Morning Note: Market news and a positive update from Halma.

Market News

Copper prices jumped after Freeport McMoRan said force majeure was declared on contracted supplies from its giant Grasberg mine in Indonesia.

Brent Crude rose to $69 a barrel, a seven-week high, driven by government data showing a decline in US crude inventories, defying market expectations. At the same time, President Trump’s administration is pressurising the World Bank to fund more fossil fuel projects.

US bond yields rose as the latest Fed commentary muddied expectations for additional rate cuts, with markets no longer fully pricing in a reduction next month. The 10-year Treasury yields 4.15%, while gold drifted back to $3,750 an ounce.

US equities paused for breath last night – S&P 500 (-0.3%); Nasdaq (-0.3%). Intel rose after people familiar said the chipmaker approached Apple about securing an investment and discussed how to work more closely together.

In Asia this morning, equity markets were mixed: Nikkei 225 (+0.3%); Hang Seng (-0.1%); Shanghai Composite (+0.1%). The Bank of Japan minutes fuelled rate hike hopes.

The FTSE 100 is currently 0.3% lower at 9,225, while Sterling trades at $1.3460 and €1.1455. The Bank of England’s Megan Greene said a cautious approach to easing interest rates is needed given uncertainties in inflation.

The UK’s gilt market jitters are starting to impact demand at government auctions as fiscal concerns grow ahead of the budget in November. The 10-year yields 4.70%.

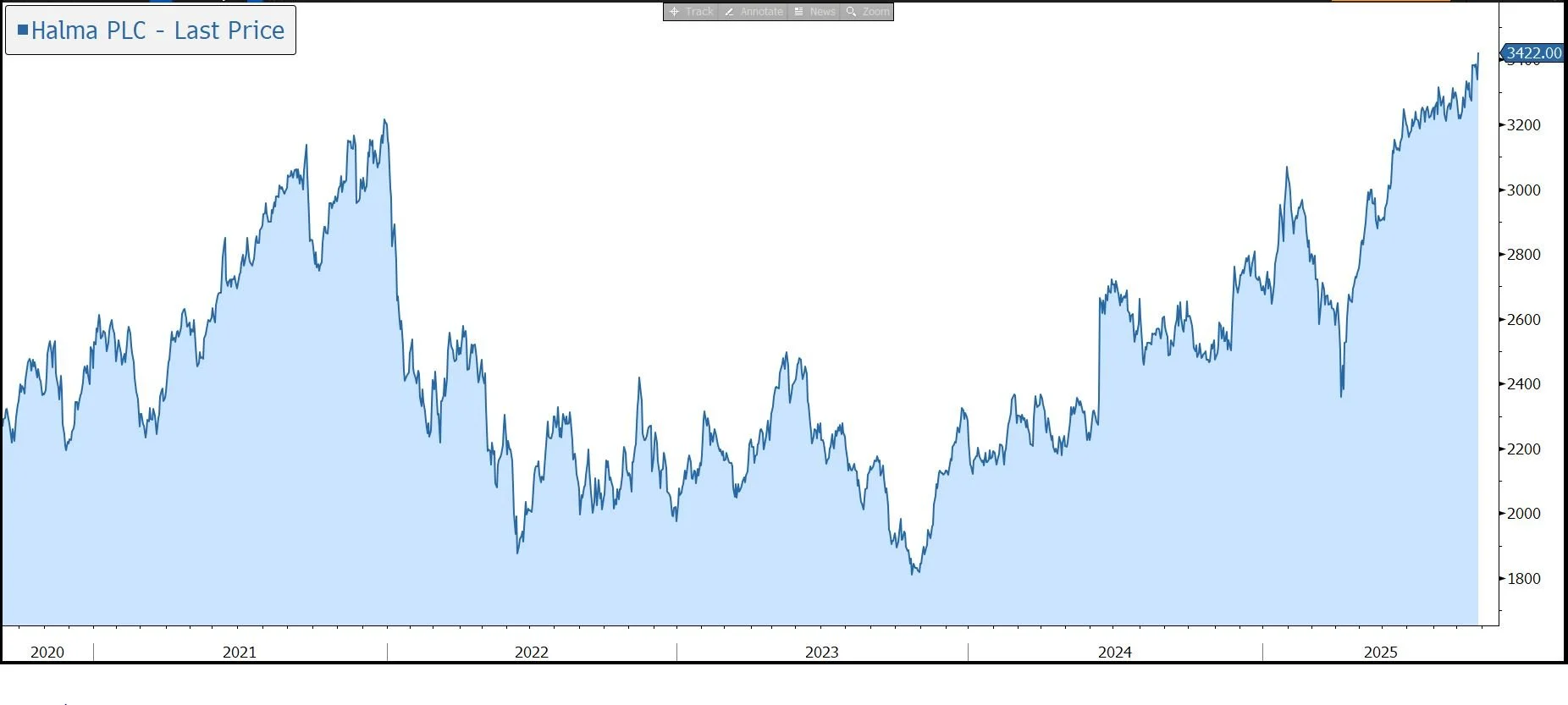

Source: Bloomberg

Company News

Halma has today released a positive trading update ahead of its half year-end on 30 September 2025 and upgraded its sales guidance for the full year. In response, the shares have been marked up by 2% in early trading.

Halma is a global group of life-saving technology companies, with a focus on safety, health, and the environment. The group’s technology is used to save lives, prevent injuries, and protect people and assets across a broad range of sectors including commercial and public buildings, utilities, healthcare/medical, science/environment, process industries, and energy/resources. The main growth drivers include increasing health and safety regulation, demand for healthcare from an ageing population, and demand for life-critical resources. Strong market positions deliver upgrade and replacement sales opportunities as customers seek to maintain regulatory compliance and conform with best practice. As a result, customer spending is often non-discretionary and drives sustained demand throughout the economic cycle.

During the last six months, the company has made strong progress against a backdrop of varied market conditions and a challenging economic and geopolitical environment.

Based on current expectations for the remainder of the financial year to 31 March 2026, the company now expects to deliver low double-digit percentage organic constant currency revenue growth. This compares to the previous guidance of upper single-digit growth, with the increase being primarily driven by stronger-than-expected growth in photonics within the Environmental & Analysis Sector.

Growth is supported by order intake which remains ahead of both revenue in the year to date and the comparable period last year.

The group’s adjusted EBIT margin guidance is unchanged: to be modestly above the middle of the target range of 19-23% in this financial year.

Strong cash generation and a robust financial position is supporting continued strategic investment in future organic growth, as well as providing capacity to fund acquisitions. In the year to date, the group has completed two purchases: Brownline, a provider of advanced gyroscopic locating systems (£129m), and Nu Perspectives, a cryogenic therapy device engineering company (£1.5m). The acquisition pipeline remains healthy. The company has also sold AAI, a designer and manufacturer of smoke, heat, and carbon monoxide detectors.

Halma has a fantastic dividend track record, having increased the payout by 5% or more every year for the last 45 years.

The appreciation of Sterling in the financial year, especially against the dollar, is expected to have a negative currency translation effect on the group’s results

In what was a brief statement, there was little detail on the group’s performance by sector or region – more clarity is expected at the time of the results in November.

Source: Bloomberg