Morning Note: A Round-up of Global Financial Market News

Market News

Canadian Prime Minister Mark Carney said Ottawa has no plans to pursue a free trade deal with China, noting the recent agreement only reduces tariffs on select sectors. Carney’s remarks came a day after President Trump threatened to slap 100% tariffs on Canadian imports if it solidifies a trade deal with Beijing. Frictions between the US and Europe over Greenland, as well as tensions in the Middle East, also kept investors on edge. Meanwhile, risks of a US government shutdown surfaced as Senate Democrats vowed to block a major funding bill following the Minneapolis shooting.

Against that backdrop, demand for safe haven assets remained strong. Gold surged past the $5,000 an ounce barrier – it currently trades at $5,095 – while silver also extended its record-setting rally helped, in part, by supply concerns.

The dollar fell against most of its major peers as potential US involvement in foreign-exchange intervention in Japan hurt sentiment toward the world’s reserve currency. Last week’s sudden crash turned Japan’s bond market into a $7 trillion threat to global financial stability.

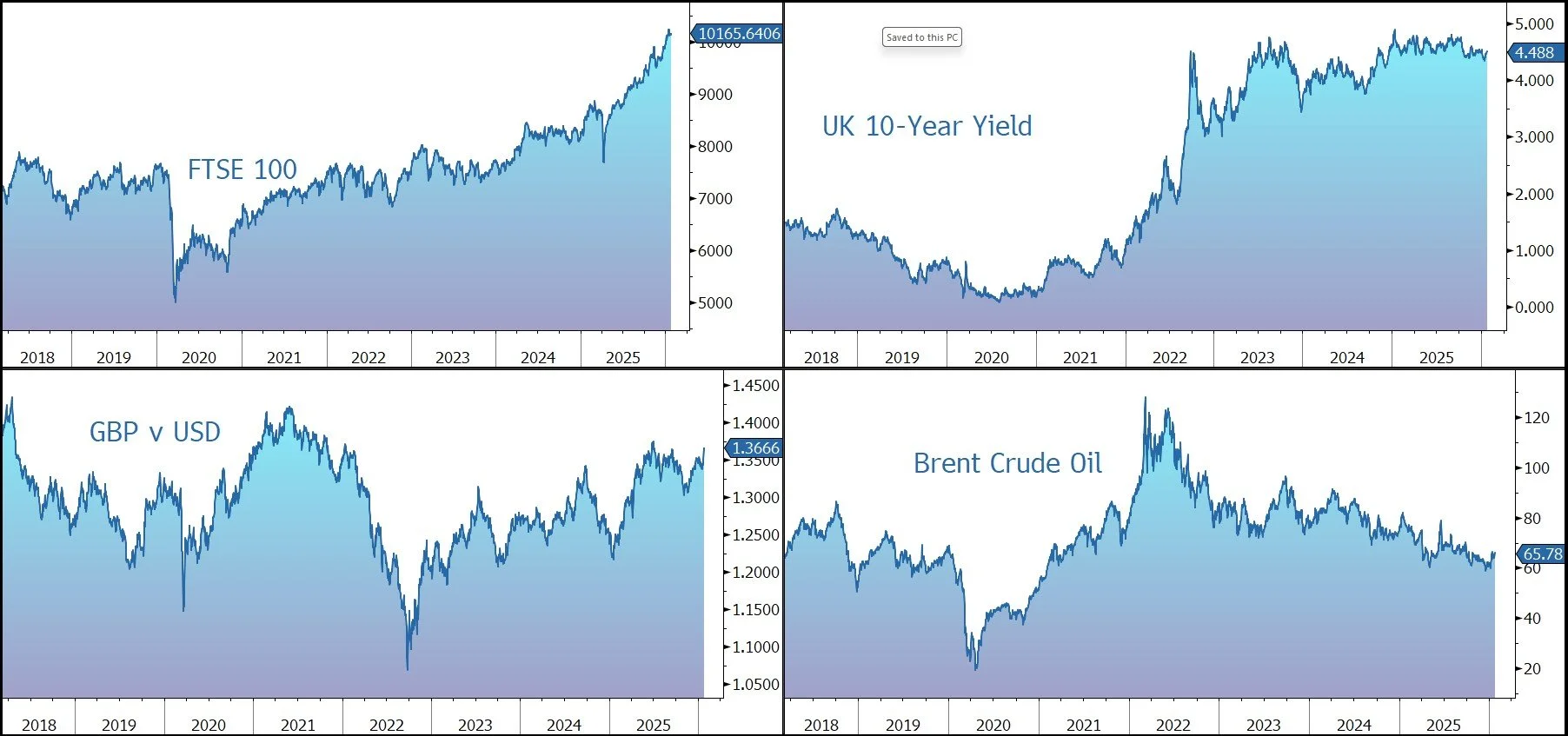

Equities kicked off the week on a subdued note – Nikkei 225 (-1.8%); Hang Seng (+0.1%); Shanghai Composite (-0.1%) – while the FTSE 100 is currently 0.2% higher at 10,165. The S&P 500 Futures are currently predicting little change at the open this afternoon.

This week, the AI theme faces its most important test in months as Microsoft, Meta, Tesla, and Apple report earnings on Wednesday and Thursday. Other companies reporting include Atlas Copco, ASML, LVMH, Visa, Mastercard, and Colgate-Palmolive.

Brent Crude trades at $65.50 a barrel, while US natural gas continued its recent rally driven by the cold snap. The US is in talks with crude producers and oilfield service providers about a plan to quickly revive output in Venezuela at a fraction of the estimated $100bn cost for a complete rebuild.

Keir Starmer’s Labour allies blocked Manchester Mayor Andy Burnham from contesting a seat in Parliament, thwarting a possible leadership challenge against the UK PM.

Traders have scaled back expectations for Bank of England rate cuts following comments from policymaker Megan Greene and stronger-than-expected UK economic data. Greene noted that a central bank survey suggests the decline in wage growth has run its course, and she expressed less concern over slowing disinflation, while looser US monetary policy could support higher UK inflation. Sterling trades at $1.3640 and €1.1520, while 10-year Gilts yield 4.48%.

British companies lost a net 8% of jobs over the past 12 months because of AI — a faster rate than international peers, according to Morgan Stanley research.

Source: Bloomberg