Morning Note: Market news and an update from Richemont.

Market News

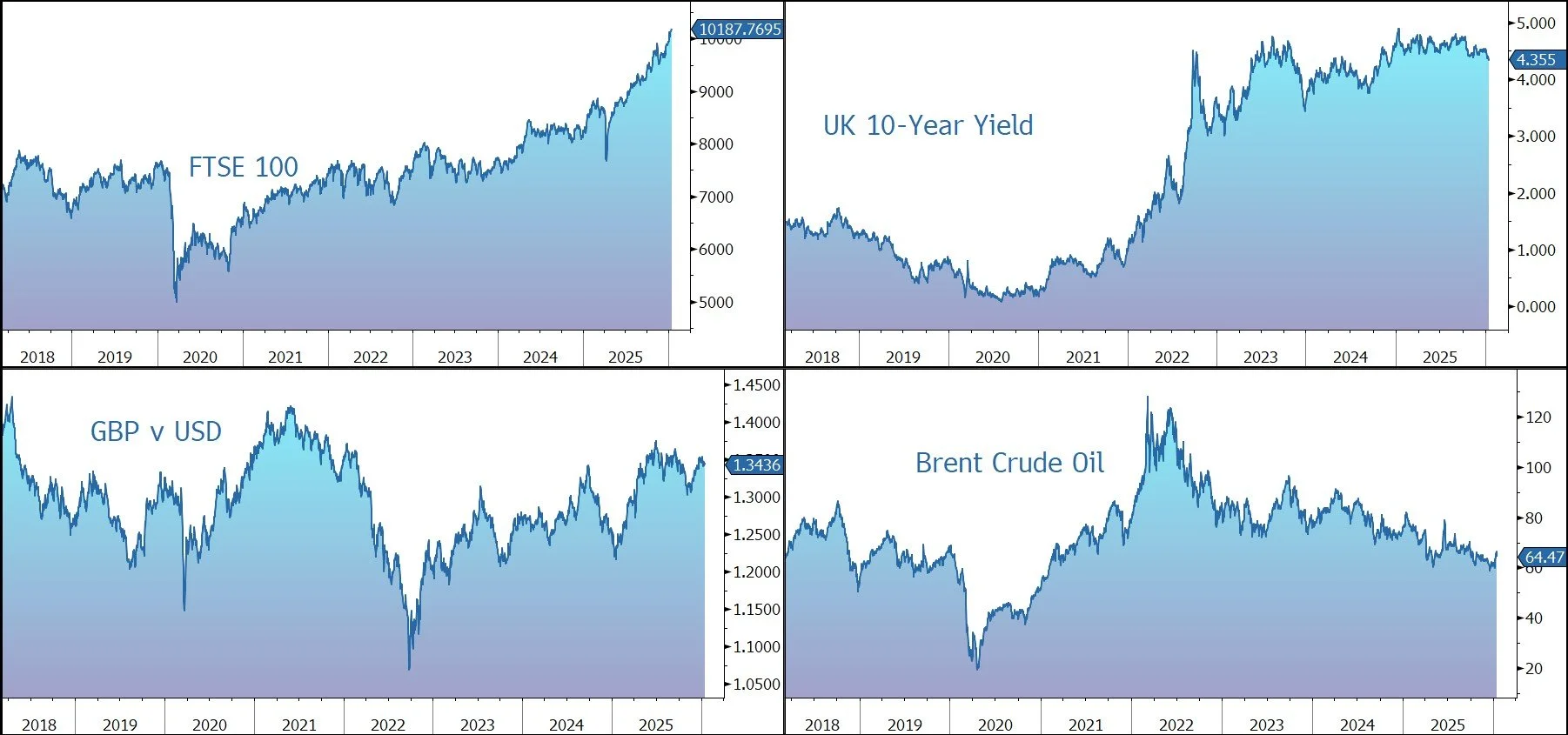

President Trump told Reuters he has no plans to fire Jerome Powell despite the DOJ’s investigation. However, the feud appears to be denting the appeal of US assets – the FT reports that Trump’s ‘unpredictable’ policies have prompted bond giant Pimco to diversify away from US assets. The 10-year Treasury currently yields 4.15%.

Silver fell back below $90 an ounce as the US held off imposing tariffs on imports of critical minerals. Gold hovered just above $4,600 an ounce. Oil fell for the first time in six days after President Trump signalled he may hold off on attacking Iran for now after being reassured that Tehran would stop killing people involved in protests. Brent Crude trades just above $64 a barrel

US equities moved lower last night – S&P 500 (-0.5%); Nasdaq (-1.0%). Wells Fargo fell by 5% after reporting stronger-than-expected earnings for Q4 2025. However, revenue slightly missed analyst forecasts and concerns were raised about potential margin pressures in 2026.

In Asia this morning, stocks also fell back: Nikkei 225 (-0.4%); Hang Seng (-0.2%); Shanghai Composite (-0.3%). TSMC rose by 1% as its net profit surged to $16bn last quarter, beating estimates.

The FTSE 100 is currently little changed at 10,188. Companies trading ex-dividend today include Compass (1.39%) and Diploma (0.79%).

The UK 10-year gilt yield fell to around 4.34%, its lowest level since December 2024, as easing inflation and improved confidence in the UK’s public finances boosted demand for government bonds. The UK’s GDP grew 0.3% in November, beating all expectations and rebounding from October’s contraction. Sterling trades at $1.3434 and €1.1550.

Source: Bloomberg

Company News

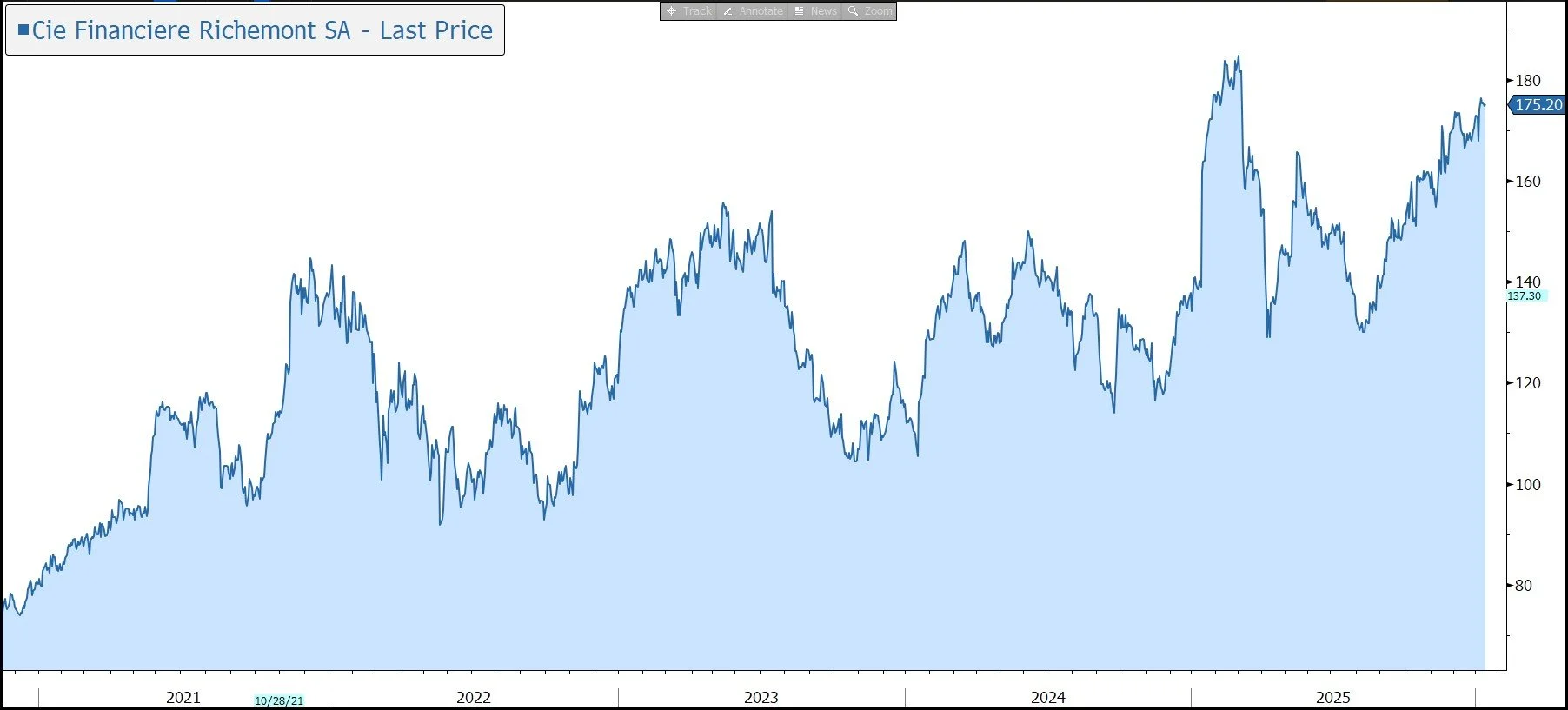

Richemont has released results for the three months to 31 December 2025. Performance was better than market expectations driven by strong sales momentum. However, in response, the shares are little changed in early trading.

Richemont is a Switzerland-based luxury goods group which generates annual sales of around €21bn, split between retail, wholesale, and online distribution. The group owns a portfolio of leading international ‘Maisons’ which are recognised for their distinctive heritage, craftsmanship, and creativity. Jewellery Maisons include Buccellati, Cartier, and Van Cleef & Arpels. Specialist Watchmakers account for 16% of sales. Fashion & Accessories ‘Maisons’ (termed ‘Other’) include leather goods, clothing, and writing instruments, etc. This division now includes Watchfinder, a leading omni-channel platform for premium pre-owned timepieces. In April, the group completed the sale of its stake in YOOX Net-A-Porter (YNAP), the leading online luxury retailer.

The company’s products are discretionary purchases. Currency movements, and their impact on tourist flows, can also have an impact on sales at the regional level. As a result, sales tend to be discretionary in nature and remain vulnerable to changes in the economic outlook.

In the quarter ending 31 December, sales rose by 11% at constant exchange rates (CER) to €6.40bn, slightly above the market expectation of €6.28bn. The result was struck against a demanding double-digit year-on-year comparative and leaves sales in the first nine months of the group’s financial year up 10% at €17.0bn.

By distribution channel, Retail sales increased by 12% at CER, led by the Jewellery Maisons. Wholesale and Online Retail rose by 9% and 5%, respectively. By segment, the stand-out performer once again was the Jewellery Maisons, up 14% at CER to €4.8bn. Specialist Watchmakers enjoyed an ongoing improvement, with sales up 7%. The Other division was flat.

The group achieved double-digit growth at CER the Americas (+14%), Japan (+17%), and the Middle East & Africa (+20%). Growth was slower Europe (+8%) and Asia Pacific (+6%).

As expected, today’s announcement was a sales update, with no disclosure on profitability. The does statement does, however, highlight that the environment continues to be marked by weaker main trading currencies, while rising material costs continue to weigh on margins.

The group’s balance sheet remains strong, with net cash at the quarter end of €7.6bn.

Source: Bloomberg