Morning Note: Market News and an update from BAT

Market News

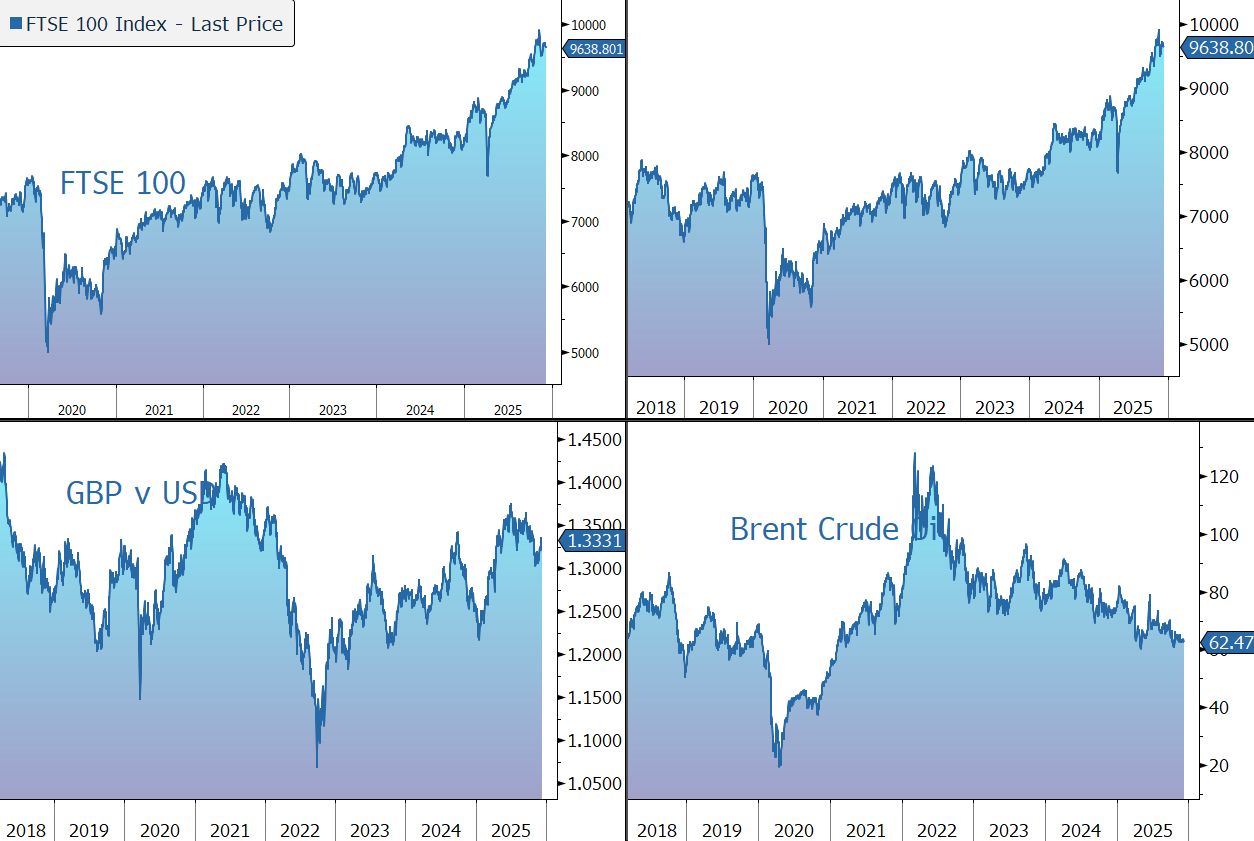

Equities are struggling for direction as traders grow anxious about the pace of Federal Reserve easing beyond this week’s near-certain rate cut. Treasuries were weaker across the curve, while gold trades at $4,190 an ounce. Brent Crude is currently $62.30 a barrel after sliding 2% yesterday, as fears of a supply glut outweighed geopolitical risks.

US equities finished slightly lower last night – S&P 500 (-0.4%); Nasdaq (-0.1%). Donald Trump granted Nvidia permission to ship its H200 AI chips to China in exchange for a 25% surcharge and said AMD and Intel would receive the same treatment. Shares of Nvidia, AMD and Intel gained post-market.

Paramount made a hostile bid for Warner Bros. Bloomberg believes that the deal would face fewer anti-trust hurdles given the combined market share would be lower than a Netflix deal.

In Asia this morning, markets were mixed: Nikkei 225 (+0.1%); Hang Seng (-1.5%); Shanghai Composite (-0.4%). Foreign investors now dominate Japan’s $7.4 trillion JGB market, accounting for roughly 65% of monthly transactions, up from 12% in 2009. The BOJ’s retreat, coupled with PM Sanae Takaichi’s spending plans, have driven yields to multi-decade highs.

The FTSE 100 is currently little changed at 9,639, while Sterling trades at $1.3345 and €1.1460. UK retail sales rose 1.4% year on year in November, the smallest gain in six months, the BRC said. The Bank of England still has its “foot on the brake a little bit” with monetary policy even as UK price and wage pressures continue to cool, according to rate-setter Alan Taylor.

German lawmakers are set to approve a record €52bn in defence orders next week as part of the government’s push to transform the Bundeswehr armed forces into Europe’s strongest conventional army.

Source: Bloomberg

Company News

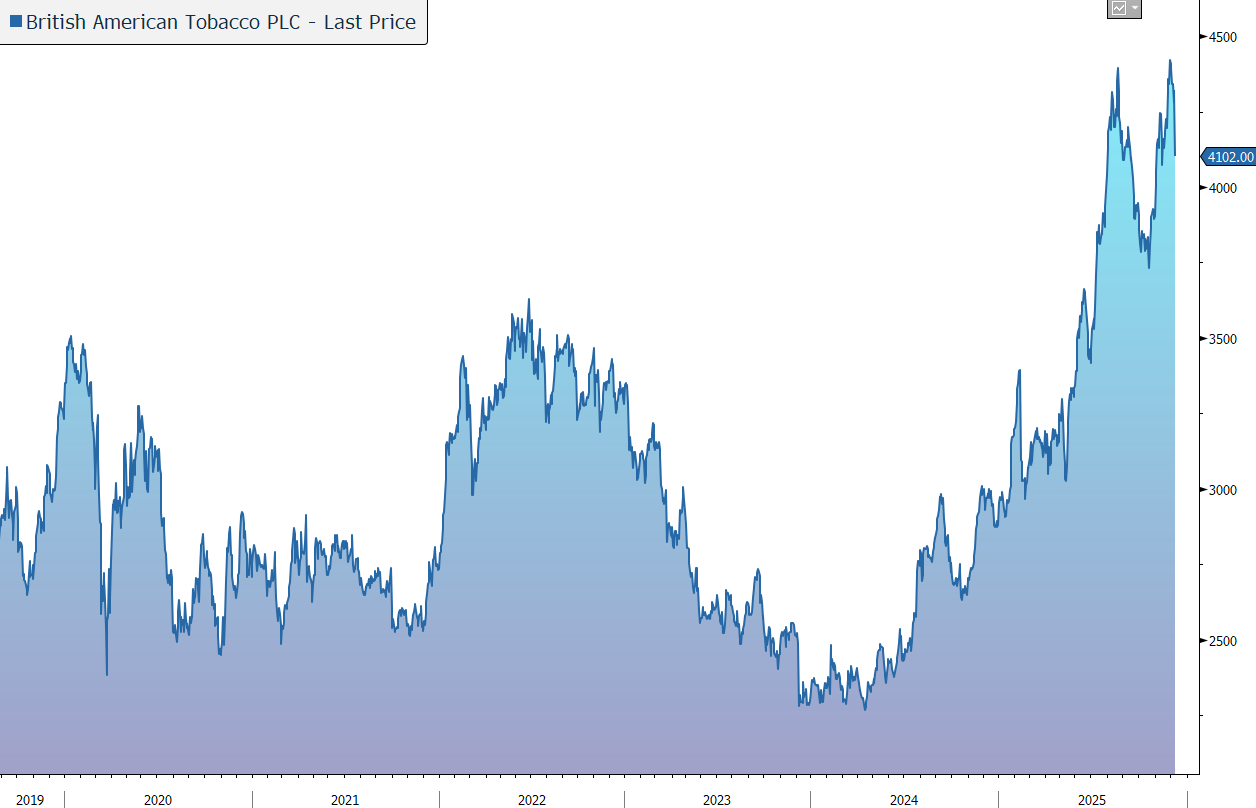

British American Tobacco (BAT) has this morning released a trading update which highlights performance in line with management expectations, leaving the group on track to deliver its full-year guidance. The company has also raised the size of its share buyback programme. However, guidance for 2026 is lower than expected and, in response, the shares have been marked down by 4% in early trading.

BAT is a global tobacco company with more than 200 brands. The group has a Strategic Portfolio of priority brands made up of combustible tobacco products (including Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Newport, and Camel) and New Categories (including vapour, tobacco heated products (THP), and modern oral, with brands including Vype, glo, and Vuse). BAT also owns a portfolio of other international and local cigarette brands.

The group’s aim is to progressively improve its performance to deliver a mid-term growth algorithm from 2026 of 3%-5% revenue, 4%-6% adjusted profit from operations, and 5%-8% adjusted diluted EPS.

This morning, BAT has confirmed its full-year 2025 guidance. Revenue is expected to grow by around 2%, versus previous guidance to be at the top end of a 1%-2% guidance range. Adjusted profit from operations is also expected to grow by around 2%, versus a 1.5-2.5% guidance range. This is at a time when the global tobacco industry volume is expected to be down by around 2%.

In Combustibles, momentum has been positive in the US, the world’s largest nicotine value pool, where the group has seen value share growth of 20bps and flat volume. In the AME region, resilient financial performance was led by Brazil, Türkiye, and Mexico. In the APMEA region performance was impacted by material fiscal and regulatory headwinds in Bangladesh and Australia.

New Category revenue growth accelerated to double-digit in the second half, driving mid-single digit growth for the full year. Velo is the stand-out performer, with strong double-digit revenue growth, driven by industry growth and volume share gains. In the vaping category, full-year revenue at Vuse is expected to be down high-single digit (vs. -13% in H1) due to illicit headwinds in US and Canada, re-prioritised resource allocation, and market exits. glo revenue is expected to be broadly flat, impacted by competitive activity and resource reallocation ahead of glo Hilo launches.

Overall, BAT remains highly cash generative and expects to deliver operating cash flow conversion in excess of 95% again in 2025. Leverage is expected to be within the target range of 2.0x-2.5x net debt/EBITDA by the end of next year. This will be helped by last week’s disposal of a 9% stake in ITC Hotels for £315m. BAT owns the stake as an indirect result of a corporate demerger. BAT inherited the shares due to its existing, large shareholding in the parent company, India Tobacco Company (ITC) Limited. Following this transaction, BAT retains a 6.3% stake in ITC Hotels.

The company will continue to reward shareholders through strong cash returns, including a progressive dividend, while the 2026 share buyback programme has been raised to £1.3bn.

The company has set out guidance for 2026 which is a little underwhelming: performance is expected at the lower end of the range of the mid-term growth algorithm of 3%-5% revenue and 4%-6% adjusted profit from operations.

Source: Bloomberg