Morning Note: Market News and an update from Johnson & Johnson.

Market News

Risk appetite returned to equities after President Trump ruled out military force and said he would refrain from imposing tariffs on Europe, citing a ‘framework’ deal over Greenland. Trump didn’t detail the parameters of the so-called ‘framework’ and it was unclear what the agreement entails. Denmark also ruled out negotiations over ceding the semi-autonomous island to the US. Overall, investors interpreted the remarks as a sign of easing geopolitical and trade tensions.

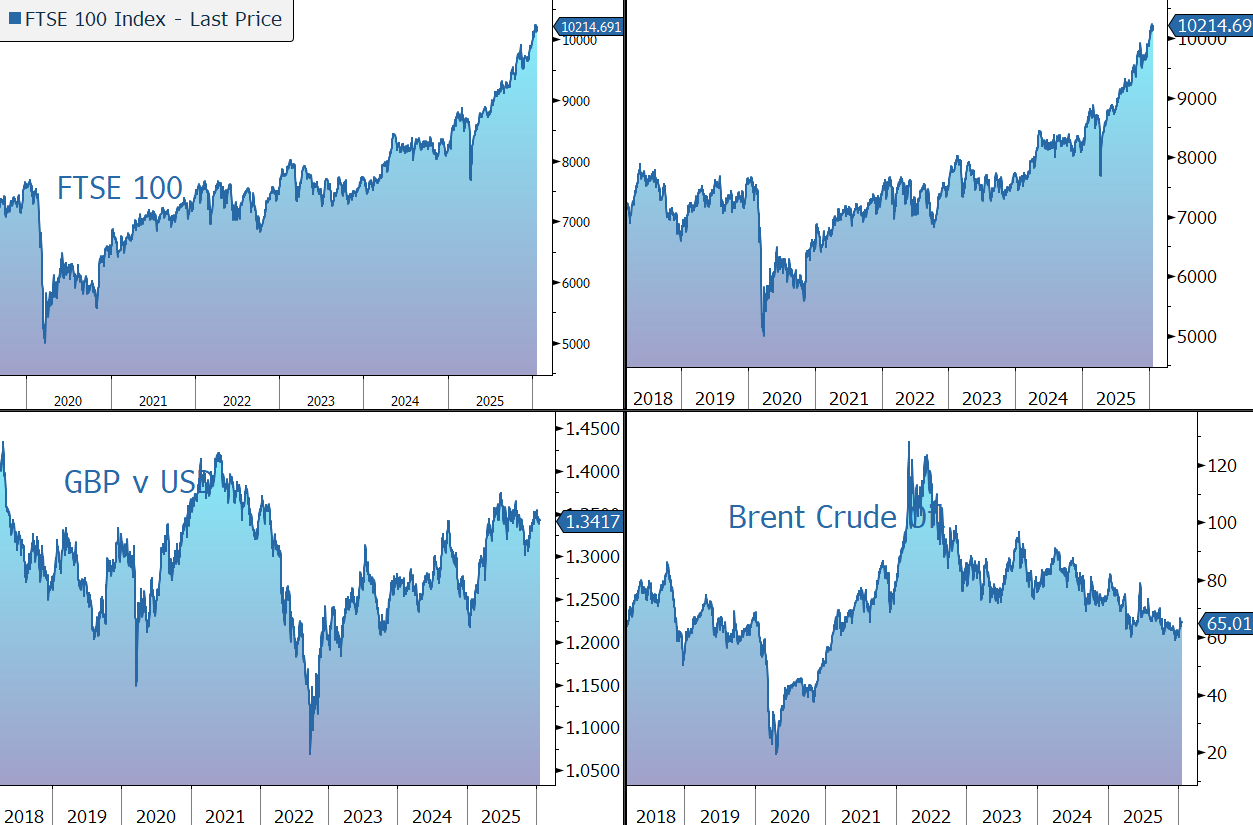

US equities were firm last night – S&P 500 (+1.2%); Nasdaq (+1.2%) – with the momentum continuing in Asia this morning: Nikkei 225 (+1.7%); Hang Seng (flat); Shanghai Composite (+0.1%). Japanese government bonds rebounded for a second straight session. The FTSE 100 is currently 0.7% higher at 10,214.

Global semiconductor stocks advanced as Nvidia CEO Jensen Huang’s comments at Davos helped reinforce investor enthusiasm for the AI trade. The benchmark gauge in South Korea — a bellwether for technology stocks — climbed to a new record.

The upbeat mood in stocks curbed demand for safe haven assets, sending spot gold lower. However, the loss was pared after Goldman Sachs raised its year-end price forecast from $4,900 an ounce to $5,400. The spot price is currently $4,828 an ounce. The 10-year Treasury yields 4.24%. Brent Crude trades at $64.50 a barrel, while US natural gas futures surged to the highest since 2022.

UK government borrowing fell more than expected in December, helping Chancellor Rachel Reeves in her bid to bring the public finances under control. The £11.6bn figure was £7.1bn less than the previous year and significantly below the market expectation of £13bn. Sterling trades at $1.3410 and €1.1475.

Source: Bloomberg

Company News

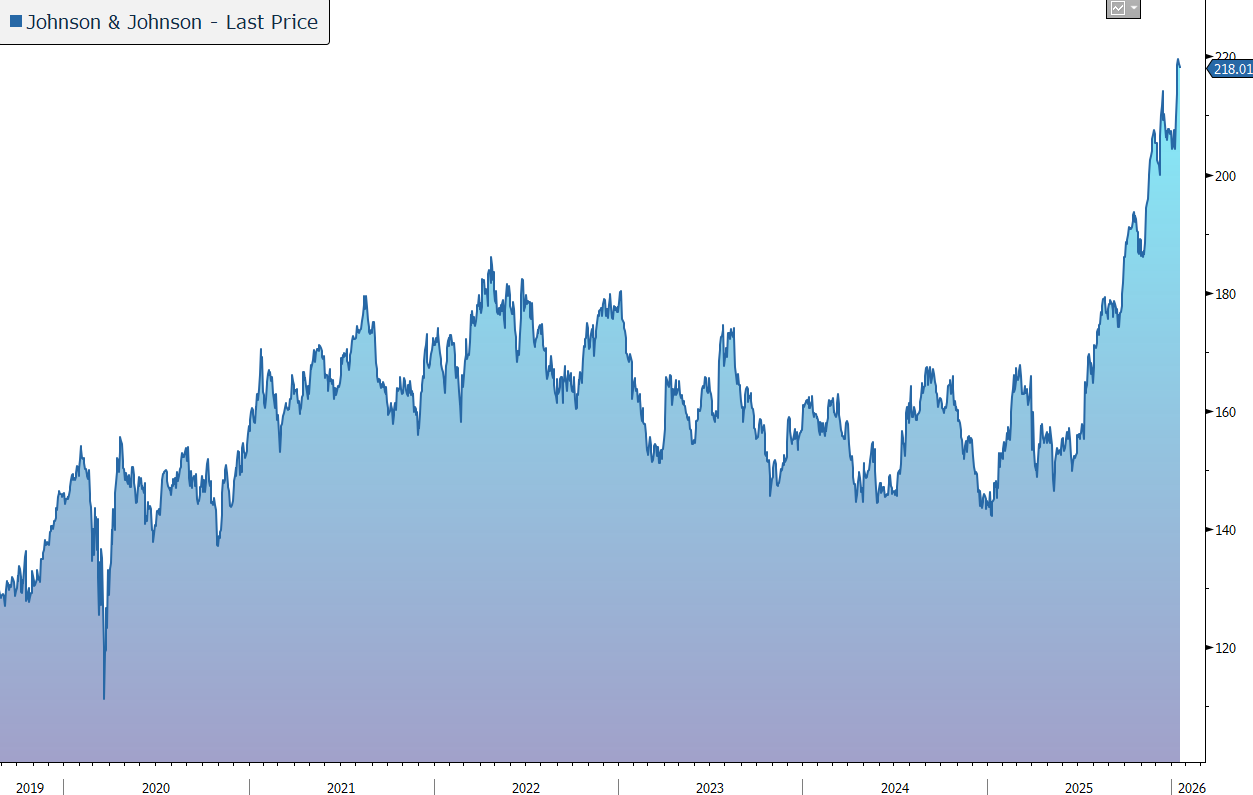

Yesterday lunchtime, Johnson & Johnson released robust Q4 results and set out its guidance for 2026, which was below some of the more optimistic expectations. In response, the shares were marked down 1% in US trading hours.

J&J is a global healthcare company with leading positions in Oncology, Immunology, Neuroscience, Cardiovascular, Surgery, and Vision. The group has 28 products/platforms, each with sales of more than $1bn. More than 75% of sales come from No.1 or No.2 global market share leading positions. The group’s strategy is to grow sales faster than the market, and to grow earnings faster than sales. Given its broad spread of businesses, J&J is considered the bellwether of healthcare companies, providing a good read-across for a range of other stocks.

J&J is undertaking a strategy of ‘shrink to grow’. The company’s former Consumer Health unit was spun off in 2023 and trades as a separate listed company, Kenvue. The company is also spinning off its orthopaedics business over the next 18 to 24 months – the standalone DePuy Synthes will be the largest, most comprehensive orthopaedics-focused company in the world, currently generating sales of more than $9bn.

For the full year, reported sales grew by 6.0% to $94.2bn. On an adjusted operational basis, which excludes the impact of acquisitions and disposals, growth was 4.2%, a touch ahead of the company’s 3.5%-4.0% guidance.

In the final quarter, reported sales grew by 9.1% to $24.6bn, a touch better than the market forecast of $24.2bn. On an adjusted operational basis, sales grew by 6.1%, with US domestic sales (+5.7%) growing slightly behind international sales (+6.8%).

The group’s performance demonstrates continued strength and resilience across both of its businesses. Innovative Medicine (i.e., Pharmaceuticals, 64% of sales) grew by 6.2% in the final quarter to $15.8bn. 13 brands grew in the double digits. Growth was driven by a broad range of products including cancer drug Darzalex and Neuroscience product Spravato. Growth was partially offset by an approximate 1,040 basis points impact from Stelara in Immunology.

In 2025, the group made significant pipeline progress, with 51 approvals and 32 filings across major markets. There were 17 key studies with positive readouts and 11 new phase 3 programmes initiated. Key approvals included Caplyta for major depressive disorder and Rybrevant Faspro for non-small cell lung cancer.

MedTech (i.e., medical devices, 36% of sales) increased by 5.9% to $8.8bn, driven primarily by electrophysiology products and Abiomed in Cardiovascular and wound closure products in General Surgery.

In 2025, MedTech achieved 15 product launches in major markets, with more than 40 regulatory approvals. There are currently more than 60 active clinical trials.

Full-year adjusted EPS grew by 8.1% to $10.79, a touch below the guidance of $10.80-$10.90. In the final quarter, EPS rose by 20.6% to $2.46, a touch better than the consensus forecast of $2.44.

J&J has a very strong balance sheet and ended 2025 with net debt of $28bn on the back of free cash flow generation of $19.7bn. The group has consistently invested in organic growth – R&D spend was $3.7bn in the quarter – and, as a result, around 25% of sales come from products launched in the last five years.

J&J has raised its dividend for 63 consecutive years. In the current quarter, the payout was raised by 5% to $1.30 per share, implying a full-year yield of 2.4%.

Guidance for 2026 was issued. Reported sales are expected to be $100.5bn, with growth in adjusted operational terms of 5.9% at the midpoint. Adjusted EPS is expected to be $11.53, up 6.9% at the midpoint. This reflects the group’s understanding of the present legislative landscape and current expectations for tariffs, foreign exchange rates, and procedural volumes. This includes a hit in the ‘hundreds of millions of dollars’ from a recent drug-pricing agreement signed with the Trump administration to avoid broader tariffs.

Source: Bloomberg