Morning Note: Market News and Update from Bunzl.

Market News

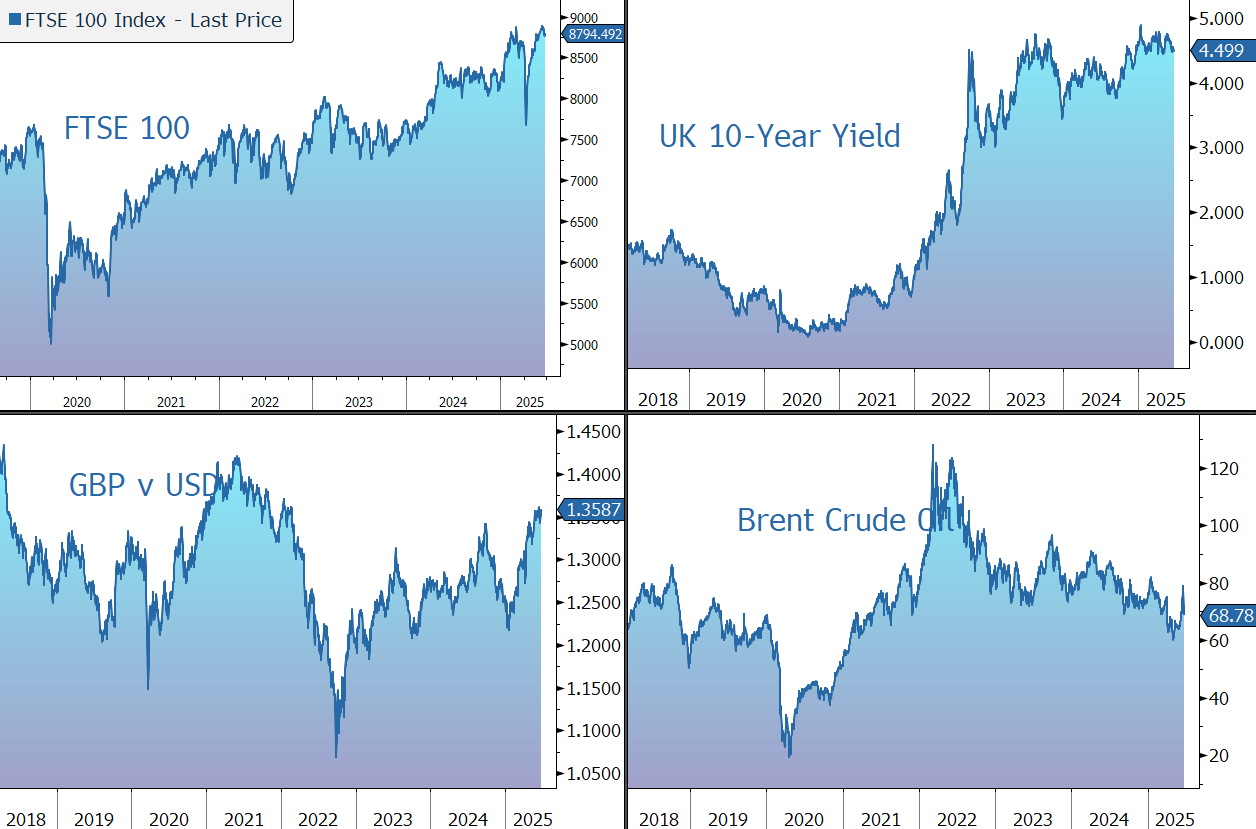

Brent Crude dropped 10% to settle back below $70 a barrel and stocks gained after Donald Trump said Israel and Iran had agreed to a ceasefire. Tehran said no agreement has been made but that it would halt fighting if Israel stops. Israel hasn’t responded publicly. A gauge of the dollar dropped, while gold fell back to $3,320 an ounce.

US equities moved higher last night – S&P 500 (+1.0%); Nasdaq (+0.9%) – with the buoyant mood continuing in Asia this morning: Nikkei 225 (+1.2%); Hang Seng (+1.6%); Shanghai Composite (+1.1%). The PBOC set the strongest yuan fixing since November as the dollar fell.

The FTSE 100 is currently 0.4% higher at 8,794. Oil stocks have been marked down – BP (-5%); Shell (-4%) – while airline and hotel shares are trading higher. Sterling trades at $1.3585 and €1.1710.

Federal Reserve Chair Jerome Powell testifies before a House committee today as investors look for signals on the central bank’s policy outlook. Ahead of the testimony, President Trump said rates should be “at least two to three points lower. In the meantime, Austan Goolsbee said the Fed should cut if “dirt in the air” from tariffs clears. The 10-year Treasury currently yields 4.34%. In Europe, Francois Villeroy told the FT the ECB could still cut rates despite oil market volatility.

NATO leaders meet as Mark Rutte tries to prevent others from following Spain in breaking ranks over a 5% defence spending target. The UK is expected to commit to that level today.

Source: Bloomberg

Company News

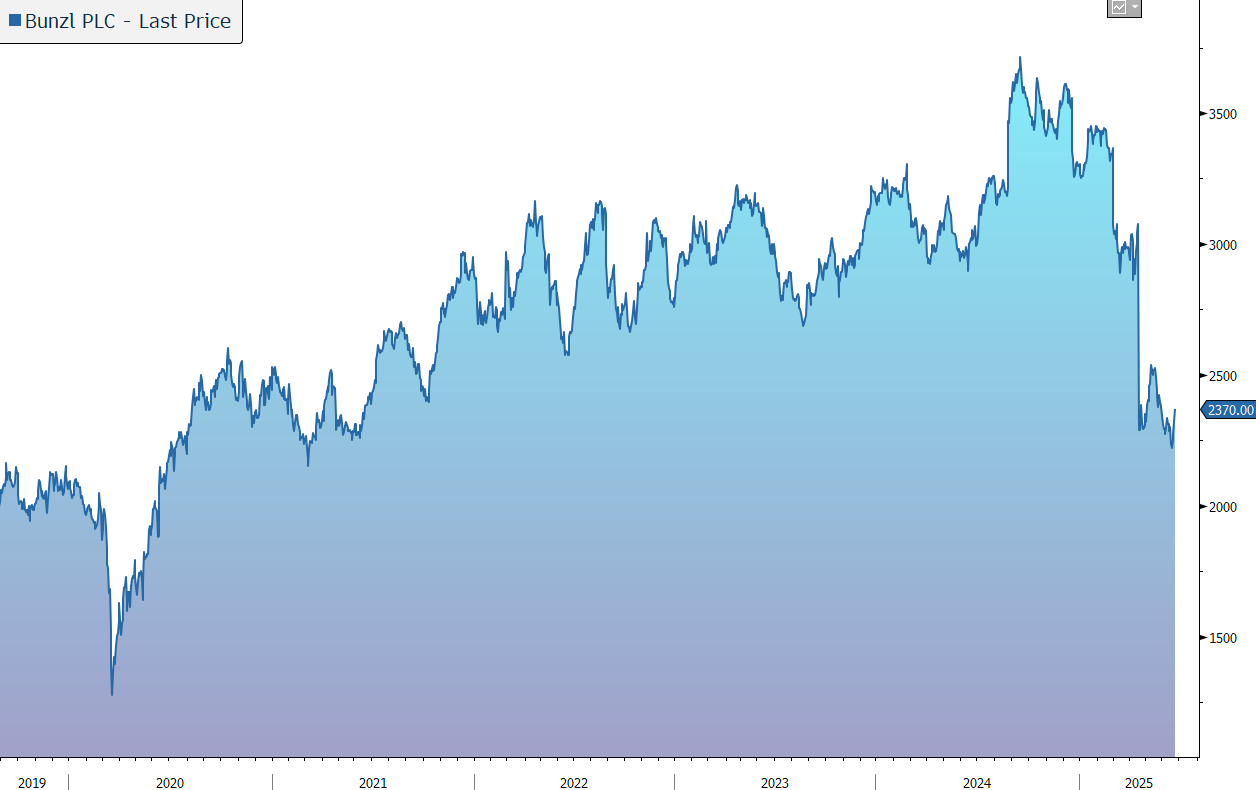

Bunzl has this morning updated the market prior to entering its closed period for the six months ending 30 June 2025. The statement highlights that trading is in line with expectations and guidance for the full year has been reiterated. In response, the shares have been marked up by 2% in early trading.

Bunzl is a specialist international distribution and services group. The company provides an efficient and cost effective one-stop-shop solution to enable its customers to reduce or eliminate the ‘hidden’ costs of sourcing and distributing a broad range of goods that are essential to the successful operation of their businesses but which they do not themselves resell – think disposable tableware, rubber gloves, and plastic trays. The strategy is to expand the business through organic growth, consolidating markets through focused acquisitions, and continuously improving operating efficiency. The group is also supporting customers looking to transition towards packaging better suited to the circular economy, with around half of Bunzl’s packaging sales made from alternative materials. The group now processes around three quarters of orders digitally, supporting customer retention and enhancing operational efficiency.

Back in April, the group warned of a more challenging economic backdrop. In response, the company lowered its full-year guidance, reduced its borrowing target, and halted its share buyback programme. At the time, the shares were marked down by 25%.

Today’s statement highlights that the macroeconomic backdrop remains uncertain and the group is trading in-line with management expectations. Actions are underway to improve performance in the group, particularly in its largest business in North America and in Continental Europe.

In the first half of the year, group revenue is expected to be approximately 4% higher than the prior year, at constant exchange rates, and up to 1% higher at actual exchange rates. Growth is expected to be driven by acquisitions, net of disposals, and with broadly flat underlying revenue over the period.

Group operating margin is expected to be in line with previously published guidance at around 7.0%, with the expected adjusted operating profit decline also in line with expectations.

Looking to the full year, the group continues to expect moderate revenue growth in 2025, at constant exchange rates, driven by announced acquisitions and broadly flat underlying revenue. Group operating margin for the year is expected to be moderately below 8.0%, compared to 8.3% in 2024. The group’s second half operating margin is seasonally higher and expected to benefit from actions taken.

Given the macroeconomic uncertainty, the company believes it is prudent to be around the lower end of its target leverage range of 2.0x to 2.5x adjusted net debt to EBITDA. At the end of June, leverage is expected to be around 2.0x. The buyback programme was paused in April, with £115m of shares purchased up to that point.

The company has continued to supplement growth through bolt-on acquisitions – three deals have been made this year and the pipeline remains active. Most recently, in May, Bunzl signed an agreement to acquire Solupack, a Brazilian distributor of own brand packaging solutions to the food industry. In 2024 the business generated revenue of c.£15m, and alongside the existing business will enhance the group’s offering to customers.

Source: Bloomberg