Morning Note: Market news and results from Nvidia and Halma.

Market News

US equities ticked higher last night – S&P 500 (+0.4%); Nasdaq (+0.6%) – and continued to rally after hours following the release of positive results from Nvidia (see below). At the same time, White House officials are urging members of Congress to oppose a bill limiting Nvidia’s ability to sell AI chips to China and other adversary countries, according to people familiar. Alphabet also rose after a wave of positive reviews for the newly released version of Google’s Gemini AI model.

In Asia this morning, the positive momentum continued across most markets, with tech-heavy Japan (Nikkei 225 +2.7%), Taiwan, and South Korea leading the gains. However, the Hang Seng (flat) and Shanghai Composite (-0.4%) underperformed. China left benchmark lending rates unchanged for the sixth straight month. It is also considering new measures to revive its struggling property market, including the unprecedented step of offering nationwide mortgage subsidies to first-time homebuyers.

Minutes from the FOMC’s last meeting confirmed the policymakers’ growing division on the appropriate level for interest rates, with key members suggesting that higher inflation may warrant a hold in December. Bets of a hold next month also increased after the BLS stated it would only release November jobs data after the FOMC’s decision. The 10-year Treasury yield ticked up to 4.13%, while gold drifted to $4,060 an ounce,

The FTSE 100 is currently 0.7% higher at 9,568., while Sterling trades at $1.3066 and €1.1340. Brent Crude fell more than 2% to $63.80 per barrel after reports indicated the US is pushing to end the Russia-Ukraine war. A Ukrainian official said Kyiv received “signals” of US proposals to end the Russia-Ukraine war, raising hopes of renewed diplomacy. Russia, meanwhile, said sanctions on Rosneft and Lukoil have not harmed its output.

Source: Bloomberg

Company News

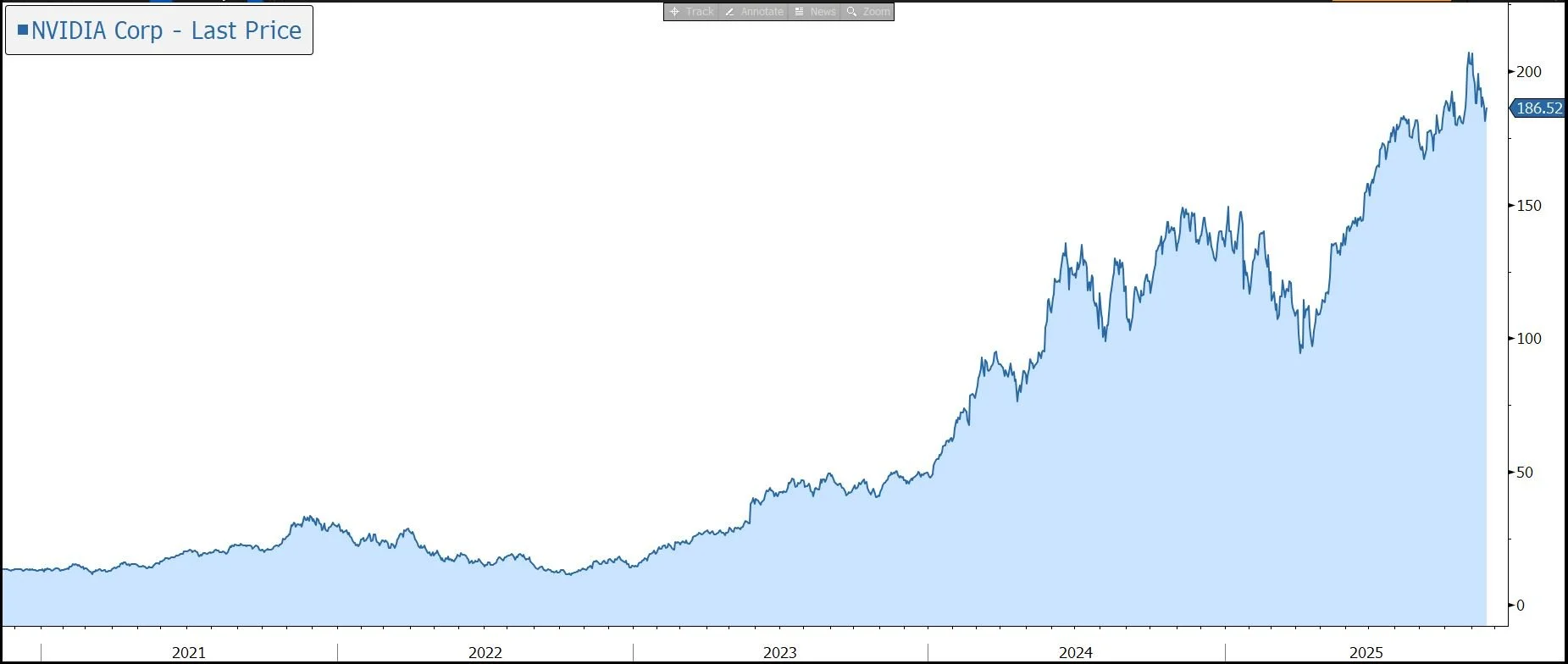

Last night NVIDIA released results for the three months to 31 October 2025, the third quarter of its financial year to January 2026. The figures came in above expectations and guidance for revenue in the current quarter was above the market forecast. The announcement eased concerns about an AI bubble and in response the shares moved up 5% in after-hours trading.

NVIDIA is one of the world’s largest semiconductor companies, with a leading market share in Graphics Processing Units (GPUs). From its original focus on PC graphics, the company has expanded to several other large and important computationally intensive fields, leveraging its GPU architecture to create platforms for scientific computing, AI, data science, autonomous vehicles, robotics, metaverse, and 3D internet applications.

The company is benefitting as data centres make a platform shift from general computing, primarily using central processing units (CPUs), to accelerated computing, primarily using GPUs, which brings significant improvements in performance, energy efficiency, and cost.

Accelerated computing’s ability to significantly speed up machine learning and to deal with large data sets has enabled the development of generative artificial intelligence (AI), which offers human-like computing performance. This is driving significant investment in new enterprise applications, which is in turn driving new demand for accelerated computing.

In the latest quarter, Nvidia’s revenue rose by 62% to $57bn, above the company guidance of $54bn, plus or minus 2%, and the market forecast of $55bn. We note the result was 22% higher than the previous quarter.

The vast majority (90%) of revenue is generated in the Data Centre division, with around half derived from cloud service providers and the remainder from consumer internet and enterprise companies. During the quarter, revenue increased by 66% to $51.2bn, driven by three platform shifts: accelerated computing, powerful AI models, and agentic applications

Blackwell sales are ‘off the charts’ and cloud GPUs are sold out. The company announced a strategic partnership with OpenAI to deploy at least 10 gigawatts of NVIDIA systems for OpenAI’s next-generation AI infrastructure.

The smaller divisions performed as follows: Gaming (+30% to $4.3bn); Professional Visualisation (+56% to $760m); and Automotive and Robotics (+32% to $592m).

The gross margin is high. In the latest quarter, it fell from 75.0% to 73.6%, in line with the group’s guidance of 73.5%, plus or minus 50 basis points. However, the margin increased sequentially as Blackwell ramped with an improved mix and cost structure. Operating expenses rose by 38% to $4.2bn, primarily driven by compute and infrastructure costs and higher compensation and benefits due to compensation increases and employee growth. EPS rose by 60% to $1.30, ahead of the market forecast of $1.25.

The business is very cash generative, with free cash flow of $22bn in the three months to 31 October. The company’s balance sheet is very strong, with net cash of $52bn at the end of the quarter. The cash is being used, in part, for shareholder returns, including $12.5bn in share repurchases in the latest quarter. As of the end of the recent quarter, the company had $62.2bn remaining under its share repurchase authorisation. The company also pays a dividend, with a payout of $243m for this quarter.

For the current quarter, the company is guiding to revenue of $65bn, plus or minus 2%. This was ahead of the consensus expectation of $61.7bn. A gross margin of 75.0%, plus or minus 50 basis points is forecast, and operating expenses of $5.0bn.

Source: Bloomberg

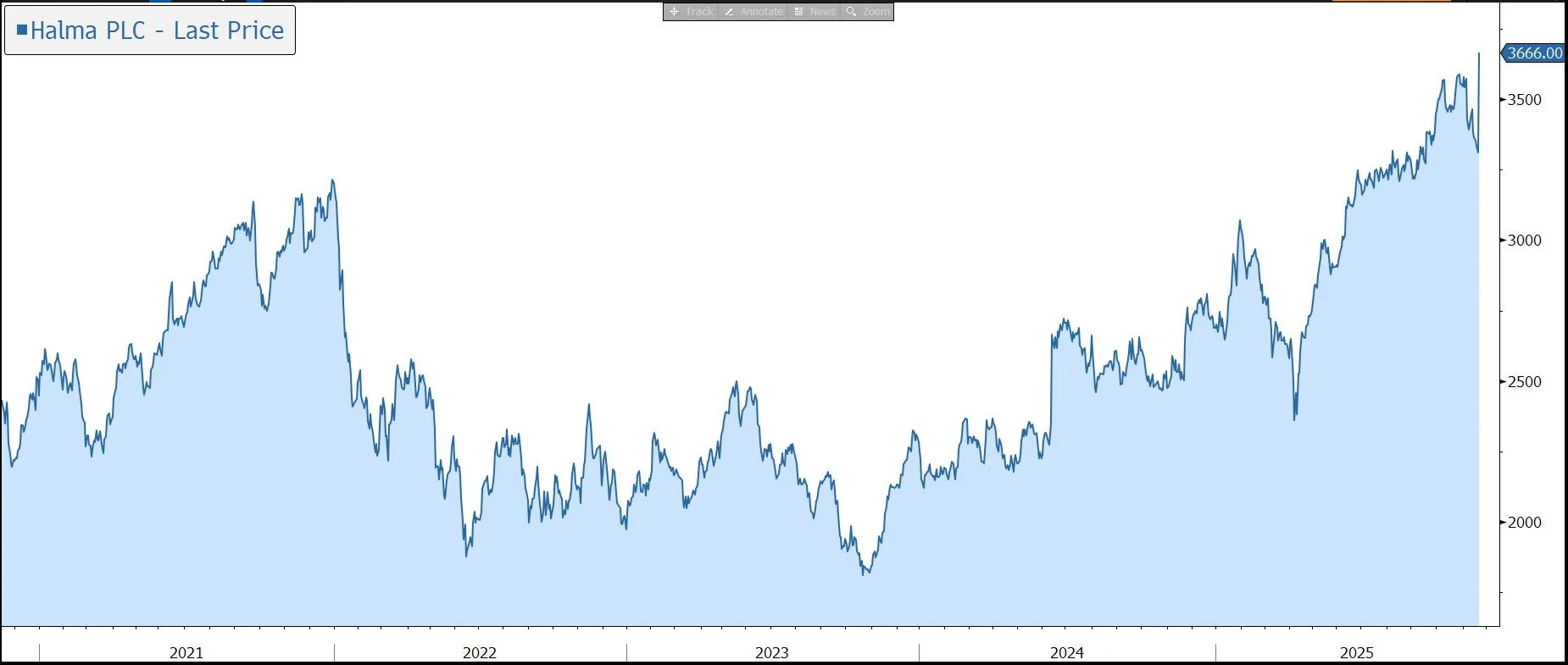

Halma has today released results for the financial half-year to 30 September 2025. The results were ahead of expectations driven by premium growth in photonics within the group’s Environmental & Analysis division. In response, the company has once again raised its guidance for the full year and raised its half-year dividend by 7%. The shares have been marked up 10% in early trading.

Halma is a global group of 50 or so life-saving technology companies, with a focus on safety, health, and the environment. The group’s technology is used to save lives, prevent injuries, and protect people and assets across a broad range of sectors including commercial and public buildings, utilities, healthcare/medical, science/environment, process industries, and energy/resources.

Products include control panels for fire safety systems, corrosion monitoring systems, gas detection systems, and moisture control systems, and blood pressure monitoring systems.

The main growth drivers include increasing health and safety regulation, demand for healthcare from an ageing population, and demand for life-critical resources. Strong market positions deliver upgrade and replacement sales opportunities as customers seek to maintain regulatory compliance and conform with best practice. As a result, customer spending is often non-discretionary and drives sustained demand throughout the economic cycle. Over time, this has driven consistent profit growth and shareholder returns.

During the latest six months, the company has made strong progress against a backdrop of varied market conditions and a challenging economic and geopolitical environment.

Revenue grew by 15.2% to £1,237m, helped by a 0.8% contribution from M&A, offset by a 3.2% currency headwind. The organic increase was 17.6%, with price increases of 1%-2%, in line with the group’s typical historical range, offsetting cost inflation. Excluding one-off revenue realised from a transaction in the Environmental & Analysis Sector, organic growth was 16.7%, half of which flowed from premium growth in photonics.

The Environmental & Analysis Sector was up by 36.3% in organic terms, driven by very strong growth in the Optical Analysis subsector, primarily driven by photonics, reflecting increased demand from a long-standing customer, who is a “hyperscaler” technology company, for critical solutions that support the ongoing development of its data centre capabilities

Revenue growth in the Safety Sector (+6.4%) was driven by strong growth in the Public Safety and Worker Safety subsectors. In Healthcare, revenue grew by 7.4%, reflecting broad-based growth across the division.

By region, the US, which accounts for 48% of revenue, grew by 25.9%. Elsewhere growth was made up of: UK (+7.4%). Mainland Europe (8.3%), Asia Pacific (17.8%), and other regions (+8.3%).

The adjusted operating margin rose from 20.7% to 22.3%, versus the group’s target range of 19%-23%, and adjusted profit before tax grew by 29% to £270m. The group’s return on total invested capital improved from 14.3% to 16.2% and remains well above its estimated weighted average cost of capital.

Halma has a fantastic dividend track record, having increased the payout by 5% or more every year for the last 46 years. Today, the group has declared a half-year payout of 9.63p, 7% higher than last year.

Cash conversion was 79%, below the group’s target of 90%, although the full-year rate is expected to be more in line with the target. Net debt has moved up from £536m to £641m, although financial gearing is still only 1.03x net debt to EBITDA, well within the target of ‘up to 2x’.

This enables continued investment, both organically and by acquisition, to support continued growth. R&D investment rose by 9% to £59.1m, representing 4.8% of revenue. The group has made two acquisitions in the financial year to date, for consideration of £129m, and has a healthy pipeline.

The group’s companies continue to experience varied conditions in their end markets and the economic and geopolitical environment remains uncertain. However, the company has made a good start to its second half and given current expectations for the remainder of the financial year to 31 March 2026, the company raised its guidance. It now expects to deliver mid-teens organic constant currency revenue growth, versus low double-digit growth previously. The group’s adjusted EBIT margin guidance is now expected to be around 22%, versus previous guidance to be modestly above the middle of the target range of 19-23%.

Source: Bloomberg