Morning Note: Market news and results from Microsoft.

Market News

US equity futures rallied on stronger-than-expected tech earnings – Microsoft (see below) and Meta Platforms both released upbeat results – and signs the Trump administration may be close to announcing the first round of trade deals to reduce planned tariffs. Japan will hold talks with the US today and the EU is said to be planning to present a package next week.

Markets had recovered from early losses triggered by weak US GDP numbers. In Asia this morning, the Nikkei 225 rose by 1.1%. The yen weakened 1% against the dollar after Kazuo Ueda emphasised risks stemming from tariffs. The central bank also cut its GDP forecasts and flagged downside risks to inflation while keeping its key rate at 0.5%.

The FTSE 100 is currently little changed at 8,493. Companies trading ex-dividend today include Glencore (1.53%) and Centrica (1.87%). Sterling trades at $1.3290 and €1.1760.

Gold is trading at around $3,230 per ounce, marking its third consecutive session of losses and hitting its lowest level in two weeks as easing trade tensions dented the metal’s safe-haven appeal. Brent Crude slipped to $61 a barrel.

The US and Ukraine reached a deal over access to Ukraine’s natural resources, a person familiar said. Scott Bessent said on Fox News that the deal is a signal to Russian leadership.

Results are due today from Apple, Amazon, Mastercard, Becton Dickinson, and Eli Lilly. Tesla denied a WSJ report the board is looking for a successor to Elon Musk. Chair Robyn Denholm said the board is highly confident in Musk’s ability to continue in the role and that it was “absolutely false” the board had contacted recruitment firms.

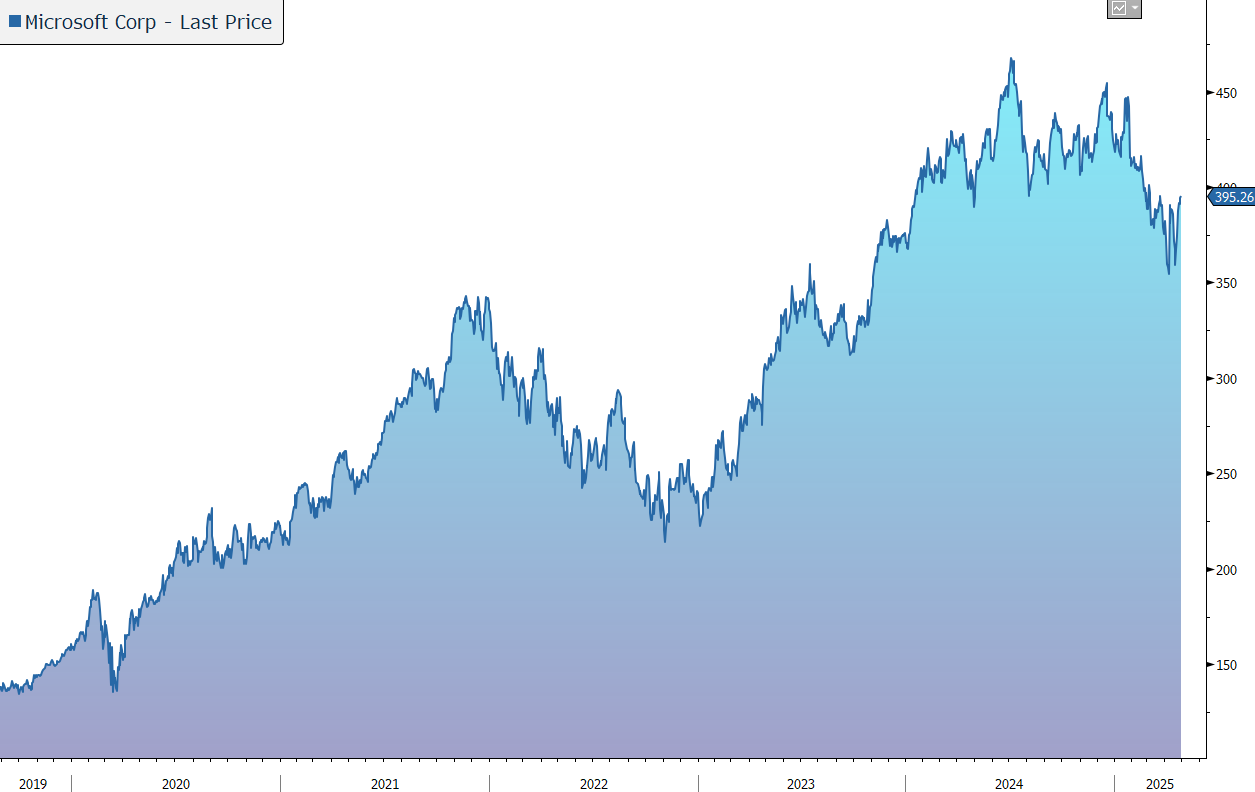

Source: Bloomberg

Company News

Last night, Microsoft released results for the three months to 31 March 2025, the third quarter of its financial year to June 2025, which were ahead of market expectations driven by the group’s cloud and AI offerings. Guidance for the current quarter was better than expected, while capex is expected to grow at a lower rate next year. In response, the shares rose 7% in after-hours trading.

Microsoft is a global leader in consumer and enterprise software, services, devices, and solutions, leaving it well placed to benefit from the ongoing shift to digital technology and several other secular trends including AI. In an inflationary world, digital technology provides a deflationary force to help business offset cost pressures elsewhere. The group’s competitive edge lies in the strength and breadth of its portfolio of resilient and trusted technology which provides unique integration of its cloud-based products and services, covering productivity apps, infrastructure services, security, and communications. The group’s offering includes Windows, Microsoft 365 (formerly Office), Skype, Hotmail, LinkedIn, Bing, GitHub, Surface, Xbox, and OpenAI ChatGPT. Not only are the group’s products designed to work together but, for the customer, it is also more economical to bundle multiple products.

Its portfolio is being continuously enhanced through in-house product development and acquisitions, allowing the company to push through price increases and sell new products and services to a growing base of consumers. In addition, as one of the world’s three largest cloud companies, Microsoft Azure is benefitting from the migration of workloads from on-premise to public cloud platforms, a transition that we believe has further to go. With its stake in OpenAI and its agreement to be their exclusive cloud provider, Microsoft is well placed in the world of AI.

The group operates a user subscription model which generates a visible, long-term annuity revenue stream with high margins and strong cash flow. In FY2024, the company generated revenue of $245bn (up 15%), gross margins of 70%, and operating margins of 43%. Microsoft has a very strong balance sheet and in addition to reinvesting cash back into high growth opportunities and M&A, the company has consistently increased its dividend and is repurchasing its own shares.

During the latest quarter, revenue grew 15% at constant current (CC) to $70.1bn, above the consensus forecast of $68.4bn.

· Productivity & Business Processes generated revenue of $29.9bn, up 13% at CC, versus company guidance of 11%-12%. Growth was driven by Microsoft 365 Commercial Cloud (+15%) and Dynamics 365 (+18%).

· Intelligent Cloud generated revenue of $26.8bn, up 22% at CC, versus the company guidance of 19%-20%. Growth was driven by Azure (+35%). Microsoft Azure’s is outperforming the other cloud providers due to its greater exposure to enterprise and hence, potentially more resilience, and its better positioning around AI workloads.

· More Personal Computing generated revenue of $13.4bn, up 7% at CC. Growth was driven by Search and news advertising revenue (+23%).

Other commercial highlights included 17% growth in commercial bookings and a 98% commercial revenue annuity mix. All cloud revenue growth by 22% to a record $42.4bn, with a gross margin of 69%.

The group gross margin slipped by one percentage point to 69%. Operating expenses grew by 3%, driven by investments in cloud and AI engineering as the group continued to reduce layers with fewer managers. As a result, the operating margin rose by a point to 46%. EPS grew by 19% at CC to $3.46, well above the market forecast of $3.22.

Microsoft spent heavily on capex, $21.4bn in the quarter to support demand in cloud and AI offerings. As a result, free cash flow fell by 3% to $20.3bn and the group ended the period with net cash of $bn. The company is authorised to repurchase up to $60bn in shares, with $3.5bn bought back in the latest quarter. The company also paid out $6.2bn in dividends.

On the analysts’ call, the group provided divisional revenue guidance for the current quarter: Productivity and Business Processes is expected to grow by 11%-12% and Intelligent Cloud by 20%-22%.

We believe in the current environment the company faces a relatively lower level of political risk and should prove more defensive during the current economic uncertainty.

Source: Bloomberg