Morning Note: Market news and an update on alternative investment fund BH Macro.

Market News

India and the EU have agreed on a free trade pact after nearly two decades of negotiations – the deal creates a free-trade zone of nearly 2 billion people, which is a key strategic counterweight to other regional blocs. New Delhi is also expected to expand trade in oil and gas with Canada. President Trump threatened to raise tariffs on South Korean goods to 25% after the country failed to codify the trade deal.

The US has indicated to Ukraine that security guarantees are contingent on Kyiv agreeing to a peace deal that would likely involve ceding Donbas to Russia, the FT reported. There is increasing pressure for a diplomatic resolution.

Precious metal prices experienced heightened volatility yesterday but have regained their poise this morning. Gold and silver trade at $5,080 and $111 an ounce, respectively. Options traders are betting on a further rally in gold prices, with bets reaching $5,550 to $6,500 as investors shun bonds and currencies.

The Japanese yen traded near 154 per dollar on Tuesday after rallying as much as 3.2% over the previous two sessions amid heightened concerns about a potential joint foreign exchange market intervention by Tokyo and Washington.

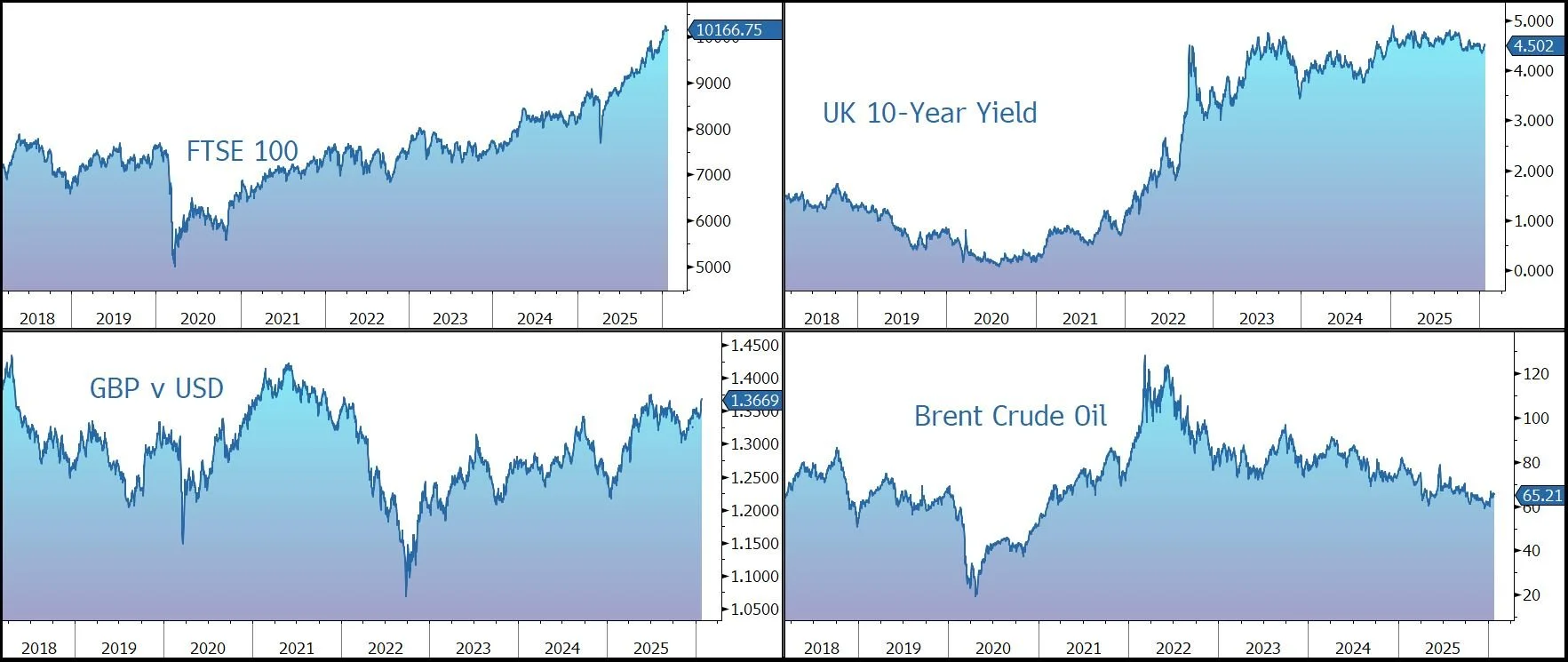

Equity markets are firm across the board, with gains in both the US last night – S&P 500 (+0.5%); Nasdaq (+0.4%) – and in Asia this morning: Nikkei 225 (+0.8%); Hang Seng (+1.4%); Shanghai Composite (+0.2%). Tech shares were among the biggest gainers in Asia, with companies such as SK Hynix and Samsung Electronics among those advancing. A gauge of Asian technology stocks jumped 2.3% to an all-time high. The FTSE 100 is currently 0.3% higher at 10,167, while Sterling trades at $1.3670 and €1.1530.

Source: Bloomberg

Alternative Investment News

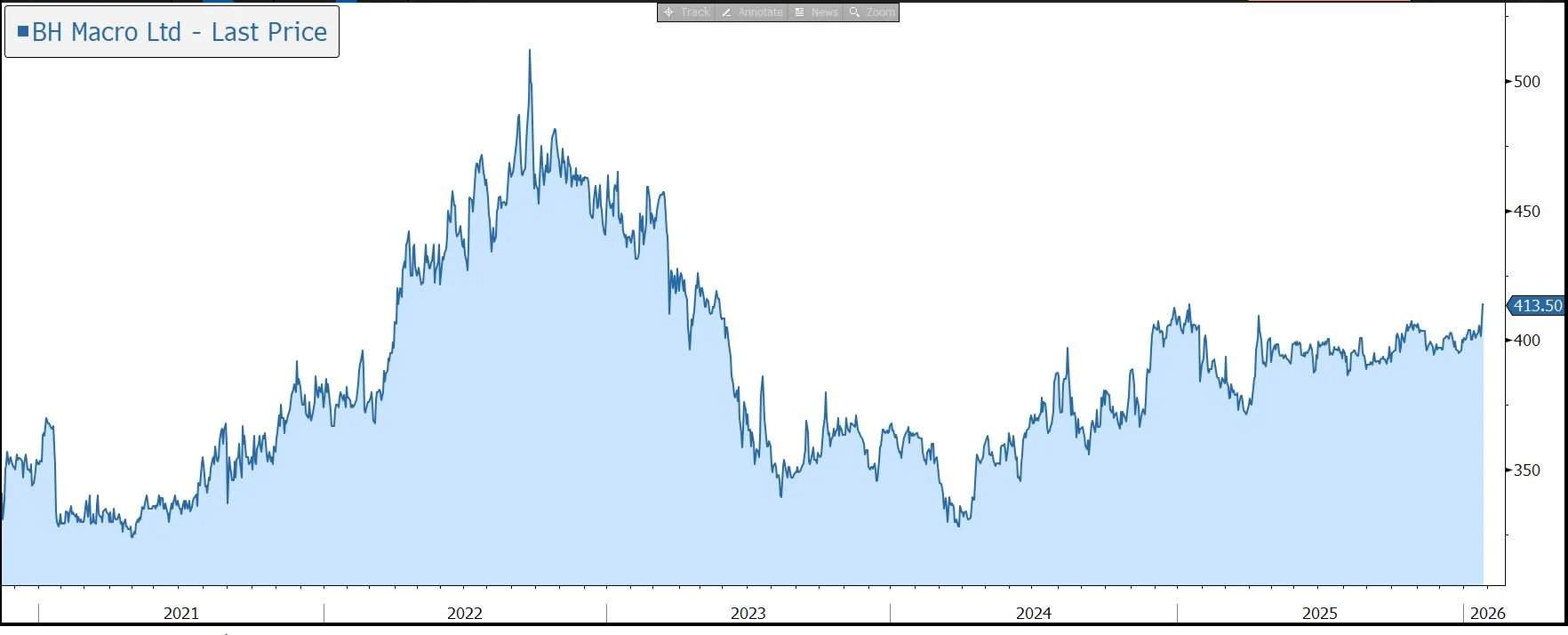

BH Macro (BHMG) is a London-listed closed-ended investment company that invests substantially all its assets in the ordinary shares of $12bn Brevan Howard Master Fund. This is Brevin Howards’s longest running fund and one of the most successful hedge funds of all time in terms of the absolute amount of money returned to investors.

The decision to hold the shares depends on whether the fund will provide capital protection during periods of market stress. In this regard, it has a good track record when equity markets are falling and has shown correlation with market volatility. Since inception in 2007 to the end of 2025, in the 20 worst performing months for equities, the BH Macro NAV has produced 17 positive monthly returns.

However, over time the BH Macro share price has been more volatile than the NAV, with significantly larger drawdowns – a risk of the investment trust structure. For a number of reasons, the shares have lingered at a sizeable discount over the last couple of years.

Against this backdrop, the company has announced that it has been informed by its manager, Brevan Howard Capital Management (the ‘Manager’), that the Manager is in the process of establishing a new private fund which, once launched, intends to invest and trade in strategies and funds managed by the Manager, including BH Macro itself.

This is a significant development that is structurally designed to support the share price and narrow the persistent discount to NAV.

The new private fund is explicitly designed to invest and trade in BH Macro shares. The fund has the ability to buy BH Macro shares, of either currency class, directly on the London Stock Exchange. This creates a new, consistent ‘buyer of last resort’ that can help soak up excess supply in the market. The fund will finance these purchases by redeeming its direct holdings in the Brevan Howard Master Fund. Effectively, the manager is shifting internal capital from the private master fund into the public BH Macro shares whenever the public shares are trading at an attractive discount.

BH Macro has persistently suffered from a discount to its NAV, currently 10%, which is wider than its historical average. By establishing a fund that can actively trade these shares, the manager can essentially arbitrage the discount themselves. This signals to the market that the manager believes the shares are undervalued, which typically acts as a floor for the share price and discourages short-sellers or aggressive discount hunters.

This announcement comes at a time when BH Macro faces a potential mandatory wind-up vote. Under BH Macro’s rules, if the share price discount averages more than 8% over a calendar year (which it did), it triggers a vote on whether to close the share class and return money to investors. By boosting demand through this new private fund, Brevan Howard is taking a proactive ‘self-help’ measure to push the share price back toward the NAV and avoid the risk of a forced liquidation or share class closure.

At the same time, the company will continue to buy back its shares. In fact, last week the board increased its annual buyback allowance from 5% to 14.99% of shares in issue. Previously, if the company bought back more than 5% of its shares, it had to pay a 2% penalty fee to the manager. The board has successfully negotiated the removal of this fee for 2026, meaning they can now buy back nearly 15% of the company without incurring extra costs.

The main negative is that the move potentially reduces the liquidity of the shares. We note Rathbones still owns 19%, and if the company buys back 14.99% and the private fund buys a significant chunk more, the liquidity of the shares may become an issue for potential shareholders.

However, yesterday’s announcement is very positive and sends a clear message that the board will not let the discount persist. In response, the shares have been marked up by 3%, effectively closing some of the NAV discount.

Source: Bloomberg