Morning Note: Market news and an update from The Campbell's Company.

Market News

Global equities are fairly directionless ahead of the Federal Reserve decision. Beyond the expected quarter-point cut today, traders now see the Fed delivering a total half-point of easing in 2026. US officials are floating Kevin Hassett for a shortened stint as Fed chair, the FT reported. The 10-year Treasury yield continued to drift upwards, to 4.19%, while gold trades at $4,205 an ounce. Silver hit another high of $61.50 an ounce.

US equities were little changed last night – S&P 500 (-0.1%); Nasdaq (+0.1%). JPMorgan fell after the bank said it anticipates spending $105bn next year, more than analysts expected. SpaceX is moving ahead with plans for an IPO that may raise well over $30bn, people familiar said, a haul that would make it the largest listing of all time. The Elon Musk-led company is targeting a valuation of about $1.5trn.

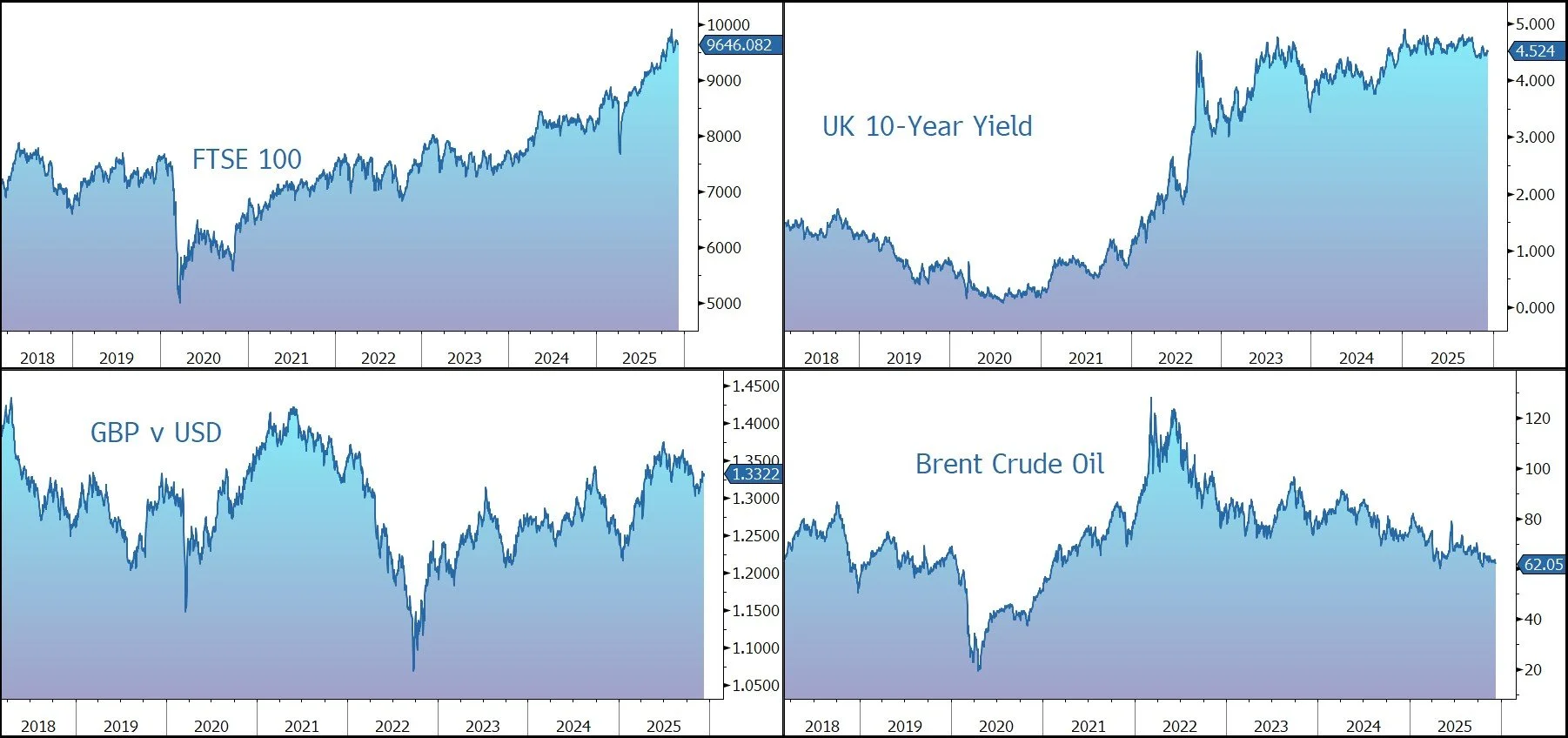

In Asia this morning: Nikkei 225 (-0.1%); Hang Seng (+0.3%); Shanghai Composite (-0.2%). China’s CPI growth accelerated to 0.7% year on year in November, matching expectations, on higher food costs. Factory deflation unexpectedly worsened. The FTSE 100 is currently up 0.1% at 9,646. Anglo American and Teck shareholders have approved a merger of equals to create Angle Teck. Sterling trades at $1.3325 and €1.1430.

Oaktree’s Howard Marks warned AI poses a “terrifying” threat to employment that may deepen political divisions. Investors are behaving in a “speculative” manner even though the demand growth for the technology is “totally unpredictable.”

France’s National Assembly adopted a social security bill for next year, making it more likely lawmakers will pass a new budget by year-end. The Bank of France estimates the economy will grow in the fourth quarter despite the budget uncertainty.

Source: Bloomberg

Company News

Yesterday afternoon, The Campbell's Company released results for the first quarter of its financial year to July 2026. The figures were in line with management expectations, but the market was disappointed the company only maintained its guidance for the current financial year. The shares have been a poor performer this year, and in response to yesterday’s update, they fell by a further 6% in US trading hours.

The Campbell's Company is a US-listed company that generates sales of just under $10bn from a range of soups and simple meals, beverages, snacks and packaged fresh foods in retail and foodservice channels. Brands include Campbell’s condensed and ready-to-serve soups; Swanson broth and stocks; Prego pasta sauces; Pace Mexican sauces; Pepperidge Farm cookies, Snyder’s of Hanover pretzels, and Kettle Brand potato chips.

The business has been impacted by a number of trends: the shift to cooking at home as consumers look to save money (a positive); the reduction in spend on discretionary purchases, such as snacks (a negative), the demand for healthier products (a negative), and the rise of GLP1 drugs (a negative).

In order to help offset tariff headwinds, the company is currently undertaking a cost savings programme with a FY2028 target of $375m. In the latest quarter, the company delivered $15m of savings, bringing the total achieved so far to $160m.

During the three months to 2 November 2025, sales decreased by 3% to $2.68bn (vs. consensus of $2.66bn). Organic net sales, which excludes the impact from divestitures, decreased 1% primarily driven by lower volume (-3%), partially offset by pricing (+1%).

The Meals & Beverages division generated sales of $1,665m, down 4%. Excluding the impact of the noosa divestiture, organic net sales decreased 2% mainly driven by declines in US soup, Canada, SpaghettiOs, Pace Mexican sauces and 5 V8 beverages, partially offset by gains in Rao’s.

The Snacks division generated sales of $1,012m, down 2%. Excluding the impact of the Pop Secret divestiture, organic net sales decreased by 1%, driven primarily by declines in third-party partner and contract brands, Snyder’s of Hanover pretzels, fresh bakery, Goldfish crackers and Cape Cod potato chips partially offset by gains in Pepperidge Farm cookies.

The company continued to make progress on cost savings and productivity initiatives to help offset inflation and continued to invest in its brands.

The adjusted gross margin decreased by 150 basis points to 29.9%, mainly driven by cost inflation and other supply chain costs, the gross impact of tariffs and unfavourable volume/mix, partially offset by cost savings and supply chain productivity improvements and favourable pricing.

Adjusted operating profit (EBIT) fell by 11% to $383m, due to lower adjusted gross profit, partially offset by lower admin and marketing expenses. Adjusted EPS declined by 13% to $0.77. Cash flow from operations was $224m, in line with last year, and net debt ended the quarter at $6.8bn.

During the latest quarter, the company entered into definitive agreements to acquire a 49% interest in La Regina, the producer of Rao’s tomato-based pasta sauces, for $286m.

The group returned $144m to shareholders including $120m in dividends. The company has $301m remaining under its September 2021 strategic share repurchase programme.

Looking ahead to the full year to July 2026, the group has reaffirmed its guidance ranges: organic sales growth (-1% to +1%), adjusted EBIT (-13% to -9%), and adjusted EPS (-18% to -12% to $2.40-$2.55). The guidance is based on the exclusion of the additional week in FY2025, which represented 2% to net sales, 2% to adjusted EBIT, and $0.06 to adjusted EPS.

Source: Bloomberg