Morning Note: Market news and an update from Winton Trend

Market News

The dollar weakened on concern over the Federal Reserve’s independence after Chair Jerome Powell said threats of a criminal indictment were a consequence of the central bank’s interest-rate policies. The Fed been served grand jury subpoenas from the Justice Department over ongoing renovations of its headquarters

Gold jumped as much as 2% to a record, before easing back to $4,585 an ounce, while silver hit another high of $84 an ounce. The Swiss franc, seen as a haven, strengthened as much as 0.5%.

Geopolitical tensions remain high - Iran’s parliament speaker warned the US and Israel against any intervention after President Trump threatened strikes amid widespread protests in Iran that have reportedly killed hundreds of people. Brent Crude moved above $63 a barrel, after the largest two-day rally since October.

US equities ended last week on a strong note – S&P 500 (+0.9%); Nasdaq (+1.2%) – brushing aside concerns about the Trump administration’s tariff regime. However, markets are expected to fall back at the open this afternoon.

In Asia this morning, equities moved higher: Hang Seng (+1.2%); Shanghai Composite (+1.1%). Japan was closed for a holiday. China overtook the US in investing abroad in H1 2025, signalling a historic shift in global capital flows.

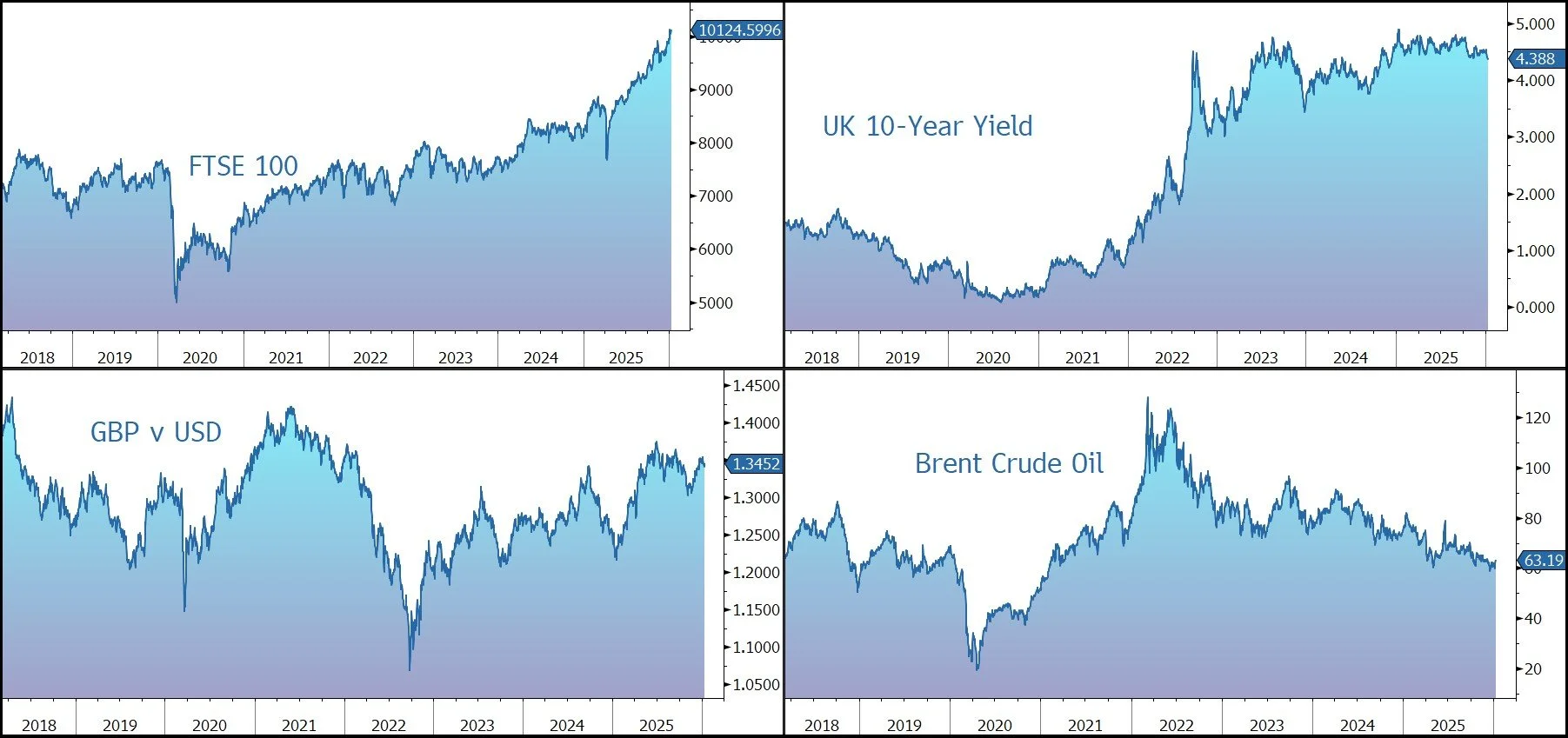

The FTSE 100 is currently 0.2% lower at 10,114, while Sterling trades at $1.3450 and €1.1510. The Recruitment & Employment Confederation and KPMG said permanent staff placements fell at the steepest rate since August, as businesses grappled with rising costs and weak sentiment in the wake of November’s tax-raising budget.

Heineken has announced that its CEO and Chairman of the Executive Board Dolf van den Brink has decided to step down from his position at the end of May 2026 – a search for a successor has been initiated.

Source: Bloomberg

Alternative Investment Update

Diversification across asset classes is a critical element of managing your investments. At Patronus, when we construct a portfolio, we look to allocate a portion of capital to so-called ‘anti-fragile’ investments that provide shelter in difficult times when other (‘fragile’) asset classes (such as equities and bonds) are struggling to a generate positive return. We believe the Winton Trend Fund is one such investment.

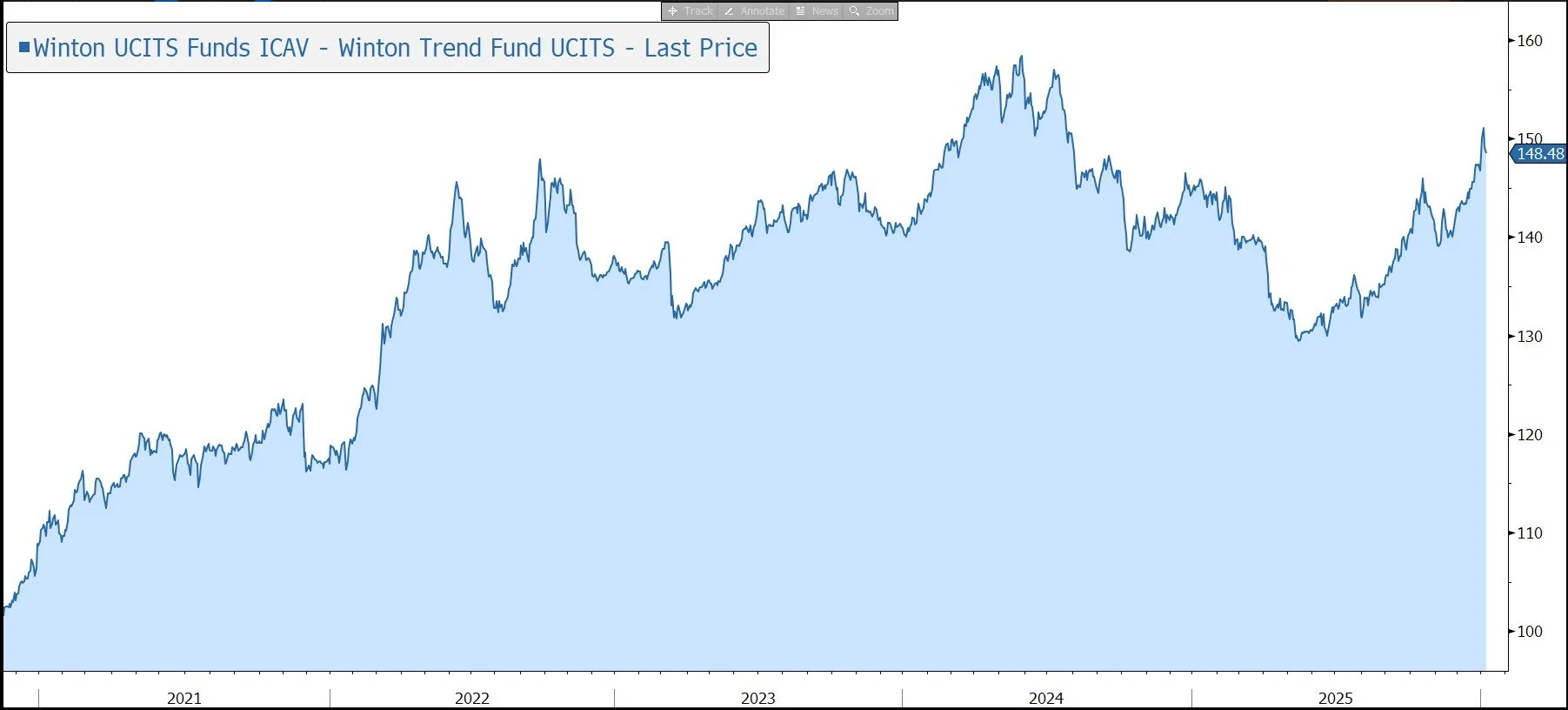

Winton Trend is an actively managed fund which seeks to achieve long-term capital appreciation through a trend following strategy. The manager invests in a diversified portfolio of financial contracts (derivatives) that provide a return linked to the performance (up or down) of certain share indices, bonds, commodities, and currencies. Although the fund has a relatively short track record (since July 2018), it has performed very well in times of market stress.

Total assets in the UCITS vehicle currently stand at around $1.0bn, while the overall trend strategy has assets of $2.4bn.

· The correlation to equities and bonds is low.

· The fund employs a low level of leverage.

· The annualised volatility is the rate at which the price of a fund increases or decreases for a given set of returns. It is measured by calculating the standard deviation of the fund’s monthly returns. It is currently just under 10%. The manager seeks to mitigate against sharp reversals – positions decrease when volatility increases; the system naturally takes profits.

· Despite periodic bursts of outperformance for faster systems, Winton believes the evidence still suggests stronger performance for slower systems over most investment horizons. The fund continues to trade a blend of speeds with the twin aims of maximising risk-adjusted returns and portfolio diversification.

· The fund is relatively low cost: 1% OCR (of which Management fee is 0.80%) and no performance fee.

The manager highlights that although trend-following strategies are often associated with strong performance in difficult times for the stock market, the strategy can also perform well at the same time as equities. What is more important for trend followers is the diversity of the trends on offer – the strategy tends to perform strongly when there are large moves relative to volatility in markets across multiple sectors. Managers can therefore increase the consistency of a trend-following strategy’s returns by maximising the range of idiosyncratic trends in which the strategy can participate.

Although it is difficult to predict where trends will come from, an investor can identify the types of environment where trend following works well. This is where there is a high level of uncertainty that leads to large market moves that are difficult to price in.

During the year, a cross-sectional trend-following system in equity indices was introduced. The system has been traded in Winton’s Diversified Macro CTA since 2021 and is designed to be non-directional, taking long positions in outperforming indices and short positions in underperforming indices. The system has had low correlation with the strategy’s directional trend following in stock indices and other sectors historically. The allocation to the signal is intentionally small, with the aim of modestly improving the overall strategy’s Sharpe ratio, while retaining the performance properties associated with directional trend following.

Overall, we believe the decision to hold the fund depends on whether it will perform well and provide capital protection during periods of market stress. Clearly, 2022 was such a year, with a marked pick-up in risk and volatility as a result of Russia’s invasion of Ukraine. The fund achieved an 18% positive return – outstanding in the context of the heavy fall in both equities (-8% for the MSCI World Equity Index in Sterling terms) and UK bonds (-15% for the Bloomberg/Barclays Bond Indices UK Govt 5-10 Year Index). On this measure, a typical 60/40 equity/bond portfolio was down by 10.8%.

Trend-following funds tend to struggle when a market move sideways or oscillates and when there is a sharp reversal in a trend. The latter factor explains the weak performance in the first half of 2025 when the fund generated an 8.0% negative return. This occurred when uptrends in the US dollar, equity indices, and bond yields began to reverse from February, before these declines accelerated amid President Trump’s “Liberation Day” tariff announcement in early April. A tilt to faster models in equity indices meant that long exposure to the sector had been cut aggressively since February, resulting in a net leverage of close to zero heading into the event. However, sharp losses still accrued in early April across fixed income and currencies, due to short positions in government bonds and non-US dollar currencies.

Winton weren’t alone – the SG Trend Index fell by 10.4% in the first half, with a wide range of returns across constituents between +3% and -18%, with the dispersion reflecting differences in the use of non-trend signals, market weightings, and risk management approaches. However, performance recovered in the second half as trends re-emerged in currencies, crops, and equity indices, and extended to platinum and silver in precious metals. By July, positioning had adapted to profit from the upswing in equity indices and declines in US natural gas, before rallying precious and base metals led the way over the final quarter of the year, with the strategy pushing into positive territory by year-end – the Sterling class was up 1.6% for the year, bringing the annualised return since inception in 2018 at 5.2%.

Looking at performance for the year in detail:

· Precious metals accounted for most of the strategy’s profits in 2025, as it captured the significant trends in gold, silver and platinum – all markets that would have been difficult for long-term investors to buy and hold, given performance over most of the past 15 years.

· Trend following in stock indices was another source of profits, although the strategy participated less in the rebound from mid-April than other CTAs. The reason for this was that the strategy is designed with the aim of diversifying investors’ wider portfolios – an aim that is inconsistent with taking large amounts of risk on the long side in equities.

· At the other end of the spectrum, the lack of direction in most fixed income, energy, and agricultural markets weighed on returns.

In terms of positioning, the strategy’s forecast beta to the MSCI World turned positive in May and increased through to October. The beta has mostly been in the 0.4 to 0.6 range since July, despite the strong uptrend in the sector. This reflects how the strategy is designed to limit risk taking in equities on the long side. The portfolio’s sensitivity to the US 10-year Treasury note turned positive in April, then switched direction six times in the second quarter, rose to 0.9 by October, and turned negative again by December. The beta to the Dollar Index, meanwhile, has been negative since March. Long exposure to precious metals, base metals and meats remains the most notable long exposure in commodities, while exposure to most crops and energies was short heading into 2026. Overall, the portfolio remains well diversified.

At the end of the year, co-CIO Carsten Schmitz retired from Winton and left the investment industry for personal reasons. Simon Judes continues as CIO, with Nick Thomas-Peter – a senior member of the investment team for over a decade – appointed to the new role of Deputy CIO. Thomas-Peter has been working on the development and scaling up of the firm’s mid-frequency futures and equity businesses. Although Schmitz had overseen the development of many of Winton’s key strategic initiatives, we were pleased to see an orderly transition.

Although performance of Winton Trend was mixed in 2025, we remain positive on the fund given its portfolio diversification attributes. At a time when the geopolitical and macro-economic outlook remain uncertain and the prospects for other asset classes remains unclear, we believe an allocation to Winton Trend Fund could continue to help mitigate any losses suffered elsewhere in portfolios.

Source: Bloomberg