Morning Note: Market news and updates from Barrick Mining and Spirax Group.

Market News

President Trump extended a suspension of tariffs on Chinese goods for another 90 days. The executive order may clear the path for the president to meet with Xi Jinping in late October. Meanwhile, China urged local firms to avoid using Nvidia’s H20 chips, complicating Donald Trump’s AI chips deal. Gold settled down 2.5% as Trump confirmed gold will not be tariffed – it currently trades at $3,355 an ounce.

Ahead of today’s US inflation reading, the 10-year Treasury yields 4.29%. Core CPI is expected to have risen by 3% in July from the prior year, the biggest increase since February. Such a reading would push against an interest rate cut, Bloomberg Economics said.

US equities drifted lower last night – S&P 500 (-0.3%); Nasdaq (-0.3%) – while in Asia this morning, Japan was the standout performer, with the Nikkei 225 (+2.3%) hitting another all-time high. Other Asian markets were also firm: Hang Seng (+0.3%); Shanghai Composite (+0.5%).

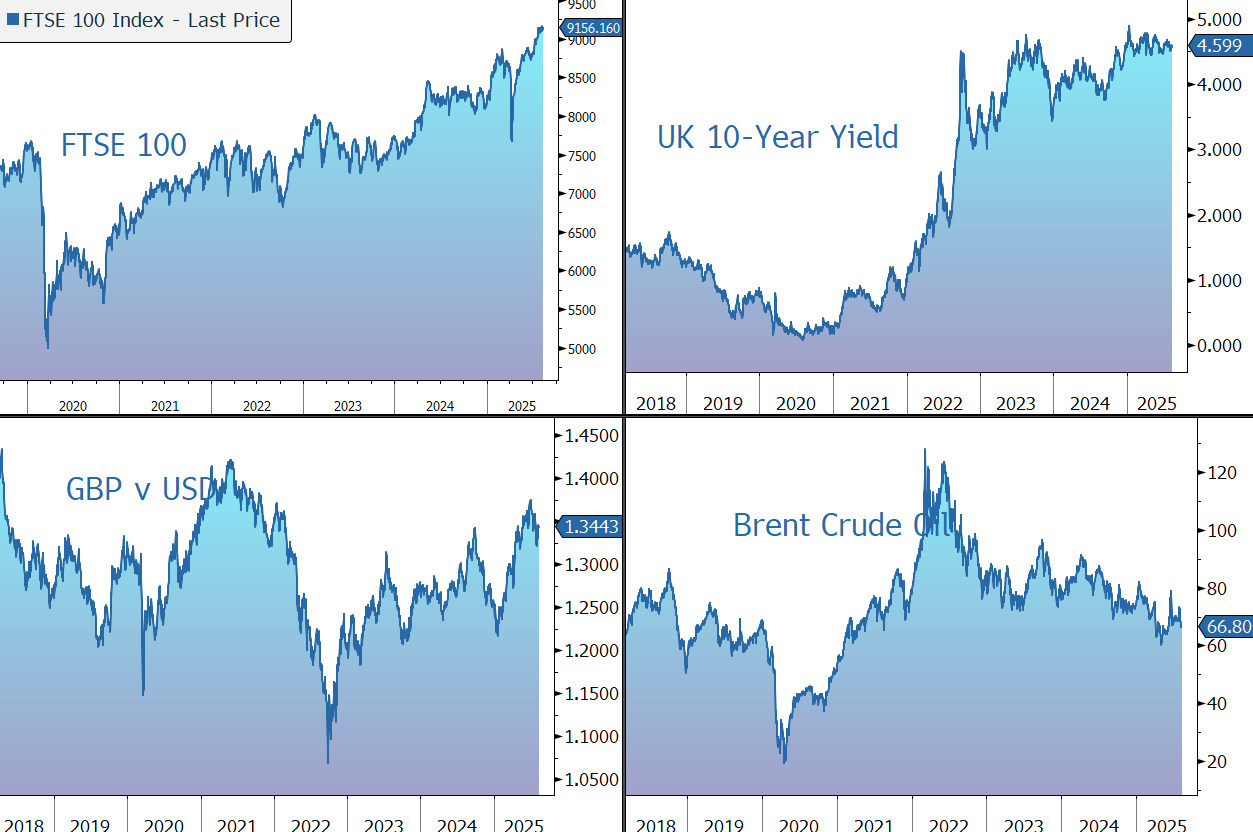

The FTSE 100 is currently 0.3% higher at 9,156. Sterling rose to $1.3477 and €1.1575 after the release of UK jobs data. Wage growth eased slightly to 4.8% in the three months to June from 4.9%. The unemployment rate also held steady at 4.7%. Retail rose 2.5% last month compared with a year ago, the BRC said. The primary driver was a 3.9% rise in food sales, fuelled by warm weather and a packed sporting schedule.

Brent Crude recovered some of its recent losses to trade up at $66.70 a barrel. OPEC+ may pause output hikes after September to assess the effect of rising supply on the oil market, Bloomberg Intelligence said.

Source: Bloomberg

Company News

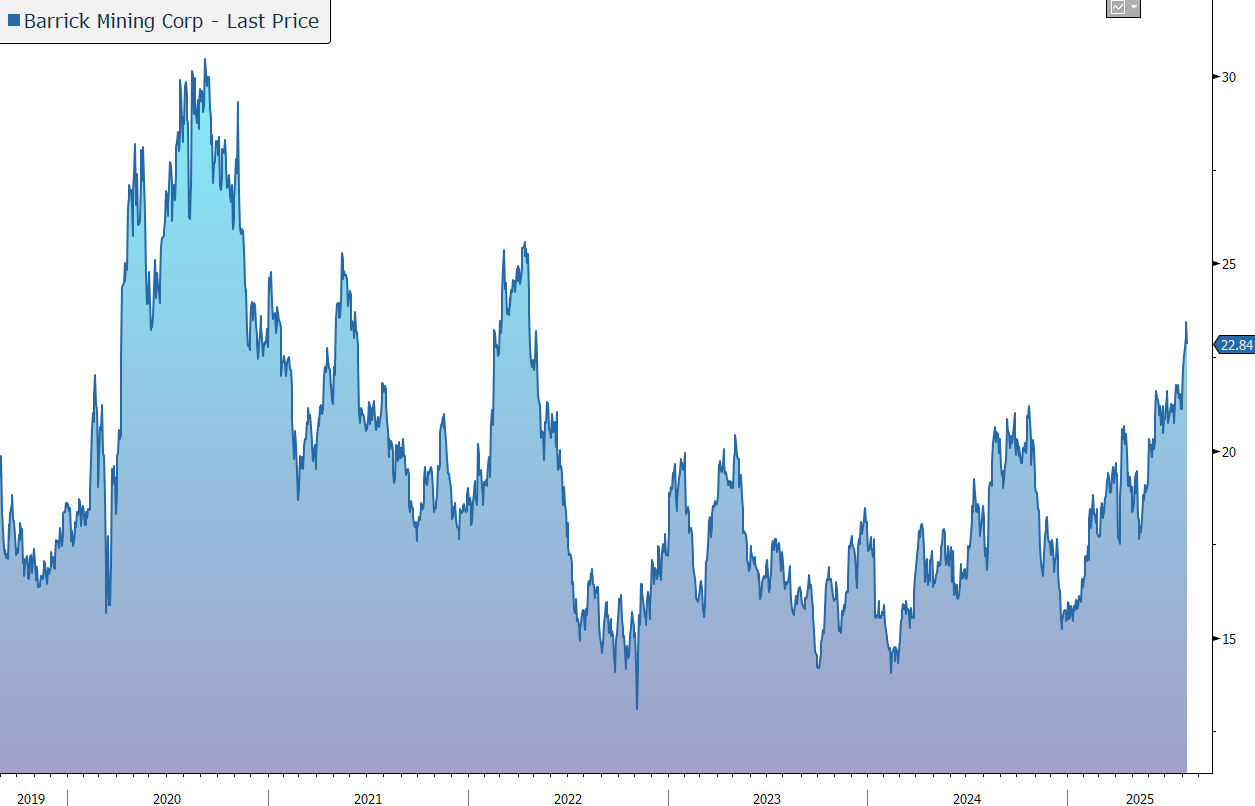

Yesterday lunchtime, Barrick Mining Corporation released Q2 results which were ahead of market expectations as the company benefitted from a higher gold price and progress on its strategic growth objectives. The company maintained its full-year production guidance and declared an enhanced dividend payout. Although we believe the outlook for the gold price is positive, it was marked down by $50 an ounce yesterday on hopes of a positive outcome from the forthcoming Trump-Putin talks in Alaska. It was for this reason that the shares were marked down by 3% during yesterday’s session.

Barrick Mining Corp. is the world’s second largest gold producer. The company was created following the 2018 merger of Barrick Gold and Randgold Resources. In addition, in 2019, the group improved its portfolio through the formation of the Nevada Gold Mines joint venture with Newmont, providing exposure to the single largest gold-mining complex in the world.

As a result, the group operates mines and projects in 18 countries in North and South America, Africa, Papua New Guinea, and Saudi Arabia. It now owns six of the industry’s Top 10 Tier One gold assets with the largest reserve base among its senior gold peers. At the end of 2024, attributable gold reserves were 89m ounces, with 10-year mine plans based on reserves and geologically understood resource extensions. Non-core assets are being sold – in June, the group completed the $1bn disposal of its 50% interest in the Donlin Gold Project.

Overall, Barrick provides an attractive way to gain exposure to the gold price, albeit with the operational and political risks that come with a production company. The company is also well positioned to capitalise on global decarbonisation trends driving the long-term fundamental strength of copper with two world-class projects set to deliver into a rising price and demand market.

In the second quarter of 2025, revenue grew by 16% to $3,681m, versus consensus of $3.5bn, while adjusted net EPS rose by 47% to 47c, ahead of the market consensus of 45c.

Gold production was up 5% versus Q1 to 797k ounces, although at the top-end of guidance, leaving the company on track to deliver on its full-year production guidance which has been reiterated. Nevada Gold Mines led the group’s gold performance, with production increasing 11% quarter-on-quarter.

The gold price has rallied this year on global geopolitical risks, macroeconomic uncertainty caused by tariffs, and central bank bullion buying. During the second quarter, Barrick realised a gold price of $3,295 per ounce, up 41% versus last year.

Barrick has the lowest total cash cost position among its senior gold peers, although in the latest quarter, all-in sustaining costs were up 12% to $1,684/ounce. That said, cost per ounce were 5% below the previous quarter and are expected to trend lower over rest of year driven by higher production.

Group copper production rose by 37% to 59k tonnes, with a realised price down 4% to $4.35/pound. All-in sustaining costs were down 21% to $2.90/pound. Production is now tracking towards the upper end of the full-year range.

The group generated free cash flow of $395m, up 16%, and ended the quarter with a net cash position of $73m. This leaves the group with the flexibility to manage its business and take advantage of new opportunities independent of the vagaries of the capital markets.

During the quarter, the company significantly advanced several key growth projects. In addition, Barrick continued to strengthen its long-term growth foundation through reserve replacement and exploration. Capital investment was up 14% to $934m, leaving the group on target for its full-year guidance of $3.1bn-$3.6bn.

In addition to a quarterly base dividend, a performance dividend is paid based on the amount of cash, net of debt, on the balance sheet at the end of each quarter. Today, the group has declared a payout of 15c for the quarter which includes a 5c performance dividend. Barrick is also undertaking a share buyback program in order to capture embedded value in business and growth pipeline. During Q2, $268m shares were repurchased under the current $1bn program.

The company has reiterated its guidance for the full year: gold production of 3.15m-3.50m ounces with all-in sustaining costs of $1,460-$1,560 an ounce; copper production of 200ktm–230kt pounds with all-in sustaining costs of $2.80-$3.10 a pound. The group is assuming an average gold price of $2,400/oz – it is currently $3,350/oz – and discloses that a $100/oz move has a $450m impact on cash flow. The group is assuming an average copper price of $4.00/pound – it is currently $4.42/pound – and discloses that a 25c/pound move has a $120m impact on cash flow.

By the end of 2030, the group is still targetting more than 7.0m ounces of GEO, up 30% driven by the organic project pipeline and continued reserve replacement.

Source: Bloomberg

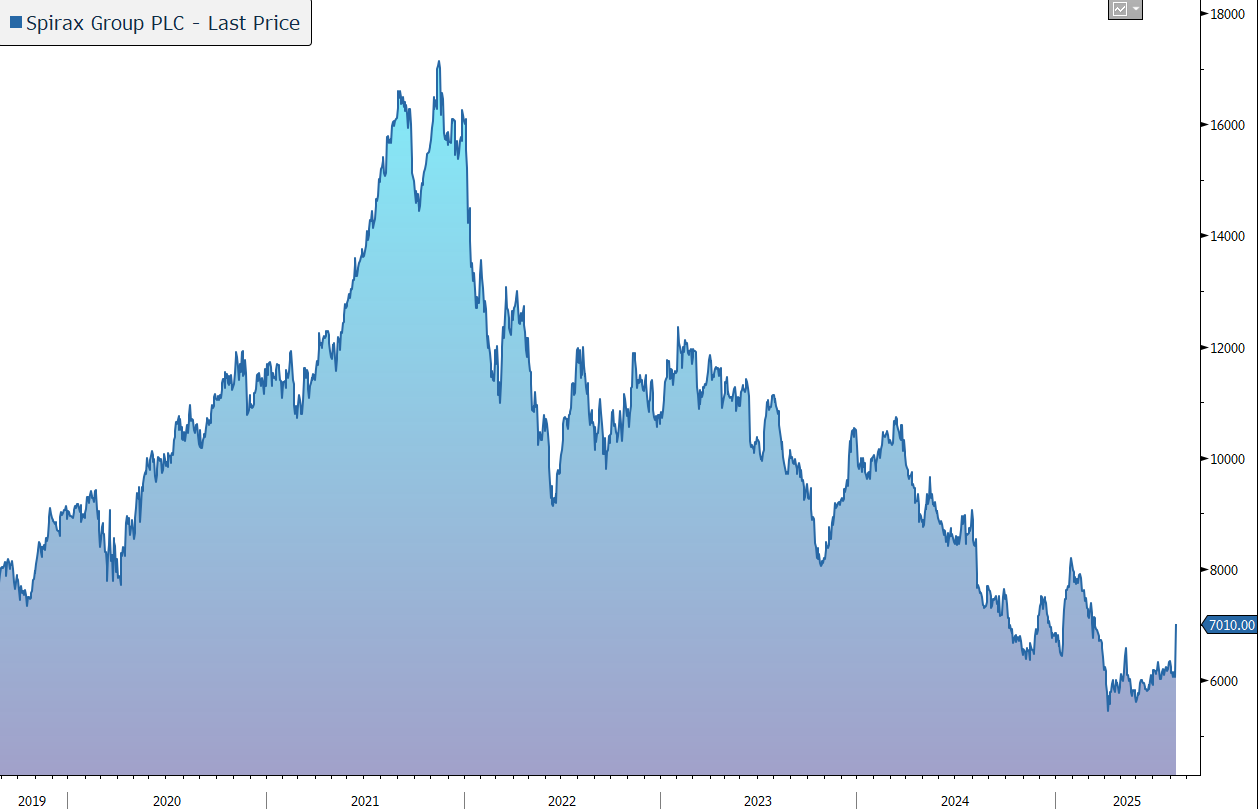

Spirax Group has released its results for the first half of 2025. Despite the challenging macroeconomic environment, the company generated a resilient sales performance and enhanced its margin. Guidance for the full-year was confirmed, with sales growth expected to accelerate in the second half. In response, the shares are up 15% in early trading.

Spirax (formerly Spirax-Sarco Engineering) is a UK-listed industrial company, with annual sales of £1.7bn. The group is a world leader in each of its three businesses. In Steam Thermal Solutions (52% of revenue), Spirax Sarco and Gestra are leaders in the control and management of steam. In Electric Thermal Solutions (24%), Chromalox and Thermocoax provide electrical process heating and temperature management solutions. Finally, Watson-Marlow Fluid Technology (24%) provides niche peristaltic pumps and associated fluid path technologies.

The group’s products are used in almost every industry worldwide: from the food sector where steam products are used in blanching, baking, packaging, and cleaning; to the pharmaceutical industry where pumps and associated fluid path equipment are critical to the production of life-saving medicines; through to the aviation industry where electrical heating elements are used in the de-icing of aeroplanes.

85% of revenue is generated from maintenance and operational (opex) budgets rather than capital (capex) budgets. Of that 85%, 50% comes from essential repair and maintenance activities, while 35% comes from small projects that improve existing systems. As a result, the group has a long history of stable, sustainable growth and strong profitability.

However, in response to a weaker macroeconomic environment, the group took early action across all three businesses to appropriately right-size capacity and overhead support costs, as well as implementing temporary cost containment actions and reducing variable compensation. In January 2025, the company initiated a restructuring programme that is expected to realise annualised savings of approximately £35m, with 40% achieved in 2025. Most of this will be reinvested in organic growth initiatives.

In the first half of 2025, the group continued to face a challenging macroeconomic environment. IP in key markets such as Germany, France, Italy, and the UK, contracted and IP in the US remained weak. Trading conditions in China remained challenging with customers reducing large project expenditure. In Korea, customers temporarily deferred capital investment decisions as a result of political instability. As expected, currency headwinds impacted revenue (by 3%) and adjusted operating profit (by 7%). In organic terms, first half revenue grew by 3% to £822m, versus of global IP of 2.5% and IP excluding China of 1.7%.

Within the Steam Thermal Solutions business, sales were flat in organic terms, with strong growth in MRO and solution-sales offset by the anticipated weakness in large projects in China and Korea. Excluding the latter impact, growth was 3%.

Sales in the Electric Thermal Solutions business were up 10% organically, driven by further operational progress and improved demand from Wafer Fabrication Equipment manufacturers (Semicon).

Watson-Marlow organic sales grew by 2%, supported by growth in Process Industries well ahead of IP. Order growth in excess of 10% from Pharmaceutical & Biotechnology customers (Biopharm) is expected to drive higher H2 sales growth.

The group’s adjusted operating profit margin rose by 70 basis points in organic terms to 19.3% with cost inflation and tariff impacts offset by continued pricing discipline. As a result, adjusted operating profit grew by 7% in organic terms to £158.8m.

The group is financially robust, with adjusted cash conversion rising from 53% to 61%, reflecting capital discipline and working capital efficiency. Net debt ended the half-year at £658m, with gearing of 1.8x net debt to EBITDA. The group has a strong track record of dividend growth, with 56 years of progress. An interim payout of 48.9p has been declared for the first half, up 3%. A similar rate of growth at the full-year stage would generate a yield of 2.8%.

Looking ahead, while IP forecasts have been revised down for the remainder of the year, the company has reiterated its full-year guidance supported by strong order books going into the second half, increasing demand from key end markets, and ongoing delivery of operational priorities. The company continues to anticipate organic growth in revenue consistent with that achieved in 2024 and well ahead of IP, with an acceleration in the second half. Group adjusted operating profit margin is expected to be ahead of the currency adjusted 19.4% in 2024, driving mid-single digit organic growth in adjusted operating profit. Cash conversion is expected to continue to improve to above 80%.

Over the medium term, the aim is to grow ahead of underlying markets, with high-single digit profit growth delivered through mid-single digit organic sales growth and an improving margin reaching between 22% and 23%. This will drive cash conversion of over 80% and an improving return on capital.

Source: Bloomberg