Morning Note: Market News and an Update from InterContinental Hotels.

Market News

US equity-index futures retreated, suggesting the multi-week slide in technology stocks may have further to run as Wall Street investors return Tuesday from a holiday break. Treasuries edged higher – the 10-year now yields 4.02%

Gold dropped more than 1% to $4,920 an ounce, marking a second consecutive session of losses, amid thin trading volumes due to local public holidays in key markets. We note some staunch gold bulls are shrugging off the precious metal’s historic correction and betting on a surge to unheard-of levels, buying December $15,000/$20,000 call spreads on the CME’s Comex exchange.

In Asia this morning, the Nikkei 225 fell back (-0.4%), while Japanese government bonds rallied, with the 30-year yield sliding 10 bps after an auction pointed to a recovery in demand.

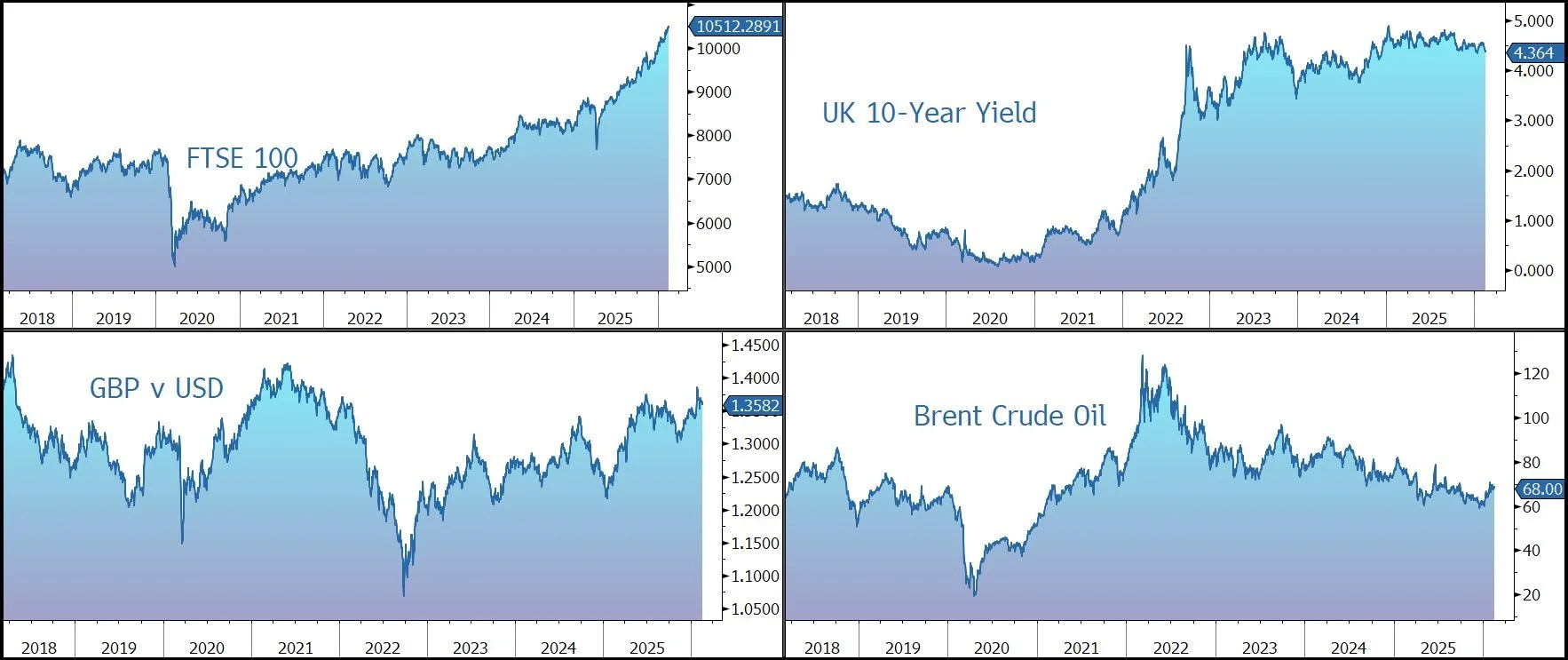

The FTSE 100 is currently 0.3% higher at 10,512. BHP climbed 2% after copper drove underlying cash profit 25% higher. The company declared a 46% increase in its interim dividend and announced a massive $4.3bn silver streaming deal.

The pound fell ($1.3585 and €1.1475) after UK unemployment unexpectedly rose to 5.2%, close to a five-year high, while wage growth eased. Traders are boosting their bets on the Bank of England cutting rates twice this year.

Source: Bloomberg

Company News

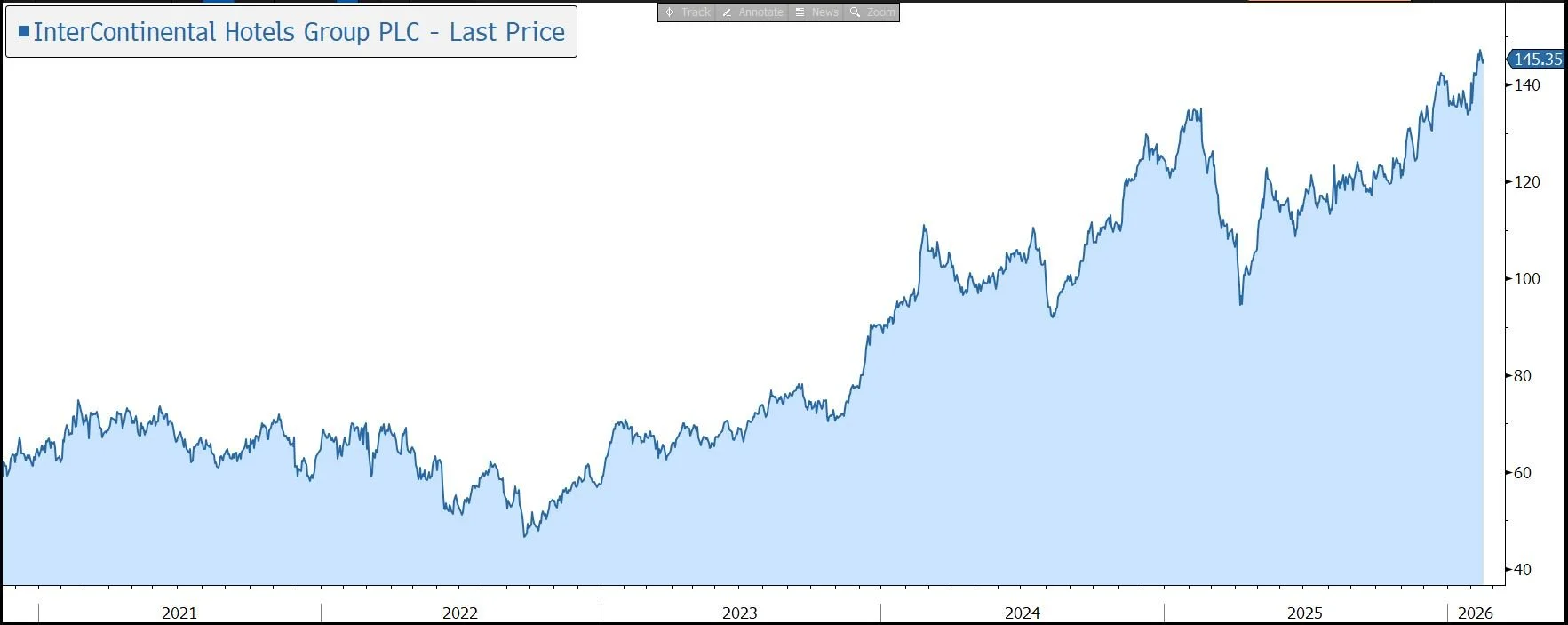

InterContinental Hotels Group (IHG) has released full-year 2025 results which were slightly better than expected. Although the US market remains subdued, Europe and Middle East were strong, and China returned to growth in the final quarter. Earnings growth of 16% was above the group’s medium-term 12%-15% target range, driven by strong fee margin growth. With the balance sheet in a strong position, the company has announced another large share buyback programme in addition to a 10% hike in the dividend. The shares have been a strong performer over the long-term and in response to today’s results they are little changed in early trading ahead of the analysts’ meeting.

IHG owns a portfolio of 21 attractive brands across all price tiers (including Crowne Plaza, InterContinental, Holiday Inn, and Six Senses) and has a strong operating system, both of which drive customer loyalty and pricing power. The group operates a highly scalable, asset-light model, based on franchising and management contracts, with low capital intensity and high returns. The model also means the group doesn’t own hotels or bear the operational costs of running them. The company is focused on delivering industry-leading net rooms growth over the medium term. It currently has a 4% global market share and a 10% share of the new room pipeline. At the end of 2025, the global estate was just over a million rooms across 6,963 hotels, with 66% in midscale segments and 34% in upscale and luxury. Annual gross revenue generated by the group’s hotels is more than $35bn.

Long-term growth is being driven by a rising global middle class with a desire to travel – Oxford Economics forecasts this cohort to nearly double in size to over 670m households by 2035, with China accounting for almost half of the growth. Global leading hotel brands are expected to continue their long-term trend of taking market share. In periods when developers are adding less new supply, revenue growth from existing room inventory is expected to be stronger as are conversion opportunities, which IHG has proven highly successful at capturing.

The group’s medium- to long-term financial framework targets:

· high single-digit percentage growth (i.e. 7%-9%) in fee revenue, through combination of RevPAR (revenue per available room, the key measure of industry performance), system size growth, and ancillary revenue growth. In addition, the company expects 100-150bps of fee margin expansion, annually on average. This excludes the positive margin impact of the credit card business.

· 100% conversion of adjusted earnings into adjusted free cash flow, supporting investment in the business to optimise growth, sustainably growing the ordinary dividend and returning surplus capital.

· 12-15% adjusted EPS compound annual growth rate, including the assumption of ongoing share buybacks.

From the start of 2026, the trading currency of the group’s shares on the LSE changed from Sterling to US dollars. The move does not affect the nominal currency of the shares which remains in Sterling, nor does it impact IHG’s London listing or its New York ADR listing. Shareholders based in the UK will continue to receive dividend payments in Sterling. The company’s aim is to better align its share price with its financial performance – the company already reports its results in US dollars – and simplify investment appraisal.

In 2025, revenue grew by 6% in underlying terms to $2,468m, while operating profit grew by 12% in underlying terms to $1,265m. Fee margins jumped by 3.6 percentage points to 64.8%, better than the group’s framework target and driven by positive operating leverage and a step-up in ancillary fee streams. Ongoing efficiency and productivity drove a 3% decline in the cost base. Adjusted EPS grew by 16% to 501c, above the top-end of its financial framework range.

Global revenue per available room (RevPAR) grew by 1.5%. Growth in the final quarter was 1.6%, a pick-up from the two previous quarters, and a shade ahead of market expectations. Growth in full-year occupancy – up 0.5 percentage points – was supplemented by an increase in pricing, with average daily rate up 0.8%.

By sector, global rooms revenue on a comparable basis comprised Business (+2%), Leisure (flat) and Groups (+1%).

There is still a wide regional variation across the business.

· In Americas (the group’s largest division), RevPAR was up 0.3% in the year. In the final quarter, RevPAR fell by 1.4%. This was slower than the previous quarter and held back by a tougher year-over-year comparison due to hurricane-related demand in the US in 2024.

· The EMEAA region grew by 4.6% in the year and 7.1% in Q4

· Greater China RevPAR fell by 1.6% in the year but returned to growth in Q4 (+1.1%) driven by a notable improvement in Leisure demand

IHG continued to open new hotels and sign more rooms into its pipeline as owner demand for its world class brands continues to increase. 2025 was one of the group’s biggest ever years for both openings and signings. During the year, 65.1k rooms across 443 hotels were opened, up 10% year-on-year.

Gross system growth was 6.6% year-on-year, while after removals, net system size growth was 4.0% year-on-year. Excluding the previously disclosed one-off impact of removing rooms previously affiliated with The Venetian Resort Las Vegas, net growth was an impressive 4.7%. Demand for quick-to-market conversions to IHG’s brands continues to be high, representing more than half of openings. This is a big positive given the time to open is much shorter than with a new build.

IHG signed 102.1k rooms (694 hotels) in the year, up 9%, in underlying terms excluding the acquisition of Ruby, a premium urban lifestyle brand with 34 hotels. This leaves a global pipeline of 340k rooms (2,292 hotels), up 4% year-on-year, and 33% of the current system size, providing good growth visibility. Around 50% of the global pipeline is under construction.

The group has announced the launch of Noted Collection, a new brand targeting the large and fast-growing premium segment.

The asset-light model means IHG has low investment requirements and a negative working capital cycle. The group operates a conservatively leveraged business model and maintains strong liquidity. During 2025, adjusted free cash flow rose by 36% to $893m, driven by higher profit and lower outflows related to capital expenditure, tax, and the central System Fund.

Net debt rose from $2.8bn to $3.3bn, mainly due to shareholder returns, M&A, and adverse currency movements. Gearing ended the year at 2.5x net debt to EBITDA, at middle of its 2.5x-3.0x target range.

The group is returning surplus capital through share buybacks. A $900m programme was undertaken in 2025 and today the group has announced a further $950m programme to be completed by the end of 2026. In addition, the 2025 dividend has been raised by 10% to 184.5c (1.2% yield). In total, the company expects to return more than $1.2bn to shareholders in 2026, amounting to 5% of the current market cap.

Looking ahead, the company has confirmed its mid-term target to generate compound growth in adjusted EPS of 12%-15% annually on average. In the key US market, less turbulent trading conditions and stronger demand are expected for the industry. From the second quarter, the company will benefit from easier year-on-year comps, the FIFA World Cup in the summer in North America, and improved momentum in China. Robust growth in the EMEAA region is expected in 2026.

Source: Bloomberg