Morning Note: Market News and an update from uranium company Yellow Cake.

Market News

US equities rolled over last night – S&P 500 (+0.6%); Nasdaq (+1.0%) – as overbought conditions in tech stocks and concerns about margin risks as telegraphed by S&P Global’s PMI preliminary report for September weighed on the market. The dollar fluctuated and the Brazilian real gained amid news Trump will meet with President Lula da Silva next week and Argentine assets stabilised as traders wait for a meeting between Trump and Javier Milei.

Gold reached an intraday record, nearing $3,800 an ounce, before paring gains, and a gauge of stock market volatility rose to the highest in nearly three weeks after Fed Chair Jerome Powell reiterated there’s no risk-free policy path ahead, adding that uncertainty over the path of inflation remains high while the labour market sees meaningful weakness. 10-year Treasuries yield 4.10%.

Brent Crude rose more than 2% to $67 a barrel after President Trump — while addressing the UN General Assembly — called for more sanctions on Russia. US crude inventories fell 3.8m barrels last week, the API is said to have reported. That would reduce total holdings to the lowest in three and a half years if confirmed by the EIA.

In Asia this morning, equity markets firmed: Nikkei 225 (+0.3%); Hang Seng (+1.4%); Shanghai Composite (+0.8%). Alibaba jumped after the company revealed plans to raise AI spending.

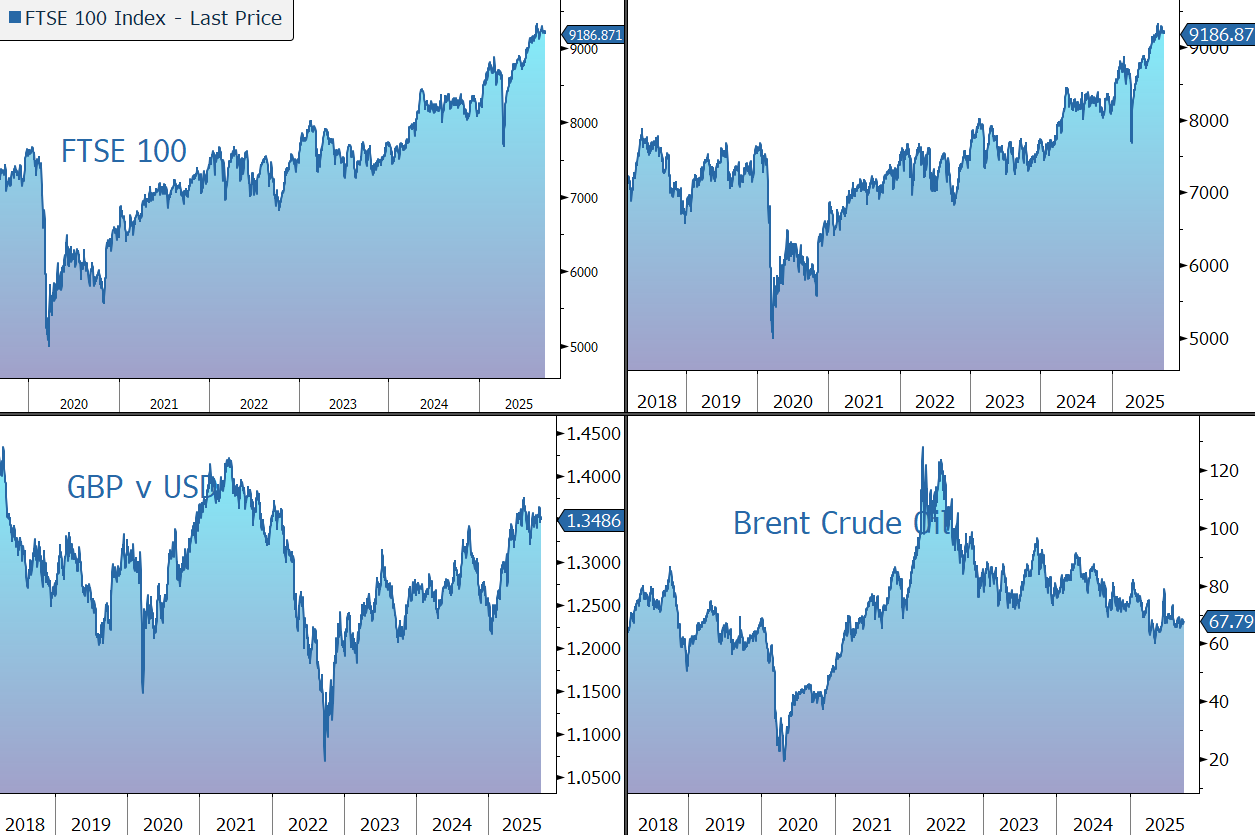

The FTSE 100 is currently 0.5% lower at 9,187, while Sterling trades at $1.3495 and €1.1445. Pimco’s Andrew Balls is betting on a drop in UK inflation that will allow the BOE to cut interest rates, the FT reported. 10-year gilt yields slipped back to 4.68%. Meanwhile, the Institute for Government (IfG) has urged Chancellor Rachel Reeves to rethink Labour’s manifesto pledge not to raise income tax, national insurance, or VAT, warning that relying on small levies or wealth taxes could damage growth and public trust.

Source: Bloomberg

Company News

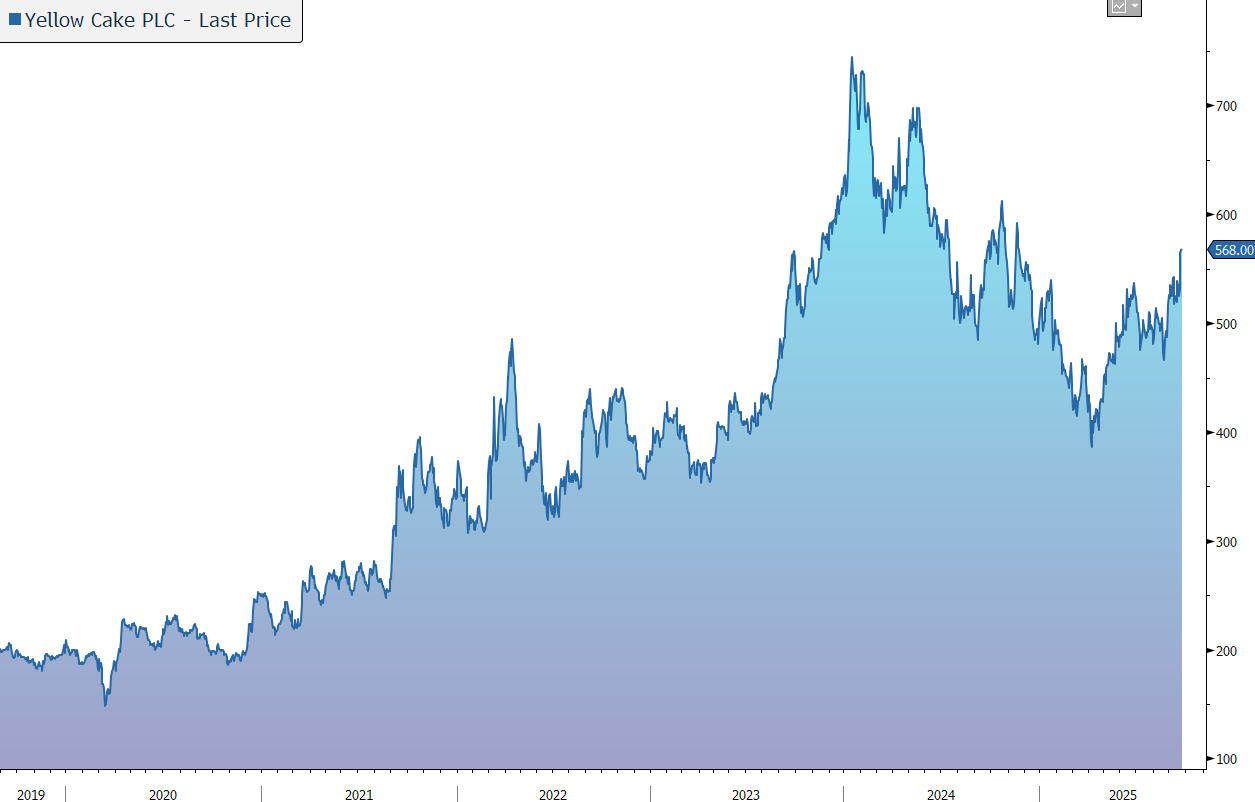

Yellow Cake has today announced a proposed uranium purchase and new share placing.

Yellow Cake is an AIM-listed company focused on buying and holding physical uranium (U3O8). The company offers shareholders exposure to the uranium spot price, without the risks associated with investment in companies that explore for and produce uranium. The company utilises a low-cost outsourced business model that minimises cost leakage – annual operating costs are less than 1% of NAV – while securing access to additional expertise through strategic partnerships with suppliers and other relevant industry players.

The company’s fundamental premise is that uranium, as a commodity, is structurally mispriced. The directors believe the central source of this mispricing is the potential looming supply gap, as demand for nuclear power as a low-carbon baseload source continues to increase, while a lack of investment in new supply sees existing mines reaching end of life, with insufficient new mines under development to replace them.

Under a Framework Agreement with Kazatomprom (the world’s largest producer), Yellow Cake has the option to purchase up to $100m of uranium per year from Kazatomprom at an undisturbed spot price, through to 2027. To date the company has financed its uranium purchases through the issue of equity. Yellow Cake currently owns 21.68m pounds of uranium in storage in Canada and France.

This morning, the company has announced an intention to conduct a non-pre-emptive placing of new shares to fund a further purchase of uranium. The aim is to raise gross proceeds of $125m (£92.5m) with existing and new institutional investors at a fixed price of 564p. This amounts to 7.5% of the existing market cap, although the final number of shares placed will be determined following the close of the bookbuild.

The proceeds will be mainly used to fund the purchase of 1.33m pounds physical uranium, fully utilising the company’s purchase option for calendar year 2025 with Kazatomprom at a price of $75.08/lb, which is the average of the weekly TradeTech and UxC spot prices as reported on 12 September and 15 September, respectively. It represents a 7.1% discount to the current spot price of $80.80/lb (as at 23 September).

The cash will also be used to pay costs associated with the placing and for working capital and general corporate purposes. Delivery of the purchased material is anticipated in 2026.

The placing price of 564p is the closing mid-market price on 22 September. The implied pro-forma NAV at the proposed uranium purchase price is 560p per share, while the implied NAV at the uranium price as at 23 September of $80.80 a pound is 602p per share.

Yellow cake believes the current level of the uranium price offers a compelling buying opportunity. The supply-demand imbalance continues to intensify, driven by global nuclear energy expansion, persistent production constraints, escalating input costs, and increasing demand for secure supply

Security of supply continues to be a significant driving force in the nuclear industry, with persistent political strategic considerations balancing on an East / West divide, evidenced by the US’s recent comments about the need to boost its strategic uranium reserve.

These supply concerns are underscored by a potentially widening supply / demand gap: developers and producers continue to face operational challenges in meeting or maintaining production targets. We note that industry giant Cameco recently lowered its production forecast for 2025.

The incentive price required for new mines to be developed and constructed is higher than the current spot price. This misalignment in pricing has resulted, and is continuing to result, in a lack of investment in new uranium supply.

On the demand side, there has been a change in attitude towards nuclear energy and the role it can play in future energy plans as countries seek to meet their carbon emission reduction commitments and limit global warming. 2025 has seen an increasing focus on nuclear as a low-carbon baseload power source, with governments seeking to reduce their reliance on both coal and Russian fuels.

Many countries are undertaking aggressive nuclear plant build programs and reactor life extensions, while, in time, small modular reactors are expected to be a new source of demand. At the same time, significant new demand is taking shape in the form of hyper-scalers (such as Microsoft and Google) and demand is coming from the rapidly growing sector of data centres.

Exposure to uranium in a diversified portfolio provides a low correlation to other asset classes and the potential for a high level of capital growth if the cycle continues to turn up. Yellow Cake provides a ‘cleaner’ exposure, without the operational risk, while for investors who are happy to take on the operational risk inherent with a production company, we would consider Cameco or, for more diversified exposure, the Global X Uranium ETF.

For Yellow Cake, the estimated NAV on 23 September was 602p per share, based on 21.67m pounds uranium valued at a spot price of $80.80/lb and cash & other current assets and liabilities of $13.5m. The shares currently trade on a 7% discount to NAV.

Source: Bloomberg