Morning Note: Market News and updates from Nvidia and CrowdStrike.

Market News

The EU is said to weigh secondary sanctions to stop third countries from aiding Russia’s sanctions evasion. Mexico plans to raise tariffs on China as part of its 2026 budget proposal next month, people familiar said, following months of pressure from President Trump.

European car sales rose the most in 15 months in July as consumers embraced electric and hybrid vehicles.

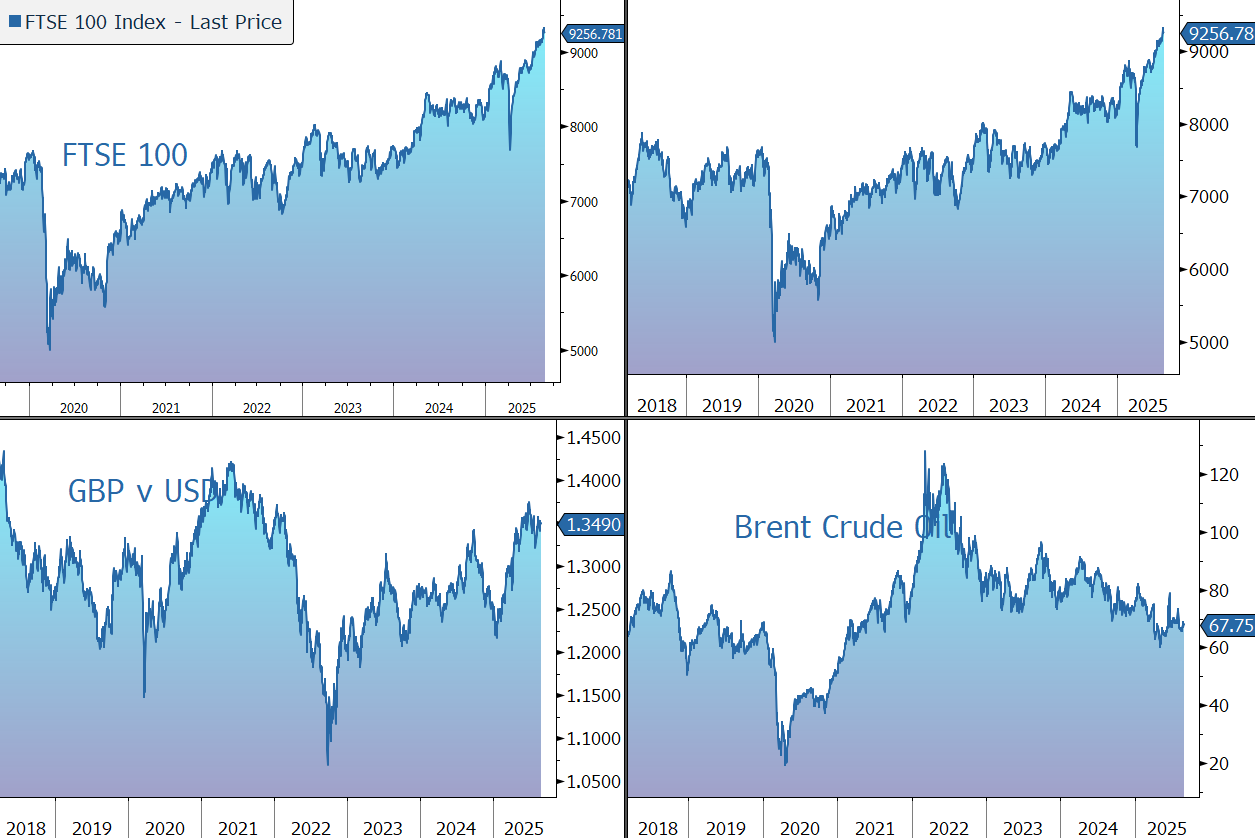

Treasuries were mixed with more curve steepening – the spread between the 2-year and 30-year is around 130bps, the widest in nearly four years. The 10-year yield is 4.23%, while gold moved up to $3,395 an ounce. Brent Crude slipped to $67.50 a barrel despite Peter Navarro stepping up pressure on India to stop buying Russian crude.

US equities moved higher last night – S&P 500 (+0.2%); Nasdaq (+0.2%) – and ended just off their best levels as S&P 500 set a fresh record close. Nvidia fell by 3% after-hours following the release of its earnings (see below). The company said Donald Trump’s plan to take a 15% cut of China AI chip sales may pose legal risks.

In Asia this morning, equities were mixed: Nikkei 225 (+0.7%); Hang Seng (-0.8%); Shanghai Composite (+1.1%). The FTSE 100 is currently little changed at 9,257. Companies trading ex-dividend today include Aviva (1.93%), Croda (1.98%), and Glencore (1.26%). Sterling trades at $1.3490 and €1.1590.

Source: Bloomberg

Company News

Last night NVIDIA released results for the three months to 31 July 2025, the second quarter of its financial year to January 2026. The figures came in ahead of market expectations, although guidance for future revenue fell short of the most optimistic market expectations. In response, the shares fell 3% in after-hours trading.

NVIDIA is one of the world’s largest semiconductor companies, with a leading market share in Graphics Processing Units (GPUs). From its original focus on PC graphics, the company has expanded to several other large and important computationally intensive fields, leveraging its GPU architecture to create platforms for scientific computing, AI, data science, autonomous vehicles, robotics, metaverse, and 3D internet applications.

The company is benefitting as data centres make a platform shift from general computing, primarily using central processing units (CPUs), to accelerated computing, primarily using GPUs, which brings significant improvements in performance, energy efficiency, and cost.

Accelerated computing’s ability to significantly speed up machine learning and to deal with large data sets has enabled the development of generative artificial intelligence (AI), which offers human-like computing performance. This is driving significant investment in new enterprise applications, which is in turn driving new demand for accelerated computing.

In the latest quarter, Nvidia’s revenue rose by 56% to $46.7bn, better than both the company guidance of $45bn, plus or minus 2%, and the market forecast of $46bn. We note the result was only 6% higher than the previous quarter.

There were no H20 sales to China-based customers in the quarter. NVIDIA benefited from a $180m release of previously reserved H20 inventory, from approximately $650m in unrestricted H20 sales to a customer outside of China.

The vast majority (88%) of revenue is generated in the Data Centre division, with around half derived from cloud service providers and the remainder from consumer internet and enterprise companies. During the quarter, revenue increased by 56% to $41.1bn, driven by demand for the group’s accelerated computing platform used for large language models, recommendation engines, and generative and agentic AI applications.

The company continued to ramp its Blackwell architecture, which grew 17% sequentially, including its newest architecture, Blackwell Ultra.

The smaller divisions performed as follows: Gaming (+49% to $4.3bn); Professional Visualisation (+32% to $601m); and Automotive and Robotics (+69% to $586m).

The gross margin is high, although in the latest quarter and excluding the impact of the H20 release, it fell from 75.7% to 72.3%, albeit above the group’s guidance of 72%. Operating expenses rose by 37% to $3.8bn, slightly below the company guidance of $4.0bn, primarily driven by compute and infrastructure costs and higher compensation and benefits due to compensation increases and employee growth. EPS rose by 54% to 105c. Excluding the impact of the H20 release, EPS was 104c versus the market forecast of 101c.

The business is very cash generative, with free cash flow steady at $13.5bn in the three months to 31 July. The company’s balance sheet is very strong, with net cash of $48.3bn at the end of the quarter. The cash is being used, in part, for shareholder returns, including $9.7bn in share repurchases in the latest quarter. As of the end of the second quarter, the company had $14.7bn remaining under its share repurchase authorisation and has now approved an additional $60bn authorisation. The company also pays a dividend, with a payout of $0.01 declared for this quarter.

For the current quarter, the company is guiding to revenue of $54bn, plus or minus 2%, and has not assumed any H20 shipments to China in the outlook. Although this was ahead of the consensus expectation, it was below the most optimistic forecast. A gross margin of 73.5%, plus or minus 50 basis points is forecast. The company is continuing to work toward achieving gross margins in the mid-70% range late this year and expects operating expense growth to be in the mid-30% range.

Source: Bloomberg

Last night, CrowdStrike Holdings released results for the second quarter of its financial year ended 31 January 2026 which highlighted growth ahead of expectations across all guided metrics. However, guidance for the current quarter disappointed the market and the highly-rated shares were marked down by 4% in after-hours trade.

CrowdStrike is a US-listed cybersecurity technology company with annual revenue of more than $4.2bn. The CrowdStrike Falcon platform protects customers against cyber-attacks across on-premise, virtualised, and cloud-based environments running on a variety of endpoints such as laptops, desktops, servers, virtual machines, and Internet of Things devices.

The CrowdStrike Threat Graph aggregates security data across its customer base, using advanced AI techniques to create a security solution able to constantly adapt to new threats and attacks. As the company grows, its access to security data will also grow, enhancing its competitive position. The AI-native Falcon XDR platform has become the cybersecurity consolidator of choice.

The business is well placed to benefit from secular trends, such as digital and security transformation, cloud adoption, and a heightened threat environment, which the current geopolitical uncertainty has clearly exacerbated. The 2024 CrowdStrike Global Threat Report highlighted a surge in adversaries leveraging stolen identity credentials. However, at present, Cloud Security Spend is only around 1% of Cloud IT Spend, well below what is considered necessary. The total addressable market is estimated to be $116bn in 2025, rising to $250bn in 2029.

The group offers more than 30 cloud modules via a software as a service (SaaS) model that spans multiple large security markets, including corporate workload security, security and vulnerability management, managed security services, IT operations management, and threat intelligence services. The group continues to add new modules organically and via M&A. The success of the group’s platform strategy and its growing brand leadership have led to a groundswell of customers turning to CrowdStrike as their trusted security platform of record.

In July 2024, the company distributed a faulty update to its Falcon Sensor security software that caused widespread problems with Microsoft Windows computers running the software. As a result of the outage, 8.5m systems crashed and were unable to restart properly. The company gave affected customers about $60m in credits as compensation for the trouble it caused. In the latest quarter, the net cost associated with the incident and related matters was $35.7m.

In the three months to 31 July 2025, total revenue grew by 21% to $1,169m, versus the company’s guidance range ($1,145m-$1,152m) and the market forecast of $1,149m. Annual subscription revenue grew by 20% to $1,103m, while professional services grew by 45% to $66m.

Annual Recurring Revenue (ARR) increased 20% to $4.66bn as of 31 July, with a record $221m added in latest quarter, a reacceleration ahead of expectations. The company’s vision is to reach $10bn in ARR over the next five to seven years.

Gross retention rates remain high, while the number of subscription customers that have adopted six or more modules, seven or more, and eight or more increased to 48%, 33%, and 23%, respectively, as of 31 July.

The business has strong operating leverage, with subscription gross margin down slightly at 80%, and achieved improved operating profitability, rising from $241m to $255m. EPS rose by 6% to 93c, well above the company guidance of 82c-84c and the market forecast of 83c.

The group generated record free cash flow of $284m (up 4%) and ended the quarter with cash and cash equivalents of $5.0bn. The company announced it has agreed to acquire Onum Technology Inc., a pioneer in real-time telemetry pipeline management.

For the current quarter, revenue is expected to be between $1,208m-$1,218m, slightly below the current market forecast, with EPS of 93c-95c. For the full year (FY2026), the company expects revenue of $4,750m-$4,805m and EPS of 360c-372c.

Source: Bloomberg