Morning Note: Market news and a positive update from Whitbread.

Market News

The Fed subpoenas have triggered a backlash that may derail Trump’s plans to tighten his grasp of the central bank.

US attorney for DC Jeanine Pirro has no plans to back down and didn’t even seek sign-off from her bosses before subpoenaing the Fed. The 10-year Treasury yields 4.20%, while gold has slipped to $4,595 an ounce.

Donald Trump vowed to impose a 25% tariff on goods from any country doing business with Iran, a move that risks upending America’s trade truce with China, the world’s top buyer of Iranian oil. Brent Crude is $64 a barrel.

US equities edged higher last night – S&P 500 (+0.2%); Nasdaq (+0.3%). Google owner Alphabet pushed through the $4 trillion market cap barrier following confirmation of a multi-year deal for AI Technology with Apple. JPMorgan kicks off Big Bank earnings in the US pre-market, with the lender’s credit card business in focus after Trump’s threats of an interest-rate cap. Revenue from trading stocks and bonds may show a 13% surge from a year earlier.

In Asia this morning, the yen weakened to its lowest since July 2024 and stocks soared – Nikkei 225 (+3.1%) – after Kyodo reported PM Sanae Takaichi intends to call a snap election The move is aimed at solidifying support for her hawkish political stance and pro-stimulus policies. Elsewhere, other Asian indices were firm: Hang Seng (+0.9%); Shanghai Composite (+1.1%).

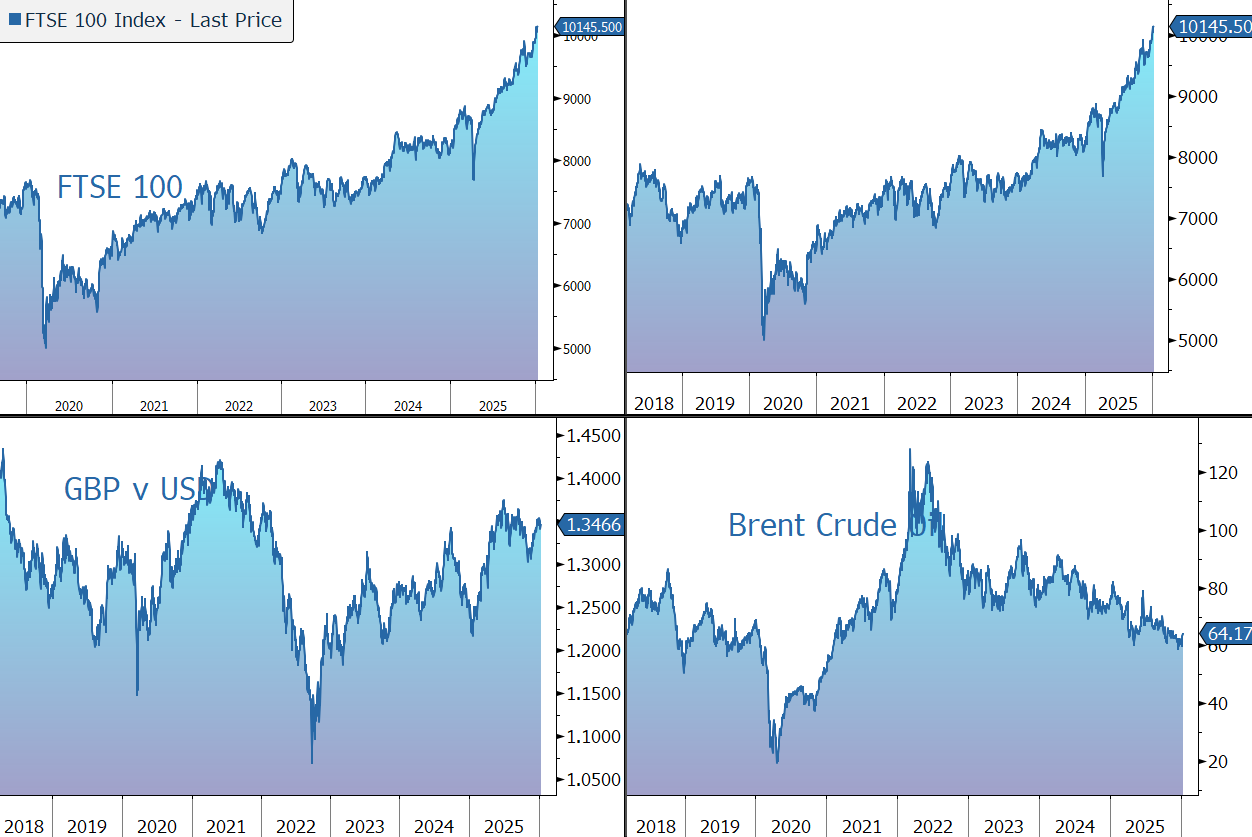

The FTSE 100 is currently little changed at 10,145, while Sterling trades at $1.3470 and €1.1545. UK retailers have reported a drab Christmas as shoppers waited for the Sales.

Source: Bloomberg

Company News

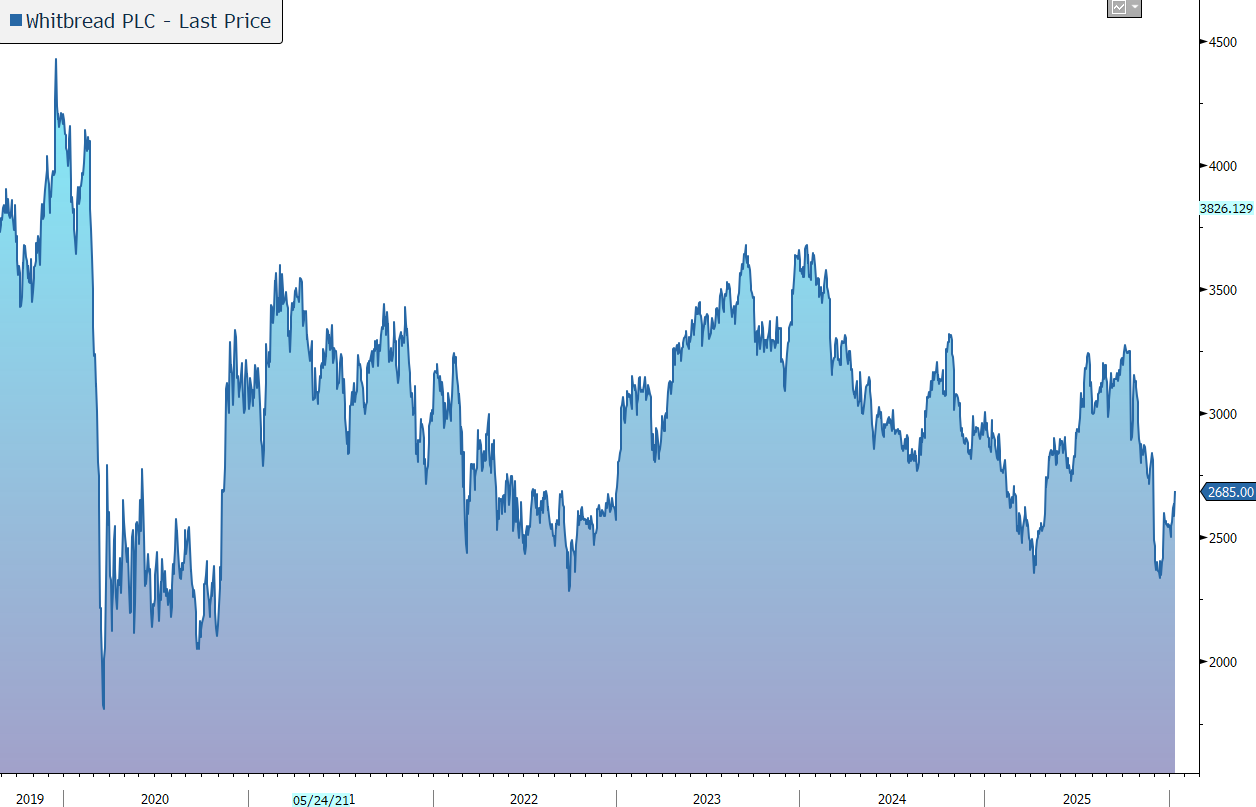

Whitbread has today released a trading update for the 13 weeks to 27 November 2025, the third quarter of its financial year to end-February 2026. The statement highlights continued strong trading momentum, good progress on key strategic initiatives, and increased cost efficiencies. In response, the shares are up 5% in early trading.

Whitbread is the UK’s largest operator of hotels (Premier Inn) and restaurants (Beefeater, Brewers Fayre, Table Table and Bar + Block). Premier Inn has over 850 hotels and more than 85,000 rooms across the UK and Germany. A joint site model means that more than half of the group’s hotels are located alongside its own restaurant brands.

The group’s ‘Accelerating Growth Plan’ is seeking to optimise the food and beverage offer and convert lower returning branded restaurants into higher returning hotel extensions. Around 90% of planning applications have been submitted, with 65% planning applications approved. Overall, the group is planning to grow its estate to 98,000 rooms by FY2030, as it progresses towards the long-term potential of 125,000 rooms across the UK and Ireland.

The 5-year plan is set to deliver incremental profit of at least £300m by FY2030 and release more than £2bn for shareholders through a combination of dividends and share buybacks. This morning, the company has raised the level of cost efficiencies it expects to deliver in FY2026 across labour, technology, and procurement, from £65m-£70m to £75m-£80m.

The company has previously announced in response to the recent UK Budget it is exploring a variety of options in order to further drive profits, margins, and returns and will provide an update to the market regarding its Five-Year Plan at the time of its FY2026 results on 30 April 2026.

During the latest quarter, total group sales rose by 2% to £781m, with positive total accommodation performance in Premier Inn, partially offset by the expected reduction in UK food and beverage (F&B) sales as a result of the Accelerating Growth Plan.

In the UK, the overall hotel market continued its return to growth and Premier Inn delivered a positive RevPAR performance, which has continued and stepped up in the current quarter. The structural shift in supply, together with Premier’s brand strength and commercial programme, means the company is confident in its ability to maintain a healthy RevPAR premium versus the market.

Total UK Premier Inn accommodation sales were up 2%, as were like-for-like (LFL) sales. RevPAR (revenue per available room, the key industry operating indicator) rose by 3% to £69.86, with good occupancy (82.5%) and average room rate of £84.65. The group is competitively well-placed to outperform other budget branded and independent operators, as both have become increasingly financially constrained. In the latest quarter, the group enjoyed continued outperformance versus the wider midscale and economy market with a RevPAR premium of £5.83.

UK food and beverage LFL sales fell by 4% year-on-year, performing in line with management expectations reflecting the impact of the Accelerating Growth Plan. The LFL decline was 1%.

In Germany, demand has increased and Premier Inn outperformed the wider market in what is an important trading period with a number of key events. The company remains confident in reaching profitability this year, which is a key milestone as Premier Inn progress towards becoming the country’s number one hotel brand. Total accommodation sales were up 12% (+% LFL), led by the increasing maturity of the estate and commercial initiatives. Total estate RevPAR increased 7% to €76, with the more established hotels RevPAR up 9% at €86, significantly outperforming the wider midscale and economy market. Food & Beverage sales were up 11% in LFL terms.

The group’s strong operating cashflow funds the ongoing investment in both the UK and Germany whilst maintaining a healthy balance sheet – net cash less lease liabilities was £563m at the last balance sheet date at the end of August 2025. The company expects to complete its £250m share buyback by 30 April 2026, with £217m purchased so far.

The company has completed the sale and leaseback of a further nine hotels for £89m at attractive yields, and remain on track to recycle £250m-£300m of property proceeds into high-returning growth opportunities that will drive profits, margins and returns.

Whilst forward visibility in the UK remains limited, the favourable supply backdrop, together with the group’s brand strength and commercial initiatives, means management are confident that the business can continue to outperform the market. In Germany, the business remains on-track to break even on a run-rate basis this year.

The current quarter has got off to a positive start – in the six weeks to 8 January 2025, total UK accommodation sales and RevPAR were both up 4% and total Germany accommodation sales were up 11%, with total Germany estate RevPAR up 5% to €56.

Looking forward, Whitbread now expects the cost impact from the proposed changes in business rates included in the recent UK Budget to be c.£35m in FY2027, which is lower than the preliminary estimate of £40m-£50m. Overall, the group expects gross UK cost inflation to be between 6.5% and 7.5% on its £1.7bn UK cost base.

Source: Bloomberg