Morning Note: Market News and an Update from Heineken.

Market News

US equities drifted lower last night – S&P 500 (-0.3%); Nasdaq (-0.6%). Asian equities climbed to a record (Hang Seng, +0.3%; Shanghai Composite, +0.1%) and the dollar declined ahead of Wednesday’s US jobs report after weak retail sales reinforced bets that the Federal Reserve will cut interest rates later this year. Gold edged up to $5,050 an ounce.

China’s factory deflation eased more than expected in January as downward pressure moderated, while consumer prices rose just 0.2% from a year ago. China’s persistent $1 trillion trade surplus must be addressed, Scott Bessent said, while adding that the US’s goal is fair competition and de-risking, not decoupling.

EU lawmakers are progressing towards a trade agreement with the US, but with new stipulations. Chief among these is a sunset clause, which would afford Washington a six-month window to reduce the current 50% tariff imposed on products containing steel and aluminium

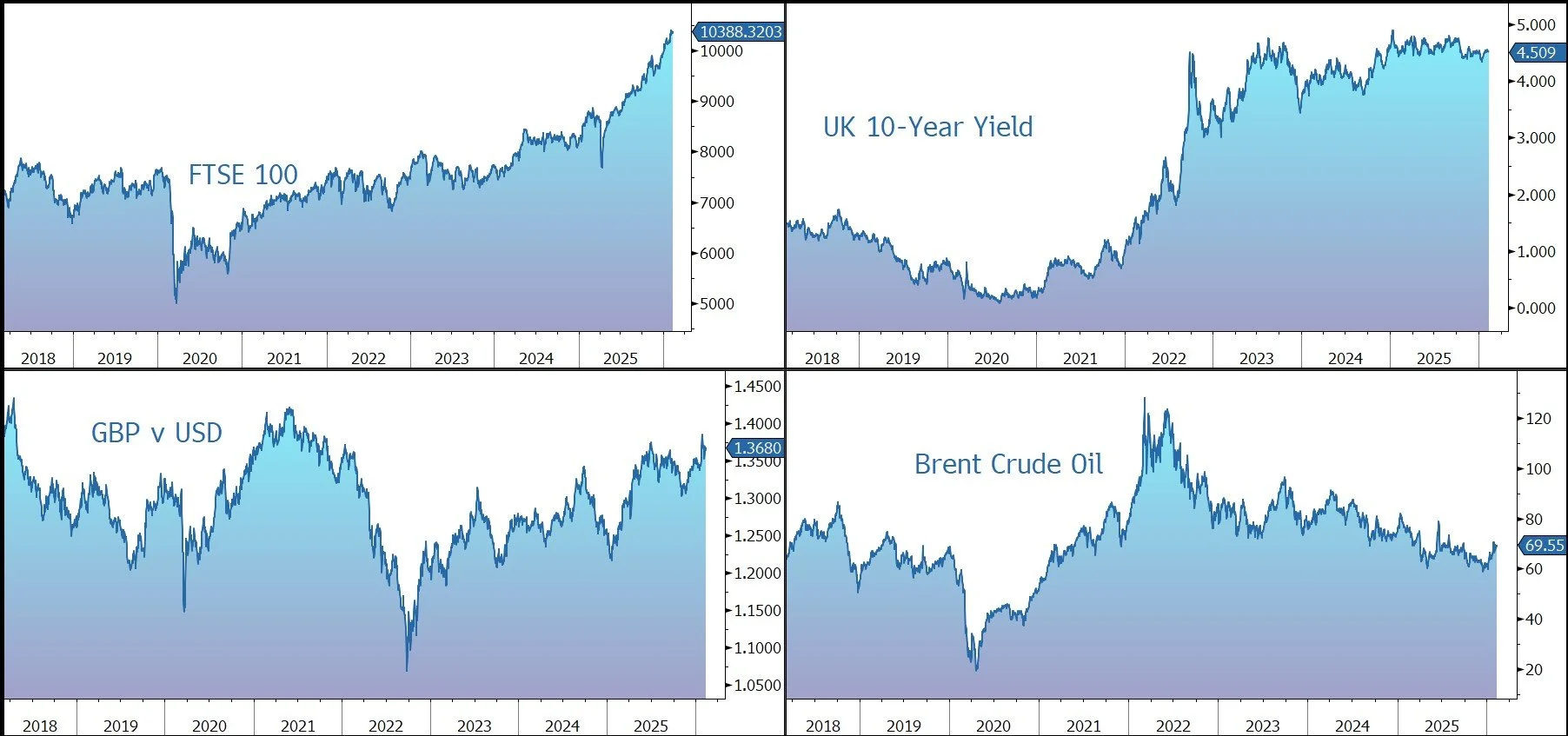

The FTSE 100 is currently 0.4% higher at 10,388, while Sterling trades at $1.3685 and €1.1480. Brent Crude moved up to $69 a barrel.

Source: Bloomberg

Company News

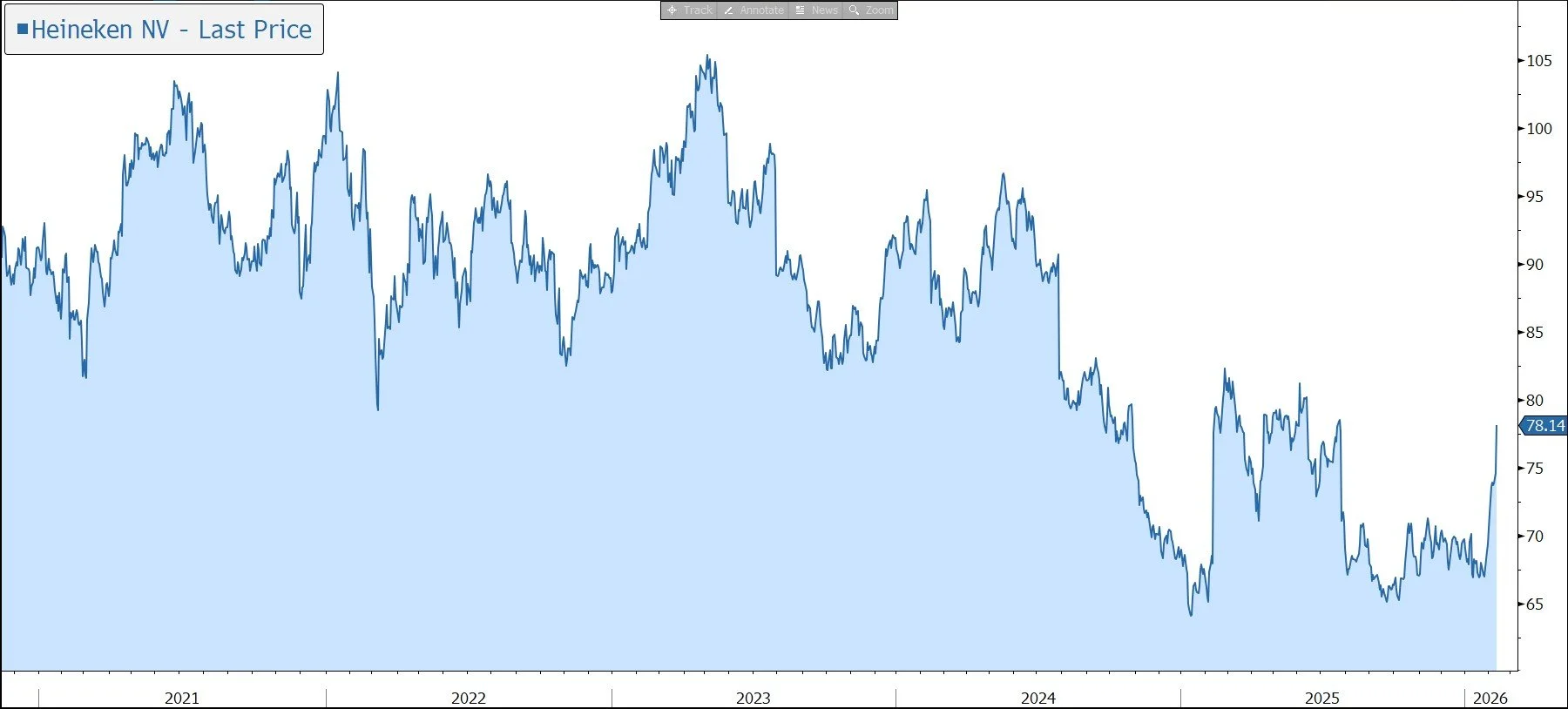

Heineken has released its 2025 full-year results which were slightly ahead of market expectations. The company has initiated prudent guidance for 2026 – operating profit growth of 2%-6% – that is below last year and the market expectation of 5%. However, the company enjoyed a good market share performance, has enhanced its dividend payout ratio, and is just about to embark its next share buyback. As a result, ahead of this morning’s analysts’ meeting, the shares are trading up 4%.

Heineken is the world’s second largest brewer, generating net revenue of €29bn from a portfolio of iconic brands, many of which have been quenching the thirst of consumers for decades. In addition to the core Heineken brand, the company owns several well-known beers and ciders, including Sol, Tiger, Amstel, Murphy’s, and Strongbow, as well as more than 300 or so local brews. The company also owns around 2,400 pubs in the UK, runs a wholesaling operation in Europe, and has a strong global distribution capability. Over time, the group has expanded and developed its global footprint through investment in new breweries, partnerships, and acquisitions. It has also exited several businesses to refine the portfolio.

We believe the company is well placed to benefit from long-term growth opportunities in emerging markets (which generate 55% of revenue), where young and growing populations, low per-capita beer consumption, and increased wealth are expected to drive growth. The company believes the biggest opportunity is in India, with strong prospects in Mexico, Brazil, China, Vietnam, and South Africa. Most recently, the group strengthened its position in Central America through the $3.2bn acquisition of the multi-category beverage portfolio and retail business of FIFCO, a deal that is expected to be immediately accretive to EPS.

The group generates more than 40% of its revenue from premium brands, where volume is growing faster than mainstream beer because consumers turn to better brands as they grow older and wealthier. Premium brands tend to have greater pricing power. Finally, the group is benefiting from the growth of low and no-alcohol products, where it is the global leader, and products ‘beyond beer’ such as seltzers and ready-to-drink products.

We believe the shareholding structure, supported by family ownership, ensures the company is run for the long term and in the best interests of all shareholders.

The EverGreen 2030 Strategy is targeting 17 markets and fewer, bigger brands (5 global and 25 local). The aim is to grow ahead of the Beer category’s +1% volume CAGR, which combined with pricing above input cost inflation, as well as positive mix, underpins the mid-single-digit revenue guidance. Productivity savings of €400m-€500m p.a. are expected to underpin organic profit growth ahead of sales growth. EPS growth is expected to outpace EBIT growth, while the cash conversion target is 90%.

In the near-term, however, the global industry environment is challenging, with headwinds from the impact of weight-loss drugs on alcohol consumption and the request by the US Surgeon General for alcoholic drinks to carry warnings of their links to cancer. Other structural threats include Gen-Z moderation and cannabis cannibalisation, while political risk comes from the proposed US tariffs.

However, these structural concerns are not set in stone – last summer, investment bank Jefferies commissioned a survey of 3,600 US consumers to better understand their attitudes towards alcohol, finding that although moderation was becoming increasingly important, money was the biggest impediment rather than health concerns. This implies that the biggest consumption headwind is cyclical, not structural, and that a macroeconomic recovery could be an inflection point. In addition, the industry has increased its lobbying to counter the message coming from health authorities.

At Heineken, volume remains below pre-covid levels. This a partly explained by the lack of a full recovery in the on-trade business (i.e. pubs, bars, and restaurants), especially in Europe where there are 10% fewer outlets. Heineken’s volume has also been held back by the intentional removal of low-quality, low-margin business.

Last month, the company announced that its CEO and Chairman of the Executive Board Dolf van den Brink has decided to step down from his position on 31 May 2026. The company’s Supervisory Board is now searching to appoint a successor. To ensure the company has full access to the CEO’s industry experience and deep company knowledge, he has agreed to remain available to the company in an advisory capacity for a period of eight months, starting on 1 June 2026. The timing came as a surprise given the CEO’s recent commitment to the financial targets.

On to today’s results. In 2025, net revenue grew by 1.6% on an organic basis to €28.9bn, a touch ahead of market expectations. Growth was driven by a 3.8% increase in net revenue per hectolitre as pricing was used to mitigate inflationary pressure. Total consolidated volume fell by 2.1%, while the underlying price-mix was up 4.1%.

In Q4, net revenue grew by 2.4%. This was driven by 5.0% growth in net revenue per hectolitre. Total consolidated volume fell by 2.4%.

Beer volume fell by 1.2% in organic terms in the full year, in line with guidance for a modest decline, and by 1.7% in the final quarter.

Beer category dynamics varied meaningfully across the group’s markets. In many of the key value and advancing markets, such as Vietnam, Ethiopia, and South Africa, the category expanded, driven by rising penetration, growing consumption, and continued premiumisation, all structural drivers of growth. Despite the macro-economic and geopolitical uncertainties, the Mexican beer category remained resilient and stable. Category momentum was impacted by predominantly cyclical factors in Brazil, where consumer demand weakened with declining real disposable income and withdrawal of government subsidies to lower income households. In Europe, the category declined due to a mix of cyclical factors, notably consumer price sensitivity and the temporary impact from customer negotiations.

Revenue growth in Asia Pacific (+4.2%) and the Africa & Middle East region (+15.7%) was offset by decline in the Americas (-1.0%) and Europe (-3.2%, with an improved volume trajectory in the last quarter).

Marketing and selling expenses expanded to 9.9% of net revenue. This helped the company gain or hold market share in over 60% of its markets, including over 80% of its priority growth markets.

The group continues to see an ongoing shift towards product premiumisation, with volume up 2.7% organically. The Heineken brand itself was also up 2.7% in the year.

In the low & no-alcohol category, the company consolidated its market leadership, with volume up in the low single-digits with double-digit growth in 18 markets. The beyond beer segment continue to growth, driven by Desperados.

The group’s e-commerce platforms continued to grow, with gross merchandise value captured via B2B digital platforms of €13bn. The company is now connecting 800k active customers in fragmented, traditional channels.

The EverGreen strategy continues to generate benefits and leaves Heineken better placed to cope with ongoing macroeconomic volatility. The company is only part-way through its productivity improvements in Europe and there is much more to do in the digital space. The programme delivered in excess of €0.5bn of gross savings in 2025, versus guidance of €0.5bn, and enjoyed an increased flow-through to profit.

Adjusted operating profit grew by 4.4% to €4,385m, versus guidance for growth at the lower end of the 4%-8% range, and market expectations of 4.5%. Improved portfolio mix, pricing, and productivity savings more than offset inflationary pressures in the cost base. The margin expanded by 41 basis points to 15.2%.

Free operating cash flow fell from €3.1bn to €2.6bn, against a tough prior-year comparison, and translated into a cash conversion ratio of 87%.

Heineken has a strong balance sheet. At the end of 2025, financial gearing was 2.2x net debt to EBITDA, below the long-term target to be below 2.5x. With today’s results the group has upped its dividend payout ratio from 30%-40% of full-year net profit to 30%-50%, with the 2025 payment up 2.2% to €1.90 (2.5% yield).

The priority for capital allocation remains organic investment, the dividend, and bolt-on M&A. The company has said it is beyond peak capex and has more to do in terms of working capital improvements. Significant deleveraging has left the company well positioned to return additional capital to shareholders – a two-year €1.5bn share buyback programme is ongoing. The first tranche of €750m was recently completed and the second tranche will start shortly.

Regarding tariffs, the company has previously highlighted that over 95% of its volume is locally produced. The main exception is the US into which the group imports from Mexico and The Netherlands. However, given the US accounts for less than 5% of group revenue, the impact of any tariffs won’t be material. The impact of tariffs on the local economy, particularly in Vietnam and Mexico, have been acknowledged but not quantified.

Guidance for 2026 has been initiated – 2%-6% operating profit growth – a prudent target that is below last year’s 4%-8% and the market expectation of 6%. This reflects the company’s current assessment of beer market conditions, inflation, and other macroeconomic conditions, as well as the investments and changes required to accelerate the EverGreen 2030 strategy with a planned reduction of 5,000–6,000 roles over the next two years. Within the guidance gross savings from productivity initiatives are expected to be at the upper end of the medium-term range of €400m-€500m.

Source: Bloomberg