Morning Note: A Round-up of Financial Market News.

Market News

US inflation slower from 2.7% to 2.4% in January, lower more than the 2.5% expected. However, the core measure, which strips out the often-volatile cost of food and energy, was in line at 2.5%. The data spurred bigger bets on Federal Reserve rate cuts, with bond yields falling – the two-year yield dropped to its lowest level since 2022; the 10-year yields 4.05%. The probability of a rate cut at the April meeting rose, while pricing for December indicates roughly even odds between a rate reduction and a hold. Markets continue to assign the highest probability to a 25bps cut in June, followed by another in September. Gold slipped to $5,010 an ounce.

In Asia this morning, equities steadied following a volatile week driven by AI disruption concerns: Nikkei 225 (-0.2%); Hang Seng (+0.5%). The moves opened a week marked by Lunar New Year holidays, with mainland China closed. The yen weakened after Japan’s GDP missed estimates. The US market is closed today for Presidents’ Day.

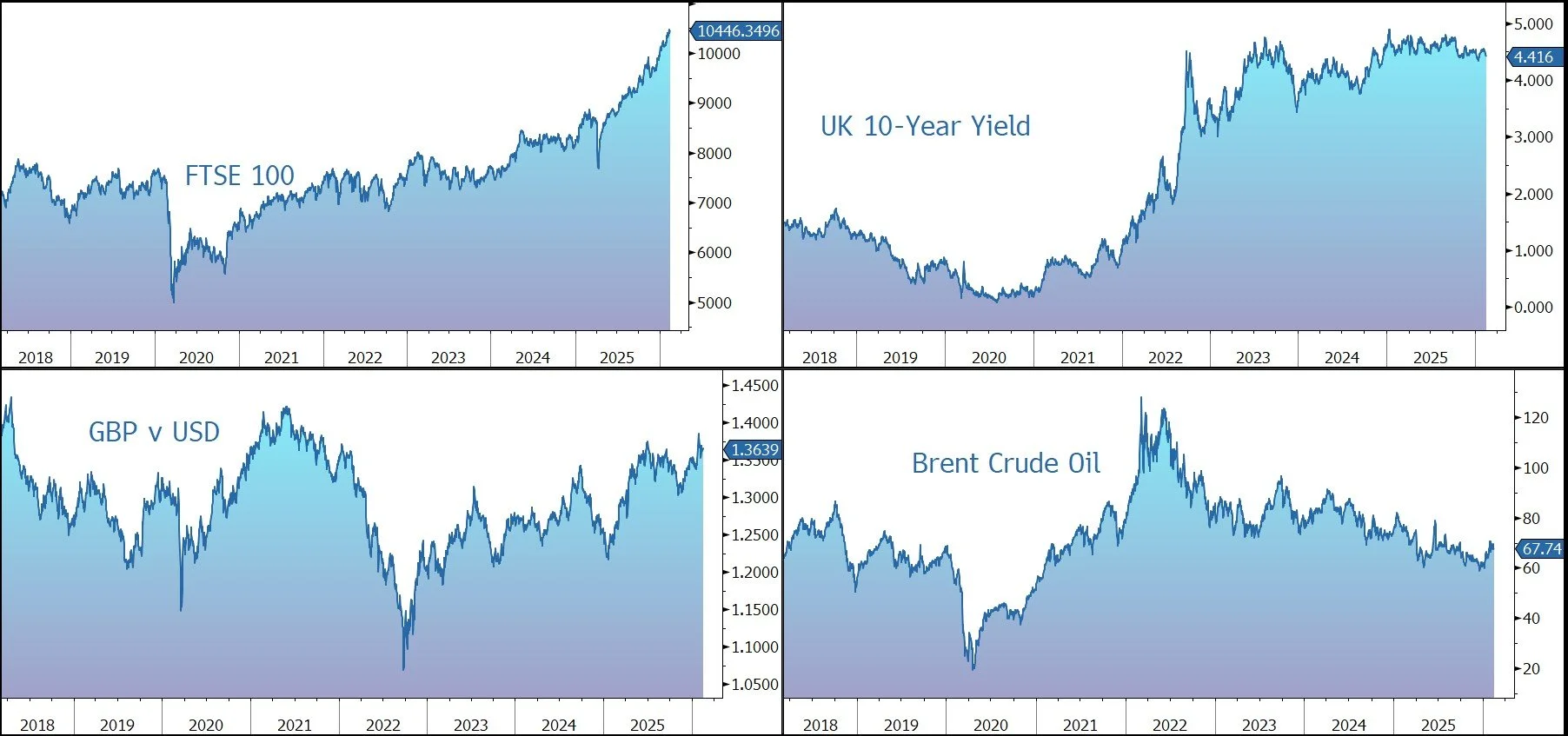

The FTSE 100 is currently little changed at 10,446. The UK’s average newly-listed home price held steady at £368,019 this month, according to Rightmove. Sterling trades at $1.3645 and €1.1505.

Brent Crude trades at $67 a barrel after posting the first back-to-back weekly decline of the year, as investors closely watch a second round of US-Iran talks. This comes as the US increases its military presence in the region, with President Trump repeatedly warning of potential strikes if a nuclear deal is not reached.

This week, traders will look to the ADP private payrolls data tomorrow and the minutes from the Federal Reserve’s January meeting on Wednesday for a fresh read on the economy and how policymakers are assessing the balance between employment and inflation, after pausing their easing cycle last month. On the corporate front, the reporting season continues with results from InterContinental Hotels, BHP, Medtronic, Glencore, Nestle, Deere, Newmont, and Danone.

Source: Bloomberg