Morning Note: A round-up of global financial news.

Market News

Gold hit a record high ($4,675 an ounce) as investors flocked to safe-haven assets following President Trump’s announcement of new tariffs on European countries. Trump said he would impose a 10% tariff on goods from eight European nations starting 1 February due their opposition to American control over Greenland. The rate could rise to 25% in June if no agreement is reached on what he noted as the “complete and total purchase of Greenland.” The announcement sparked concerns across Europe, with European leaders expected to hold an emergency meeting in the coming days to discuss possible retaliatory measures, including levies on €93bn worth of US goods.

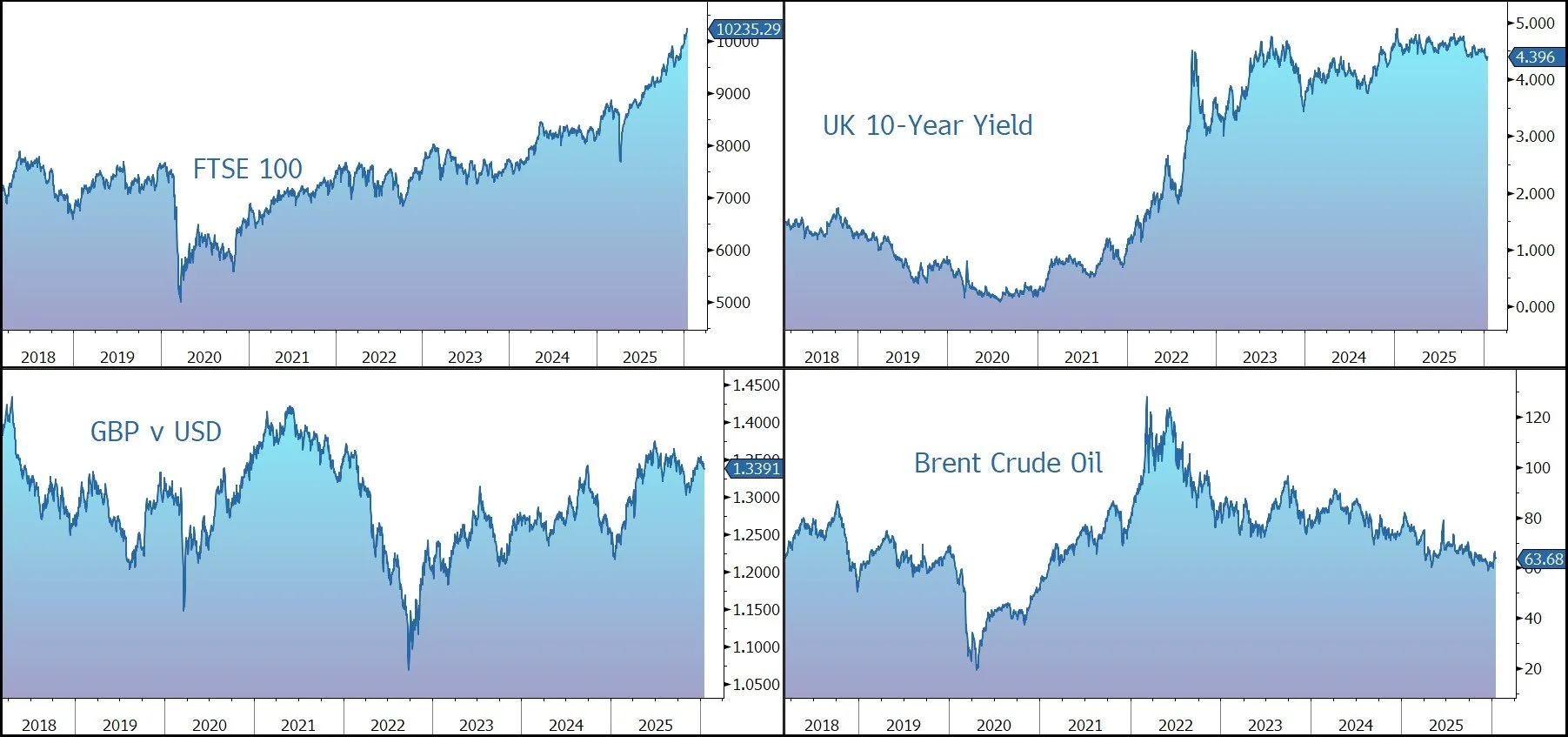

Equity markets have reacted negatively to the tariff threat. In Asia this morning, the main indices moved lower – Nikkei 225 (-0.7%); Hang Seng (-1.0%) – while the FTSE 100 is 0.1% lower at 10,230. The S&P Futures are currently trading down almost 1%, although the US market will be closed today for Martin Luther King Jr Day.

Treasuries dropped across the curve as traders slightly dialled back expectations for Fed rate cuts this year. The 10-year bond currently yields 4.22%. Japan’s government bonds fell on reports Sanae Takaichi may suspend sales tax on food before a snap election expected to be held next month. The yield on 30-year debt climbed to its highest since its debut, while rates on 10- and 20-year notes rose to the steepest since 1999.

According to Bloomberg, Chinalco, one of Rio Tinto's top shareholders, is likely to support the mining giant’s potential acquisition of rival Glencore, a combination that would give the Chinese company increased exposure to copper. Brent Crude fell back below $64 a barrel after recording a fourth weekly gain, as cooling tensions in Iran alleviated concerns over potential supply disruptions.

Sterling trades at $1.3405 and €1.1520. According to Rightmove, asking prices for homes across Britain recorded their biggest January increase on record. The average price rose 2.8% from the previous four weeks, to £368,031.

Source: Bloomberg