Morning Note: Market news and updates from Melrose and Richemont.

Market News

Donald Trump is preparing substantial tariff cuts for Latin American countries to address high food prices at home, eying lower US levies and barriers for groceries including beef, bananas, and coffee.

The 10-year Treasury yield held at 4.14% after a rise in the prior session, as investors scaled back expectations for a Federal Reserve rate cut in December. Markets now assign about a 50% chance of a 25 basis points cut next month, down sharply from over 95% a month ago. The move comes amid uncertainty over inflation and differing views among Fed policymakers on the economic and monetary outlook. Neel Kashkari and Beth Hammack both indicated they weren’t sold on another reduction. Gold pulled back to $4,175 an ounce.

US equities posted a heavy decline last night – S&P 500 (-1.7%); Nasdaq (-2.3%) – with big tech dragging the market down. Market weakness continued in Asia this morning, with semis/tech notable declines: Nikkei 225 (-1.8%); Hang Seng (-1.8%); Shanghai Composite (-1.0%). China’s economic activity cooled more than expected at the start of the fourth quarter, with industrial production missing the mark while property investment slid.

The FTSE 100 is currently 1.1% lower at 9,704. 10-year gilt yields rose sharply to 4.50% and Sterling slipped ($1.3150 and €1.1310) following comments that Rachel Reeves is reconsidering plans to raise income tax rates and other levies in the upcoming budget, prompting questions about how she will make up for a revenue shortfall. Over 60 groups urged the Chancellor to prioritise reducing electricity bill charges over VAT cuts.

Oil tanker freight costs have surged to a five-year high, reaching almost $126,000 a day for a supertanker from Saudi Arabia to China. Goldman followed the IEA with a bullish outlook on oil, forecasting consumption will keep rising until 2040, reaching 113m barrels a day. Brent Crude rose to $63.50 a barrel after a Ukrainian attack damages a Russian oil depot.

Source: Bloomberg

Company News

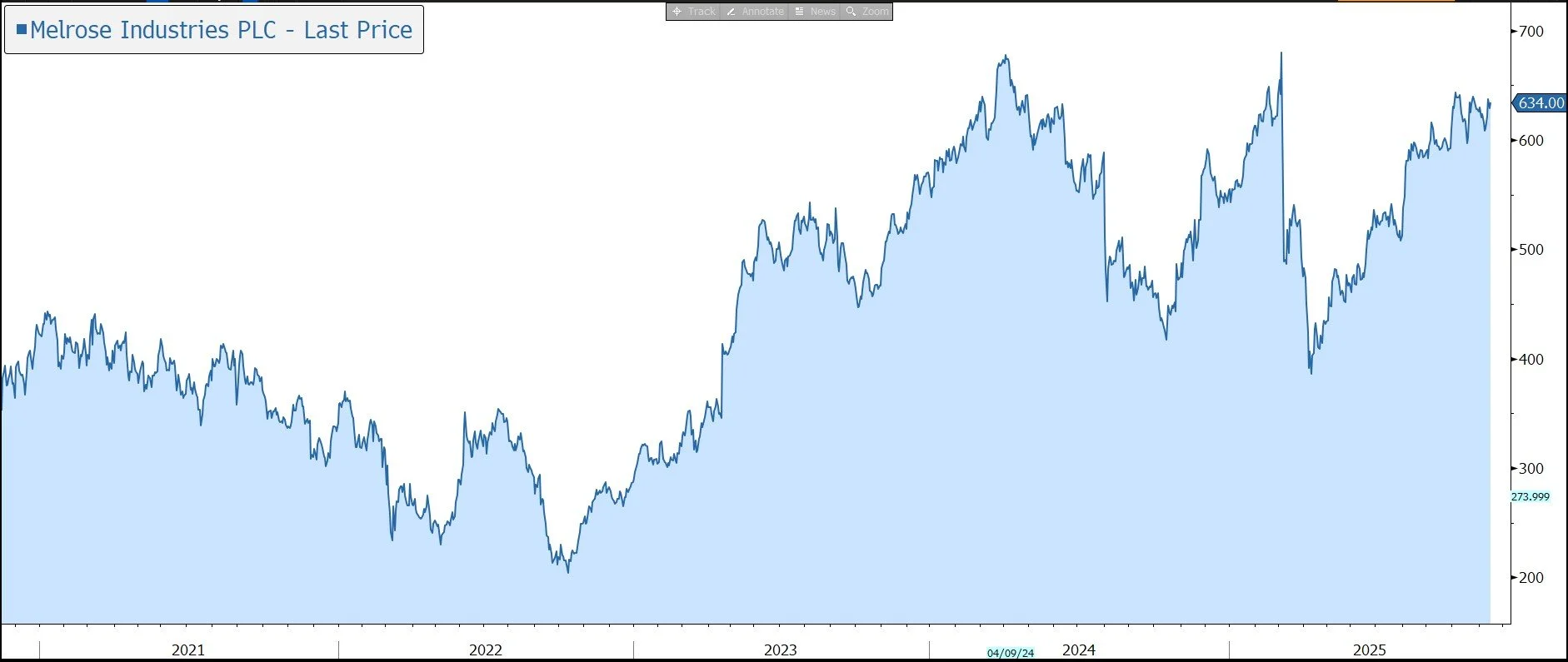

Melrose Industries has released a trading update for the four months from 1 July to 31 October which highlights a strong performance driven by continued positive momentum in both its civil and defence businesses. The company is coming to the end of its multi-year transformation programme and is seeing a ramp-up in cash flow generation. Guidance for the full year has been reiterated on a constant currency basis. The shares are little changed in early trading against a weak overall market backdrop.

Melrose is a tier one aerospace technology supplier with established positions on all the world’s high-volume aircraft. Its products are on-board 90% of civil aircraft on the market today (wide and narrow body) and the company generates 95% of its revenue from industry-leading positions (and more than 70% as sole supplier).

Revenue is split 70% civil, 30% defence. The civil industry is expected to enjoy long-term structural growth as airlines upgrade their ageing fleets after years of underinvestment. Backlogs for new aircraft stand at a record level of ~15,000. Defence is also growing as ongoing geopolitical tension drives NATO countries to increase military spending.

R&D excellence and long-standing relationships create high barriers to entry and mean the company is well positioned for the next generation of technology, particularly that enabling zero emission flight – additive manufacturing, composite structures, and electric and hydrogen propulsion.

There are two divisions: Engines and Structures (i.e. bodies and wings of planes). In 2025, Engines is forecast to contribute over 75% of Melrose profit with over 85% of this being from the accretive and structurally growing aftermarket. The business has OEM-level capability and responsibility for selected engines which gives more technical and commercial advantages than normal for a Tier 1 supplier. The company is partner to all major engine OEMs (original equipment manufacturers) with its lucrative and diverse Revenue and Risk Sharing Partnerships (RRSP) portfolio providing strong cash flow growth. In response to ongoing investor concerns (and valuation discount) regarding the accounting treatment of its RRSPs, the company has published a booklet which provides detailed information on how Melrose is positioned today, how the cash generation grows, and the accounting involved. The total expected lifetime future RRSP gross cash inflow is £22bn (£6bn net), with 17 of the 19 RRSPs already in the cash generation phase.

In the four months to 31 October, revenue was up 14% at constant currency and excluding the impact of exited businesses. The group’s multi-year transformation programme is nearing completion. This has been the key driver of margin expansion. In today’s update, the company highlights that its adjusted operating profit was ‘significantly higher’ than the comparative period and in line with management expectations.

In civil aerospace, record backlogs are underpinning the OE production ramp. Air traffic growth and low retirement rates continue to support the aftermarket. Geopolitical uncertainty is driving a step change in defence spending, which is providing a number of new growth opportunities for the group. The UK/US and EU/US tariff agreements have been welcomed by market participants, providing greater certainty for the civil aerospace industry.

In Engines, revenue grew by 28%, driven by a strong performance in both OE and the aftermarket. OE growth of 35% was driven by the group’s RRSP portfolio across both narrowbody and widebody platforms. Aftermarket grew by 22% and included a return to robust growth for the parts repair business. Engines’ performance includes continued momentum from the increase in OE production rates and the recovery from tariff-related uncertainty and backlogs in the first half. Looking ahead, the division is well placed to meet the ongoing industry ramp-up from its established positions and to support customers on new technologies and the next generation of engines.

In Structures, revenue grew by 5%, ahead of the growth rate at the half year. Melrose saw encouraging growth in Defence, reflecting strong demand coupled with the group’s business improvement actions and the work carried out on sustainable pricing across the business. The performance in Civil continued to be constrained by well-publicised customer supply chain issues. Melrose is well positioned to support its OEM customers as build rates continue to grow over the next few years to meet record backlogs in both civil and defence.

Looking forward, free cash flow is expected to ramp up sharply as a result of increased RRSP cash flows, operational improvements, and reduced restructuring cash spend as the transformational restructuring programme nears completion.

Melrose has a strong balance sheet with leverage at the end of the first half of 2.0x net debt to EBITDA, versus the target to be between 1.5x and 2.0x. Financial strength is driving attractive shareholder returns through a progressive dividend – during the summer, a half-year payout of 2.4p was declared, 20% higher than last year. The company is also undertaking a £250m share buyback programme expected to complete in March 2026. There is potential for a sizeable cash return every year until the end of the decade. The company has said no material acquisitions will be made in the near term.

Guidance for 2025 remains unchanged on a constant currency basis and continues to exclude the direct and indirect impact of any new or changed tariffs: Revenue of £3,425m-£3,575m, operating profit (adjusted EBIT pre-PLC costs of £30m) of £620m-£650m; margin of 18%+; and free cash flow of more than £100m.

Overall, the most significant contributor to future Melrose value is profitably capturing the growth from its established positions across civil and defence platforms, as production ramps and the aftermarket reads through. The company has targets for 2029: revenue of £5bn, operating profit (post PLC costs) of £1.2bn+ (i.e. 17% CAGR), margin of 24%+, and free cash flow of £600m and growing beyond. 90% of revenue will come from existing platforms – growth will be driven by maturing engine RRSP portfolio, margin improvement at structures, and ongoing demand for parts – and 10% from new opportunities.

Source: Bloomberg

Richemont has released results for the half-year to 30 September 2025. Performance was better than market expectations driven by strong sales momentum in the group’s second quarter. In response, the shares have been marked up by 8% in early trading.

Richemont is a Switzerland-based luxury goods group which generates annual sales of around €21bn, split between retail, wholesale, and online distribution. The group owns a portfolio of leading international ‘Maisons’ which are recognised for their distinctive heritage, craftsmanship, and creativity. Jewellery Maisons include Buccellati, Cartier, and Van Cleef & Arpels. Specialist Watchmakers account for 16% of sales. Fashion & Accessories ‘Maisons’ (termed ‘Other’) include leather goods, clothing, and writing instruments, etc. This division now includes Watchfinder, a leading omni-channel platform for premium pre-owned timepieces. In April, the group completed the sale of its stake in YOOX Net-A-Porter (YNAP), the leading online luxury retailer.

The company’s products are discretionary purchases. Currency movements, and their impact on tourist flows, can also have an impact on sales at the regional level. As a result, sales tend to be discretionary in nature and remain vulnerable to changes in the economic outlook.

In the six months to 30 September, sales rose by 10% at constant exchange rates (CER) to €10.6bn, above the market expectation of €10.4bn. Growth accelerated in Q2 (+14%) versus Q1 (+6%).

By distribution channel, Retail sales increased by 10% at CER, led by the Jewellery Maisons. Wholesale and Online Retail rose by 9% and 7%, respectively. By segment, the stand-out performer was Jewellery Maisons, up 14% at CER to €7.7bn. Specialist Watchmakers fell by 2%, while the Other division rose 2%.

The group achieved double-digit growth at CER in Europe (+11%), the Americas (+18%), and the Middle East & Africa (+19%). Growth was slower in Asia Pacific (+5%), while Japan fell by 4% on higher comparatives versus the prior year.

Operating profit rose by 24% at CER to €2.4bn, well above the market forecast of €2.2bn. Growth was underpinned by strong sales contribution and continued cost discipline, mitigating the impact of macroeconomic headwinds including the rising price of gold. The margin rose by 30 basis points to 22.2%.

Cash flow from operations of €1.9bn was 48% above last year and net cash ended the period at €6.5bn.

Source: Bloomberg