Morning Note: Market news and updates from LVMH and J&J.

Market News

The yield on the US 10-year Treasury note fell toward 4%, nearing April lows after Fed Chair Powell’s comments on labour market weakness strengthened expectations for more rate cuts. Powell also said the Fed may stop shrinking its balance sheet in months ahead. The Fed’s Susan Collins said borrowing costs should be lowered but kept high enough to make sure inflation remains in check. She sees a “relatively modest increase” in the unemployment rate this year and early in 2026. Gold hit another all-time high, crossing the $4,200 an ounce level.

US equities were mixed last night – Dow Jones (+0.4%), S&P 500 (-0.2%); Nasdaq (-0.8%) – although they are currently forecast to open higher this afternoon after Powell’s remarks.

Executives at the big US bank said more windfalls are coming after a strong quarter for stocks and a resilient economy, despite sweeping US tariffs. But some warned that asset prices look frothy. This comes after JPMorgan Chase, Goldman Sachs, and others posted quarterly results at the start of earnings season. Investment banking revenue surged 42% at Goldman and 16% at JPMorgan Chase. Wells Fargo and Citigroup also saw investment banking gains

In Asia this morning, equities were also firm: Nikkei 225 (+1.8%); Hang Seng (+2.1%); Shanghai Composite (+1.2%). China’s consumer prices slid a more-than-expected 0.3% in September from a year earlier on falling food costs. The core CPI rose to a 19-month high of 1%. The offshore yuan extended gains after China boosted its currency defence.

The FTSE 100 is currently little changed at 9,453, while Sterling trades at $1.3355 and €1.1475. The Bank of England Governor Andrew Bailey raised concerns about the nation’s economy running “under potential” and a softening jobs market.

Source: Bloomberg

Company News

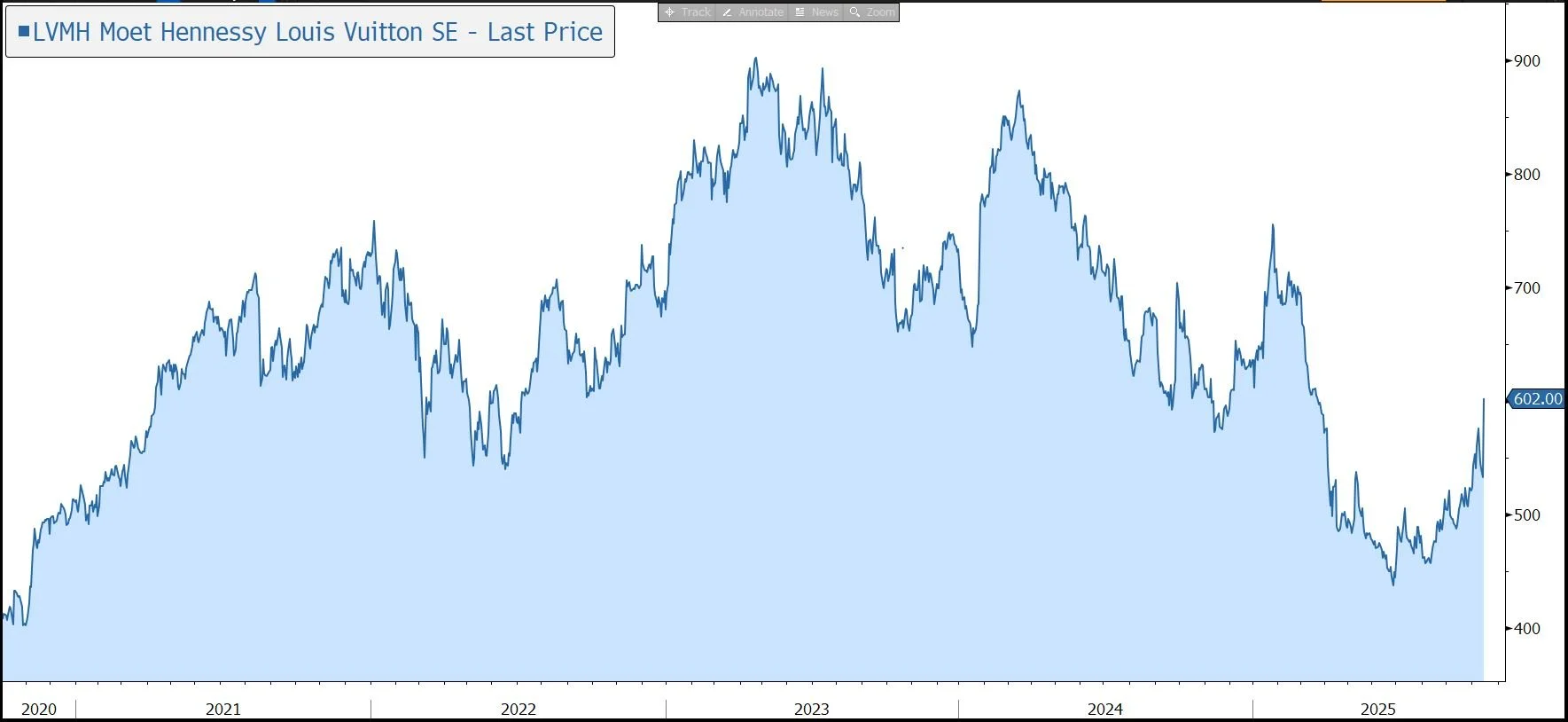

Last night, luxury goods bellwether LVMH released its Q3 revenue update which highlighted a return to organic revenue growth. Against an uncertain economic and geopolitical, this is positive news from a company seen as a sector bellwether with operations spanning fashion, alcohol, and retail. In response, the shares have been marked up by 12%.

LVHM is the world’s leading luxury products group, which owns around 75 prestigious brands and a global retail network of over 6,300 stores. In Fashion & Leather goods, iconic brands include Loewe, Louis Vuitton, and Christian Dior. In Perfumes & Cosmetics, the group owns Givenchy and Guerlain, while in Watches & Jewellery, brands include Tag Heuer, Bulgari, and Tiffany & Co. In Wine & Spirits, the group owns Moët & Chandon, Krug, Veuve Clicquot, Hennessy, Château Cheval Blanc, and Château d’Yquem. In Selective Retailing, the group operates in two spheres: retail designed for the international traveller and selective retailing concepts such as Sephora and Le Bon Marche.

The company is a family-run group that seeks to build on the heritage of its ‘Houses’ or ‘Maisons’. A vertically integrated operating model controls every link in the value chain, from sourcing and production facilities to selective retailing. In 2024, the company generated revenue of almost €85bn. Gross margins are high, in the mid-60s, while the operating margin is in the mid-20s.

In the first nine months of 2025, reported revenue fell by 4% to €58.1bn, with an organic decline of 2%. However, the third quarter revenue came in at €18.3bn, with organic growth of 1%. This was better than the flat result the market was expecting and driven by improved sequential trend across all business groups and all regions, with the exception of Europe, where revenue from tourist spending declined, affected by currency fluctuations, which weighed more on the quarter than earlier in the year.

By geography, the US (+3%) and Asia (ex-Japan, +2%) experienced growth, offset in part by declines in Europe (-2%) and Japan (-13%).

By division, Fashion & Leather Goods, the largest unit with 46% of revenue, only fell by 2%, reflecting good resilience with local customers. Wine & Spirits (+1% in organic terms) enjoyed a sequential improvement in champagne and wines, and a good performance in Provence rosé wines. The trends seen in cognac since the beginning of the year were driven by trade tensions weighing on demand in the key markets of the US and China. Elsewhere, Perfumes & Cosmetics rose by 2%, as did Watches & Jewellery, while Selective Retailing increased by 7%.

The group doesn’t provide specific guidance but highlights that in an uncertain economic and geopolitical environment, it remains confident and will maintain a strategy focused on continuously enhancing the desirability of its brands, drawing on the authenticity and quality of its products, excellence in retail and agile organisation.

Source: Bloomberg

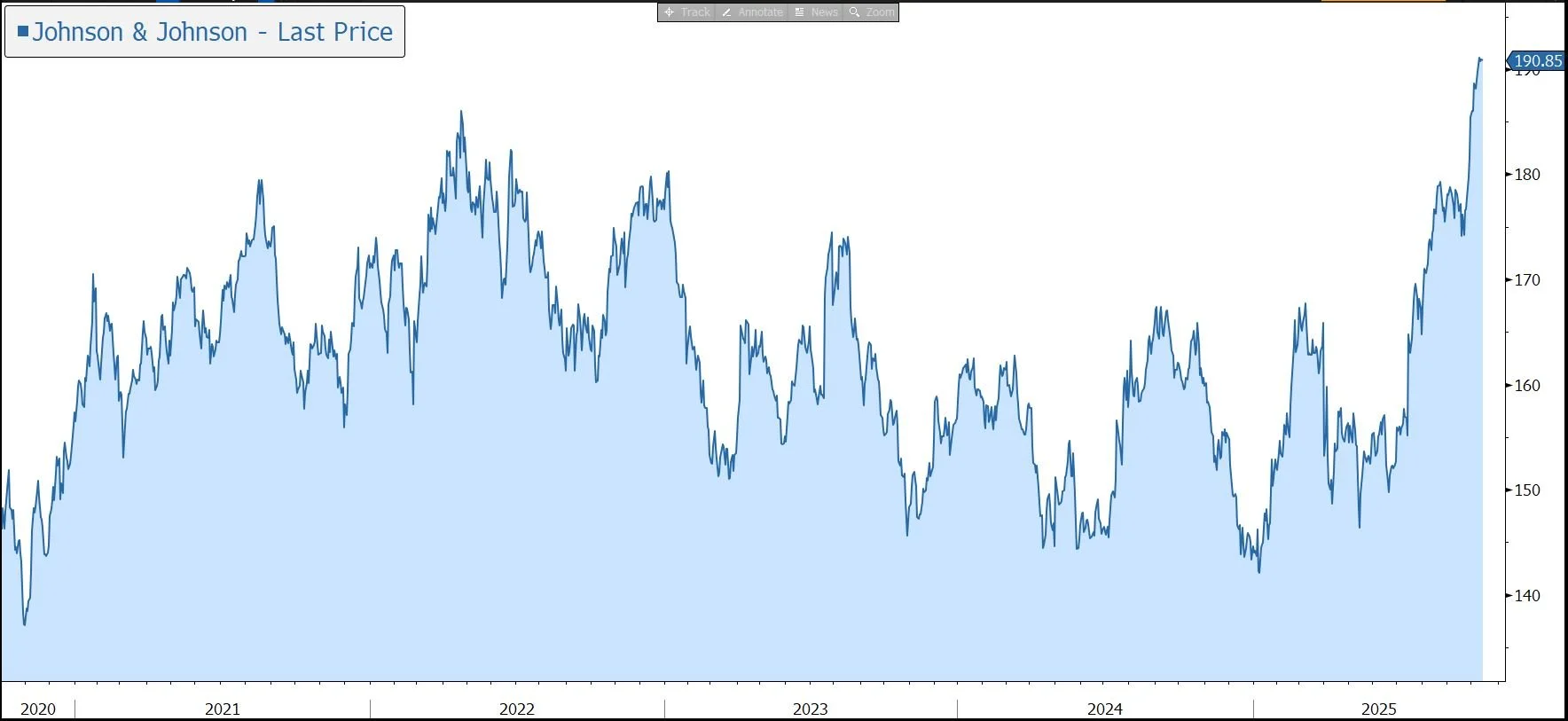

Yesterday lunchtime, Johnson & Johnson released positive Q3 results and raised its revenue guidance for the full year. The company has also announced plans to spin off its orthopaedics business. In response, the shares were little changed in US trading hours against a weak overall market backdrop.

J&J is a global healthcare company with leading positions in pharmaceuticals and medical devices. The group has more than 20 products/platforms each with sales of more than $1bn. More than 75% of sales come from No.1 or No.2 global market share leading positions. The group’s strategy is to grow sales faster than the market, and to grow earnings faster than sales. Given its broad spread of businesses, J&J is considered the bellwether of healthcare companies, providing a good read-across for a range of other stocks.

The company’s former Consumer Health unit was spun off in 2023 and trades as a separate listed company (Kenvue). J&J still owns around 9% of the stock, a stake currently worth around $2.8bn. With today’s results, the company has also announced plans to spin off its orthopaedics business within 18 to 24 months. The standalone DePuy Synthes will be the largest, most comprehensive orthopaedics-focused company in the world.

In the three months to 30 September, reported sales grew by 6.8% to $24.0bn, slightly better than the market forecast of $23.7bn. On an adjusted operational basis, which excludes the impact of acquisitions and disposals, growth was 4.4%, with US domestic sales (+4.4%) matching international sales (+4.4%). Adjusted EPS rose by 15.7% to $2.80, a touch ahead of the consensus forecast of $2.75.

The group’s performance demonstrates continued strength and resilience across both of its businesses. Innovative Medicine (i.e., Pharmaceuticals, 65% of sales) grew by 3.7% to $15.6bn. Growth was driven by a broad range of products, with 11 brands growing double-digit, including its cancer drug, Darzalex. Growth was partially offset by an approximate (1,070) basis points impact from Stelara in Immunology, as well as Imbruvica in Oncology.

MedTech (i.e., medical devices, 35% of sales) increased by 5.7% to $8.4bn, driven primarily by electrophysiology products, Abiomed and Shockwave in Cardiovascular, wound closure products in General Surgery, as well as Surgical Vision.

The group made significant pipeline progress during the quarter including approvals of Inlexzo for high-risk non-muscle invasive bladder cancer and Tremfya subcutaneous in ulcerative colitis, submission of Icotrokinra for plaque psoriasis, landmark data for Rybrevant plus Lazcluze overall survival in non-small cell lung cancer, and DanGer Shock long-term survival benefit of Impella Heart Pump.

J&J has a very strong balance sheet and ended the quarter with net debt of $27bn on the back of free cash flow generation of $14.2bn. The group has consistently invested in organic growth – R&D spend was $3.7bn in the quarter – and, as a result, around 25% of sales come from products launched in the last five years. J&J has raised its dividend for more than 60 consecutive years. In the current quarter, the payout was raised by 5% to $1.30 per share, implying a full-year yield of 2.7%.

Guidance for full-year adjusted operational sales growth was raised to 3.5%-4.0% (vs. 3.2%-3.7% previously), while adjusted operational EPS is still expected to increase by 8.7% to $10.80-$10.90, despite absorbing higher tax costs. This reflects the group’s understanding of the present legislative landscape and current expectations for tariffs, foreign exchange rates, and procedural volumes.

In 2026, the company expects the Innovative Medicine division to generate accelerating sales growth driven by in-market brands and continued progress from recently launched products. In MedTech, the company expects to see accelerating sales growth driven by a continued focus on higher-growth markets.

Source: Bloomberg