Morning Note: Market news and an update from Prudential

Market News

The White House is exploring ways to exert more influence over the Fed’s 12 regional banks, including how their presidents are vetted and chosen, people familiar said. Donald Trump said he is ready for a legal fight with Fed Governor Lisa Cook and floated the idea of shifting CEA Chairman Stephen Miran into her position.

The 50% US tariff on some Indian goods took effect today — the steepest in Asia. Citi said the levy may shave 0.6 to 0.8 percentage point from annual GDP growth.

France’s bond yields may spike to 100 basis points above their German peers if the nation’s political crisis deepens, Carmignac said. The 10-year spread is currently 77 bps.

Brent Crude slipped back to $67.20 a barrel, breaking four-day streak of gains, as President Trump praised the low oil price. According to the Wall Street Journal, Exxon held talks with Rosneft over a re-entry into Russia. Gold trades at $3,380 an ounce.

US equities edged higher last night – S&P 500 (0.4%); Nasdaq (0.4%) – as traders awaited this evening’s key earnings report from Nvidia to gauge the sustainability of the global stock rally. In Asia, equities were mixed this morning: Nikkei 225 (+0.3%); Hang Seng (-1.3%); Shanghai Composite (-1.5%). The FTSE 100 is currently 0.2% higher at 9,281, while Sterling trades at $1.3460 and €1.1585.

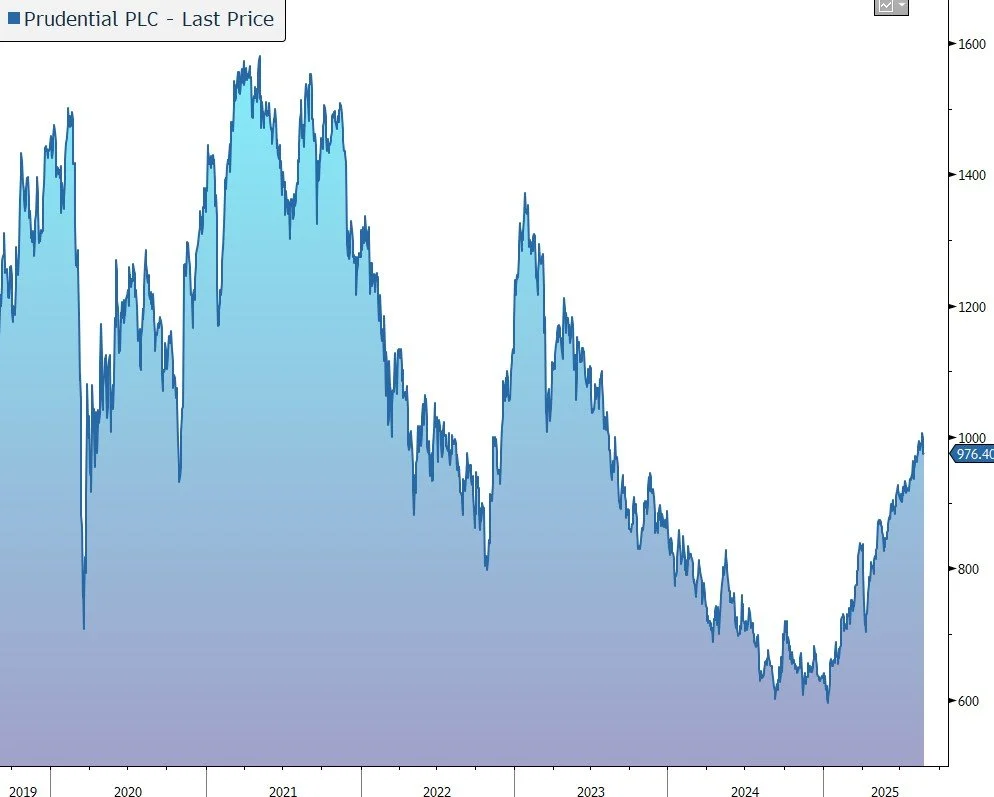

Source: Bloomberg

Company News

Prudential has today released results for the first half of 2025 in line with the guidance given earlier in the year. The company has also provided updated guidance on capital returns. In response, the shares are little changed this morning.

Prudential provides life and health insurance and asset management in 24 markets across Asia and Africa. The business has dual primary listings in Hong Kong and London. The company is not affiliated with Prudential Financial Inc., a company whose principal place of business is in the US, nor with The Prudential Assurance Company Limited, a subsidiary of M&G plc, a company incorporated in the UK which was demerged from Prudential in 2019 and is now listed in London.

As a diversified international operator, with strong branding, leadership positions, and distribution channels, Prudential is expected to benefit from the favourable structural opportunities in its key markets driven by a growing middle class and ageing population. The company operates in markets with a combined population of four billion people that are expected to collectively generate incremental annual gross written premiums of almost $1 trillion in 2033 compared with 2022.

The company has set out its 2027 financial and strategic objectives, one of which is to grow new business profit at a compound annual rate of 15%-20% from the level achieved in 2022. The group is also aiming to deliver double-digit compound annual growth in operating free surplus generated from in-force insurance and asset management business to deliver at least $4.4bn.

The company prioritises investment in organic new business at attractive returns and in enhancing its capabilities as it executes its strategy. Prudential will pursue selective partnership opportunities to accelerate growth in its key markets. Investment decisions will be judged against the alternative of returning surplus capital to shareholders.

In the first half of 2025, adjusted operating profit rose by 6% at constant exchanges rates (CER) to $1,644m. New business profit rose by 12% at CER to $1,260, while Annual Premium Equivalent (APE) sales increased by 5% to $3,288m.

The group’s largest market, Hong Kong, saw new business profit grow by 16%, supported by a 13% increase in APE sales and margin improvement. This growth was driven by both agency and bancassurance channels and increases from both Mainland China visitors and the domestic market.

Elsewhere, Singapore delivered new business profit growth of 5%, reflecting new business profit growth in both agency and bancassurance channels. Mainland China saw overall new business profit increase by 8%, driven by APE sales growth of 11%. Indonesia saw new business profit growth of 34%, underpinned by APE sales growth of 20% together with improvement in new business margin from positive product and repricing effects.

The group’s financial position is very robust with a strong capital base to fund growth. Prudential’s historic focus on ‘with profit’ savings, unit-linked, and health and protection business results in a relatively low volatility of free surplus to stress events. Based on the company’s current risk profile and its business units’ applicable capital regimes, Prudential seeks to operate with a free surplus ratio of between 175%-200%. If the free surplus ratio is above the operating range over the medium term and considering opportunities to reinvest at appropriate returns and allowing for market conditions, capital will be returned to shareholders.

At the end of the first half, the estimated shareholder surplus above the Group’s Prescribed Capital Requirement (GPCR) was $16.2bn, equivalent to a cover ratio of 267%. The free surplus ratio was 221%, well above the target range. Accordingly, the company is currently undertaking a $2bn share buyback programme. In the first half of 2025, the group repurchased $711m of stock and expects to complete the programme by the end of the year. The company has also declared a first interim payout up 13% to 7.71c.

With today’s results, the company has provided a capital management update that will see it move to a total return orientation out of annual flow of capital generation. This will include:

- more than 10% growth in ordinary dividend per share for each of 2025-2027.

- additional returns of capital: $500m share buyback in 2026 and $600m in 2027.

As a result, over the period 2024-2027 the company expects to have returned to shareholders more than $5bn out of excess free surplus. In addition, the group intends to return initial net proceeds from the potential IPO of ICICI Prudential Asset Management Company Limited.

Looking to the full year, the group is on track to deliver double-digit growth in new business profit, basic EPS based on adjusted operating profit, and operating free surplus generated from in-force insurance and asset management business on a constant exchange rate basis. Given performance so far in 2025, the company continues to be confident in achieving its 2027 objectives.

Source: Bloomberg