Morning Note: market news and updates from Home Depot and Currys.

Market News

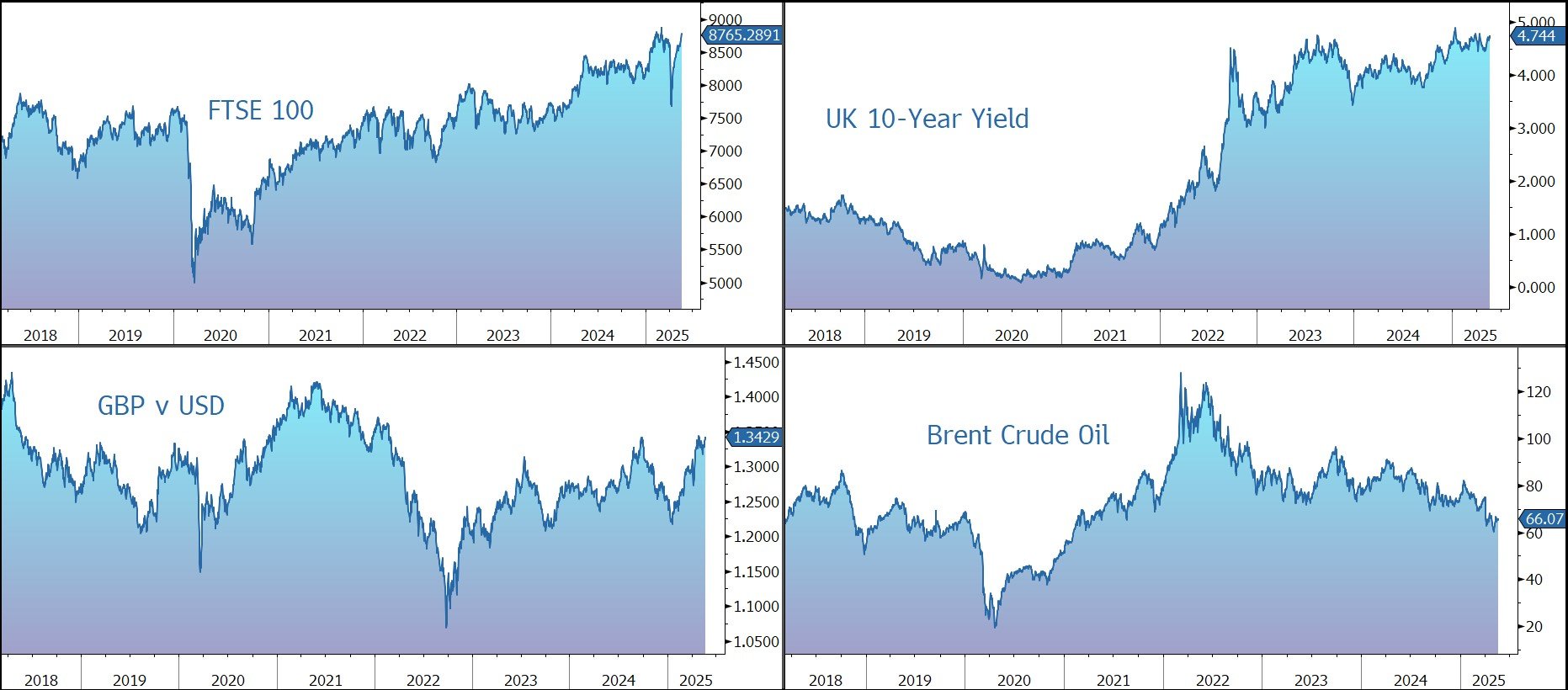

The dollar weakened after CNN reported that new US intelligence suggested Israel is preparing for a potential strike on Iranian nuclear facilities. Brent Crude rose to the highest level in a week ($66 a barrel), while gold has risen back above $3,300 an ounce. Yields on Japanese super-long sovereigns dipped after Tuesday’s surge, while those on the 30-year US Treasury hovered around the 5% mark.

The focus also remain the fiscal health of the US. The Trump tax-cut bill faces rare overnight stress test with House Republicans. The President warned dissenters to drop efforts for expanded Medicaid cuts and demands for a significant hike in the federal deduction for state and local taxes or SALT.

US equities drifted lower last night – S&P 500 (-0.4%); Nasdaq (-0.4%) – and are currently expected to slide further at the open this afternoon. Wolfspeed, the semiconductor manufacturer, tumbled 60% postmarket after the WSJ said the company’s preparing to file for bankruptcy. Put options surged before the report.

In Asia this morning, equities were mixed – Nikkei 225 (-0.6%); Hang Seng (+0.4%); Shanghai Composite (+0.2%) – while the FTSE 100 is currently 0.2% lower at 8,765.

UK inflation accelerated to 3.5% last month on the back of higher energy and services prices. This rise was more than the 3.3% expected and the highest since January 2024. Sterling hit a 3-year high against the dollar ($1.3430) and traders pared bets on the Bank of England easing to just one more cut this year.

Source: Bloomberg

Company News

Yesterday afternoon, Home Depot released fiscal Q1 results that were pretty much in line with market expectations and provided a reassuring update on the impact of tariffs. Guidance for the full year was reaffirmed, and, in response, the shares were little changed during yesterday’s trading session.

Home Depot is the world’s largest home improvement retailer, with more than 2,350 stores across North America. The typical store today averages more than 100k square feet of indoor retail space, interconnected with an e-commerce business that offers more than one million products for the DIY customer, professional contractors, and the industry’s largest installation business for the Do-It-For-Me customer. The company generated revenue of almost $160bn in 2024 in what is a large and fragmented $1 trillion addressable market. It is viewed by many as the best-in-class-operator. Last year, the company increased investment in its supply chain after acquiring Texas-based SRS Distribution.

In the three months ended 4 May 2025, the company generated results in line with management expectations, despite unfavourable weather in February and unplanned pressure from foreign exchange rates.

Net sales rose by 9.4% to $39.9bn, a touch above the market expectation of $39.3bn. On a comparable basis sales were down 0.3%, while the US was up 0.2%

The momentum in the business during the back half of 2024 continued into the first quarter, with customers taking on smaller home improvement related projects. However, the higher interest rate environment continues to pressure larger remodelling projects. 6 of the group’s 16 merchandising departments posted positive results including: appliances, plumbing, indoor garden, electrical, outdoor garden, and building materials.

The number of customer transactions was 395m, down 0.5% in comparable terms, with average ticket spend little changed at $90.71. Inflation from core commodity categories was positively impacted the average ticket by approximately 30 basis points, driven by inflation in lumber and copper.

The gross margin fell by 35 basis points to 33.8%, reflecting a change in mix as a result of the SRS acquisition, partially offset by benefits from lower shrink and supply chain productivity. Adjusted operating margin fell from 14.1% to 13.2%. Adjusted diluted EPS fell by 3.0% to $3.56, slightly below the consensus forecast of $3.60.

With an eye on tariffs, the company provided an update on its global sourcing strategy. At present, more than 50% of the group’s purchases are sourced in the US. The vast majority of supplier partners have developed diversified sourcing strategies across several countries, including the US, and as a result, Home Depot anticipates that 12 months from now, no single country outside of the US will represent more than 10% of its purchases.

For the full year, the group still expects comparable sales to grow by 1%, an operating margin of 13.4%, and adjusted diluted EPS to fall by 2%.

Source: Bloomberg

Currys has released a trading update in which it nudged up its full-year profit guidance and confirmed the resumption of dividend payments. However, the shares are little changed in early trading, possibly due to the reduced prospect of interest rate cuts following today’s UK inflation print.

Currys is a leading multichannel retailer of technology products and services, operating online and through 708 stores in six countries. As a result, the group is well placed to supply the technology that has become ever more central to people’s lives. In the UK & Ireland, the group trades as Currys, and in the Nordics under the Elkjøp brand.

Today’s statement highlights that in the financial year to 3 May 2025, like-for-like (LFL) sales rose by 2%. In the more recent 17-week period, LFL sales rose by 4%.

In UK & Ireland, adjusted operating profit (EBIT) for the full year is expected to be in line with the consensus forecast of £152m. The business has seen continued robust trading over the last 17 weeks, with LFL sales up 4%. Sales growth and gross margin improvements have more than offset cost increases.

In the Nordics, the group has generated strong growth in adjusted EBIT, with the currency neutral performance in-line with expectations. Growth accelerated to 3% in the final 17 weeks of the year, despite a still challenging consumer environment, and the gross margin further improved with cost inflation tightly controlled.

For the full year to 3 May 2025, the group now expects adjusted PBT to be around £162m, up 37% year on year, versus previous guidance of around £160m, helped by lower interest costs.

The group has enjoyed significant growth in free cash flow, benefitting from lower interest costs and tight working capital management and, as a result, finished the year with net cash of more than £180m. This robust performance underpins the Board’s intention to resume cash dividends.

Source: Bloomberg