Morning Note: Market news and updates from Nestle and Pernod Ricard.

Market News

Gold hit another high this morning: $4,230 an ounce. Holdings in physically-backed bullion ETFs have jumped nearly 6% over the past seven weeks and appear to be adding the precious metal at a much faster pace than central banks.

The Fed’s Beige Book survey showed economic activity was little changed in recent weeks and employment levels held largely stable. 10-year Treasury yields hovered around 4%. Brent Crude rose to $62.50 a barrel after President Trump said Indian Prime Minister Narendra Modi had pledged his country would stop buying oil from Russia.

US equities were mostly higher last night – S&P 500 (+0.4%); Nasdaq (+0.7%). In Asia this morning, equities were mixed: Nikkei 225 (+1.3%); Hang Seng (-0.2%); Shanghai Composite (+0.1%). Scott Bessent said the yen will find its proper level if the Bank of Japan stays on the right policy path.

The FTSE 100 is little changed at 9,413. Stocks trading ex-dividend this morning include Diageo (2.65%), Smiths Group (1.34%), and Spirax (0.73%). Sterling trades at $1.3411 and €1.1515. Rachel Reeves needs a £50bn buffer to avoid more tax hikes and spending cuts, think tank Institute for Fiscal Studies said.

Sebastien Lecornu looks set to survive two no-confidence motions today. The censure motions from National Rally and France Unbowed may not get the support of Socialist lawmakers.

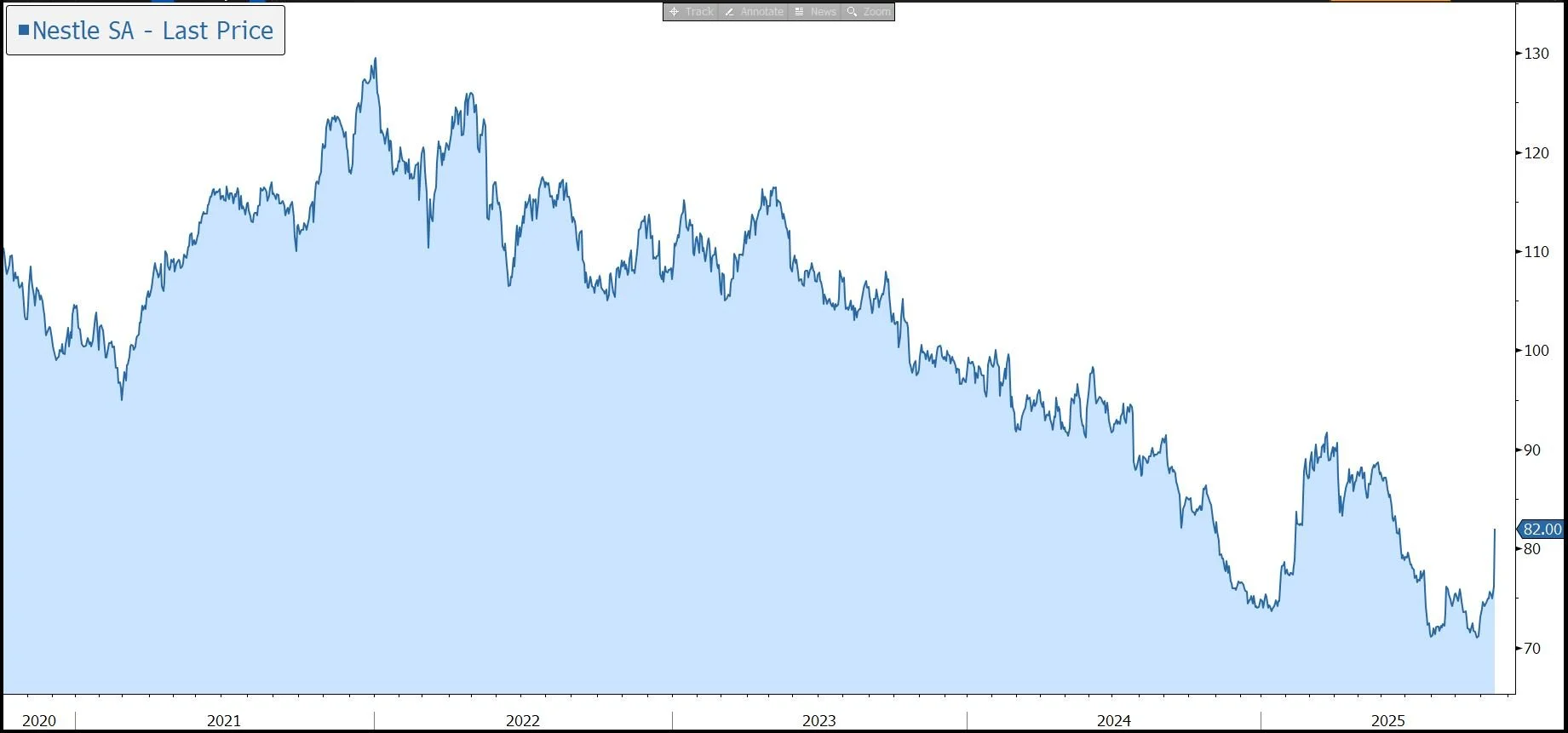

Source: Bloomberg

Company News

Nestlé has this morning released results for the first nine months of 2025 which were better than the market forecast as the benefit of increased investment starts to flow through. The company has also increased its cost savings target. In response, the shares have been marked up by 7% in early trading.

Nestlé is the world’s leading food and beverage company with sales of more than CHF 91bn (c. £80bn). The strategy is to offer a portfolio of products that evolve with consumer needs and promote nutrition, health, and wellness. The company owns a wide range of iconic brands across seven product categories, more than 30 of which have sales of more than CHF 1bn, including Nescafe, Nespresso, Cheerios, Perrier, Carnation, KitKat, and Purina.

In the nine months to 30 September 2025, reported sales fell by 1.9% to CHF 65.9bn, including M&A (+0.1%) and currency (-5.4%). Organic growth was 3.3%, driven by price growth of 2.8%. Real internal growth (RIG, i.e., volume) was 0.6%. The third quarter was up 4.3%, with RIG up 1.5%, better than the 0.3% growth expected by the market. Growth driven by growth investments and actions to manage price elasticity, helped by an easier comparison base.

Growth was broad-based across geographies and categories, with emerging markets (+5.2%) outpacing developed markets (+2.1%). By channel, organic growth in retail sales was 3.1%. Within retail, e-commerce sales grew by 13.2%, to reach 20.2% of group sales. Out-of-home channels continue to see momentum, with organic growth of 6.2%.

By product category, coffee and confectionery were the largest organic growth contributors. This growth was pricing-led, with double-digit increases in some markets. Elasticity was more pronounced in confectionery, consistent with historical trends, with coffee more resilient as RIG remains positive through the nine-month period. Outside of coffee and confectionery, organic growth was positive across most categories.

This was a revenue update and so there is no commentary on the group’s profitability or financial position. However, the group has raised its cost savings target from CHF 2.5bn to CHF 3.0bn by the end of 2027.

For the remainder of the year, Nestlé expects organic sales growth to improve compared to 2024. Sequentially, momentum remains positive, although the comparison base will be tougher in Q4. The underlying trading operating profit margin is expected to be at or above 16%.

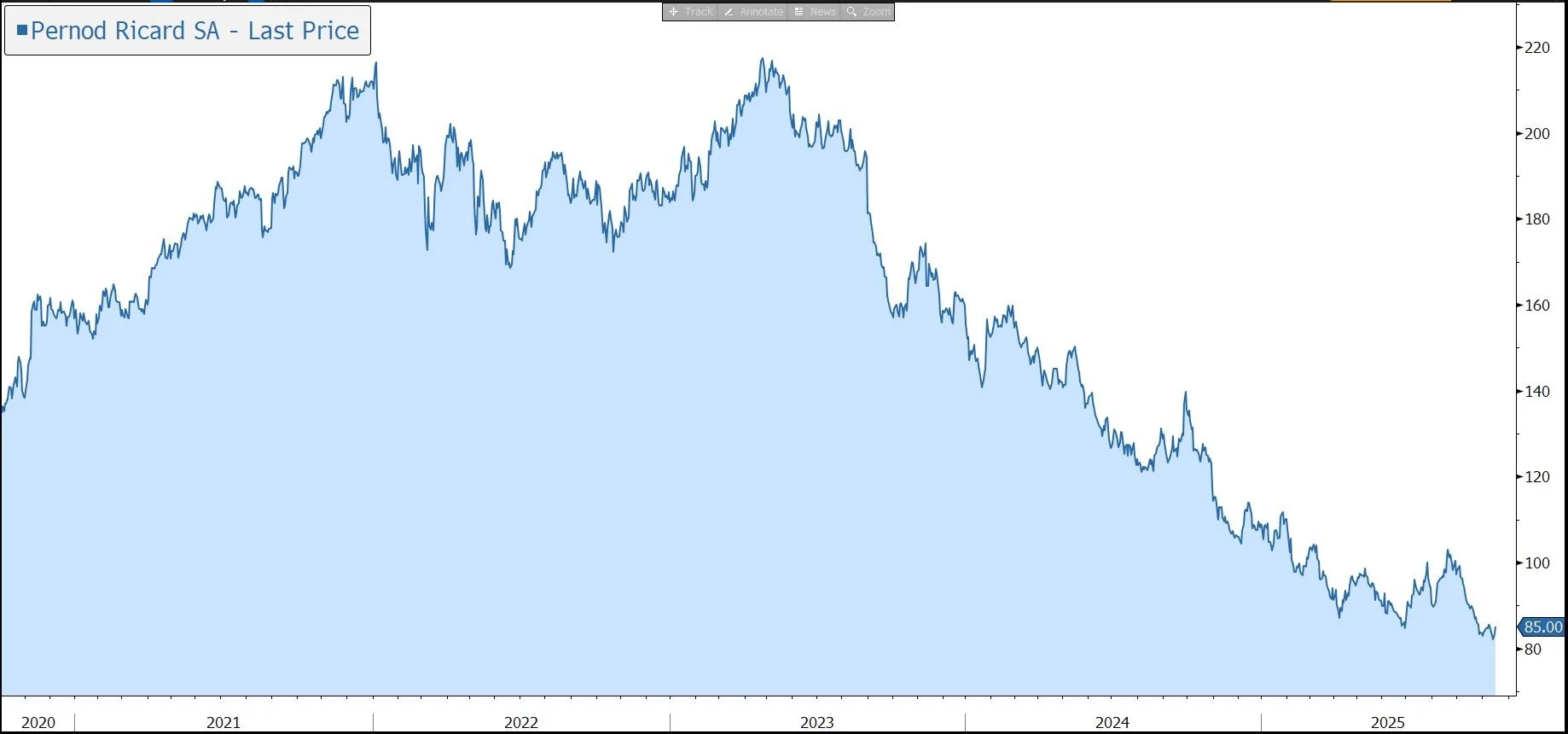

Source: Bloomberg

Pernod Ricard has released a revenue update for the first quarter of its financial year to 30 June 2026. As expected, organic revenue saw a large decline, although the company did maintain its forecast for improving trends from the second half of the financial year. In response, the shares were marked up 1% in early trading.

Pernod Ricard is the worldwide leader in wine and spirits, operating a decentralised structure comprised of a global flagship in France, autonomous affiliates, brand companies, and market companies throughout the world. The company owns a portfolio of over 240 premium brands available in over 160 countries, leaving it well placed to benefit from the trend towards premiumisation. Key brands include Ricard, Pernod, Chivas Regal, Jameson, Glenlivet, Martell, Mumm, Perrier-Jouet, Absolut, Malibu, Beefeater, Havana Club, and Plymouth Gin.

In the three months to 30 September 2025, reported sales fell by 14.3% to €2,384m. Stripping out the impact of M&A and currency movements, sales fell by 7.6% organically.

The Americas suffered a 12% decline in organic sales. Within the mix, the US fell by 16%, amplified by some inventory adjustments. The company is encouraged that its sell-out performance in the US continued to improve versus the market. Canada achieved good growth, while Mexico and Brazil declined.

Sales in China contracted sharply (-27%), with continued macroeconomic weakness that impacted consumer sentiment and demand, plus some inventory adjustments. India (+3%) enjoyed strong underlying growth apart from Maharashtra State where demand was impacted by excise policy changes.

Positive performances in several markets across most regions, in Asia, Africa, Middle East, North America and Europe, helped to partially mitigate the declines in the group’s top markets. Markets of note that enjoyed positive sales momentum include Canada, Turkey, Japan, and South Africa.

Global Travel Retail sales were soft (-15%) and will benefit from the resumption of the group’s sales of Cognac to China Duty Free from the current quarter.

By brand category, Strategic International Brands fell by 9%, mainly driven by Martell in China, Jameson and Absolut in the US. Across Strategic Local Brands (-4%) Olmeca and Kahlúa showed solid momentum, while there were declines in the remainder of the Seagram’s whiskies portfolio. Specialty Brands fell by 5%, largely driven by the US market performance. The Ready to Drink unit grew by 10%, with solid growth across the portfolio of brands.

This was only a revenue statement, so there was no update on profitability or the group’s financial position. As a reminder, in the last financial year to 30 June 2025, the gross margin was 59.5% and the operating margin was 26.9%. Net debt was €10.7bn, or 3.2x net debt to EBITDA. The company declared a dividend of €4.70, in line with the previous year, amounting to a 4.5% yield.

For the financial year to 30 June 2026 the group still expects to see improving trends in organic net sales, skewed toward H2. The company confirmed it will defend its organic operating margin to the fullest extent possible, supported by strict cost control and the implementation of the FY2026 to FY2029 €1bn operational efficiencies programme.

Over the medium term (i.e. FY2027-FY2029), the company is projecting organic net sales growth, aiming for the range of +3% to +6% p.a. on average, and annual organic operating margin expansion.

Source: Bloomberg