Morning Note: Market news and an update from BP and Diploma

Market News

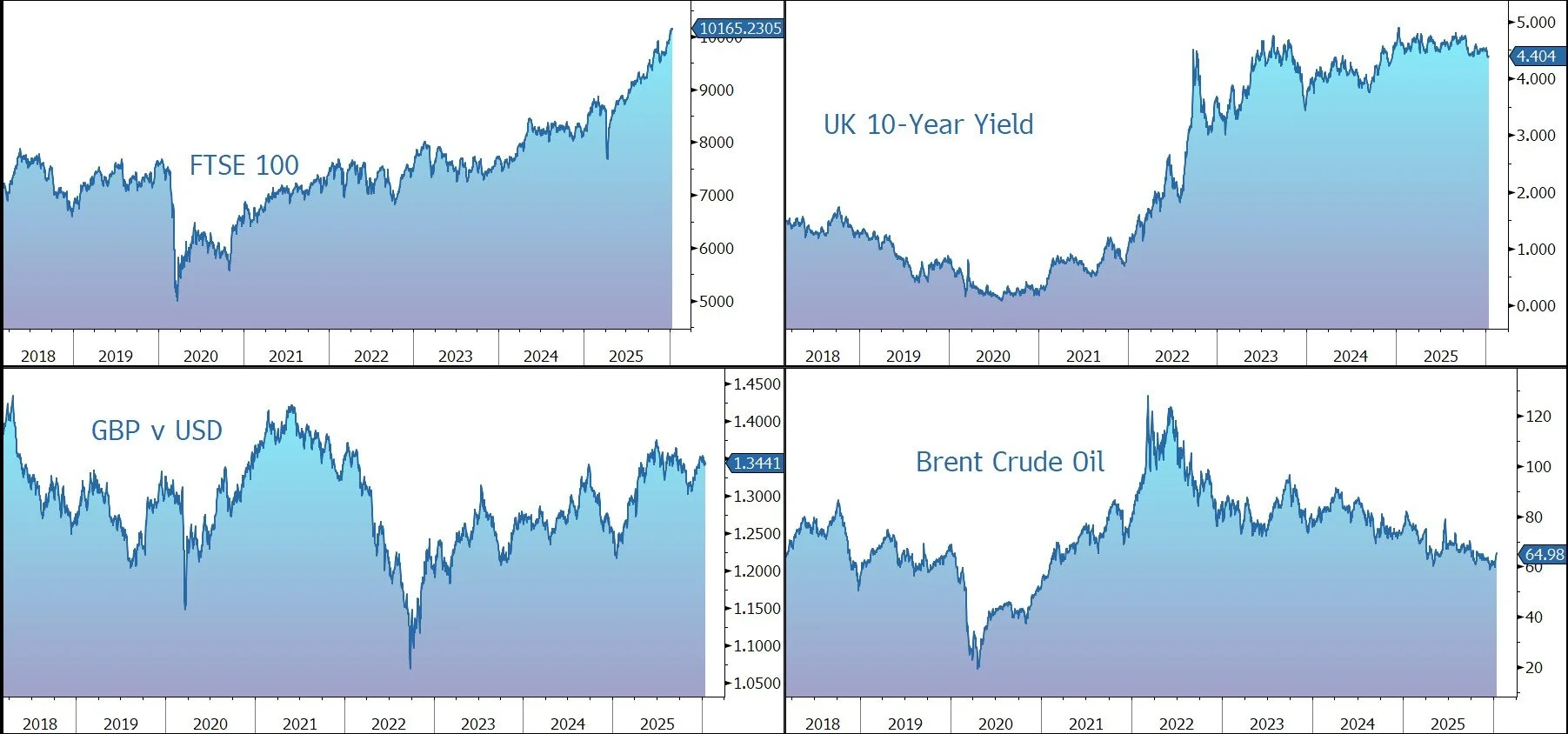

Investors continues to shift into real assets as a hedge against geopolitical uncertainties. Spot silver surged past $90 an ounce for the first time, while tin climbed to a record above $51,000 in a broad metals rally. Spot gold hit an all-time high and currently trades at $4,630 an ounce. Brent Crude drifted back to $64.50 a barrel.

President Trump said he plans to nominate a new Fed Chair within weeks, despite backlash over a DOJ probe into the central bank. The 10-year Treasury yields slipped to 4.16%.

US equities drifted last night – S&P 500 (-0.2%); Nasdaq (-0.1%). JPMorgan’s results beat analyst expectations, driven by higher trading revenue and a resilient consumer economy. However, the stock price dropped 4% on concerns over higher-than-expected 2026 expense guidance and potential regulatory pressure on credit card interest rates. BofA, Citi, and Wells Fargo report today.

In Asia this morning, Chinese shares erased gains (Shanghai Composite, -0.3%) after authorities raised the margin financing deposit ratio to 100%. The new rule will slow the equity rally rather than stop it, according to MLIV. China’s trade surplus swelled to $1.2 trillion in 2025. Exports increased 6.6% last month, topping estimates, as shipments to Southeast Asia and Europe made up for a deepening plunge in sales to the US. Elsewhere in Asia, equities moved higher: Nikkei 225 (+1.5%); Hang Seng (+0.6%).

The FTSE 100 is currently 0.3% higher at 10,165, while Sterling trades at $1.3445 and €1.1540.

Source: Bloomberg

Company News

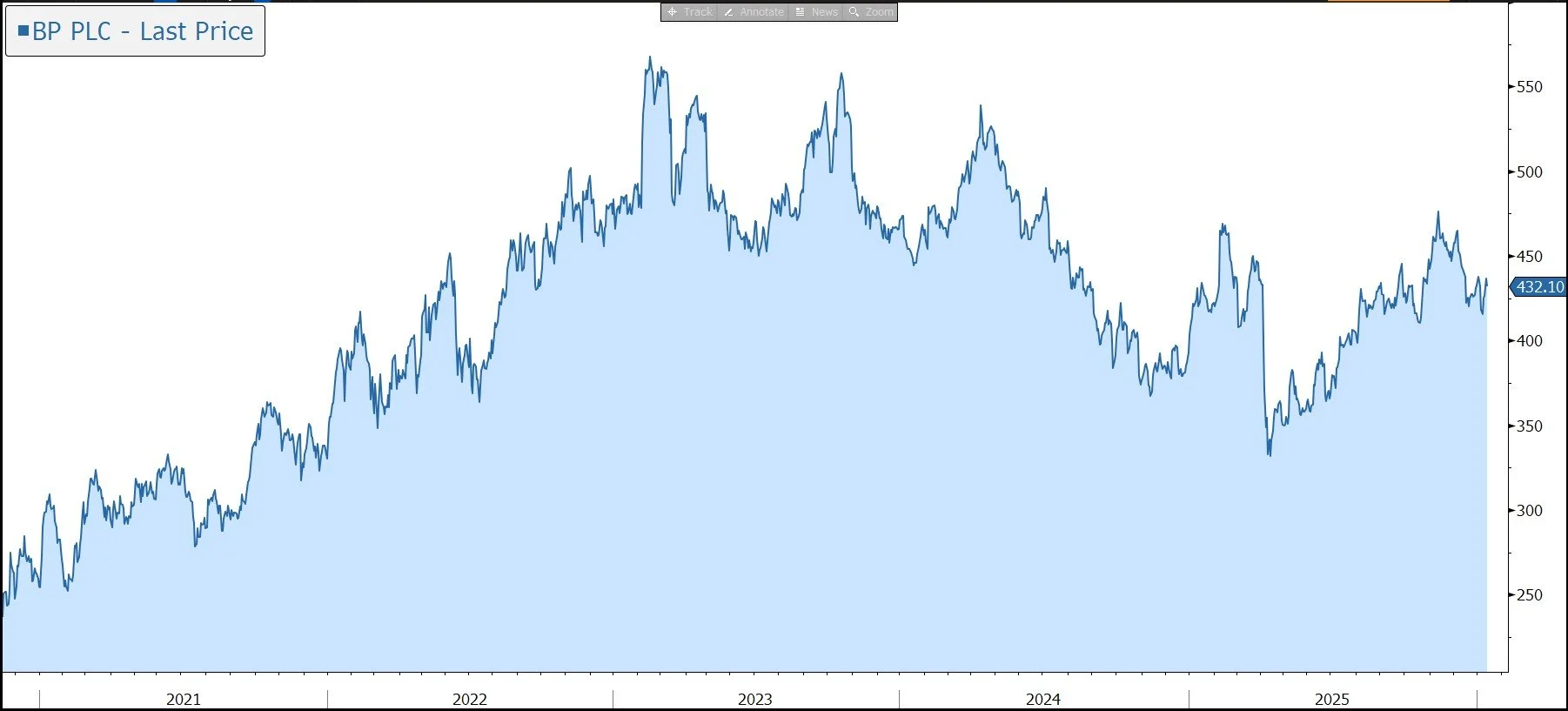

BP has today released a mixed trading statement ahead of its Q4 results scheduled for 10 February. The update provides a brief summary of current expectations for the final quarter of 2025, including data on the commodity price environment as well as group performance during the period. The release points to higher-than-expected level of refinery turnaround activity and a weak oil trading result. On a positive note, net debt will be lower than expected, although the tax charge is higher than forecast and the company will take a $4bn-$5bn impairment charge. The shares are down 1% in early trading.

BP is a global integrated energy company undertaking a strategic reset involving a reduction of capital expenditure, a reallocation of spend away from low carbon activities, and a significant cost reduction programme, all of which will drive improved cash flow and returns to support a stronger balance sheet and resilient distributions.

Following the appointment of Albert Manifold (ex CRH) as Chairman, the company is looking to accelerate the delivery of its plans, including undertaking a thorough review of its portfolio to drive simplification and targeting further improvements in cost performance and efficiency. The announcement in December that Meg O'Neill, currently the CEO of Woodside Energy, will become BP’s new CEO in April 2026 – the first outsider to lead the company in its century-plus history – is expected to drive this transition further.

For now, in the Upstream business (i.e. exploration & production), the company is increasing investment in oil & gas to $10bn p.a. (split 70% oil; 30% gas) and targetting returns of more than 15%. The portfolio will be strengthened, with 10 new major projects expected to start up by the end of 2027, and a further 8-10 by 2030. Production is set to grow to 2.3m-2.5m barrels a day in 2030, albeit it still below the 2019 level. The aim is to generate structural cost reductions of $1.5bn and an additional $2bn of operating cash flow by 2027.

The Downstream division (i.e. refining & marketing) is being high-graded and will focus on advantaged and integrated positions. The focus will be on operating performance with a target to consistently improve refining availability to 96%. Capital investment will be $3bn by 2027, with a target of $2bn in cost savings. Overall, the aim is to generate an additional $3.5bn–$4.0bn of operating cash flow in 2027 and returns of more than 15%. Following a strategic review, in December the company announced an agreement to sell a 65% shareholding in Castrol for an enterprise value of $10.1bn, with total net proceeds of $6.0bn, which will be used to reduce net debt. BP will retain a 35% stake in a new joint venture, providing exposure to Castrol’s growth and future optionality.

Investment in the group’s ‘transition’ businesses is being slashed from $5bn p.a. to $1.5bn–$2bn p.a., with less than $0.8bn p.a. in low carbon energy. The focus will be on fewer but higher-returning opportunities and more efficient growth. There will be selective investment in biogas and biofuels. In renewables, the focus will be capital-light partnerships, while there will be limited further projects in hydrogen and Carbon Capture & Storage. The group is targeting an annual structural cost reduction of more than $0.5bn in low carbon energy by 2027.

Back to today’s update. In the three months to 31 December 2025, the commodity price backdrop was mixed: Brent crude averaged $63.73/barrel (compared to $69.13/barrel in the previous quarter); US gas Henry Hub averaged $3.55/mmBtu (vs. $3.07/mmBtu); and the refining margin averaged $15.2/barrel (vs. $15.8/barrel). The environment has been volatile as a result of ongoing geopolitical uncertainty.

· As expected, reported upstream production in the fourth quarter is expected to be broadly flat compared to the prior quarter, with production broadly flat in oil production & operations and lower in gas & low carbon energy. Full-year underlying upstream production is still expected to be broadly flat compared with 2024.

· In the gas & low carbon energy segment, price realisations, compared to the prior quarter, are expected to have an impact of -$0.1bn to -$0.3bn, including changes in non-Henry Hub natural gas marker prices. The gas marketing and trading result is expected to be average.

· In the oil production & operations segment, price realisations, compared to the prior quarter, are expected to have an impact of -$0.2bn to -$0.4bn including the impact of the price lags on BP’s production in the Gulf of America and the UAE.

· In the customers & products segment, compared to the prior quarter, the customers segment has been held back as expected by seasonally lower volumes. Fuels margins were broadly flat. The products segment benefitted from stronger realised refining margins of around $0.1bn, offset by a higher impact from turnaround activity and the temporary impact of reduced capacity following a fire at the Whiting refinery. The oil trading result is expected to be weak.

· The underlying effective tax rate for the full year is expected to be around 42% compared to the previous guidance of around 40% primarily due to changes in the geographical mix of profits.

· The Q4 results are expected to include post-tax adjusting items relating to asset impairments within the group’s equity-accounted entities in the range of $4bn to $5bn attributable to its gas and low carbon energy segment. The company declined to give further details on which projects the impairments relate to.

Further detail on operating cash flow, net debt, and shareholder distributions will be provided with the Q4 results on 10 February.

As a reminder, the company is targeting significantly higher structural cost reductions of $4bn–$5bn by the end of 2027 versus a 2023 base of $22.6bn. Capital expenditure for the full year is expected to be around $14.5bn.

By 2027, the aim is to generate compound annual growth in adjusted free cash flow of more than 20% at $70/barrel oil price and returns on average capital employed of more than 16%. Note the oil price is currently $65 a barrel.

The group is targetting $20bn of divestments by 2027. There are no plans for major acquisitions. Proceeds from completed or announced disposal agreements were $5.3bn in 2025, ahead of the $4bn target, boosted by the Castrol deal at the end of the year. As a result, net debt at the end of 2025 is now expected to be in the range of $22bn-$23bn compared to $26.1bn at the end of the third quarter.

We note, however, the net debt figure doesn’t include $12.5bn of lease liabilities and $8bn of Gulf of Mexico oil spill payables. BP remains committed to maintaining a strong investment grade credit rating and a reduction in net debt to $14bn–$18bn by the end of 2027. This is seen as a more suitable level in a cyclical industry and will drive resilient shareholder distributions of 30%–40% of operating cash flow over time.

Shareholders returns are made by way of a dividend which is expected to increase by at least 4% a year and a share buyback programme. The Q4 dividend will be declared at the time of the results in February – current forecasts imply a full-year yield of just below 6%.

The $750m share buyback programme announced with the Q3 results is expected to complete this month. Related to the Q4 results, the company is expected to announce another programme of around $750m.

Overall, we believe decarbonisation can’t happen at the flick of a switch – oil and gas will remain part of the global energy mix for decades, with demand driven by population growth and higher incomes, particularly in developing countries where the desire for energy intensive goods and services like cars, international travel, and air conditioning is rising. We also believe the production of the materials needed to transition to net zero can’t happen without using hydrocarbons. At the same time, reduced investment in new production, partly because of environmental concerns, and natural decline rates, are increasingly leading to constrained supply.

Against this backdrop, investor disillusion with the group’s tilt towards low carbon energy, particularly in terms of capital discipline and returns (as evidenced by ongoing impairments), has had a negative impact on the share price over the medium term, especially relative to the peer group, leaving them on a very undemanding valuation. This and the presence of activist investor Elliott Investment Management and has driven ongoing M&A speculation.

Source: Bloomberg

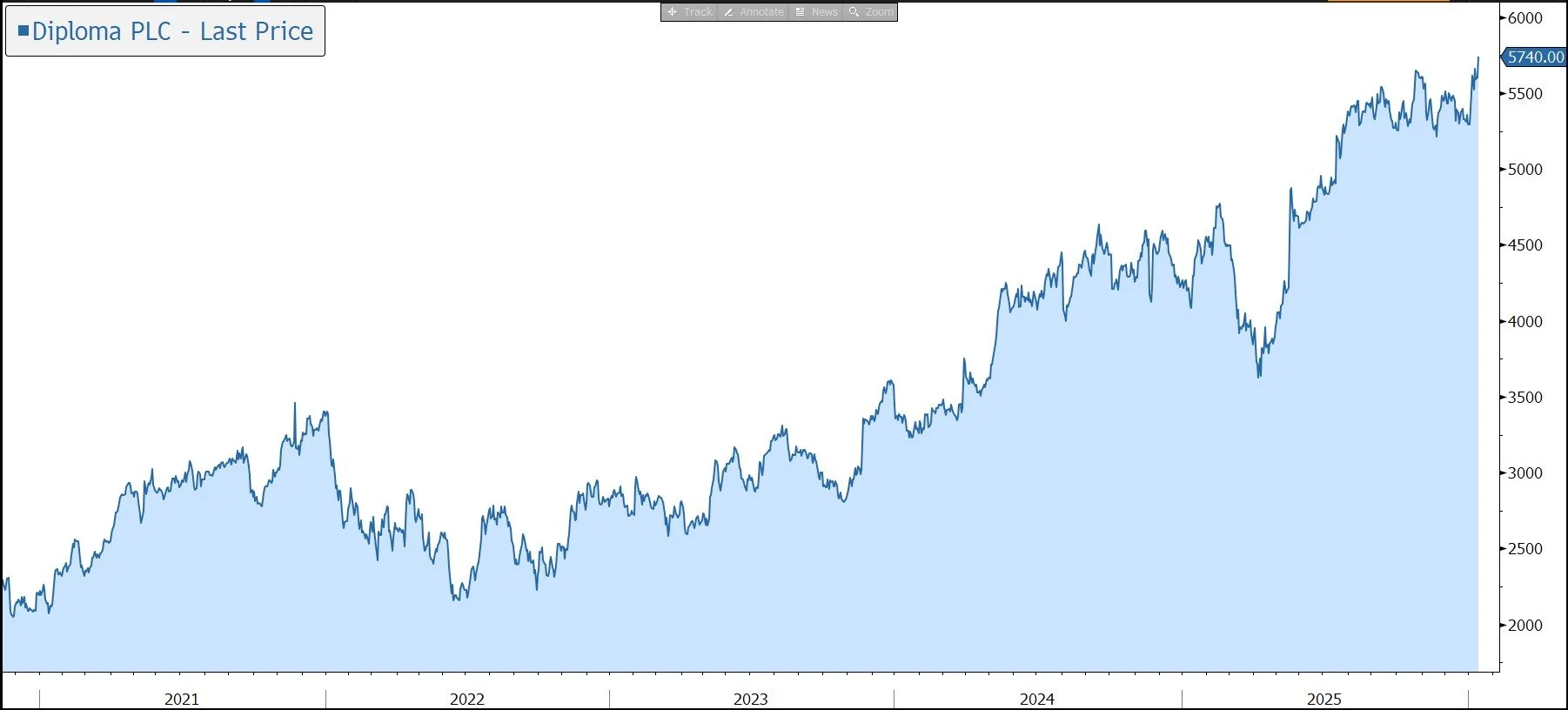

Diploma has this morning released a brief trading update for the three months to 31 December 2025. Organic revenue growth remains strong and has been supplemented by M&A. Guidance for the financial year to 30 September 2026 has been reiterated. In response, the shares are trading up 1% in early trading.

Diploma operates a decentralised collection of distribution businesses which supply specialised industrial and healthcare products and services to a wide range of niche end markets, in which service, rather than price is the key reason business is won and retained. The focus is on the supply of low cost, but essential products, such as a seal for a hydraulic cylinder. Most of the revenue is generated from consumable products, usually funded by the customers’ operating budgets rather than their capital budgets, providing a recurring revenue base. By supplying essential solutions, not just products, Diploma has built strong long-term relationships with its customers and suppliers, which support attractive and sustainable margins (c. 20%) and consistently strong cash flow.

The strategy is to build high-quality scalable businesses that deliver sustainable organic growth. Acquisitions are an integral part of the strategy, with a disciplined focus on acquiring value-added businesses in fast growing niches, with great management teams, to accelerate organic growth and generate attractive returns on investment.

In the latest quarter to 31 December 2025, performance has been very strong, as expected, with organic revenue growth of 14%.

As expected, there was little detail on the group’s profitability and financial position in today’s statement. Note that the company is financially strong – at the last balance sheet date (30 September 2025), gearing was 0.8x net debt to EBITDA, well below the 2.0x target.

Acquisitions continue to be an integral part of the group’s growth strategy – during the latest quarter, the company completed four deals. This includes Swift Aerospace (which extends the group’s reach in aerospace fasteners) and Hydraulic Seals Australia (which expands the group’s aftermarket offering). Over the last two quarters, Diploma has completed eight deals for £130m with expected annualised operating profit contribution of £20m. The group remains disciplined in its approach to acquisitions and has a ‘healthy’ pipeline.

Guidance for the full year to 30 September 2026 has been reiterated: organic revenue growth of 6% (significantly weighted to the first half) and margin of 22.5%. Net acquisition growth is now expected to be 3%, up from 2% previously, reflecting recent deals.

Source: Bloomberg