Morning Note: A round-up of global financial market news.

Market News

The Federal Reserve’s Mary Daly expects inflation to ease over the course of the year. Jeff Schmid said rates should stay at a level where they continue to put some pressure on the economy. Gold trades just above $4,600 an ounce, amid reduced safe-haven demand and fading expectations of a near-term interest rate cut by the Federal Reserve. The dollar strengthened, while the 10-year Treasury yields 4.17%.

Global corporate bond yield premiums have fallen to their lowest since 2007 on a resilient economic outlook. Goldman raised $16bn in the largest investment grade bond sale ever by a Wall Street bank, people familiar said, in what’s expected to be a record year of corporate debt issuance. Morgan Stanley and Wells Fargo each raised $8bn.

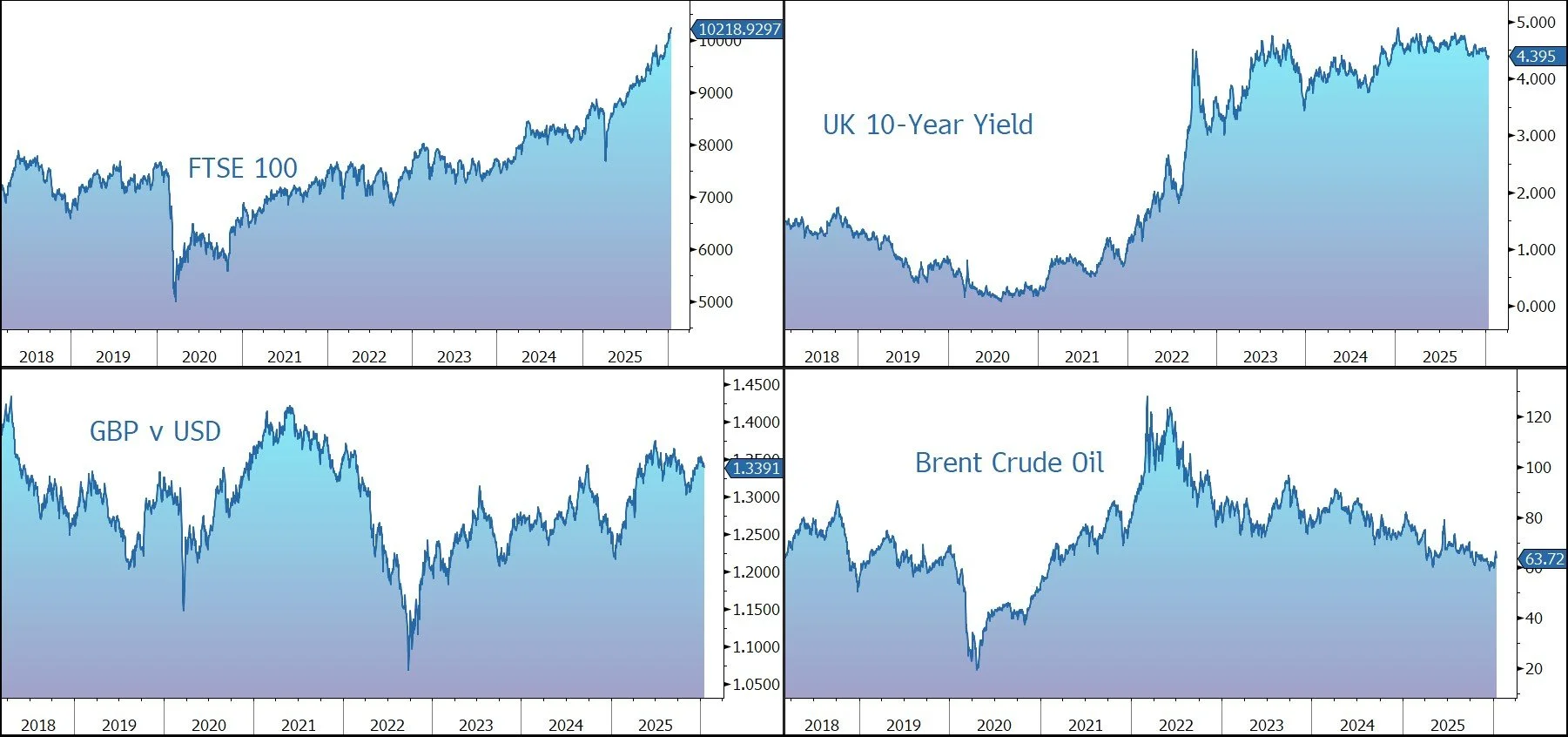

US equities ticked higher last night – S&P 500 (+0.3%); Nasdaq (+0.3%) – as concerns about overheating in the technology sector eased after the blowout results from a chip bellwether. The market is currently expected to enjoy further moderate gains at the open this afternoon. The FTSE 100 is currently 0.2% lower at 10,219, while Sterling trades at $1.3385 and €1.1530.

In Asia this morning, equity markets drifted: Nikkei 225 (-0.3%); Hang Seng (-0.4%); Shanghai Composite (-0.3%). The yen climbed after Japan’s finance minister expressed concern about the currency’s weakness. China is clamping down on high-frequency traders by moving their dedicated servers away from local exchanges’ data centres. The US and Taiwan struck a trade deal that will cut tariffs on goods from the island to 15% and see Taiwanese chip companies increase financing for American operations by $500bn.

Brent Crude trades at $63.50 a barrel after yesterday’s 4%+ decline as concerns over a potential US military strike on Iran eased.

Source: Bloomberg