Morning Note: Market news and an update from Reckitt Benckiser.

Market News

Commodities slumped again this morning as a stronger dollar fuelled a broader sell-off. Gold slid more than 8% to below $4,500 per ounce, extending losses from the prior session when the precious metal suffered its steepest fall in more than a decade. Friday’s rout was sparked by reports that US President Donald Trump plans to nominate Kevin Warsh, viewed as a more hawkish choice, to lead the Federal Reserve. Profit-taking also emerged after a relentless rally that had pushed gold to record highs. Silver tumbled more than 10% to around $75 per ounce, nearly wiping out year-to-date gains and extending Friday’s 26% plunge which was its biggest one-day decline ever. Other commodities, such as oil (down 4% to $66 a barrel) and copper (-5%), have also fallen.

Long-term Treasuries underperformed. The 10-year yield slipped to 4.23%. Interestingly money markets looked through the Warsh nomination, with traders actually slightly increasing bets on two Fed cuts in 2026.

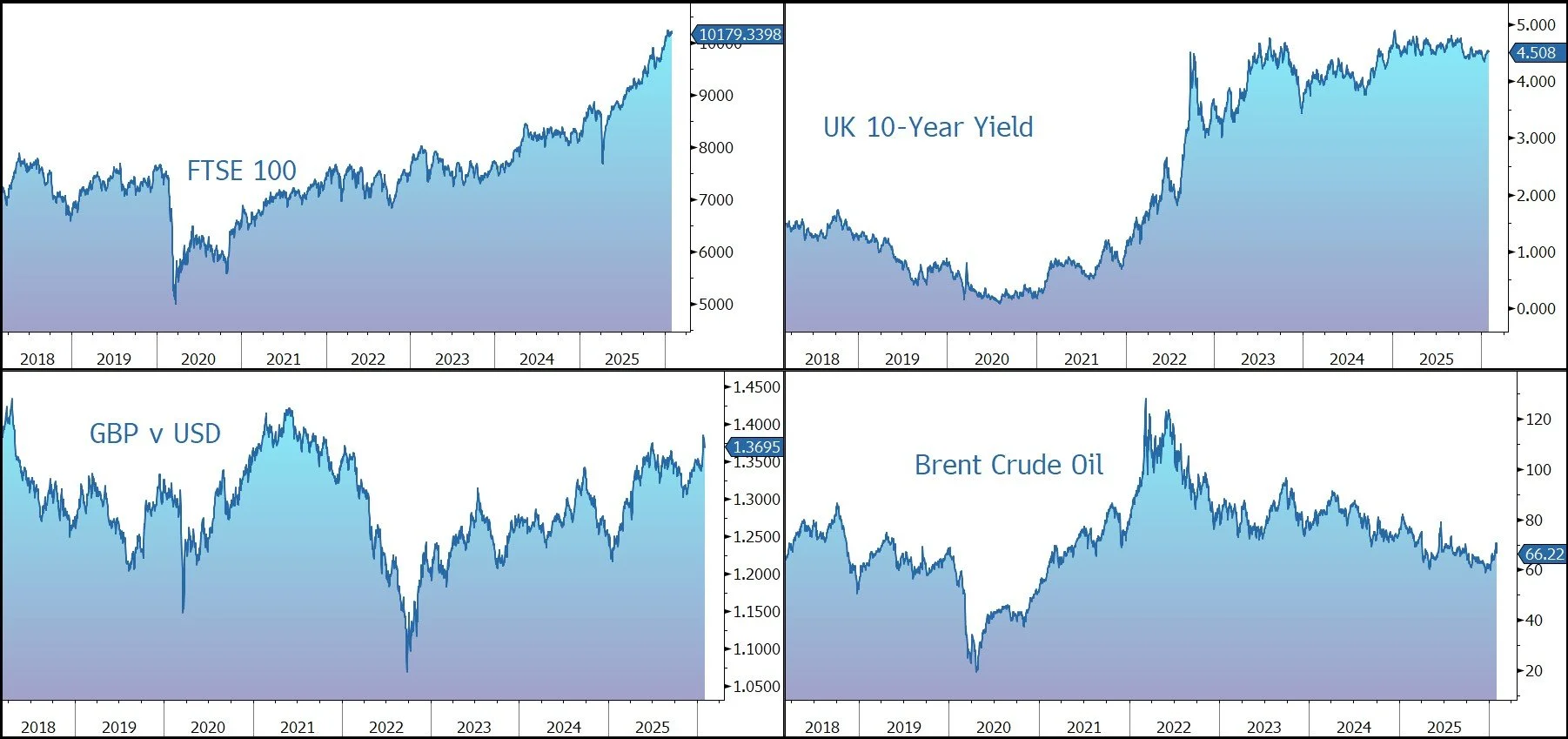

Asian stocks declined – Nikkei 225 (-1.3%); Hang Seng (-2.4%); Shanghai Composite (-2.5%) – along with US and European futures, with Nasdaq currently expected to open down 1%. The FTSE 100 is currently 0.4% lower at 10,179, with companies exposed to the US dollar outperforming. Sterling trades at $1.3677 and €1.1540.

The corporate earnings season remains in full flow this week with releases from Alphabet (Google), Amazon, Novo Nordisk, Pepsi, Assa Abloy, Compass Group, Shell, Barrick Mining, and Air Products. Waymo, Alphabet’s autonomous driving technology company, is seeking about $16bn in funding at a valuation of about $110bn.

Geopolitical uncertainty remains elevated. Ukraine will hold peace talks with the US and Russia 4-5 February in Abu Dhabi, President Zelenskiy said. Iran’s supreme leader warned of a ‘regional war’ as tensions mount over potential US strikes on Tehran. Trump said he’s hopeful of a deal.

Source: Bloomberg

Company News

The Reckitt Benckiser share price is undertaking two simultaneous technical events this morning – a special dividend and consolidation – which follow the successful completion of the sale of the group’s Essential Home business.

Reckitt is a global leader in health, hygiene, and nutrition. Trusted brands, such as Dettol and Lysol, continue to benefit from the shift to healthier and more hygienic lifestyles, particularly in emerging markets. To help ease the pressure on state-funded healthcare systems, we are seeing a transition to self-care and growth of over the counter (OTC) brands such as Mucinex, Nurofen, and Gaviscon, all of which are owned by Reckitt. A focus on immunity, mental health, and overall well-being is expected to drive growth of the group’s preventative treatments, such as vitamins, minerals, and supplements (VMS).

Reckitt is currently focusing its portfolio and simplifying its organisation to drive accelerated growth and value creation. A new operating model and structure went live at the start of 2025.

· Core Reckitt (72% of revenue) includes a portfolio of 11 market-leading (No.1 or No.2), high margin Powerbrands across four categories of self-care, germ protection, household care, and intimate wellness. Brands include Mucinex, Strepsils, Gaviscon, Nurofen, Lysol, Dettol, Harpic, Finish, Vanish, Durex, and Veet.

· Essential Home (13% of revenue) includes a portfolio of non-core brands such as Air Wick, Mortein, Calgon, and Cillit Bang. The company has sold the unit in a fairly complex $4.8bn transaction – it includes up to $1.3bn of contingent and deferred consideration and Reckitt will retain 30% of the business. Excess capital is being returned to shareholders as a $2.2bn (£1.6bn) special dividend.

· Mead Johnson Nutrition (15% of revenue). The company is ‘evaluating opportunities’ for the business which includes infant formula brands Enfamil and Nutramigen.

This morning, following the completion of the sale of the Essential Home business, the share price is undertaking two simultaneous technical events.

Firstly, the shares are trading ex the 235p per share special dividend. Shareholders who were on the register as of the close of business last Friday are entitled to the payout, which will be distributed on 20 February. The company has also announced it has completed the second tranche of its £1bn ‘ordinary’ share buyback programme.

Secondly, to prevent the share price from dropping (as it normally would when a dividend is paid out), Reckitt is performing a 24-for-25 share consolidation. This means for every 25 old shares you held, you now hold 24 new ones. The aim is to maintain the share price at a ‘comparable’ level so that the special dividend doesn’t look like a massive loss in value on the share price chart.

As an aside, the shares are firm this morning on the back of the strong dollar, in line with other companies that generate a large proportion of their profit from the US.

The company is scheduled to release its full-year 2025 results on 5 March.

Source: Bloomberg