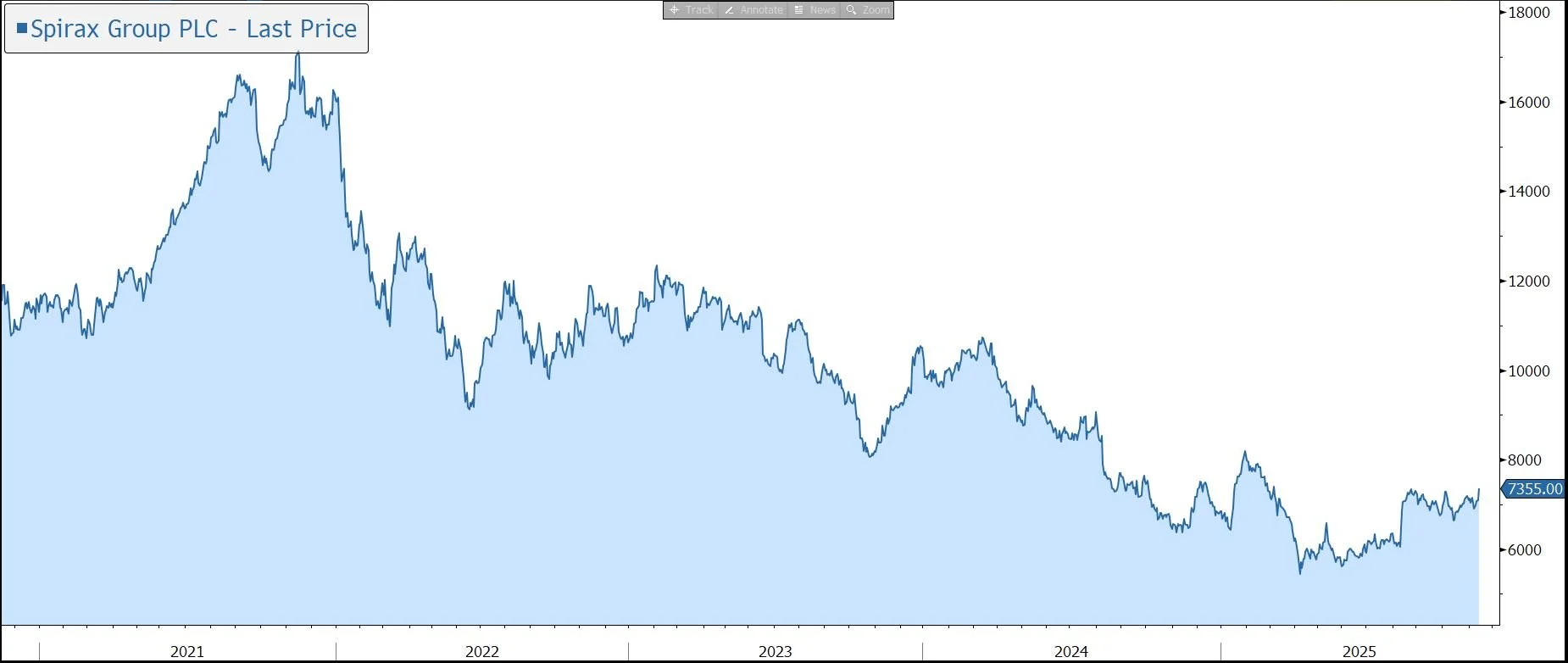

Morning Note: Market news and an update from engineer Spirax Group.

Market News

Donald Trump signed legislation to end the US government shutdown after lawmakers passed the temporary funding bill, marking the official conclusion to a record 43-day impasse.

Kevin Hassett said he told Trump he would accept the nomination to become the next Federal Reserve Chair if the job was offered. He also said he’d prefer a larger rate cut when policymakers meet in December. Rising investor confidence in additional easing is helping gold to continue its recent recovery – it currently trades at $4,235 an ounce. Treasuries were firmer across the curve – the 10-year currently yields 4.10%.

The EU is preparing a new plan to implement the next phase of its trade agreement with the US.

US equities were little changed last night – S&P 500 (+0.1%); Nasdaq (-0.3%) – during another session characterised by better breadth. Cisco rose after boosting its 2026 forecasts on booming AI spending. In Asia this morning, the main equity indices ended the session in positive territory: Nikkei 225 (+0.4%); Hang Seng (+0.6%); Shanghai Composite (+0.7%). The yen climbed after the currency’s slump past 155 spurred concerns about possible intervention.

The FTSE 100 is currently 0.3% lower at 9,888. Companies trading ex-dividend today include BP (1.35%), Bunzl (0.9%), GSK (0.88%), Shell (0.94%), and Sainsbury (4.43%). The UK economy grew by a meagre 0.1% in the third quarter, missing expectations. Sterling drifted to $1.3140 and €1.1315, while the UK 10-year gilt yield slipped below 4.4%, its lowest level of the year.

Brent Crude slipped to $62.50 a barrel. Increased supplies from OPEC+ will continue to put pressure on crude prices next year, Chevron CEO Mike Wirth said.

Source: Bloomberg

Company News

Spirax Group has released a trading update in respect of the four months ended 31 October 2025. As expected, organic revenue growth and the margin were ahead of the first half. Guidance for the full year was reiterated and, in response, the shares are up 5% in early trading.

Spirax (formerly Spirax-Sarco Engineering) is a UK-listed industrial company, with annual sales of £1.7bn. The group is a world leader in each of its three businesses. In Steam Thermal Solutions (52% of revenue), Spirax Sarco and Gestra are leaders in the control and management of steam. In Electric Thermal Solutions (24%), Chromalox and Thermocoax provide electrical process heating and temperature management solutions. Finally, Watson-Marlow Fluid Technology (24%) provides niche peristaltic pumps and associated fluid path technologies.

The group’s products are used in almost every industry worldwide: from the food sector where steam products are used in blanching, baking, packaging, and cleaning; to the pharmaceutical industry where pumps and associated fluid path equipment are critical to the production of life-saving medicines; through to the aviation industry where electrical heating elements are used in the de-icing of aeroplanes.

85% of revenue is generated from maintenance and operational (opex) budgets rather than capital (capex) budgets. Of that 85%, 50% comes from essential repair and maintenance activities, while 35% comes from small projects that improve existing systems. As a result, the group has a long history of stable, sustainable growth and strong profitability.

However, in response to a weaker macroeconomic environment, the group took early action across all three businesses to appropriately right-size capacity and overhead support costs, as well as implementing temporary cost containment actions and reducing variable compensation. In January 2025, the company initiated a restructuring programme that is expected to realise annualised savings of £35m. Most of this will be reinvested in organic growth initiatives.

In the first nine months of 2025, Global industrial production (excluding China) grew by 1.6%, with full-year forecasts revised down to 1.6%. Third quarter IP was lower than the first half with continued weakness in key markets such as the US, Germany, France, Italy, and the UK. Uncertainty around the broader impact of tariffs on global trade has persisted and continues to dampen business confidence and demand for large projects.

In the 10 months ended 31 October, group organic sales growth and adjusted operating profit margin were ahead of organic growth (3%) and margin (19.3%) in the first half.

Steam Thermal Solutions (STS) sales for the four months to October were broadly level organically on the prior year as large project sales continue to be impacted by the challenging IP conditions. Excluding large project sales in China and Korea, STS sales were ahead of the prior year. As expected, the rate of organic sales decline in China is moderating compared to the first half. Organic sales growth in Korea is also recovering, with both orders and sales expected to grow in the second half.

In Electric Thermal Solutions, the strong organic sales growth of the first half continued in the four months to October. Process Heating continued to benefit from ongoing operational improvements driving increased shipments from the group’s order book, including residual legacy orders. Organic sales growth in Equipment Heating was supported by continuing strength in demand for Semicon equipment solutions.

In Watson-Marlow, double-digit order growth in Biopharm has continued into the second half and, as expected, this has driven an acceleration in sales growth during the four months to October compared to the first half. Process Industries sales also grew strongly and above the rate of growth in the first half, supporting strong overall organic sales growth in Watson-Marlow.

The group is financially robust, with net debt (excluding leases) at 31 October at £596m, with gearing of 1.6x net debt to EBITDA. The group has a strong track record of dividend growth, with 56 years of progress. An interim payout of 48.9p was declared at the half-year stage, up 3%. A similar rate of growth at the full-year stage would generate a yield of 3%.

Looking ahead, guidance for the full year remains unchanged. The company continues to anticipate organic revenue growth consistent with that achieved in 2024 and well ahead of IP. Group adjusted operating profit margin is expected to be ahead of the currency adjusted 2024 margin of 19.4%, driving mid-single digit organic growth in adjusted operating profit.

Over the medium term, the aim is to grow ahead of underlying markets, with high-single digit profit growth delivered through mid-single digit organic sales growth and an improving margin reaching between 22% and 23%. This will drive cash conversion of over 80% and an improved return on capital.

Source: Bloomberg