Morning Note: Market news and an update from Adobe.

Market News

Last night, the US Federal Reserve announced a cut to its benchmark interest rate by 0.25 percentage points to a target range of 3.5% to 3.75%. This was the third consecutive rate cut this year. The decision was not unanimous, with a 9-3 vote among the committee members. Two members voted to keep rates steady, while one member advocated for a larger, half-point cut, reflecting internal divisions over how to balance a weakening job market and elevated inflation. President Trump criticised the Fed’s rate move, saying it “could have been doubled.” The president said he’s meeting with Kevin Walsh, as search for the next central bank chair nears an end.

The new economic projections (the ‘dot plot"’) suggest only one additional rate cut in 2026, which is a more cautious outlook than the market had been expecting. The US 10-year Treasury yield fell to 4.14%, while gold has risen to $4,215 an ounce.

US equities rose slightly last night – S&P 500 (+0.7%); Nasdaq (%). However, after hours, shares of Oracle, whose fate is deeply tied to the AI boom, plunged more than 10% after cloud sales fell just short of analysts’ estimates. The gloom spread to the wider market - Nasdaq futures are down by 1.2%. In Asia this morning, stocks drifted lower: Nikkei 225 (-0.9%); Hang Seng (-0.1%); Shanghai Composite (-0.7%).

The FTSE 100 is currently little changed at 9,659, while Sterling trades at $1.3375 and €1.1430. London’s housing market is facing its worst downturn, with prices plummeting due to Labour’s new mansion tax. A gauge of London property values dropped to minus 44 in November, the lowest in more than two years.

Mexico approved wide-ranging tariffs of up to 50% on China, broadly aligning itself with US efforts to tighten trade barriers against Beijing.

Source: Bloomberg

Company News

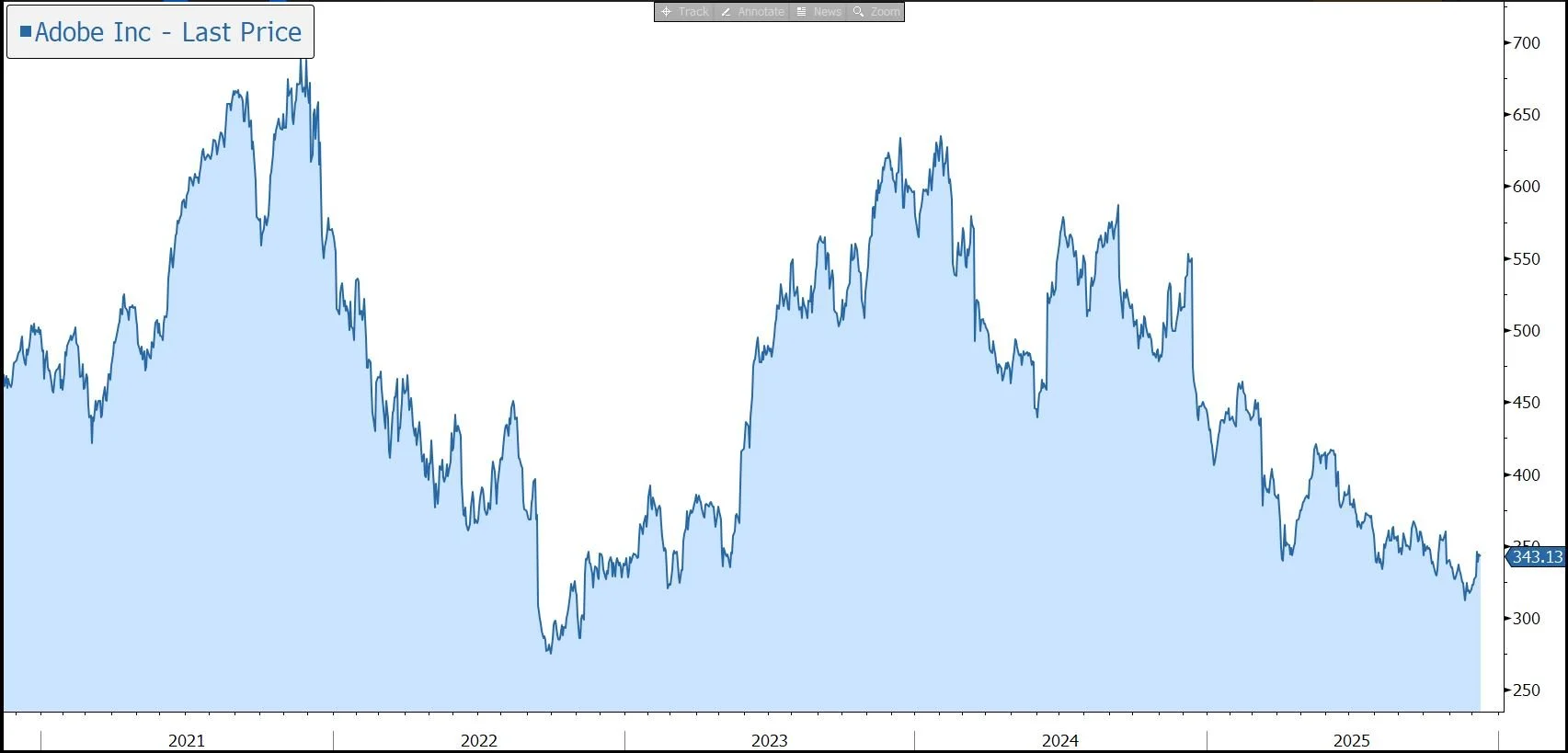

Last night, Adobe released results for the financial year to 28 November 2025. The figures were slightly above market expectations driven by adoption of AI-driven tools. Guidance for FY2026 was in line with the market forecast and, in response, the shares were down slightly in after-hours trade.

Adobe is a global software company, best known for the Acrobat product, considered the gold standard for creating, editing, scanning, signing, and sharing digital documents. The company generates annual revenue of almost $24bn through a recurring revenue model with real-time visibility – subscriptions account for more than 95% of the total. As a result, the business tends to be fairly resilient during economic downturns.

The group believes every disruptive technology has presented opportunities for Adobe to innovate and increase its addressable market opportunity. This has been true for cloud computing, mobile, as well as AI. The company estimates it has an addressable market of more than $200bn, leaving it well positioned for significant growth in the years ahead with its industry-leading products and platforms.

The company has introduced multiple generative AI models in the Adobe Firefly family including Imaging, Vector, Design, and most recently Video. However, there is increased competition, with smaller firms such as Figma eager to capture market share.

During the latest financial year, revenue grew by 11% in constant currency to a record $23.77bn, just above the guidance range of $23.65bn-$23.70bn. Growth was driven by strong global demand for the group’s AI solutions across Business Professionals & Consumers and Creative & Marketing Professionals customer groups. In the final quarter, revenue was up 10% to $6.19bn, slightly above the market forecast of $6.11bn.

Exiting the quarter, Remaining Performance Obligations (RPO – i.e. its future sales pipeline) were $22.52bn, and Current Remaining Performance Obligations (i.e. expected to be recognised as revenue within the next 12 months) were 65%.

Digital Media is the group’s largest division, accounting for 74% of revenue. During the latest quarter, revenue grew by 11% to $4.62bn. Net new Digital Media Annualised Recurring Revenue (ARR) grew by 11% to $19.2bn. Total new AI-influenced ARR now exceeds one-third of the overall business as Adobe integrates AI deeply into its solutions and continues to launch new AI-first offerings.

Digital Experience grew by 8% to $1.52bn, while the smallest division, Publishing & Advertising, fell by 14% to $60m.

The company earns very high operating margins, in the mid-40s, although in the latest financial year, the margin slipped slightly from 46.6% to 46.2%. EPS grew by 14% to $20.94 in the year, just above the guidance range of $20.80-$20.85, and by 14% to $5.50 in the final quarter, above the $5.39 expected by the market.

The business is very cash generative, with $10bn of cash flow from operations generated in the year, and the group ended the year with net cash of $385m. This was despite making significant investments in its technology platforms. The group repurchased $12bn of its shares during the year, leaving $5.9bn remaining on the current $25bn programme to be completed by the end of the year.

Adobe provided guidance new guidance for FY2026 which factors in current expectations for the macroeconomic environment. Revenue is expected to be between $25.9bn-$26.1, versus the current consensus forecast of $25.9bn, while EPS is expected to hit $23.30-$23.50. The company is also targetting double-digit ARR growth in FY2026.

Source: Bloomberg