Morning Note: Market news and an update from global miner BHP.

Market News

Gold prices rose past $4,720 an ounce, setting a new record high as renewed US-EU trade tensions strengthened demand for safe-haven assets. Meanwhile, the yield on the US 10-year Treasury note climbed above 4.25%, reaching its highest level since early September. Reports on Monday indicated that Denmark is increasing its military presence in Greenland as President Trump refused to rule out using force to secure control of the island. The FT reports the President has agreed to a meeting of ‘various parties’ over Greenland in Davos.

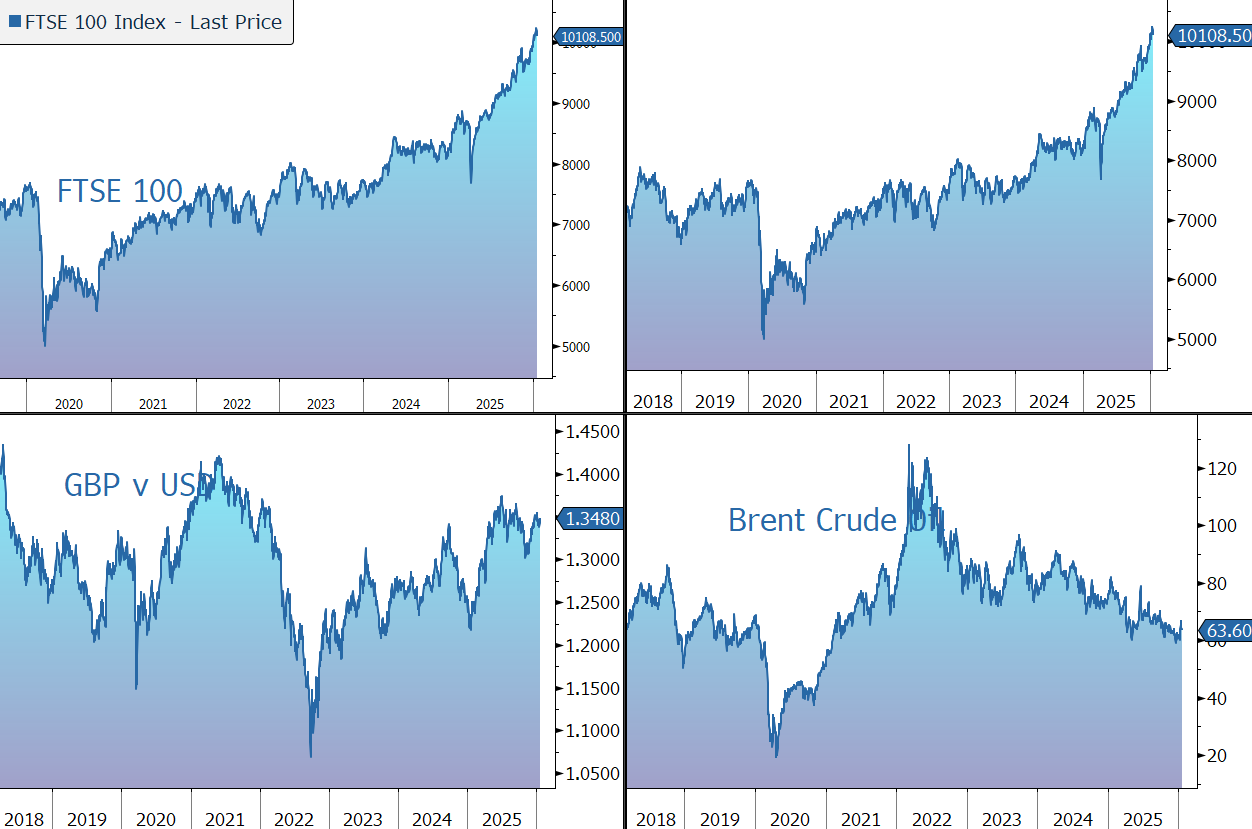

US natural gas futures surged over 17% to $3.65/MMBtu, rebounding from a 13-week low of $3.10 last week, as an intensifying Arctic outbreak grips the US. A sudden transition from a mild outlook to a severe cold snap has forced a rapid market correction, as traders price in significantly higher fuel consumption to combat the prolonged Arctic blast. Brent Crude trades at $64 a barrel.

In Asia this morning, equities fell to their lows of the day – Nikkei 225 (-1.1%); Hang Seng (-0.3%) – after a meltdown in Japanese bonds late in the Tokyo afternoon. Japanese long-term bond yields jumped to records as investors gave a thumbs down to Prime Minister Sanae Takaichi’s election pitch to cut taxes on food. The 10-year JGB currently trades at 2.35%

US equity futures are down by 0.6%, while the FTSE 100 is currently 0.8% lower at 10,108. Sterling trades at $1.3480 and €1.1510.

Source: Bloomberg

Company News

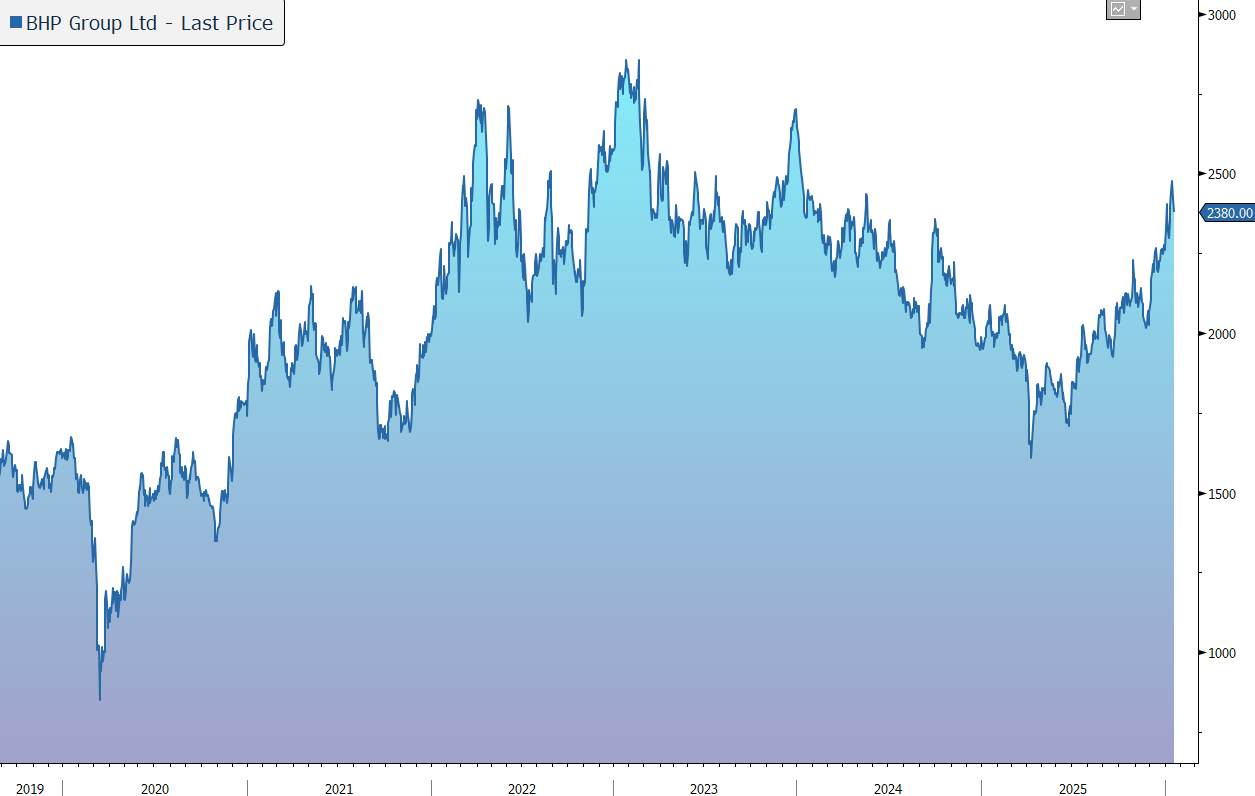

BHP Group has released an operational review for the half-year ended 31 December 2025 which highlights strong performance and increased copper production guidance capitalising on strong commodity prices. In response to today’s update, the shares are down 2% in early trading against a weak overall market backdrop.

BHP is a diversified resources company with exposure to iron ore, metallurgical coal, copper, and potash. Assets are high quality and largely located in lower-risk jurisdictions, with strong development potential. The group’s capital allocation framework provides flexibility at the bottom of the cycle and discipline at the top, and has seen a shift in focus to low-cost, high-return projects. BHP has positioned itself to benefit from the unfolding mega-trends of decarbonisation, electrification, population growth, and the drive for higher living standards in the developing world, which it sees becoming key drivers of commodity demand.

Productivity initiatives and cost discipline have helped to mitigate cost pressures, and the company generated a 53% EBITDA margin in the last financial year, maintaining the 20-year average above 50%.

The company’s external operating environment is being shaped by complex and evolving global developments. Policy uncertainty, particularly around tariffs, fiscal policy, monetary easing, and industrial policy, has been elevated and continues to influence investment and trade flows. However, during the latest half-year the company achieved operational records at its copper and iron ore assets and benefitted from a positive commodity price environment.

Total copper production was broadly in line at 984kt, with the flagship operation, Escondida, achieving record concentrator throughput. To capitalise on higher prices – the average realised price was up 32% to $5.28/lb – production guidance for FY2026 has increased to between 1,900kt and 2,000kt (from between 1,800kt and 2,000kt previously). The company has a significant copper growth pipeline, and a pathway to 2m tonnes of attributable copper production in the 2030s.

Iron ore production increased 2% to 134mt. The average realised price increased by 4% to $84.71/wmt. The company notes it has had to navigate some tougher negotiations with China’s state buyer (CMRG), leading to some pricing concessions. Production guidance for FY2026 remains unchanged at between 258mt and 269mt. The flagship Western Australia Iron Ore (WAIO) achieved record first-half production and shipments, positioning the company well ahead of the typically wet third quarter.

Steelmaking coal tonnes from the BMA operations were up 2%, although the average realised price fell by 9% to $189/t. Energy coal production rose by 10% due to increased bypass coal as well as mining lower strip ratio areas.

Capital and exploration expenditure is increasingly focused toward future-facing commodities of potash and copper. The company has a pipeline of copper projects under development in Chile and Australia, while the Jansen potash project in Canada is on track to begin production in mid-2027. The company published an updated cost estimate for Jansen, rising from $7.0bn–$7.4bn to $8.4bn.

In each of the next two years, BHP expects to spend $11bn in capital and exploration, reducing to $10bn on average each year between FY2028 and FY2030. 70% of medium-term capital spend is expected to be focused on future-facing commodities.

The company has a strong balance sheet, enabling it to invest in high-quality organic growth projects. Net debt as at 31 December 2025 expected to be between $14bn and $15bn, in the middle of its 10bn-$20bn range. The group’s financial position has been helped by a $2bn transaction with Global Infrastructure Partners regarding their Pilbara power network.

BHP’s dividend policy provides for a minimum 50% payout of underlying attributable profit at every reporting period and the company has a track record of delivering robust shareholder returns through the cycle. The announcement of the payout for the latest half-year will be announced with the results on 17 February.

Looking forward, the company highlights that China’s commodity demand remains resilient, supported by targeted policy measures and solid exports. Momentum moderated in the second half of 2025, notably in construction, manufacturing, and infrastructure investments. India is emerging as a key engine of demand, with strong domestic activity sustaining steel and rising copper needs. Forecast global growth in 2026 is around 3%, creating a positive backdrop for commodity demand.

We believe commodities and resource stocks are inexpensive when compared to financial assets and are relatively under-owned in investor portfolios. Furthermore, the mining sector has a long history of M&A, and we expect further industry consolidation in the future. Most recently, we note the potential tie-up below industry rivals Rio Tinto and Glencore, a deal BHP is keeping a keen eye on as the 5 February deadline for a formal offer approaches.

Source: Bloomberg