Morning Note: Market news and a round-up of recent company news.

Market News

Acting President Delcy Rodríguez invited the US to work with Venezuela in a “balanced and respectful” relationship. Donald Trump said Washington would cooperate but needs “total access” to the South American country. The US will use oil leverage to press for further change in Venezuela, Marco Rubio said, as he seeks to reshape Latin America in Washington’s favour.

Gold (+2% to $4,425 an ounce) and silver (+4% to $75.70 an ounce) both generated strong gains as investors sought safe havens. The 10-year Treasury yields 4.17%. Copper trades at $5.80 per pound, moving closer to the record levels reached in July last year as tightening global supply conditions continued to support prices.

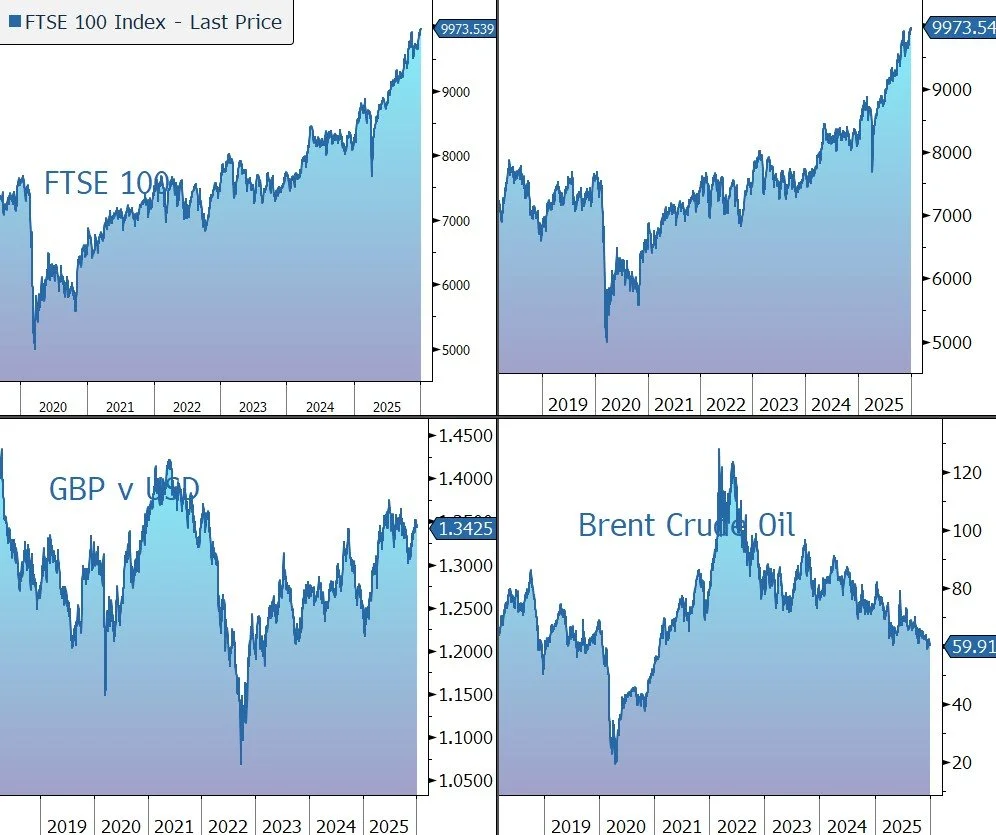

Brent Crude trades at $60 a barrel. Markets are weighing the potential impact on crude supply, given Venezuela holds the world’s largest proven oil reserves. However, some analysts expect limited disruption, noting Venezuela currently produces less than 1m barrels of crude per day, less than 1% of global output. However, the US raid raises the potential for output weighing on prices over time. OPEC+ agreed to keep oil output unchanged in March despite global market turmoil. Delegates said Venezuela was not discussed at the brief meeting.

Following Friday’s gains, US equities are currently expected to open in positive territory this afternoon. In Asia this morning, shares rose to a record: Nikkei 225 (+3.0%); Hang Seng (+0.1%); Shanghai Composite (+1.4%). Japan’s five and 10-year yields advanced amid lingering inflation concerns, while the yen weakened.

The FTSE 100 is currently 0.3% higher at 9,984, having briefly breached the 10,000 barrier for the first time last week. Sterling trades at $1.3430 and €1.1490. PM Starmer told the BBC he would pursue greater access to the EU’s single market, his strongest language yet on softening the UK’s Brexit deal.

Source: Bloomberg

Company News During the Holiday Break

Last Friday, the trading currency of the ordinary shares of InterContinental Hotels Group on the London Stock Exchange changed from Sterling to US dollars. This change, previously announced at the time of the Q3 Trading Update, does not affect the nominal currency of the shares, which remains in Sterling, nor does it impact IHG’s London listing or its New York ADR listing. Shareholders based in the UK will continue to receive dividend payments in Sterling. The company’s aim is to better align its share price with its financial performance – the company already reports its results in US dollars – and simplify investment appraisal.

Last week, SEC filings showed Nike CEO Elliott Hill bought stock for about $1m at $61.1 a piece last week. This followed a $3m purchase by Apple CEO and Nike board director Tim Cook. As a result, the company’s shares have recovered some of the losses incurred following its weak results on 19 December.

On Christmas Eve, BP announced an agreement to sell a 65% shareholding in Castrol to Stonepeak for an enterprise value of $10.1bn, with total net proceeds of $6.0bn, which will be used to reduce net debt. This well-flagged transaction accelerates BP’s strategy to simplify its portfolio, strengthen its balance sheet, and focus its downstream operations. BP will retain a 35% stake in a new joint venture, providing exposure to Castrol’s growth and future optionality. The deal is expected to complete by the end of 2026 and contributes to BP’s goal of reducing net debt to between $14bn and $18bn by the end of 2027, vs. $26.1bn at the end of Q3 2025.