Morning Note: Market News and an update from Procter & Gamble

Market News

The US seeks to remove any limits to its military presence in Greenland in a revised defence agreement with Denmark, people familiar said. EU lawmakers, meanwhile, are set to ratify the bloc’s trade deal with Washington.

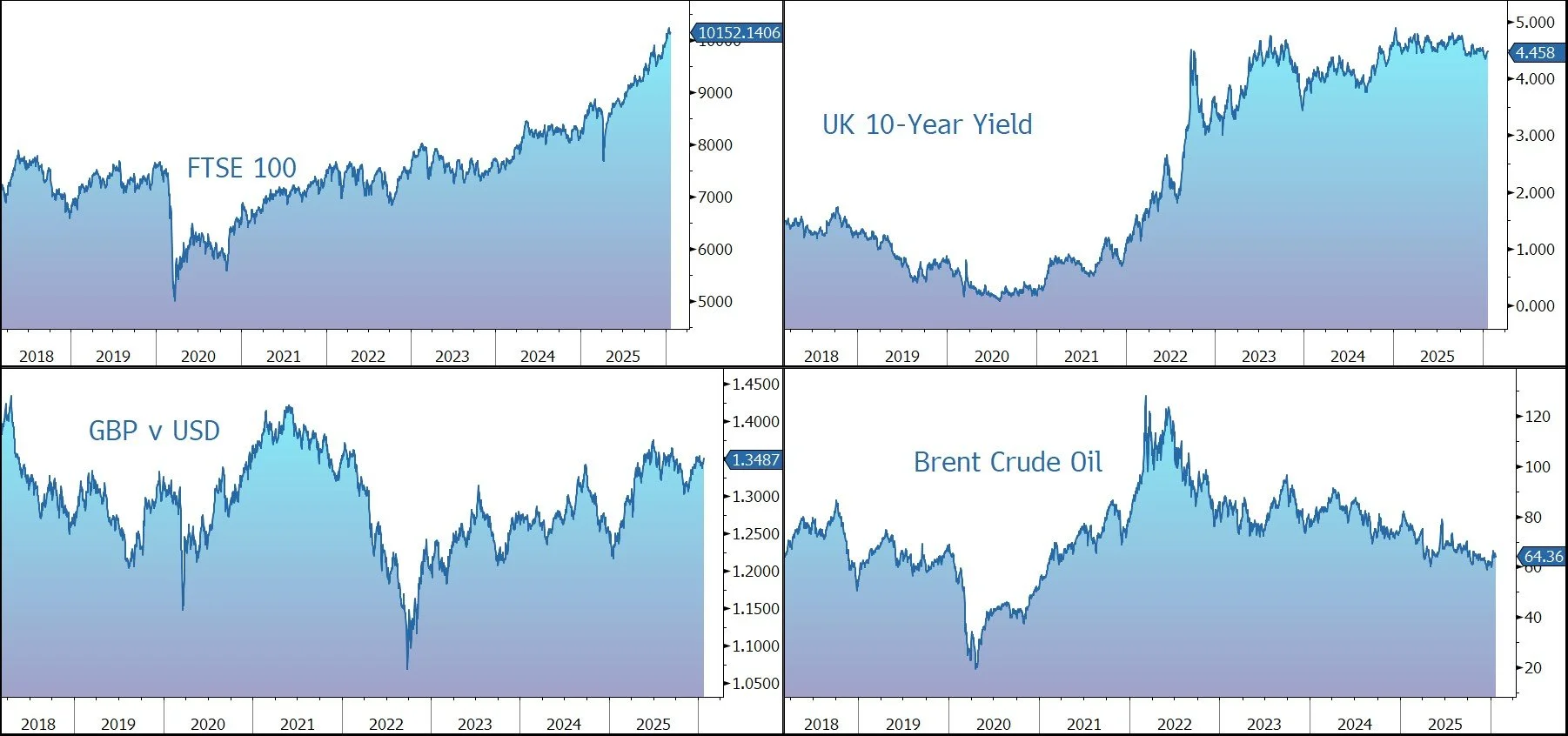

Asian stocks climbed to a record and the dollar held its losses as global investors favoured non-US assets amid policy unpredictability and geopolitical risks. Precious metals also set new all-time highs before falling back. The FTSE 100 is currently little changed at 10,152, while Sterling trades at $1.3495 and €1.1490.

The yen weakened 0.3% against the dollar after Bank of Japan governor Kazuo Ueda said the central bank may conduct operations for stable yield formation. The comments came after the Bank of Japan kept its policy rate unchanged at 0.75% as expected.

UK Gilts were volatile yesterday – the 10-year currently yields 4.47%. In addition to the downward pressure on yields from the public-sector deficit figures and softened tone regarding Greenland, there was market chatter regarding a potential return to Westminster for Greater Manchester Mayor Andy Burnham. The market is incredibly sensitive to any perceived shift in the ‘fiscal team’ or future spending plans of the government. Any news that hints at a change in the political leadership or a move away from current fiscal discipline tends to push yields higher as investors demand a higher risk premium.

UK consumer confidence was in line with Bloomberg expectations at -16 in January, up slightly from the -17 reading in December. Consumers reported improved personal finances, worse perceptions of the economy and, in turn, increased savings intentions. The figure has now been negative for five years.

Source: Bloomberg

Company News

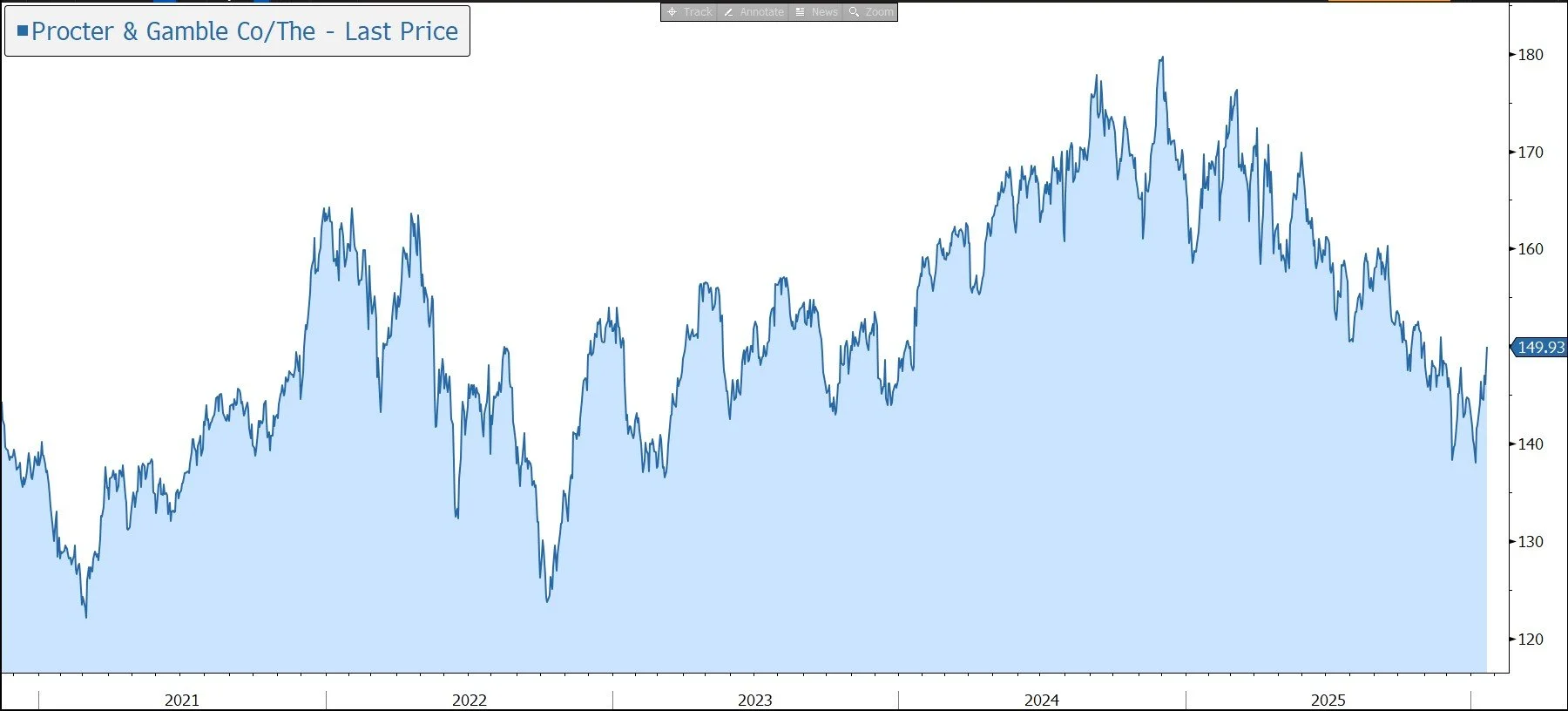

Yesterday lunchtime Procter & Gamble released results for the three months to 31 December 2025, the second quarter of its financial year to 30 June 2026. Sales were held back by weak consumer spending in core categories such as laundry detergent and toilet paper, which overshadowed strength in its beauty products. Earnings were ahead of the market forecast. Although the core guidance for the full year was reiterated, guidance for reported earnings was cut due to higher restructuring charges. Despite this, the shares were marked up by 2%.

P&G is a global consumer goods company with annual sales of $84bn across a broad range of iconic brands including Gillette, Crest, Ariel, Oral-B, and Pampers. The focus is on daily use categories. The group generates around half of its sales in North America, a fifth in Europe, and the remainder in emerging markets.

The company has been exiting underperforming businesses over the past few years, the latest being laundry bars in India and the Philippines, as it adjusts its portfolio to shifting consumer spending trends in overseas markets. Last June, the company announced a portfolio and productivity plan to focus its portfolio and organisation to improve its cost structure and competitiveness. The move will lead to a reduction of about 7,000 non-manufacturing roles over the course of two years.

In the three months to 31 December, net sales rose by 1% to $22.3bn, in line with the market forecast, against a challenging economic and geopolitical backdrop.

Organic growth, which excludes the impact of acquisitions, disposals, and negative currency movements, was flat in the quarter. The result was driven by a 1% increase in pricing, offset by a unit volume decline of 1%. Mix had a neutral impact.

The company highlights that lower-income households have cut back on spending even on essentials, as they deal with high prices, a tepid employment market, and broader geopolitical uncertainty. This was exacerbated by a government shutdown that delayed payments for food assistance in October and November.

7 out of 10 product categories grew or maintained organic sales, a deterioration versus the previous quarter. Global aggregate value share was 20 basis points down on the prior year, with 25 of the group’s top 50 category/country combinations holding or growing share in the quarter.

The group operates across five divisions:

· Fabric & Home Care (35% of full-year sales) was flat in organic terms.

· Baby, Feminine & Family Care (23% of sales) fell by 4%, driven by a 10% decline in family care products which faced a tough year-on-year comparison.

· Beauty (19% of sales) rose 4%, driven by mid-single digit growth in personal care and hair care products.

· Health Care (15% of sales) was up 3%.

· Grooming (8% of sales) was flat as innovation-driven pricing was offset by volume declines.

On a currency-neutral basis, the core gross margin fell by 30 basis points in the quarter to 52.1%. This was a fifth decline in a row, with the benefits of gross productivity savings and higher pricing, more than offset by unfavourable costs from tariffs and commodities, unfavourable product mix, and product reinvestments. The operating margin fell by 80 basis points to 25.4%, despite gross productivity savings of 270 basis points. Core EPS was flat at constant currency in the quarter at $1.88, slightly above the market forecast of $1.86.

Adjusted free cash flow was $3.8bn and adjusted free cash flow productivity was 88%, just below the 90% target. The group ended the quarter with net debt of $25.8bn and returned over $4.8bn of cash to shareholders through dividends ($2.5bn) and share repurchases ($2.3bn). The group has increased its dividend for 69 years in a row – earlier in the month the quarterly payout was raised by 5% to $1.0568. On a full-year basis, this equates to a yield of 3%.

For the financial year to June 2026, the group still expects to deliver organic sales growth of flat to +4%, including a growth headwind of 30 to 50 basis points from brand and product form discontinuations. Core EPS is still expected to grow in the range of flat to +4% to $6.83-$7.09. The guidance for reported EPS growth has been reduced from 3%-9% to 1%-6% due to higher non-core restructuring charges in the year. The company still expects free cash flow productivity of 85%-90% and to pay around $10bn in dividends and to repurchase $5bn of shares in the year.

Source: Bloomberg