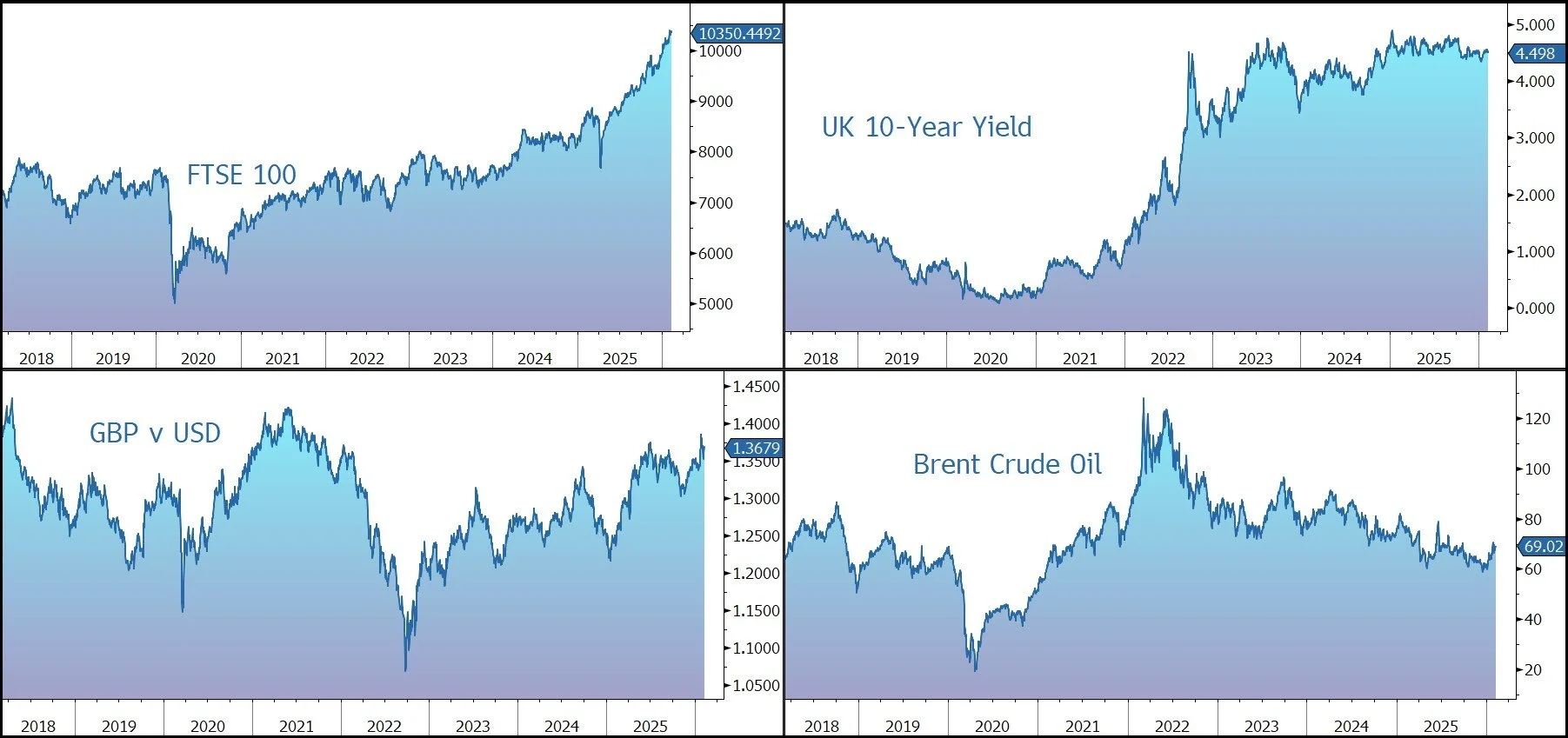

The FTSE 100 is currently 0.3% lower at 10,350, while Sterling trades at $1.3670 and €1.1480. UK retail sales rose by 2.3% year on year in January according to the British Retail Consortium, up from 1.0% in December and ahead of the 1.3% rate predicted by Bloomberg consensus. While food sales rose by 3.2%, non-food sales rose 1.4%.

President Trump’s trade wars are adding to UK inflation as China raises export prices to Britain to offset US tariffs, Bank of England policymaker Catherine Mann said, countering expectations of cheaper diverted goods.

Source: Bloomberg

Company News

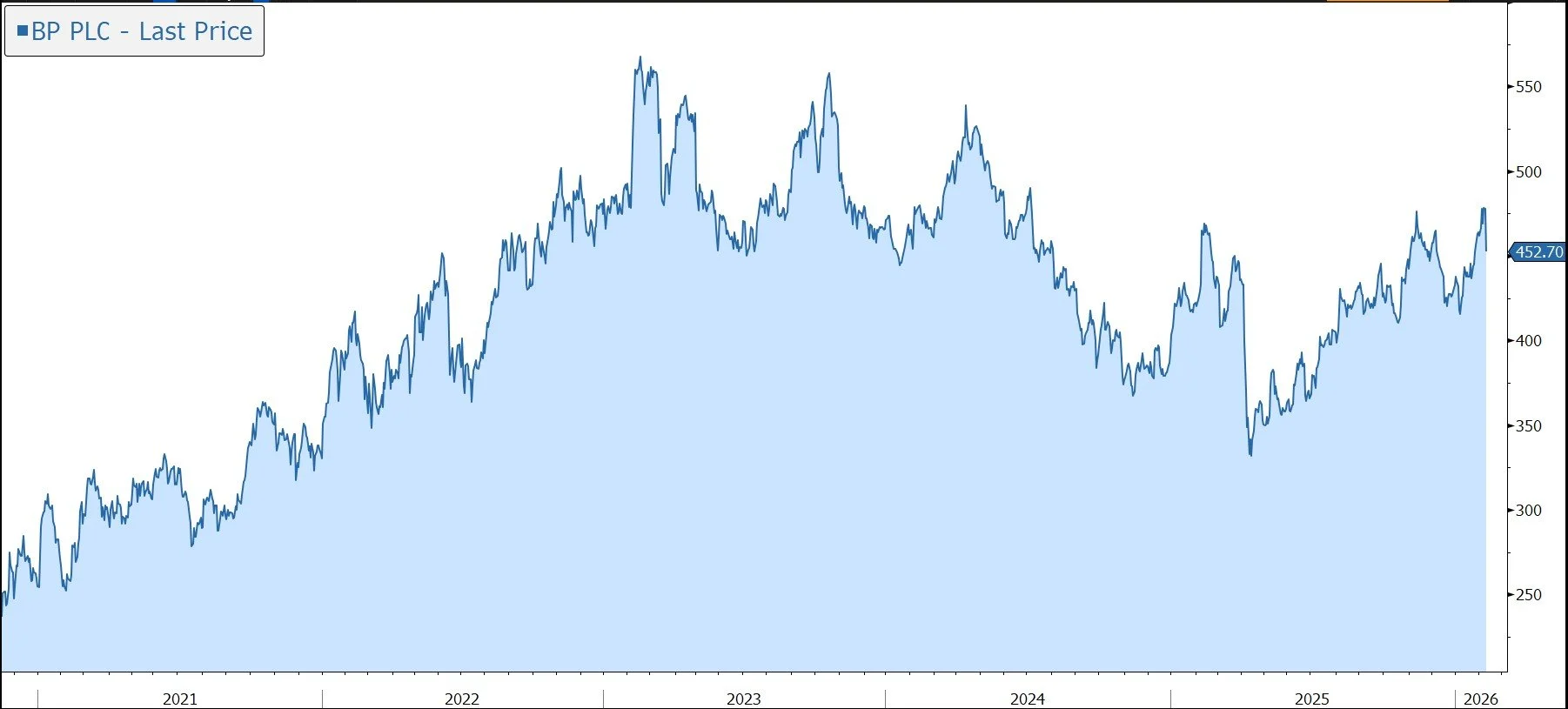

BP has today released Q4 results which were in line with the market forecast and raised its quarterly dividend by 4%. However, company is suspending its share buyback programme and will fully allocate excess cash to accelerate strengthening of its balance sheet and create a strong platform to invest into oil and gas opportunities. In a move which looks like a clear-out before the new CEO starts in April, the shares are down 5% in early trading. This leaves the share on an attractive 5.5% yield.

BP is a global integrated energy company undertaking a strategic reset involving a reduction of capital expenditure, a reallocation of spend away from low carbon activities, and a significant cost reduction programme, all of which will drive improved cash flow and returns to support a stronger balance sheet and resilient distributions.

Following the appointment of Albert Manifold (ex CRH) as Chairman, the company is accelerating the delivery of its plans, including undertaking a thorough review of its portfolio to drive simplification and targeting further improvements in cost performance and efficiency. The announcement last December that Meg O'Neill, ex-CEO of Woodside Energy, will become BP’s new CEO in April 2026 – the first outsider to lead the company in its century-plus history – is expected to drive this transition further.

For now, in the Upstream business (i.e. exploration & production), the company is increasing investment to $10bn p.a. (split 70% oil; 30% gas) and targetting returns of more than 15%. The portfolio will be strengthened, with 10 new major projects expected to start up by the end of 2027, and a further 8-10 by 2030. Production is set to grow to 2.3m-2.5m barrels a day in 2030, albeit still below the 2019 level. The aim is to generate structural cost reductions of $1.5bn and an additional $2bn of operating cash flow by 2027. As a result, the cash flow from the group’s production barrels is expected to be significantly higher due to the ‘high-grading’ of the portfolio.

The Downstream division (i.e. refining & marketing) is being high-graded and will focus on ‘advantaged’ and integrated positions. The focus will be on operating performance with a target to consistently improve refining availability to 96%. Capital investment will be $3bn by 2027, with a target of $2bn in cost savings. Overall, the aim is to generate an additional $3.5bn–$4.0bn of operating cash flow in 2027 and returns of more than 15%. Following a strategic review, in December the company announced an agreement to sell a 65% shareholding in Castrol for an enterprise value of $10.1bn, with expected net proceeds of $6.0bn, which will be used to reduce net debt. BP will retain a 35% stake in a new joint venture, providing exposure to Castrol’s growth and future optionality.

Investment in the group’s ‘transition’ businesses is being slashed from $5bn p.a. to $1.5bn–$2bn p.a., with less than $0.8bn p.a. in low carbon energy. The focus will be on fewer but higher-returning opportunities and more efficient growth. There will be selective investment in biogas and biofuels. In renewables, the focus will be capital-light partnerships, while there will be limited further projects in hydrogen and Carbon Capture & Storage. The group is targeting an annual structural cost reduction of more than $0.5bn in low carbon energy by 2027. As expected, today’s results include $4bn post-tax adjusting items relating to asset impairments within the group’s equity-accounted entities attributable to its gas and low carbon energy segment, primarily on its solar energy unit Lightsource BP and its US biogas business Archaea.

We note the recent resolution filed by a group of pension funds (ACCR) demanding BP prove that the shift back to oil will actually deliver the promised returns.

Back to today’s results. In 2025, underlying replacement cost profit – the key measure of the group’s performance – fell by 16% to $7,485m, delivered against a weaker oil price environment. In the final quarter, profit rose by 32% to $1,541m, in line with the market forecast.

Compared with the previous quarter, profit was down 30%, reflecting lower upstream price realisations, adverse impact of upstream production mix, lower refinery throughputs due to higher turnaround activity and the temporary impact of reduced capacity following an outage at the Whiting refinery and seasonally lower customer volumes, partly offset by lower exploration write-offs.

The commodity price backdrop was mixed: Brent crude averaged $63.73/barrel (compared to $69.13/barrel in the previous quarter); US gas Henry Hub averaged $3.55/mmBtu (vs. $3.07/mmBtu); and the refining margin averaged $15.2/barrel (vs. $15.8/barrel). The environment has remained volatile since the year end because of ongoing geopolitical uncertainty.

By division, the results for the quarter for underlying operating profit were: gas & low carbon energy (-30%); oil production & operations (-33%); and customers & products ($1.3bn vs a loss of $302m). As expected, full-year underlying upstream production was broadly flat compared with 2024. In 2026, the company also expects production to be broadly flat. Cost discipline and operational performance have been strong – in 2025, upstream plant reliability was 96.1% and refining availability was 96.3%. Overall unit production costs only rose by 2%.

Seven major projects were started in 2025. The main discovery was the Bumerangue exploration well, deepwater offshore Brazil, the company’s largest in 25 years. This find is at a very early-stage, with no guarantee of a commerciality, and where initial estimates indicate around 8bn barrels of liquids in place.

The company has raised its 2027 target for structural cost reductions from $4bn–$5bn to $5.5bn-$6.5bn, versus a 2023 base of $22.6bn. This reflects the outcome of the strategic review to divest Castrol.

Capital expenditure was $4.2bn in Q4 and $14.5bn for the full year, in line with company guidance. Looking forward, the group is reducing capital expenditure for 2026 to $13.0-$13.5bn, a level it believes supports progressively growing earnings per ordinary share in the long term.

Operating cash flow rose by 2% in Q4 to $7.6bn, but slipped by 10% to $24.5bn in the full year, including $2.9bn adjusted working capital build. By 2027, the aim is to generate compound annual growth in adjusted free cash flow of more than 20% at $70/barrel oil price and returns on average capital employed of more than 16%. Note the oil price is currently $69 a barrel.

The group is targetting $20bn of divestments by 2027. There are no plans for major acquisitions. Proceeds from completed or announced disposal agreements were above $11bn in 2025, boosted by the Castrol deal at the end of the year. In 2026, proceeds of $9bn-$10bn are expected.

The company’s first capital allocation priority is a resilient dividend, which is expected to increase by at least 4% per ordinary share a year. Today, the group has declared a quarterly dividend of 8.32 US cents, 4% higher than last year, implying a full-year yield of 5.5%.

During the final quarter, net debt fell to $22.2bn, with gearing of 23.1%. BP remains committed to maintaining a strong investment grade credit rating and a reduction in net debt to $14bn–$18bn by the end of 2027. We note, however, the net debt figure doesn’t include $12.5bn of lease liabilities and $8bn of Gulf of Mexico oil spill payables. In a nod to these other obligations, the company has today announced the decision to suspend the share buyback and fully allocate excess cash to accelerate strengthening of its balance sheet. This will create a strong platform to invest with discipline into the group’s distinctive deep hopper of oil & gas opportunities. The guidance for shareholder distributions to be around 30%-40% of operating cash flow is now retired.

Overall, we believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without using hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, and natural decline rates, are increasingly leading to constrained supply.

Against this backdrop, investor disillusion with the group’s tilt towards low carbon energy, particularly in terms of capital discipline and returns (as evidenced by ongoing impairments), has had a negative impact on the share price over the medium term, especially relative to the peer group, leaving them on a very undemanding valuation. With Elliott Investment Management pushing for further capital discipline and the impending arrival of the new CEO in April, the combination of operational high-grading and ongoing M&A speculation suggests that the ‘valuation gap’ between BP and its peers could narrow.

Source: Bloomberg

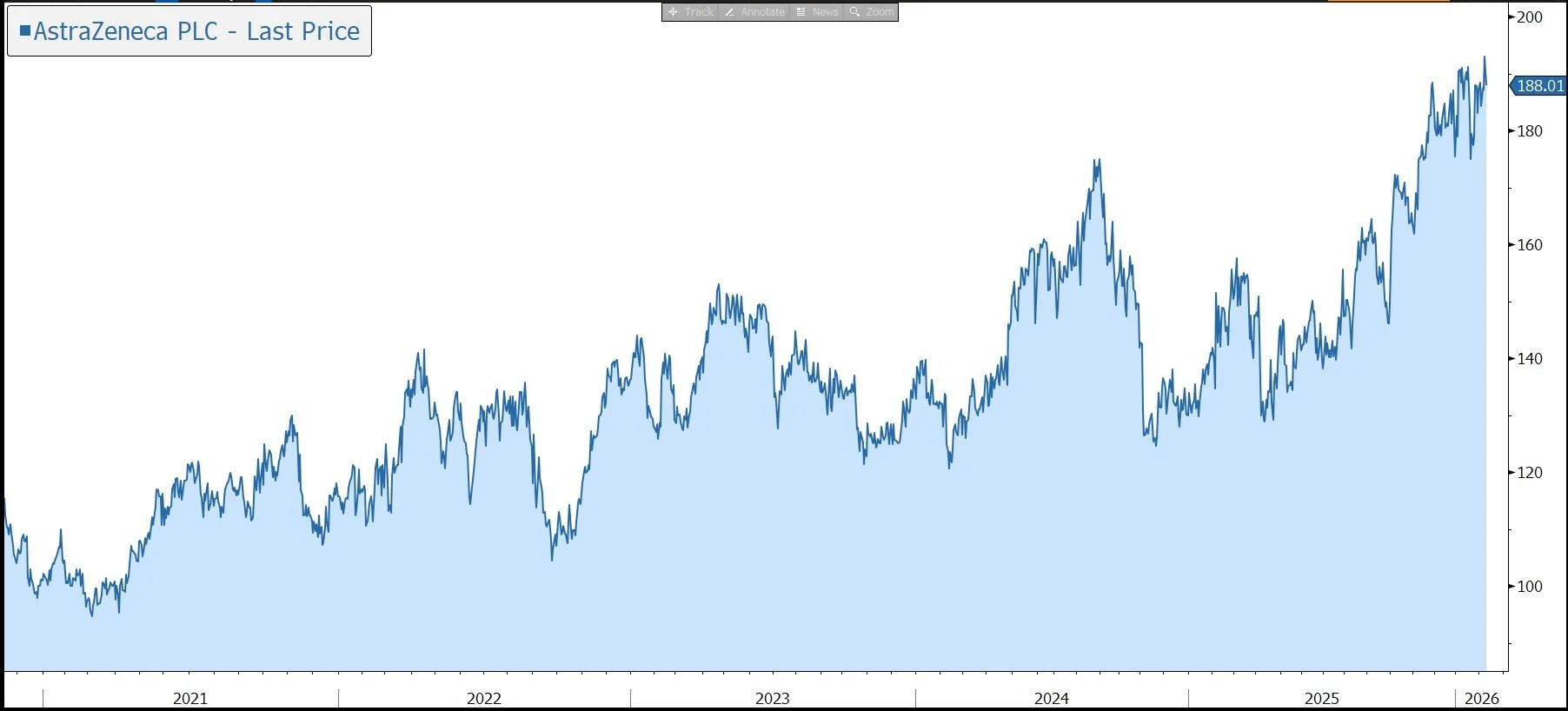

AstraZeneca has released its 2025 full-year results and provided an update on its R&D programme. The figures and dividend were in line with market expectations. Guidance for 2026 has been initiated, with earnings expected to rise by low double digits. In response, the shares are up 2% in early trading.

AstraZeneca (AZ) is a global, science-led biopharmaceutical company. The main growth driver has been the group’s key Oncology franchises (including Tagrisso, Lynparza, Enhertu, Imfinzi, and Calquence), which have been supplemented by the other growth platforms of Respiratory & Immunology (R&I), Cardiovascular, Renal, & Metabolic diseases (CVRM), Vaccines & Immune Therapies (V&I), and rare diseases (through the $41bn acquisition of Alexion).

The group’s (tough) ambition is to deliver $80bn of revenue by 2030, up 8.3% p.a. from a 2023 base of $45.8bn. This will be driven by growth across its existing portfolio through geographic expansion and follow-on indications, as well as new products currently in late-stage development, offset by the loss of patent exclusivity in some existing products. The group expects to launch 20 new medicines before the end of the decade, with some products having the potential to generate more than $5bn in peak-year revenue. Beyond 2030, the company will seek to drive sustainable growth by continuing to invest in transformative new technologies and platforms that will shape the future of medicine.

The aim is to generate a mid-30s core operating margin by 2026, versus 32% in 2023. Beyond 2026, the margin will be influenced by portfolio evolution and the company will target at least the mid-30s percentage range.

AZ currently invests more than 20% of sales in R&D and uses partnerships to gain access to innovative technology. The group has an attractive pipeline of potential new products, the success or failure of which will drive future profitability and the share price. Recent news flow on the pipeline in terms of new data and product approvals has been mainly positive – in 2025 the company delivered 16 positive Phase III study read-outs and 43 approvals in major regions. The company now has 16 blockbuster medicines (i.e. sales above $1bn). The momentum across the company is continuing in 2026, with results of more than 20 Phase 3 trial readouts expected this year, and more than 100 Phase 3 studies ongoing.

In 2025, revenue increased by 8% at constant exchange rates (CER) to $58.7bn, versus guidance for growth in the high single-digits. Within that, product sales grew by 9% to $55.6bn. In the final quarter, revenue increased by 2% at CER to $15bn, in line with the market forecast.

By therapy area, product sales grew 14% in Oncology in the full year, 2% in CVRM, 12% in Respiratory & Immunology, and 4% in Rare Diseases. The only blot was Vaccines & Immunology which fell by 14%.

Core operating expenses rose by 7% at CER, with R&D and SG&A up +12% and +3%, respectively. The operating margin was little changed at 31%. Core EPS grew by 11% at CER to $9.16, versus guidance for growth in the low double-digits. Q4 EPS was down 2% to $2.12, in line with the market forecast.

AZ has a robust balance sheet and generates strong free cash flow. In 2025, net debt slipped from $24.6bn to $23.4bn, around 1.2x net debt to EBITDA. The company’s capital allocation priorities include investing in the business and the pipeline. To that end, the company increased capital expenditure by 47% in 2025, driven by manufacturing expansion projects and investment in IT systems, to support portfolio growth and build capacity for transformative technologies

M&A remains central to the strategy. Earlier in the month, the company struck a deal worth up to $18.5bn to license drugs from China’s CSPC Pharmaceutical.

AZ is also committed to a progressive dividend policy and intends to maintain or grow the payout each year. In 2025, the company raised its payout by 3% to $3.20, equating to a yield of 3%. In 2026, the company intends to increase the annual dividend to $3.30.

Political headwinds have eased somewhat during the year and the company struck a deal with the US administration. In return for a three-year exemption from pharmaceutical tariffs, AZ agreed to implement price-lowering measures in certain channels in the US and announced a huge $50bn investment in the US for medicines manufacturing and R&D. This includes the massive new Virginia manufacturing site (which broke ground in October 2025) focused on the company’s weight-loss and metabolic portfolio.

Earlier this month, AstraZeneca harmonised its share structure and now has a direct listing on the New York Stock Exchange in place of its US ADRs. This is a major win for liquidity and makes the stock much more attractive to US institutional funds. The company remains listed, headquartered, and tax resident in the UK.

Looking ahead to 2026, the company is guiding to total revenue growth in the mid to high single-digits (slightly better than expected) and Core EPS growth in the low double-digits, both at CER.

We believe the outlook for the pharmaceutical sector remains mixed despite the backdrop of an ageing population. Although the business provides some protection against macroeconomic uncertainty and R&D productivity is expected to increase with the help of AI, concerns over drug pricing are likely to remain a headwind, especially at a time when governments are looking for ways to reduce debt levels. However, with a pipeline of innovative products targetting unmet patient needs, that can justify higher pricing, we believe AZ is well placed to generate above average revenue and earnings growth. This has been reflected in the strong long-term performance of the shares.

Source: Bloomberg