Morning Note: Market news and an update from Experian.

Market News

Ongoing geopolitical uncertainty continues to boost demand for safe-haven assets, with gold hitting another record of $4,870 an ounce. President Donald Trump remained firm on his plan to acquire Greenland. The Arctic island’s prime minister urged citizens to prepare for a potential military move, though he called it unlikely.

US equities moved lower last night – S&P 500 (-2.1%); Nasdaq (-2.4%). JPMorgan’s Bob Michele said the market sell-off sent a message to Donald Trump to act to restore calm. Netflix fell post-market following poor guidance, increased programme spending, and a pause in its share buybacks. United Airlines was firm following the release of better-than-expected results and an upbeat outlook.

In Asia this morning, Japanese bonds rebounded after a sell-off that rippled through global debt markets. Yields on 40-year Japanese debt fell 22 basis points to 3.99% after Finance Minister Satsuki Katayama called for calm following a rout that had pushed super-long yields to all-time highs. Equity markets moved off their lowest levels: Nikkei 225 (-0.4%); Hang Seng (+0.4%); Shanghai Composite (+0.1%).

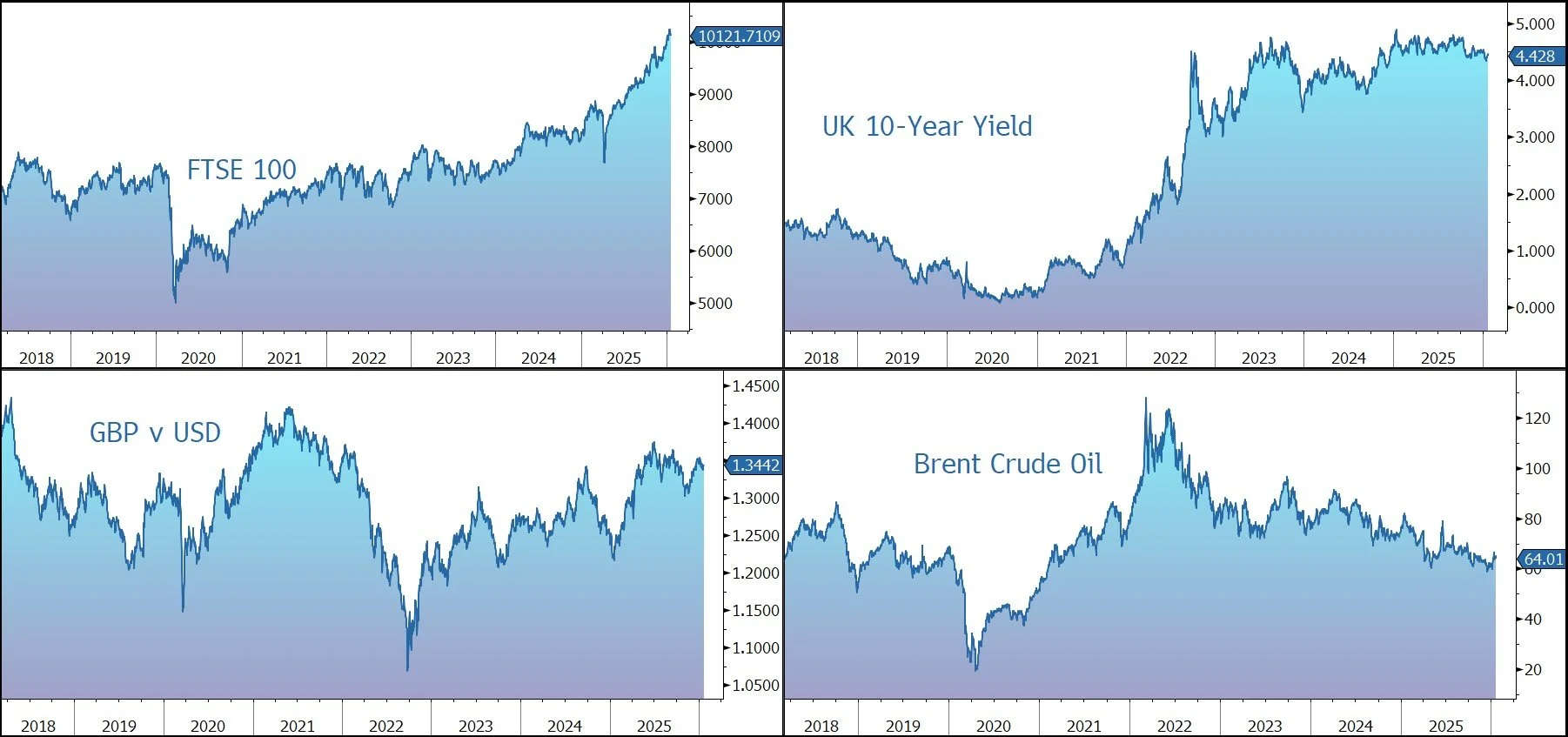

The FTSE 100 is currently 0.2% higher at 10,122. The UK’s December CPI rose 3.4% year on year, a touch above estimates. Importantly, measures of underlying price pressures offered comfort against the headline jump. Growth in core prices, which exclude energy, food, alcohol and tobacco, remained stable at 3.2% – below consensus predictions of 3.3% – while services prices picked up from 4.4% to 4.5%, below consensus bets of 4.6%. The pound dipped slightly is response to $1.3436 and €1.1469.

Source: Bloomberg

Company News

Experian has released a financial report for the three months ended 31 December 2025, the third quarter of the group’s financial year to 31 March 2026. The business enjoyed continued strong momentum and full-year expectations are unchanged. With little in the way of a catalyst, the shares are down 4% in early trading as investors look to take profits.

Experian is a global information services company that helps businesses to manage credit risk, prevent fraud, target marketing offers, and automate decision-making. The group also helps individuals check their credit report and credit score and protect against identity theft. The company has credit data on 1.4bn people and 200m businesses. The ownership of such rich, unique, and valuable data has become more important in an increasingly digital world, and the group is targeting a total addressable market of more than $140bn.

Experian operates an attractive business model where its customers supply the company with raw credit history data for free. The bureau aggregates it, applies analytics and tools, and sells it back to the customers as a credit report. The industry operates as an oligarchy with high barriers to entry because of large historical databases and regulatory know-how.

The company has shifted from simply selling data to selling enhanced decision tools and analytics software which are essential in automating customers’ decisions, helping to reduce costs, and managing risk. As a result, customer relationships are very ‘sticky’, with renewal rates of 90%, and revenue is very resilient. The business has a long history of weathering uncertainty – notably, revenue grew in organic terms in both the GFC of 2008 and pandemic of 2020. Although credit application volumes slow in a recession, we believe the company has a natural hedge of risk management and asset protection products, as well as exposure to healthcare and other defensive segments.

Regarding the potential opportunities and threats posed to the business by AI, we believe the company is well placed given its hard-to-replicate proprietary datasets with scope to accelerate product innovation and increase operational efficiency, ultimately enhancing margins. In the last financial year, the company made good progress on its cloud programme, with significant new products and Generative AI features launched.

Although the company is listed in the UK, it reported its results in US dollars.

In the final quarter of 2025, revenue from ongoing activities grew by 10% at constant exchange rates. In organic terms (i.e., underlying before M&A), growth was 8%, in line with management expectations. The company continued to leverage its scaled proprietary data assets, strong technology foundations and deep expertise to deliver on its strategic priorities and crystallise new AI opportunities.

The group saw growth in every region. In the group’s largest division, North America, which accounts for more than two-thirds of revenue, organic growth from ongoing activities was 10%.

Financial services generated strong growth, reflecting continued progress against strategic priorities, while Consumer Services delivered underlying organic revenue growth of 8%, as anticipated after the one-time contractual catch-up in the insurance business in the previous quarter.

Elsewhere, Latin America and EMEA/Asia Pacific grew by 6% and 3% respectively. The star was Brazil where the business achieved a significant milestone of 100m free members. Growth in the UK & Ireland was also 3% as strong Consumer Services results were supported by the launch of the group’s 1250 score, a new credit score that uses expanded data and better reflects how credit applications are assessed.

This was a revenue update, so there was no commentary on profitability or the group’s financial position. As a reminder, the business is very cash generative, and the company ended its financial half-year to 30 September 2025 with financial leverage of 1.8x net debt to EBITDA, below the target range of 2.0x-2.5x.

Cash flow is sensibly reinvested in organic and strategic investments that generate attractive returns. Capital expenditure focused on data, technology, and new products represents 8% of revenue and the group invests in acquisitions to support strategic growth. During the quarter, the company acquired KYC360, enhancing its fraud and financial crime compliance capabilities.

For FY2026, the group continues to expect to deliver organic revenue growth of 8%, at the top-end of its 6%-8% target range, and margin expansion in line with the group’s medium-term framework of 30-50 basis points, at constant currency and on an ongoing basis.