Morning Note: Market news and an update from Glencore

Market News

A perfect storm of geopolitical and economic triggers has caused a volatile and record-breaking rally in commodities, with gold, copper, and silver hitting all-time highs amid a weaker dollar and rising tensions. In what appears to be a continuation of the ‘debasement trade’, investors are losing confidence in traditional financial assets and the independence of the Federal Reserve, shifting instead to ‘hard assets’ like commodities. Gold currently trades at $5,510 an ounce. The Australian dollar – a proxy for commodities – gained for a ninth day, the longest winning streak in a decade.

President Trump warned Iran that ‘time is running out’ for a nuclear agreement, while reports suggest the US is weighing fresh military strikes.

The US Federal Reserve held interest rates steady (at 3.5% to 3.75%). While this was expected, the Fed's commentary reinforced expectations of rate cuts later in 2026. Two members, Christopher Waller and Stephen Miran, dissented in favour of a quarter-point cut. Jerome Powell declined to comment on his plans after his term as chair ends. The 10-year Treasury yields 4.26%.

US equities were little changed last night – S&P 500 (flat); Nasdaq (-0.2%). After hours, three of the Mag 7 reported to mixed reception. Meta rose by 7% as it beat estimates, with its strong online ads business helping fund record AI investment. Tesla rose by 2% following plans to invest $20bn in 2026 on AI, robotics, and autonomous driving, while halting production of its S and X models. Microsoft fell by 6% – although revenue and profit exceeded market forecasts, capital spending came in higher than expected. Norway’s $2.2 trillion sovereign wealth fund cut stakes in major US tech firms, including Nvidia, Apple, Microsoft, and Alphabet, in the second half of 2025.

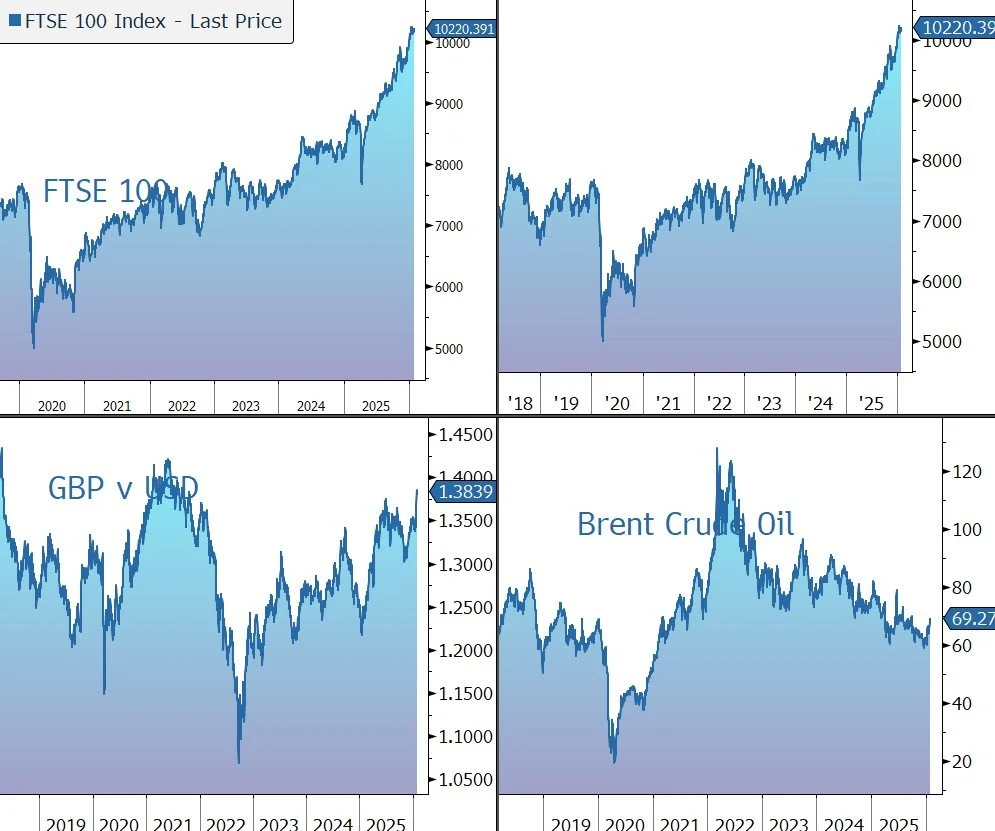

In Asia this morning, equities ticked higher: Nikkei 225 (+0.03%); Hang Seng (0.5%); Shanghai Composite (+0.2%). The FTSE 100 is currently 0.7% higher at 10,220, while Sterling trades at $1.3815 and €1.1545.

Source: Bloomberg

Company News

Glencore has this morning released its Q4 2025 production report. The shares have been very strong of late, driven by the potential bid from Rio Tinto and the ongoing strength in the copper price. As expected, there was no mention of M&A in today’s release. Although copper production came in at the low end of the guidance range, the shares have pushed on a further 3% in early trading, driven by the copper price which has surged to another new high.

Glencore is a vertically integrated commodities business, with a strong position in the production of copper, coal, nickel, zinc, cobalt, and precious metals, and a unique marketing business which markets and distributes commodities sourced from internal production and third-party producers to industrial consumers. The group’s strategy is to own large-scale, long-life, low-cost Tier 1 assets.

Following a period of portfolio simplification, the company has sold or shut 35 assets since 2021. In the meantime, it has undertaken selective M&A of assets in key/core commodities, including copper/alumina/bauxite and high-quality steelmaking coal. As part of this process, Glencore has uncovered opportunities to streamline its operating structure and identified at least $1bn of cost savings (against a 2024 baseline). These are expected to be fully delivered by the end of 2026, with more than half generated in 2025.

Glencore is a leading producer of critical minerals that are used in low-carbon and carbon-neutral technologies, such as electric vehicles and renewable energy, the outlook for which is underpinned by robust demand and persistent long-term supply challenges. Most notably, this includes copper. Back in December, the company set out plans to expand its copper production from 850kt in 2025 to 1mt by 2028 and 1.6mt by 2035, making it one of the largest producers in the world. Growth will be driven by new mines, the expansion of existing mines, and the restart of dormant mines. The plans are derisked to some extent as the targets are not dependent on one mine or process and are often a bolt-on to existing infrastructure. The major greenfield expansion is El Pachón in Argentina, one of the world’s largest undeveloped resources which the company hopes will underpin its long-term growth.

With today’s release, the group’s 2025 Resources and Reserves report includes additions to its copper mineral resource base, with notable increases at NewRange, Antapaccay, Coroccohuayco, Lomas Bayas and El Pachón.

Glencore is the world’s leading seaborne energy (thermal) coal business, a top-tier steelmaking (coking) coal business, and has a rapidly growing LNG, power, gas, and carbon business. As a result, the company will play a strategic role in supporting the world’s energy needs of today and tomorrow. The company believes global population growth, increased urbanisation, a growing middle class, AI infrastructure growth, and the energy transition will all continue to drive long-term demand for thermal coal. For now, however, the company is balancing immediate energy security needs with a commitment to a net-zero trajectory by undertaking the responsible decline of its thermal coal operations.

Glencore’s 77% interest in Teck’s steelmaking coal business (EVR) complements existing production in Australia, Colombia, and South Africa. Following consultation with its shareholders, Glencore is retaining its coal and carbon steel materials business. The company believes the cash generative capacity of the business significantly enhances the quality of the overall portfolio, by commodity and geography, and broadens the company’s ability to fund the growth of its copper portfolio as well as accelerate shareholder returns. Management sees potential upside through synergies as the EVR assets are integrated into the portfolio.

Earlier in the month, Glencore confirmed it is in preliminary discussions with Rio Tinto about a possible combination of some or all of their businesses, which could include an all-share merger between the two companies. With several corporate, strategic, and regulatory hurdles to overcome, there is no certainty a deal will occur. The parties’ current expectation is that any merger transaction would be effected through the acquisition of Glencore by Rio Tinto by way of a court-sanctioned scheme of arrangement. Under UK takeover rules, Rio Tinto must announce a firm intention to make an offer or walk away by 5pm on 5 February 2026. As expected, Glencore makes no comment on the matter in today’s production update.

Speaking of which, in 2025 the group achieved full-year production volumes for its key commodities within guidance ranges.

- Copper: own-sourced production fell by 11% to 851.6kt, at the lower end of the group’s guidance range of 850-875kt. This was primarily due to lower head grades and recoveries associated with mine sequencing and resultant ore feedstock to the plants. A mine closure at Mount Isa also impacted production. However, production in the second half was over 500kt, almost 50% above H1, primarily due to higher copper grades and recoveries at various mines. As expected, guidance for 2026 is 810-870kt

- Zinc: own-sourced production is up 7% to 969.4kt, at the upper end of the guidance range of 950-975kt, mainly reflecting higher zinc grades at Antamina and higher McArthur River production.

- Cobalt: Production fell by 5% to 36.1k as the company intentionally prioritised copper over cobalt in the DRC due to export restrictions.

- Steelmaking Coal: production of 32.5mt was in the middle of the guidance range of 30-35mt. The 63% increase includes the EVR business acquired in July 2024

- Energy Coal: production fell by 2% to 98mt, above the top-end of the guidance range of 92-97mt. This mainly reflects the voluntary Cerrejón production cuts announced in March 2025, partially offset by a stronger performance from the Australian business.

Average prices for the group’s key commodities were mixed during the year: copper (+9%), Zinc (+3%), gold (+44%), silver (+43%), steelmaking coal (-22%), and energy coal (-23%). Clearly 2026 has got off to a flying start.

Glencore’s Marketing business exploits arbitrage opportunities that continuously emerge as a result of different prices for the same commodities in different locations or time periods. It provides a good hedge against commodity price volatility and finances the $1bn base dividend (see below), although clearly there is always a risk of potential losses because of that volatility. During the year, the company raised its through-the-cycle long-term adjusted EBIT guidance range for the unit by 16% to $2.3bn-$3.5bn p.a. As expected, in 2025 the division expects to have generated adjusted EBIT around the mid-point of its higher target range.

There is no update on the group’s profitability or financial position. As a reminder, at the half-year stage net borrowing stood at $14.5bn, including $1.0bn of marketing lease liabilities, leaving gearing at a comfortable 1.1x net debt to EBITDA, or 1.0x including the $900m of cash received in July as part of the Viterra transaction, all of which provides significant financial headroom.

Looking forward, the company is looking to strike the “right balance” between its growth ambitions and returns to shareholders. Excluding the various copper growth projects, capex will average $6.5bn p.a. from 2026-2028. Depending on the level of additional capex for new developments, aggregate investment could be $23.4bn. However, the company has said that although its plans can be self-funded, it will look at opportunities to reduce financial and operational risk via passive or active minority stakes or a strategic partner.

Following the decision to retain the coal and carbon steel materials business, the group’s net debt ceiling which shapes its shareholder returns framework was reset at $10bn. When net debt falls below this level (after the base distribution), cash will be periodically returned to shareholders via special cash distributions and/or share buybacks.

The dividend policy is to pay a fixed $1bn base distribution from the Marketing business, reflecting the resilience, predictability, and stability of the unit’s cash flows, plus a minimum payout of 25% of the Industrial free cash flow. In addition, once net debt falls below $10bn (after the base distribution), cash will be periodically returned to shareholders via special cash distributions and/or share buybacks. An update on shareholder returns is expected at the time of the full-year results on 18 February.

Overall, while there is increased uncertainty around the impact of geopolitics in the near term, Glencore remains of the view that in certain commodities, the scale and pace of global mine project development will struggle to meet demand for the materials needed in the future. Glencore believes it is well placed to participate in bridging this gap, through the flexibility embedded in both its Marketing and Industrial businesses to respond to global needs.

We believe commodities and resource stocks are inexpensive when compared to financial assets and are relatively under-owned in investor portfolios. Furthermore, the mining sector has a long history of M&A, with the potential tie-up between Rio Tinto and Glencore the latest iteration.