Morning Note: Market News and an Update from Yellow Cake.

Market News

Risk assets sold off yesterday on renewed AI concerns. Equities fell in the US last night – S&P 500 (-1.6%); Nasdaq (-2.0%) – and in Asia this morning: Nikkei 225 (-1.2%); Hang Seng (-1.7%); Shanghai Composite (-1.3%). Anthropic completed a deal to raise $30bn at a $380bn valuation.

The yield on the 10-year US Treasury note held around 4.11% this morning after a sharp decline in the previous session, hovering near its lowest levels in two months as a widespread sell-off across financial markets spurred safe-haven demand for Treasuries.

In contrast, gold was caught in the crosshairs of the broad market sell-off that led investors to liquidate precious metals to raise cash. The price fell by more than 3% but has recovered somewhat to $4,980 an ounce this morning.

Investors are focused on US inflation data due later today, which could shape expectations for the Federal Reserve’s next policy move. Stronger-than-expected January jobs data released earlier this week have led markets to price in a first rate cut in July rather than June.

The US is discussing scaling back tariffs on steel and aluminium products, a person familiar with the matter said. This would act as a potential tailwind for the global automotive and construction sectors.

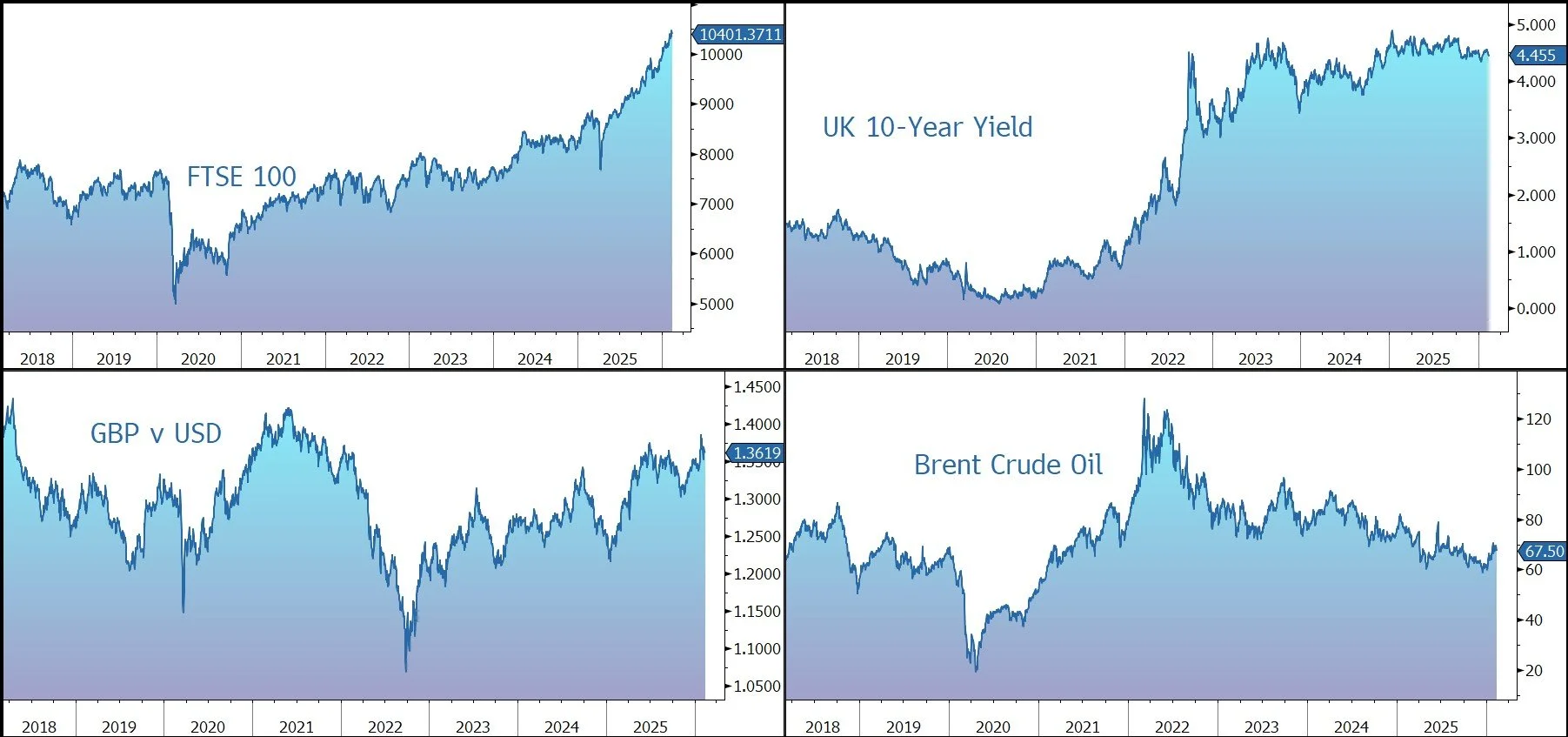

The FTSE 100 is currently bucking the trend, trading up 0.2% at 10,401. NatWest reported Q4 operating profit slightly ahead of market estimates. The share are little changed. Sterling trades at $1.3615 and €1.1480.

Source: Bloomberg

Company News

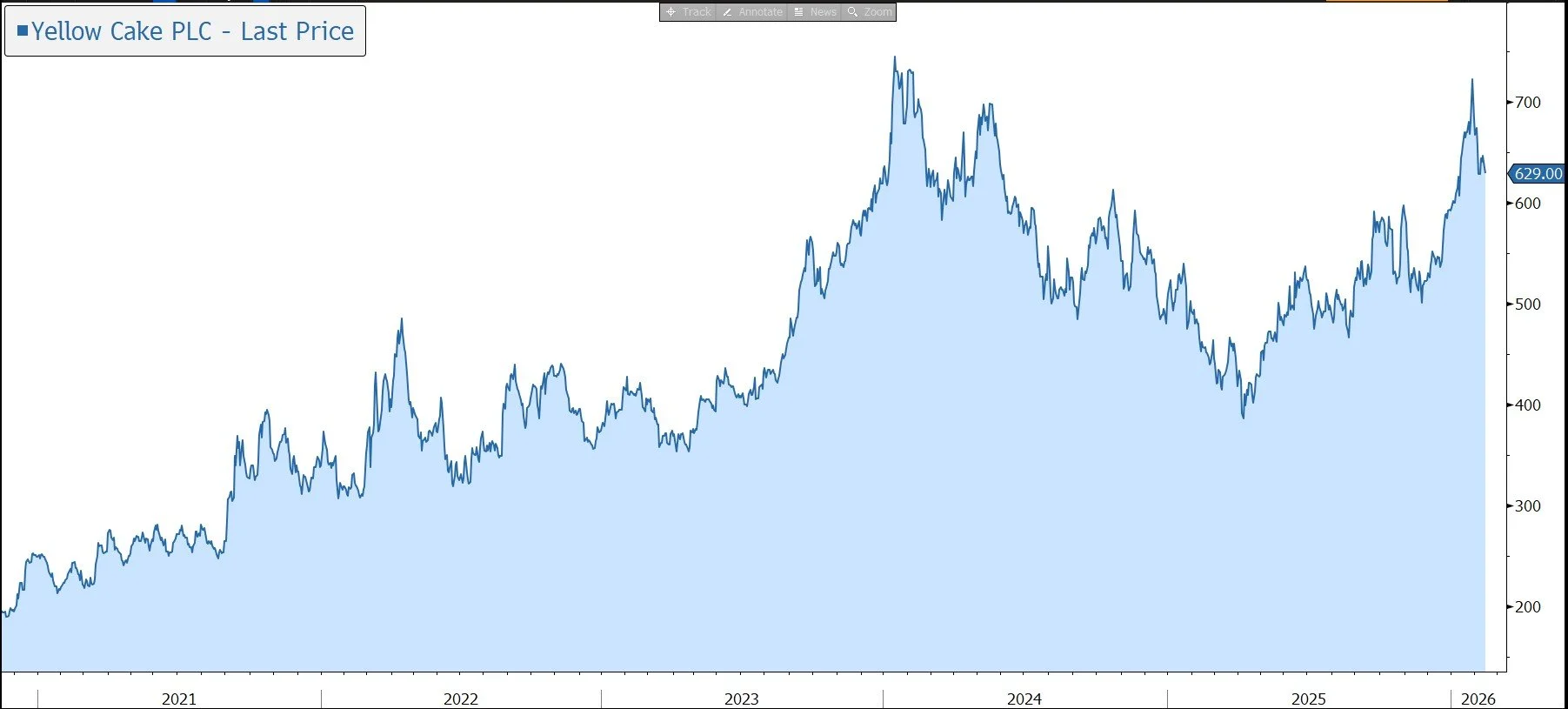

Following a heavily oversubscribed placing, Yellow Cake has raised $110m to fund an increase its holding of uranium.

Yellow Cake is an AIM-listed company focused on buying and holding physical uranium (U3O8). The company offers shareholders exposure to the uranium spot price, without the risks associated with investment in companies that explore for and produce uranium. The company utilises a low-cost outsourced business model that minimises cost leakage – annual operating costs are less than 1% of NAV – while securing access to additional expertise through strategic partnerships with suppliers and other relevant industry players.

The company’s fundamental premise is that uranium, as a commodity, is structurally mispriced. The directors believe the central source of this mispricing is the potential looming supply gap, as demand for nuclear power as a low-carbon baseload source continues to increase, while a lack of investment in new supply sees existing mines reaching end of life, with insufficient new mines under development to replace them.

Under a Framework Agreement with Kazatomprom (the world’s largest producer), Yellow Cake has the option to purchase up to $100m of uranium per year from Kazatomprom at an undisturbed spot price, through to 2027. To date the company has financed its uranium purchases through the issue of equity. Yellow Cake currently owns 21.68m pounds of uranium held in storage in Canada and France, purchased at an average cost of $34.64 a pound, well below the current spot price of $89.00/pound.

Last September, under the 2025 Kazatomprom option, the company purchased 1.33m pounds of physical uranium at a price of $75.08/lb for $100m. Following delivery of this material, anticipated in the first half of 2026, Yellow Cake is expected to hold 23.01m pounds of U3O8.

Earlier in the week, the company raised another $110m (£80.6m) through a non-pre-emptive placing of 12.82m new shares with existing and new institutional investors at a fixed price of 629p. The company took advantage of the recent move in the share price from a discount to NAV to a premium. Due to strong investor demand, the gross proceeds raised were well above the original proposal of $75m and amounted to 5.3% of the existing market cap.

The fundraise will enable the company to fully exercise its 2026 Kazatomprom option. It has agreed to purchase 1.16m pounds of physical uranium at $86.15/lb, which is the average of the weekly TradeTech and UxC spot prices as reported on 6 February and 9 February, respectively. It represents a 2.1% discount to the spot price of $88.00/lb on 10 February.

The additional funds will provide flexibility to pursue further strategic and opportunistic purchases of physical uranium, pay the costs associated with the placing, and finance working capital and general corporate purposes.

The implied pro-forma NAV at the proposed uranium purchase price is 629p per share, while the implied NAV at the uranium price as at 10 February of $88.00/lb is 643p per share, close to the current share price.

Yellow Cake believes the current level of the uranium price offers a compelling buying opportunity. The supply-demand imbalance continues to intensify, driven by global nuclear energy expansion, persistent production constraints, escalating input costs, and increasing demand for secure supply. As of early 2026, the global uranium market is producing roughly 162m pounds a year, but reactors are consuming over 180m pounds.

Security of supply continues to be a significant driving force in the nuclear industry, with persistent political strategic considerations balancing on an East/West divide, evidenced by the US seeking to boost its strategic uranium reserve and adding uranium to its list of critical minerals.

Alongside this, primary mine developers and producers continue to face operational challenges in meeting or maintaining production targets. This feeds into already fragile near-term supply growth and an increasingly widening supply/demand outlook.

The incentive price required for new mines to be developed and constructed is higher than the current spot price. This misalignment in pricing has resulted, and is continuing to result, in a lack of investment in new uranium supply.

On the demand side, there has been a change in attitude towards nuclear energy and the role it can play in future energy plans as countries seek to meet their carbon emission reduction commitments and limit global warming.

Many countries are undertaking aggressive nuclear plant build programmes and reactor life extensions, while, in time, small modular reactors are expected to be a new source of demand.

Demand growth continues to be driven by AI and hyperscale data centres that require round-the-clock power at a scale and reliability that intermittent renewables cannot provide on their own. Existing grids, already stretched by broader electrification, are now being asked to absorb multi-gigawatt loads concentrated in select, clustered locations. As such, big tech companies such as Microsoft, Amazon, Meta, and Google (among others) have collectively committed to more than 13GWe of new nuclear capacity, restarts, and uprates via long-term agreements over the past 18 months. This is equivalent to more than 5m pounds of fresh uranium demand, or 3.5% of annual production.

Exposure to uranium in a diversified portfolio provides a low correlation to other asset classes and the potential for a high level of capital growth if the cycle continues to turn up. Yellow Cake provides a ‘cleaner’ exposure, without the operational risk, while for investors who are happy to take on the operational risk inherent with a production company, we would consider Cameco or, for more diversified exposure, the Global X Uranium ETF.

For Yellow Cake, the estimated NAV on 12 February was 650p per share, based on 23.01m pounds uranium valued at a spot price of $89/lb and cash & other current assets and liabilities of $77.1m. The shares currently trading on a slight discount to NAV.

Source: Bloomberg