Morning Note: Market news and a positive update from retailer Next

Market News

Geopolitical tension remains elevated. Delcy Rodríguez was sworn in as acting president of Venezuela amid signs the unrest is unleashing a new wave of repression.

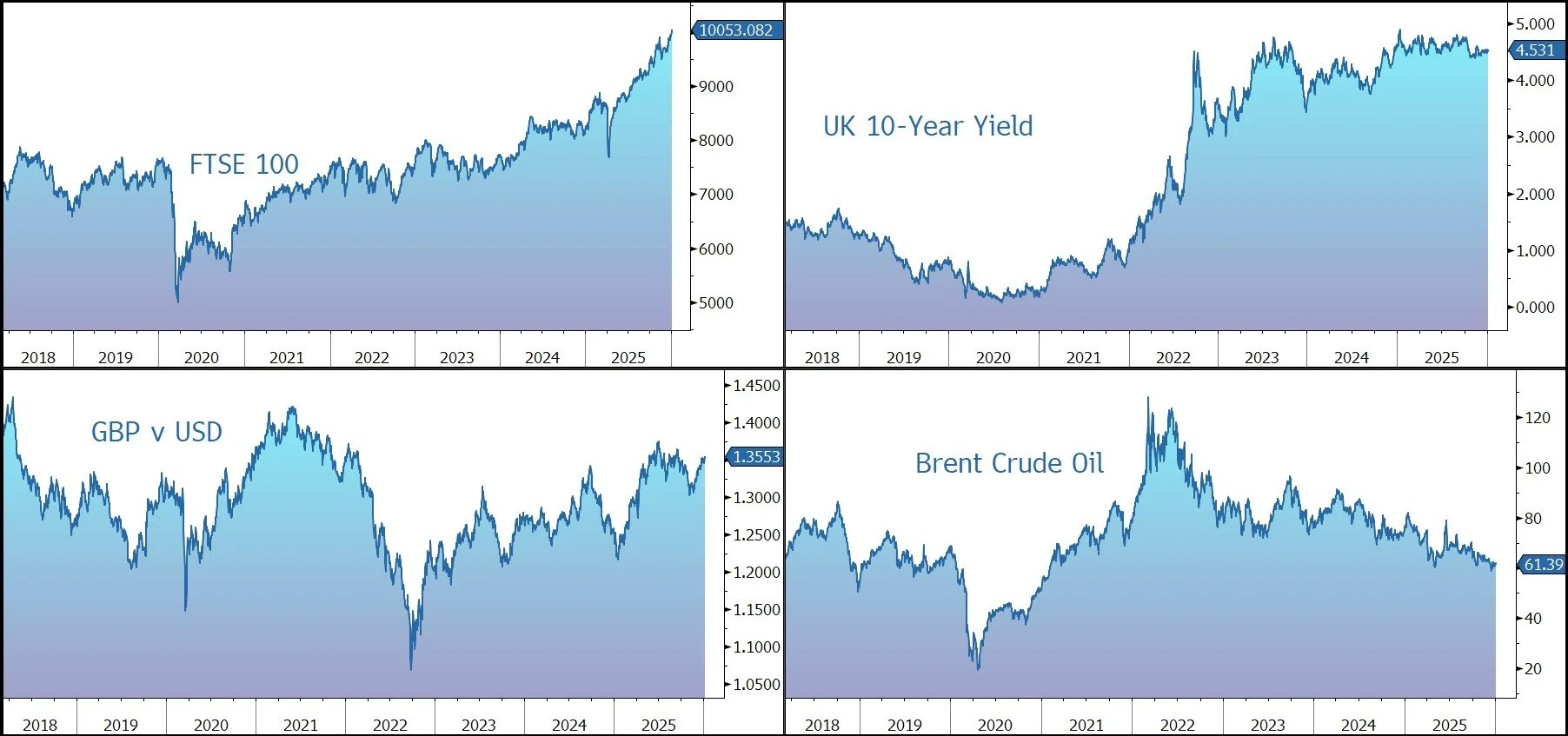

Commodities continued to march higher, with notable strength in Gold ($4,460 an ounce), silver ($78 an ounce), and copper (a record high of over $6 a pound). Brent Crude edged up to $61.50 a barrel as traders continued to assess the impact of US actions toward Venezuela on global oil supply.

Dollar weakness continued following the release of subdued manufacturing data. An MLIV pulse survey showed 76% of respondents predicting the dollar’s weakness to persist for a second year. Treasuries were firmer across the curve, with the 10-year bond currently yielding 4.18%. Twenty issuers, including GM’s auto-financing arm and Williams, sold $37bn of investment grade bonds on the first Monday of 2026, the busiest day since October.

US equities closed higher last night – S&P 500 (+0.6%); Nasdaq (+0.7%) – albeit off the best levels. Integrated energy and oil services were notably higher on Venezuela headlines and possibility for large infrastructure investments. Big tech was largely stronger, with Tesla and Amazon the notable Mag 7 gainers. In Asia this morning, stocks rose to a record, with the MSCI Asia Pacific Index logging its best start to a year since 2012: Nikkei 225 (+1.3%); Hang Seng (+1.5%); Shanghai Composite (+1.5%).

The FTSE 100 is currently 0.3% higher at 10,032. Prudential will start a $1.2bn share buyback. More than half of British companies’ finance chiefs expect AI to deliver a growth boost, in a sign of rising optimism over the technology’s potential to transform the economy, according to Deloitte. UK food inflation rose to 3.3% in the 12 months to December 2025, up from 3% in November, according to the British Retail Consortium. Total shop price inflation reached 0.7% in December, driven by the uptick in food costs despite a 0.6% deflation in non-food items. Sterling trades at $1.3554 and €1.1548.

Source: Bloomberg

Company News

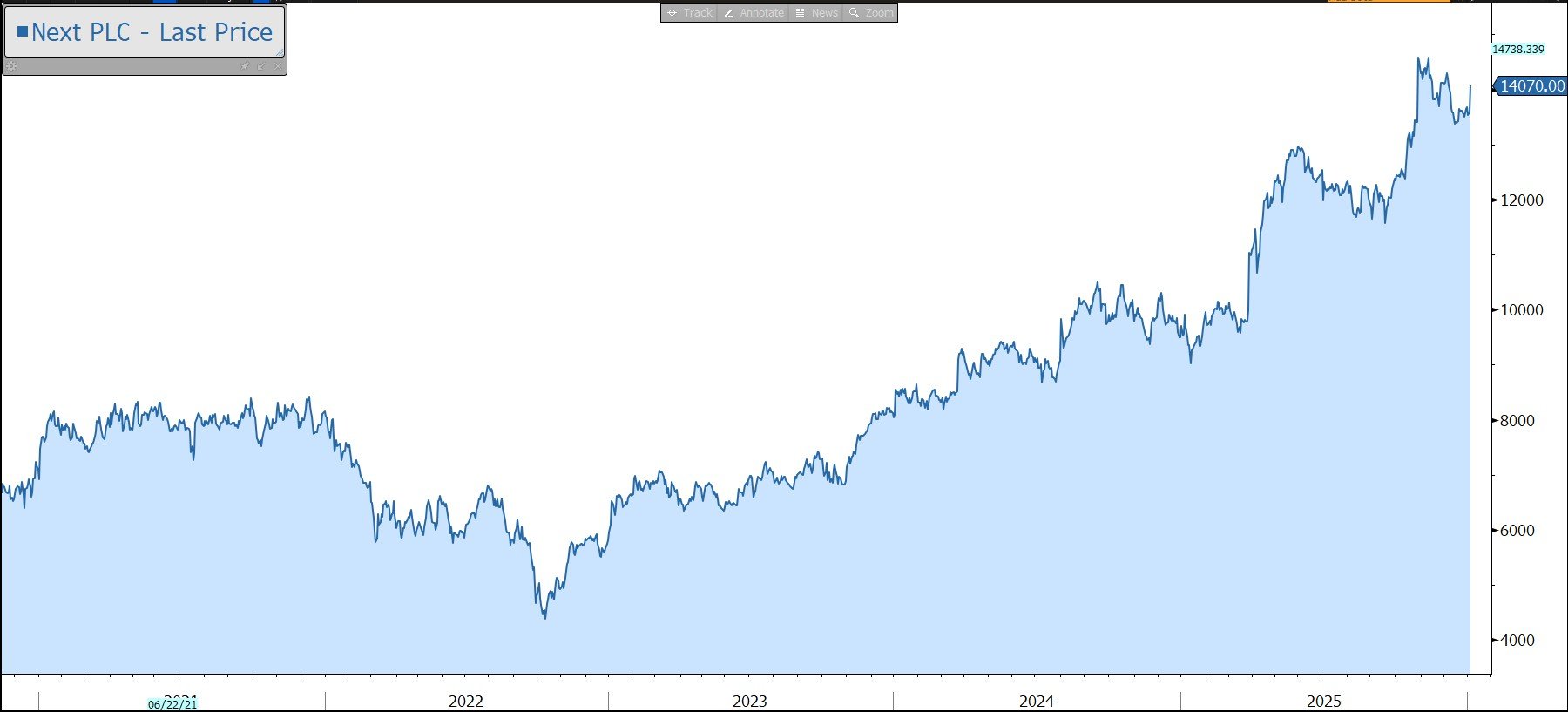

Retailer Next has this morning released a trading update for the nine weeks to 27 December 2025 which highlights that sales during November and December were better than anticipated. In response, the group has raised its guidance for the financial year to end January 2026, pushing the shares up by 3% in early trading this morning.

During the period, full-price sales were up 10.6% versus last year, £51m better than the group’s previous guidance of 7.0% growth for the period. This leaves financial year-to-date growth of 10.7%.

Note that full price sales are VAT exclusive sales of items sold at ‘full price’ in Retail and Online plus NEXT Finance interest income. They exclude items sold in sale events, clearance operations and through Total Platform.

By region, UK sales rose by 5.9%, better than expected. The company believes sales benefited from higher stock levels than last year, when supplier deliveries were delayed by disruption in Bangladesh and global freight networks. International sales rose by 38.3%, driven in by an increase in profitable marketing expenditure. By channel, Online grew by 9.1%, while Retail stores were up 1.4%.

The amount of stock in the group’s end-of-season sale was higher than previously anticipated and up 5% on last year. The adverse effect of more sale stock was offset by better-than-expected clearance rates. The net effect was to add £30m to guidance for total group sales but was profit neutral.

The group has increased its profit before tax guidance for the financial year to end January 2026 by £15m to £1,150m, up 13.7% versus last year. Earnings per share is now expected to come in at 738.8p, versus the previous guidance of 729.4p, a 1.3% upgrade.

Cash generation has remained strong, with £474m of surplus cash, before any investments and further distributions to shareholders. As previously guided, Next plans to increase net debt in line with the increase in profit before interest and tax. This will increase net debt (excluding lease liabilities) at the year-end by around £79m to £739m.

For most of the year, the share price has largely remained above the group’s self-imposed buyback price limit, limiting the scope for buybacks – only £131m was repurchased during the year.

Growth next year is expected to be lower than this year. In the UK, growth in the current year was boosted by very favourable summer weather, competitor disruption and improved stock levels. So, the company will face tough UK comparatives, particularly in the first half. Continuing pressures on UK employment are likely to filter through into the consumer economy as the year progresses. Growth from the group’s overseas direct websites is likely to moderate from the exceptional levels achieved this year.

The company has provided initial guidance for the year ended January 2027: full price sales growth of 4.5%; profit before tax forecast up 4.5% to £1,202m; cash available for distribution to shareholders is expected to be £768m (4.8% of market capitalisation). Currently the share price is above the group’s buyback price limit of £128, so management has assumed that surplus cash will be returned by way of a special dividend or other capital return.

Source: Bloomberg