Morning Note: Market news and an update from Atlas Copco.

Market News

The dollar fell for a fourth straight session to its weakest level since February 2022, as President Trump said he was not concerned about the currency’s recent decline, adding that it had not fallen too much. The remarks reinforced market perceptions that the administration is comfortable with a softer dollar as it makes exports more competitive. The greenback was also pressured by heightened policy uncertainty in Washington, including Trump’s renewed threats to take over Greenland and criticism of the Federal Reserve’s independence.

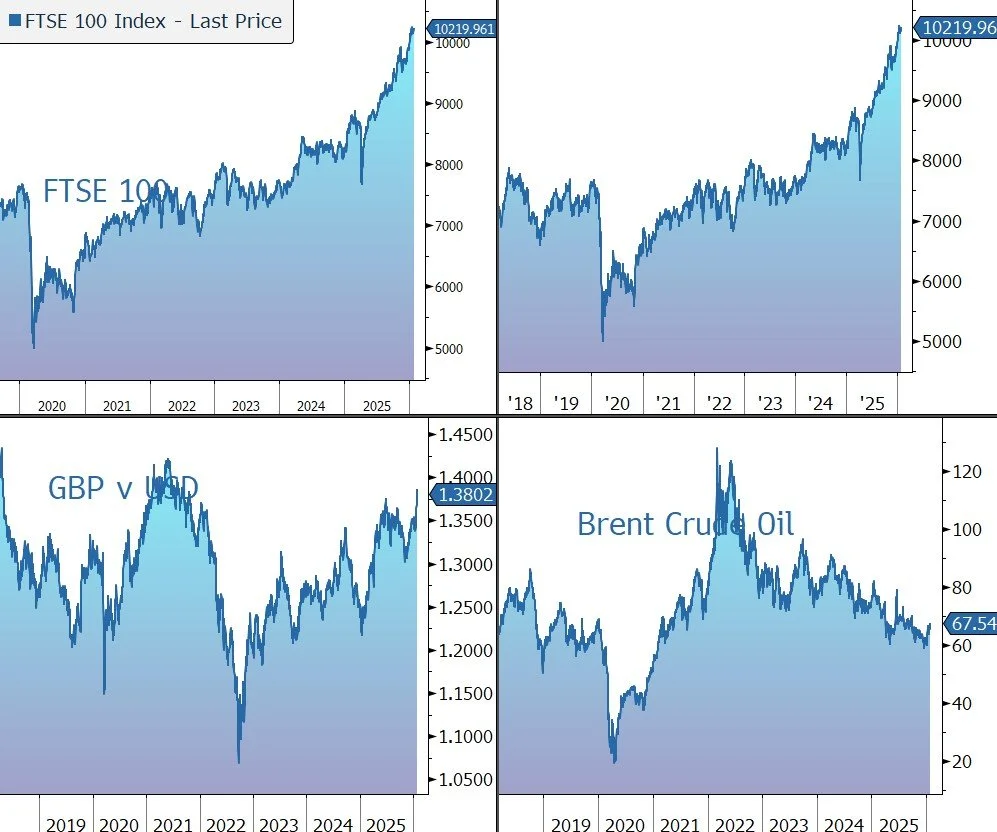

Gold rose to a new high of $5,295 an ounce as the decline in the dollar fuelled investor demand for safe-haven metals. Tether has amassed one of the largest bullion hoards in the world. Brent Crude continued its recent rally and currently trades at $67 a barrel, driven by supply disruptions resulting from the severe winter storm in the US.

The Federal Reserve is widely expected to hold interest rates steady this evening, with markets focused on any guidance regarding the timing of the next rate cut. Attention will be on Jerome Powell, who will be speaking for the first time since he issued a forceful statement on the DOJ’s subpoenas earlier this month. The 10-year Treasury currently yields 4%.

Equity markets remain well supported, both in the US last night – S&P 500 (0.4%); Nasdaq (0.9%) – and in Asia this morning: Nikkei 225 (+0.1%); Hang Seng (+2.5%); Shanghai Composite (+0.3%). The FTSE 100 is currently 0.2% higher at 10,220, while Sterling trades at $1.3780 and €1.1510.

ASML’s earnings beat and €12bn buyback sent the shares up 5%. LVMH is down 6% after its Q4 results highlighted a weaker margin and cautious tone on the first signs of demand recovery. The Mag 7 earnings season kick off after the market close, with releases from Tesla, Meta, and Microsoft.

Source: Bloomberg

Company News

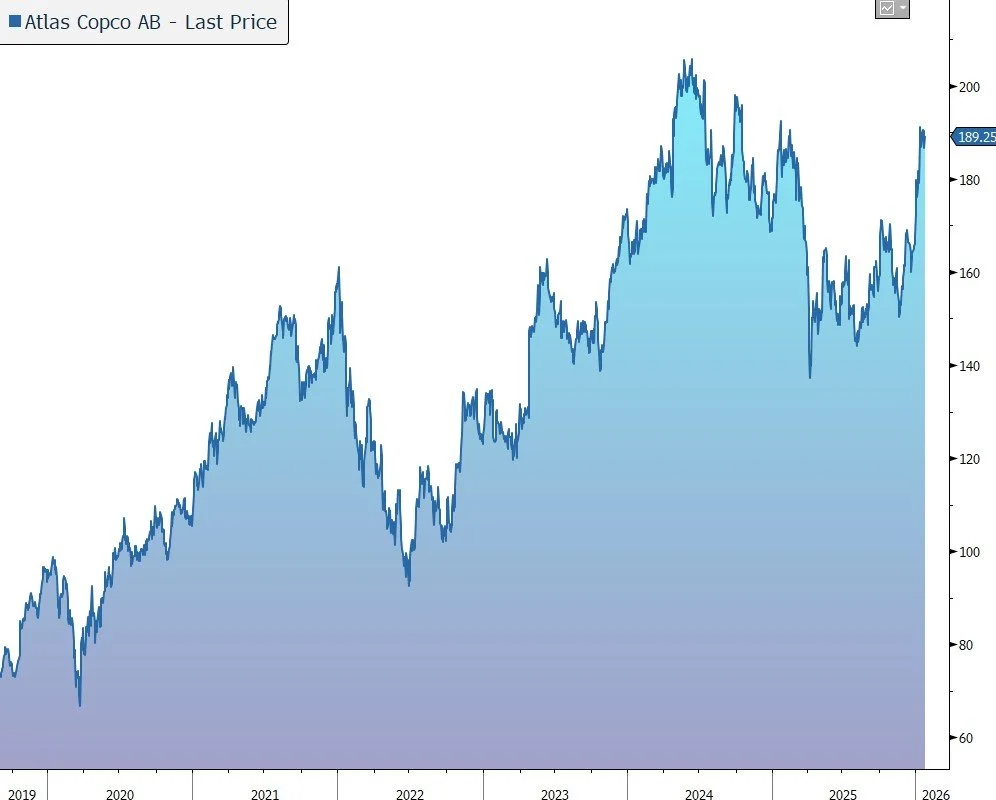

Yesterday lunchtime Atlas Copco released Q4 results which were slightly below the market forecast. The statement highlighted that although the demand for equipment remained mixed, the order volumes for both service and equipment increased during the quarter. Cash flow was solid and the company declared an ordinary dividend in line with last year and also a special payment, a strong signal of management confidence. Looking forward, the group expects customer activity will remain at the current level. In response, the shares, which are listed in Sweden, were marked down 2%, albeit the loss has been recouped this morning. We remain positive on the long-term outlook for the company as it is a quality compounder exposed to attractive growth trends.

Atlas Copco is a world-leading manufacturer of innovative compressors, vacuum solutions, generators, pumps, power tools, and assembly systems. The group has a diverse customer base made up of general manufacturing (22%), process industry (20%), electronics/semis (16%), construction (12%), auto (10%), and other sectors (20%). The products help the customer increase operational performance, save energy costs, reduce contamination, cut down on failures in the field, lower noise levels, and extend service intervals. They are almost always critical to its customers’ operations.

As a result, the company provides exposure to a broad range of trends: demand for increased energy efficiency and reduced emissions; increased use of lightweight materials in transport industries; the transition from petrol to electric vehicles; increased use of demanding materials and production environments in processes for semiconductor and industrial production; increased production automation and smart factories; demand for improved ergonomics; and increased demand for digitally-supported service offers. Overall, the company will therefore play a role in the effort to reorganise and improve the resilience of supply chains, bring manufacturing closer to domestic markets, and increase automation in the face of higher labour costs or deteriorating demographics. Finally, over time the vacuum business should benefit from the expansion of the North American semiconductor manufacturing market.

The target is to increase revenue by 8% per annum, primarily through organic means, complemented by selective acquisitions of companies in or close to existing core competencies. Using a decentralised structure, the company lets these small bolt-on companies run autonomously while plugging them into its global service network.

The group operates an asset-light strategy – only components that are critical to the performance of the equipment are manufactured in-house. The company has integrated itself with its customers and can provide rapid and extensive support to their installed base of equipment. 36% of revenue (and 50%+ of operating profit) is generated from service (i.e., spare parts, maintenance, repairs, consumables, accessories, and rental). This is more stable than equipment sales and provides a strong base for the business and greater resilience in difficult times. The cost of the group’s equipment is low relative to the customer’s operating costs, and as a result, the company has strong pricing power, helpful when trying to pass on raw material cost inflation or tariffs. Atlas Copco is based in Sweden and reports in Swedish Krona (SEK).

The Wallenberg Family (through its holding company, Investor) is the largest shareholder of Atlas Copco, having overseen its entire history, and has a member on the Board. The business is run for the long term in a way that ensures it is passed on to the next generation in better shape than it was inherited, with a focus on consistent operational culture, financial prudence, and sensible capital allocation.

During the final quarter of 2025, the overall demand for Atlas Copco Group’s equipment and services increased compared to the previous year. Order volumes for both service and equipment increased, even if the demand for equipment was mixed.

Revenue fell 7% in the quarter to SEK 42.8bn, a touch below the market forecast of SEK 43.1bn. In organic terms, which excludes M&A (+4%) and currency (-11%), revenue was flat. This was a slight deterioration compared to the 1% growth in the previous quarter. In the full year, revenue fell by 5% to SEK 168bn, with an organic decline of 1%.

Order intake was up 4% in organic terms in the final quarter to SEK 38.6bn, leaving the full year up 1% at SEK 166bn.

Atlas Copco operates through four divisions or ‘Techniques’, with the performance in the final quarter as follows:

· Compressor Technique (46% of 2025 sales): organic revenue rose by 3% in the final quarter, while orders rose 7%. Orders for industrial compressors increased, and solid order growth was achieved for gas and process compressors.

· Vacuum Technique (22% of sales): organic revenue fell 3%, while orders rose 13%. The order intake for vacuum equipment increased notably, supported by increased demand from both the semiconductor and the general industries. The hope is that the semiconductor ‘trough’ is now behind the company.

· Industrial Technique (16% of sales): organic revenue and orders fell by 3% and 1%, respectively. Orders for industrial assembly equipment and vision solutions, on the other hand, decreased somewhat due to weaker demand from the automotive industry. The company has responded quickly with a restructuring programme for which it took a SEK 261m provision.

· Power Technique (17% of sales): organic revenue and orders fell by 4% and 6% respectively. The order intake for power equipment, such as portable compressors, generators, and pumps, weakened.

Regarding tariffs, the company has previously highlighted that it has 18 production facilities in the US. They are working on a mitigation strategy, with short-term actions focused on pricing and supply adjustments, and expect to be able to fully cover the impact of tariffs over the coming quarter.

Atlas Copco generates attractive margins, with gross above 40%, providing some shelter against rising raw material costs, and operating margin above 20%. In Q4, adjusted operating profit fell by 13% to SEK 8.77bn, slightly below the SEK 9.02bn market forecast. The margin was down 130 basis points to 20.5%, due in part to increased costs related to trade tariffs and dilution from acquisitions. In the full year, adjusted operating profit fell by 10% to SEK 34.9bn, with the margin down by 120 basis points to 20.7%.

EPS declined by 15% in Q4 to SEK 1.36, and by 11% to SEK 5.40 in the full year. The return on capital employed during the previous 12 months slipped from 28% to 24% but is still well above the group’s 20% target and 8.0% cost of capital.

At the company’s latest Capital Markets Day, management highlighted some opportunities for self-help improvement as not all of the 24 smaller business units are where they need to be on profitability.

The company has a robust balance sheet and continues to generate strong operating cash flow (SEK 26.8bn in 2025). Net debt increased from SEK 18.1bn to SEK 20.7bn versus last year, while interest-bearing liabilities have an average maturity of 4.6 years. Financial gearing is a very comfortable 0.5x net debt to EBITDA.

The group continued to consolidate its industry with acquisitions, with 29 deals closed in 2025. The dividend policy is to pay out 50% of net income. For 2025, the group approved an ordinary payout of SEK 3.00 per share, in line with the previous year, and an extra distribution of SEK 2.00 per share, resulting in a total combined dividend of SEK 5.00 per share to be paid in two equal installments and equivalent to a 2.7% yield. We believe this sends a strong signal of management confidence.

The group provided brief commentary on the near-term outlook, highlighting that it expects customer activity will remain at the current level. On the call, management said the outlook across sector remains varied, with semiconductors more active, but autos weak.

Source: Bloomberg