Morning Note: Market News and an Update from Pernod Ricard.

Market News

Gold rose back above $5,000 an ounce, extending a 2% gain from the previous session as market attention shifted toward key US PCE inflation and GDP data due later this week for further cues on FOMC policy. Minutes from the January meeting showed Fed officials were divided, with some favouring a pause in further rate cuts for now, while easing could resume later in the year if inflation improves. Others raised the possibility of rate hikes and supported issuing a post-meeting statement reflecting a two-sided outlook for future policy rates. As a result, traders pared expectations for multiple rate cuts. The 10-year Treasury yield nudged up to 4.11%.

Equity markets built on their technology-led rally as volatility tied to bets on AI subsided, removing a key source of recent market anxiety. The move up in the US last night – S&P 500 (+0.6%); Nasdaq (+0.8%) – followed through into Asia this morning, with the Nikkei 225 (+0.6%) also gaining. Reports that OpenAI, the owner of ChatGPT, is close to finalising the first phase of a new funding round that may raise more than $100bn also supported sentiment.

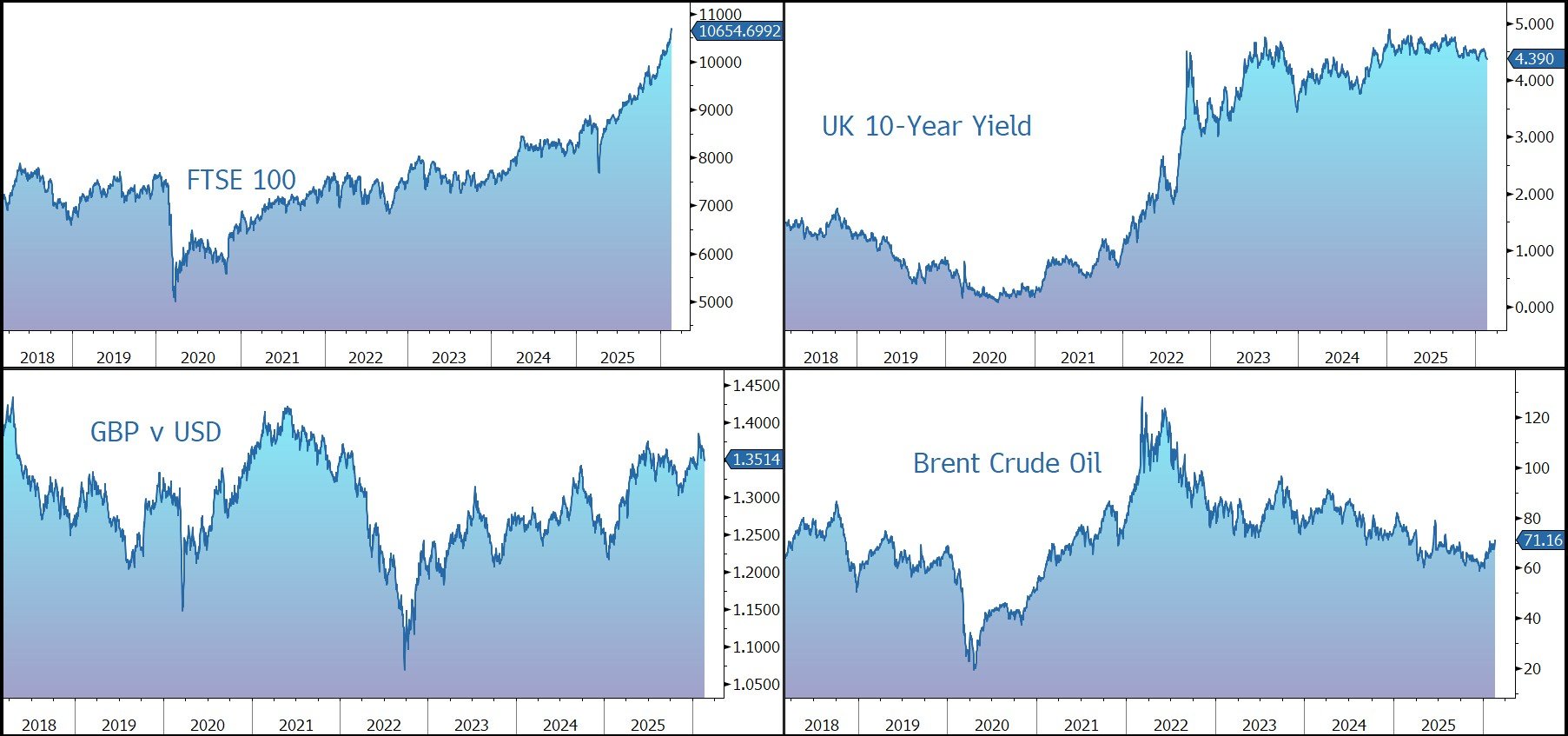

The FTSE 100 is currently 0.3% lower at 10,655, driven by companies trading ex-dividend which include AstraZeneca (1.03%), Barclays (1.15%), BP (1.31%), GSK (0.79%), Imperial Brands (1.23%), Shell (0.94%).

Sterling trades at $1.3510 and €1.1445. UK residential land prices may have bottomed as borrowing costs and planning changes increase appetite, according to Knight Frank.

Brent Crude rose above $70 per barrel, extending an over 4% gain from the previous session, the strongest advance since late October, driven by fears of a potential US-Iran conflict.

Source: Bloomberg

Company News

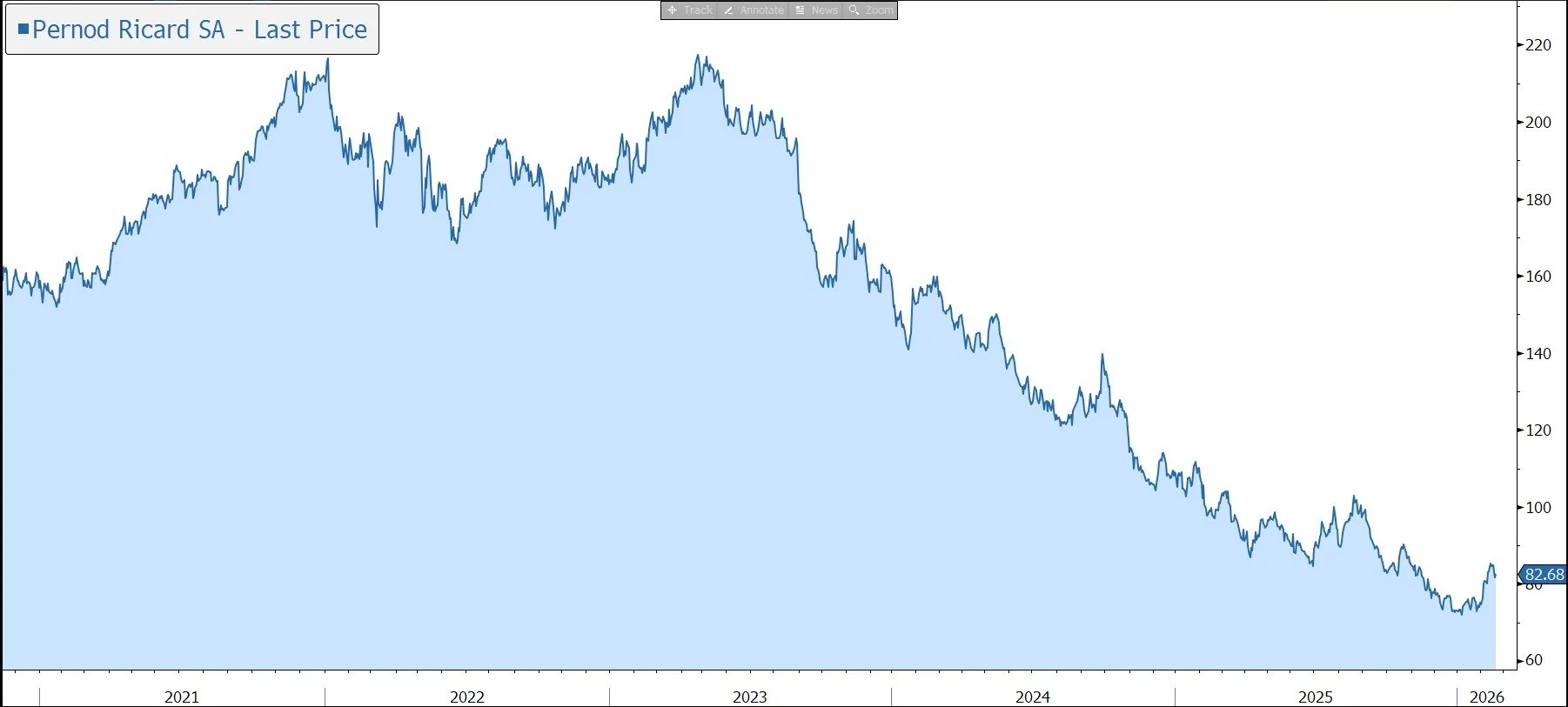

Pernod Ricard has released results for the financial half-year to 31 December 2025 broadly in line with market expectations. As expected, organic revenue fell, although the rate of decline was much improved in the group’s second quarter. The company maintained its forecast for improving trends from the second half of the financial year. In response, the shares were marked up by 1% in early trading.

Pernod Ricard is the worldwide leader in wine and spirits, operating a decentralised structure comprised of a global flagship in France, autonomous affiliates, brand companies, and market companies throughout the world. The company owns a portfolio of over 240 premium brands available in over 160 countries, leaving it well placed to benefit from the trend towards premiumisation. Key brands include Ricard, Pernod, Chivas Regal, Jameson, Glenlivet, Martell, Mumm, Perrier-Jouet, Absolut, Malibu, Beefeater, Havana Club, and Plymouth Gin.

The company is undertaking a €1bn Operational Efficiencies programme during FY2026-2029, which includes the rollout of its Fit for Future operating model. One third of the targeted efficiencies will be delivered this year and the company has accelerated the normalisation of its strategic investments.

In the six months to 31 December 2025, the company generated a soft performance in a ‘contrasted environment’, with declines in the US and China amplified by inventory adjustments. Elsewhere there was growth in many markets across all regions, and improved trajectory in the second half of the period, notably in Global Travel Retail (GTR) and in India.

Reported sales fell by 14.9% to €5,253m. Stripping out the impact of M&A and currency movements, sales fell by 5.9% organically, with the sequential improvement in the second quarter.

The Americas suffered a 12% decline in organic sales. Within the mix, the US fell by 15%, amplified by some inventory adjustments, with spirits market conditions remaining soft. Canada achieved solid growth, while Mexico and Brazil declined.

Sales in China contracted sharply (-28%), with continued macroeconomic weakness that impacted consumer sentiment and demand, plus some inventory adjustments which are expected to reverse in the current half-year. India (+8% in organic terms) enjoyed strong underlying growth apart from Maharashtra State, where demand was impacted by excise policy changes. Continued strong momentum expected in H2. The company has no plans for now to list its India unit.

In Europe (-3%), resilience in the UK was offset by declines in Germany and Spain. A modest contraction in France was driven by phasing.

Global Travel Retail sales were soft (-3%), although they rebounded in the second half of the period following the resumption of the group’s sales of Cognac to China Duty Free. The unit is expected to be broadly stable in FY2026.

By brand category, Strategic International Brands fell by 7%, mainly driven by Martell in China, Jameson in the US. Declines in Strategic Local Brands (-2%) and Specialty Brands (-7%) were offset by 12% growth in the Ready to Drink unit.

The gross margin fell by 216 basis points to 59.3%, impacted by negative market mix and tariffs while benefitting from COGS efficiency programmes. There was a 10% reduction in Structure costs, driven by implementation of the Fit for Future operating model and ongoing strong cost discipline. Profit from recurring operations fell by 7.5% in organic terms to €1,614m, with the operating margin falling by 55 basis points in organic terms to 30.7%. EPS fell by 20% to €4.04.

Free cash flow rose by 9.5% to €482m, driven by strong working capital management, leading to an improvement in cash conversion. Net debt fell by €900m to €11.2bn, or 3.8x net debt to EBITDA.

For the financial year to 30 June 2026 the group still expects to see improving trends in organic net sales, skewed toward H2. The company confirmed it will defend its organic operating margin to the fullest extent possible, supported by strict cost control and the €1bn operational efficiencies programme.

The company repeats that it remains confident in the attractive fundamentals of its industry, its strategy, and the resilience of its operating model to deliver sustainable value over time. Over the medium term (i.e. FY2027-FY2029), the company is projecting organic net sales growth, aiming for the range of +3% to +6% p.a. on average, and annual organic operating margin expansion.

Source: Bloomberg