Morning Note: Market news and updates from Visa and Adidas.

Market News

President Trump is preparing to nominate former Federal Reserve Governor Kevin Warsh to replace Jay Powell as chair of the US central bank. Warsh is viewed as a more orthodox contender with hawkish leanings who has advocated the Fed should reduce the size of its balance sheet. In trading overnight in Asia, the dollar strengthened and the 10-year Treasury yield ticked up to 4.27%.

It has been a wild 24 hours in the commodity pits, characterised by what some analysts are calling a "re-pricing of trust." We are seeing a massive tug-of-war between two extremes: a ‘fear-driven’ rally into safe havens like gold and a ‘reality-check’ sell-off in industrial metals. Gold and silver have been the center of the storm. After hitting a record high just under $5,600/oz yesterday, gold experienced a historic intraday plunge—at one point dropping 8% ($500) in just a few hours before buyers stepped back in at the lower levels and pushed the price back up to $5,450. However, the rumours surrounding the Fed chair nominee and the strength of the dollar led to more selling pressure overnight in Asia. Gold currently trades at $5,120 an ounce.

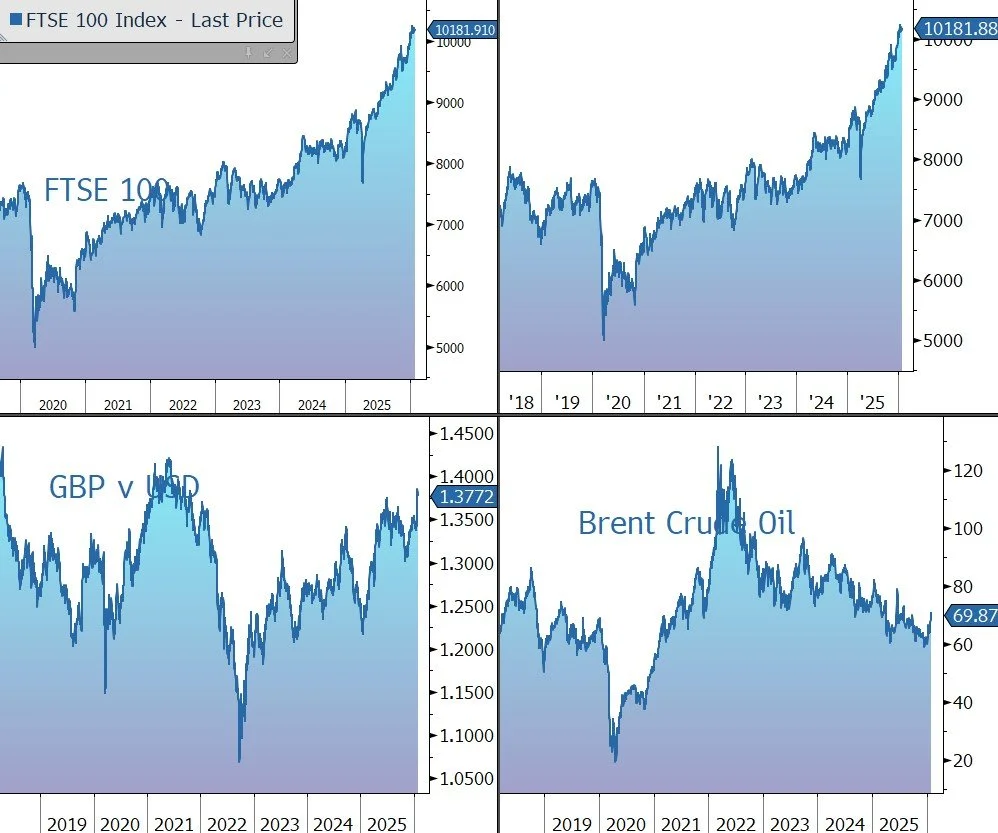

Equity markets are trading lower. In the US last night, the main indices fell – S&P 500 (-0.1%); Nasdaq (-0.7%) – with the decline continuing in the futures markets. In Asia this morning, the sell-off continued: Nikkei 225 (-0.1%); Hang Seng (-2.0%); Shanghai Composite (-1.0%). The FTSE 100 is currently little changed at 10,182, while Sterling trades at $1.3760 and €1.1530.

Apple posted record-breaking fiscal Q1 2026 results well ahead of market expectations thanks to ‘staggering’ iPhone demand and a massive 38% sales surge in China. The company warned that component costs threaten to squeeze margins, leaving the shares little changed after-hours. Both Visa (see below) and Mastercard posted a rise in fourth-quarter profit as sustained consumer spending drove up its transaction volumes despite tariff-fueled uncertainty, as consumers continue to spend on necessities. Oil majors Exxon and Chevron post results today.

Source: Bloomberg

Company News

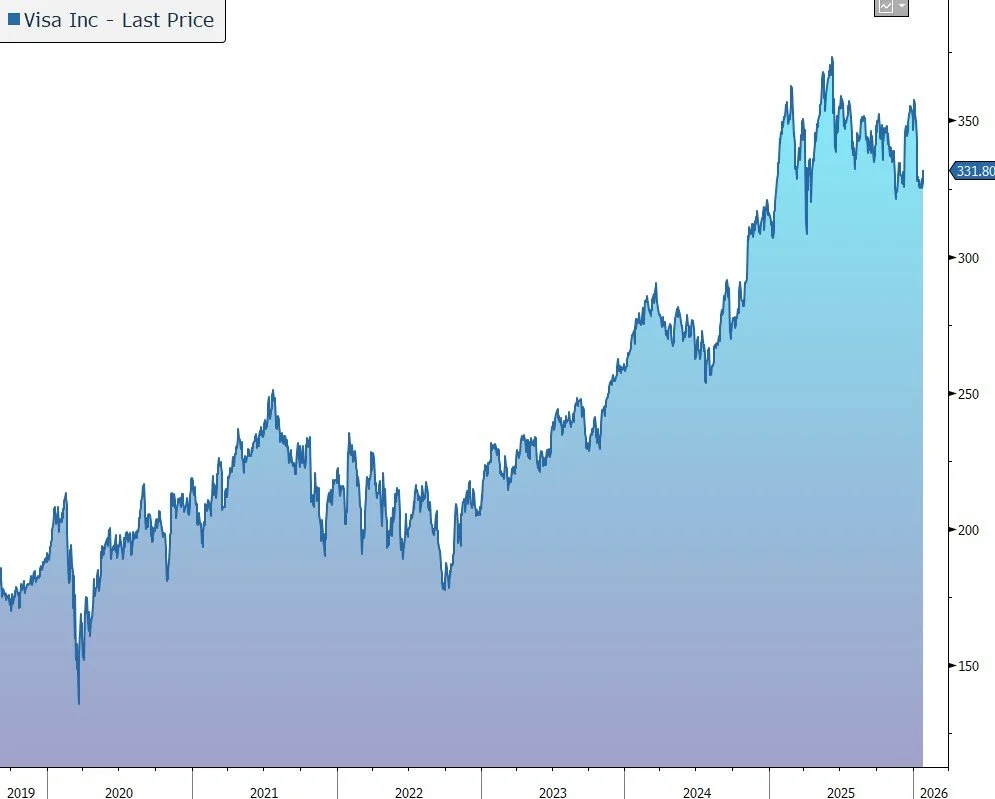

Yesterday evening, Visa released strong results for the three months to 31 December 2025, the first quarter of its FY2026 financial year and reiterated its full-year guidance of earnings growth in the low double-digits. Revenue was better than forecast, driven by resilient consumer spending and a strong holiday season, as well as continued strength in value-added services and commercial and money movement solutions. The only niggles were a slightly lower-than-expected number of processed transactions and growth in operating expenses slightly ahead of revenue growth. In response, the shares were marked down 1% after-hours.

Visa is the world’s largest electronic payments network. It connects nearly 14,500 financial institutions, 175m merchant locations, and around 12bn cards, bank accounts, and digital wallets. Visa is not a bank; it doesn’t lend or take on credit risk. It doesn’t issue cards or place the terminals at the merchant locations. Instead, the company earns a small fee from 258bn transactions processed on its network to generate annual revenue of $40bn. The company is increasingly evolving into ‘Visa-as-a-Service’ which involves unbundling Visa’s product set to support more customers in more ways across its service stack. Revenue outside of traditional Consumer Payments (i.e. Commercial & Money Movement Solutions and Value Added Services now account for more than 30% of revenue)

Visa is still benefiting from the ongoing shift from cash and cheques to electronic means of payment (NOT in the US), and the growth of online retail, contactless, and mobile payment systems. In emerging markets, a lack of physical communication infrastructure traditionally provided a barrier to payments growth, but that has been removed by the emergence of mobile phone technology and a government focus on digitalising cash to reduce the black economy. Finally, there is an opportunity for Visa’s trusted network in agentic commerce where autonomous AI agents act on behalf of consumers to discover, compare, and purchase products or services. In these transactions, security, authentication, and fraud tools that Visa provide will grow in importance.

In Consumer Payments, Visa estimates a total market of $41tn worldwide, with 56% ($23tn) still available to be served, including $11tn cash and cheques. The company has six areas of focus including: “tap to everything”, token technology, cross-border, affluent consumers, A2A (account to account payments), and credit. Since 2020, the number of Visa tokens has increased from 1bn to 17.5bn, with adoption led by ecosystem benefits including 5% higher authorisation rates and 30%+ lower fraud.

Growth in Commercial & Money Movement Solutions (CMS, formerly known as ‘New Flows’) is expected to outpace the Consumer Payments business over the long term. The company believes the total addressable market of the opportunity is massive – $145tn in B2B payments and $55tn in disbursements/payouts/P2P. Even though yields for these new flows are lower on average than Consumer Payments (often due to high-volume, low-complexity B2B transfers), they utilise Visa’s existing infrastructure and take advantage of the company’s massive scale and fixed operating costs, resulting in higher margins.

The group’s third growth engine is Value Added Services that help its clients and partners optimise their performance, differentiate their offerings, and create better experiences for their customers. The company estimates the total addressable market at $520bn, meaning only 2% has been penetrated so far. Many of Visa’s largest clients now use more than 20 value-added services, such as cybersecurity, fraud, advisory services, identity solutions, data analytics, and AI, all of which enhance the group’s competitive advantage.

During the three months to 31 December 2025, Visa saw continued healthy consumer spending. Trends were strong across key metrics: payments volume (+8% in constant currency, with both debit and credit up 8%), processed transactions (+9% to 69.4bn, slightly below market expectations), and cross-border volume growth (which includes a lot of e-commerce as well as travel, +12%).

Net revenue grew by 13% on a constant currency basis in the quarter to $10.9bn, better than the market forecast of $10.7bn and the company guidance for growth in the ‘high end of low double-digits’.

Revenue was made up of service revenue (based on prior-quarters payment volume, +13% to $4.8bn); data processing (+17% to $5.5bn); international transaction revenue (+6% to $3.7bn); and other revenue (+33% to $1.2bn). Client incentives, a contra-revenue item, were up 12% to $4.3bn. On the call, the company highlighted that Commercial & Money Movement Solutions grew by 20%, value added services revenue rose by 28%, and Visa Direct transactions increased by 23%.

Operating expenses were up 16% in the quarter, unusually outpacing revenue growth. The increase was driven by increases in personnel, marketing, and general & administrative expenses as the company invests in infrastructure to support AI-to-AI transactions. Part of the increases was due to one-off marketing spend. Adjusted EPS was up 14% on a constant currency basis, to $3.17, a touch ahead of the market expectation of $3.14 and better than the company guidance for growth in the ‘low teens’.

During the quarter, Visa generated $6.4bn of free cash flow. The group’s balance sheet remains strong, with cash, cash equivalents, and available-for-sale investment securities of $16.9bn at the end of December. The main capital allocation priority is to invest to grow the business, both organically and via acquisition – agentic commerce and stablecoins are areas of investment focus in FY2026. Visa also has an ongoing commitment to return excess cash to shareholders. The group has a record of strong dividend growth, with the latest quarterly payout raised by 13.6% to $0.67. During the quarter, the company also bought back $3.8bn of its stock as part of its $30bn authorised programme.

Visa has a long-term track record of coping with regulatory challenges and has flexibility in its cost base to mitigate any bottom-line impact. Most recently, President Trump has called for a one-year, 10% cap on credit card interest rates, significantly lower than the current market average of over 20%. This will require a legislative change, with Trump formally asking Congress to codify the cap. We believe the 10% cap is a volume risk, not a margin risk for Visa. It threatens the ‘network effect’ by potentially shrinking the pool of active spenders, but it reinforces the strategic importance of Visa’s diversification into New Flows and Value Added Services.

Overall, we believe the long-term growth prospects for Visa remain attractive, more so given the acceleration in recent years in the shift to e-commerce, tap-to-pay, and new digital payments, and in the number of acceptance points at SMEs (particularly tap-to-phone). In addition, the broad application of digital payments by businesses and government agencies provides a huge market opportunity. The long-term revenue growth framework is: Consumer Payments at 5%-7% and Commercial & Money Movement Solutions/Value Added Services at 16-18%, with the latter moving from a third to a half of revenue over time. This implies total net revenue growth of 9%-12%.

The company reiterated its guidance for the financial year to 30 September 2026: revenue growth and EPS growth on a constant dollar basis are both expected to be in the low double-digits. On the call the company said its tax rate will be lower than expected, so that EPS growth will be at the higher end of the guidance. The pace of growth seen in the last quarter has continued into January. For the current quarter as a whole, the company expects to generate revenue growth in the low double-digits and EPS growth at the high-end of low double-digit.

While some short-term economic uncertainty persists, the group remains confident in its ability to execute its strategy and expand Visa’s role at the ‘centre of money movement’. That said, a slowdown in overall consumer spending could be a drag on volumes, although spending across the network is very diversified, be it credit vs. debit, domestic vs. overseas, discretionary vs. non-discretionary spend, and low vs. high ticket spend. However, the company has previously said that if we do go into a recession, Visa is now stronger in debit – the card of choice in tougher times – than it was in the 2008/09 financial crisis. The group also highlights that if there is a downturn, they have plenty of flexibility on costs and client incentives. Note also that half of the group marketing spend is variable.

Source: Bloomberg

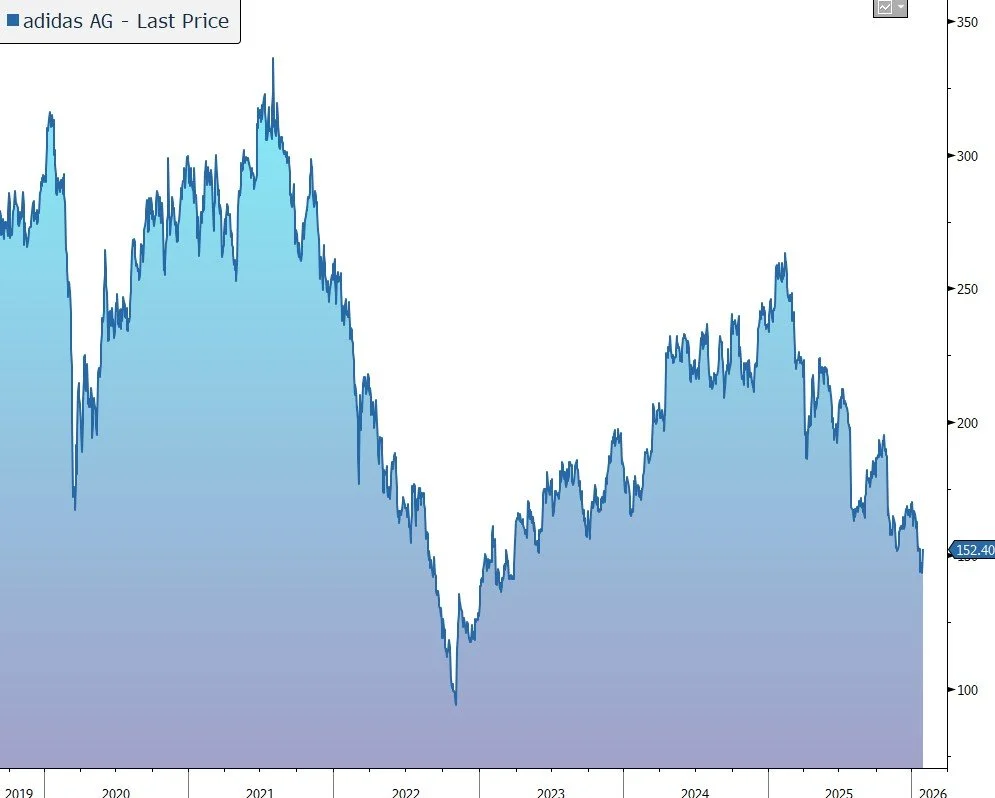

Yesterday afternoon Adidas released results for the final quarter of 2025 and launched a share buyback programme. The year ended very well and made 2025 much better than management had expected. In response, the shares have been marked up by 6% in early trading.

Adidas is a multi-brand sporting goods company. Its products have traditionally had a broad global appeal from serious athletes, casual athletes to sports fashion, and from mid-price to high-price points. As a result, the group should be well placed to benefit from the continued focus on health and fitness, the rising middle class in emerging markets, and fashion trends in sportswear.

The group’s year-on-year results were impacted by the previous initiatives to reduce inventory levels following the termination of the adidas Yeezy partnership with rapper and fashion designer Kanye West.

In Q4 2025, revenue rose by 11% in currency-neutral terms to €6.1bn. Including the impact of Yeezy sales in the prior year, growth was 10%. Based on preliminary unaudited numbers, full-year revenue came in at €24.8bn, up 13% in currency-neutral terms (or +10% excluding the Yeezy impact). This compares to guidance for double-digit currency-neutral revenue growth.

Further detail on growth by region, category, and channel will be disclosed at the time of the full-year results in March. In the meantime, the statement highlights that the company enjoyed double-digit growth in all markets and all channels, and that it has managed to keep full-price sell-through high and discounts under control.

The company’s gross margin grew by 100 basis points in Q4 to 50.8%, so that operating profit more than doubled to €164m.

For the full year, the gross margin grew by 80 basis points to 51.6%, despite the negative impacts from unfavourable currency developments and higher tariffs. The operating margin improved from 5.6% to 8.3% in 2025, pushing up operating profit by 54% to €2,056m. This is above the company guidance of ‘around €2.0bn’, which was upgraded at the Q3 stage from €1.7bn-€1.8bn.

As expected, there is no detail on the group’s financial position. However, given the strong brand momentum, the company’s robust fundamentals, its healthy balance sheet and strong cash flow generation, as well as management’s confidence in the future development of the business, the Executive Board has, with the approval of the Supervisory Board, decided to launch a share buyback programme. Starting in early February, the company plans to buy back up to €1bn of shares in 2026, financed through anticipated strong cash flow generation in the year.

Looking forward, although the environment remains volatile, the company is looking forward to a year which includes the Winter Olympic Games and the FIFA World Cup. Guidance for 2026 will be published with the results in March.

Source: Bloomberg