Morning Note: Market News and an update on copper miner Antofagasta.

Market News

Donald Trump warned he would impose “very severe consequences” if Vladimir Putin didn’t agree to a ceasefire at tomorrow’s summit in Alaska. Trump hopes to set up a quick second meeting that includes Volodymyr Zelenskiy.

Trump said he will name the next Federal Reserve chair a little bit early and added that he was down to three or four potential candidates. Raphael Bostic supports one rate cut this year if the labour market remains solid. Austan Goolsbee said he was uneasy with viewing tariffs as a one-time shock. Fed-dated OIS contracts fully priced in a 25-bp rate cut for September. 10-year Treasury yield slipped to 4.22%, while gold trades at $3,345 an ounce.

US equities finished slightly higher last night – S&P 500 (+0.3%); Nasdaq (+0.1%). The equal-weight S&P posted its best day since late May amid very positive breadth. Small-caps had another standout session. Big tech was mostly lower, though Apple responded well to AI/robotics headlines.

In Asia this morning, stocks declined: Nikkei 225 (-1.4%); Hang Seng (-0.5%); Shanghai Composite (-0.4%). The yen rose the most in almost two weeks after US Treasury Secretary Scott Bessent said he expected Japan to raise interest rates to tame inflation. DeepSeek delayed the release of its new AI model due to Huawei chip issues, the FT reported.

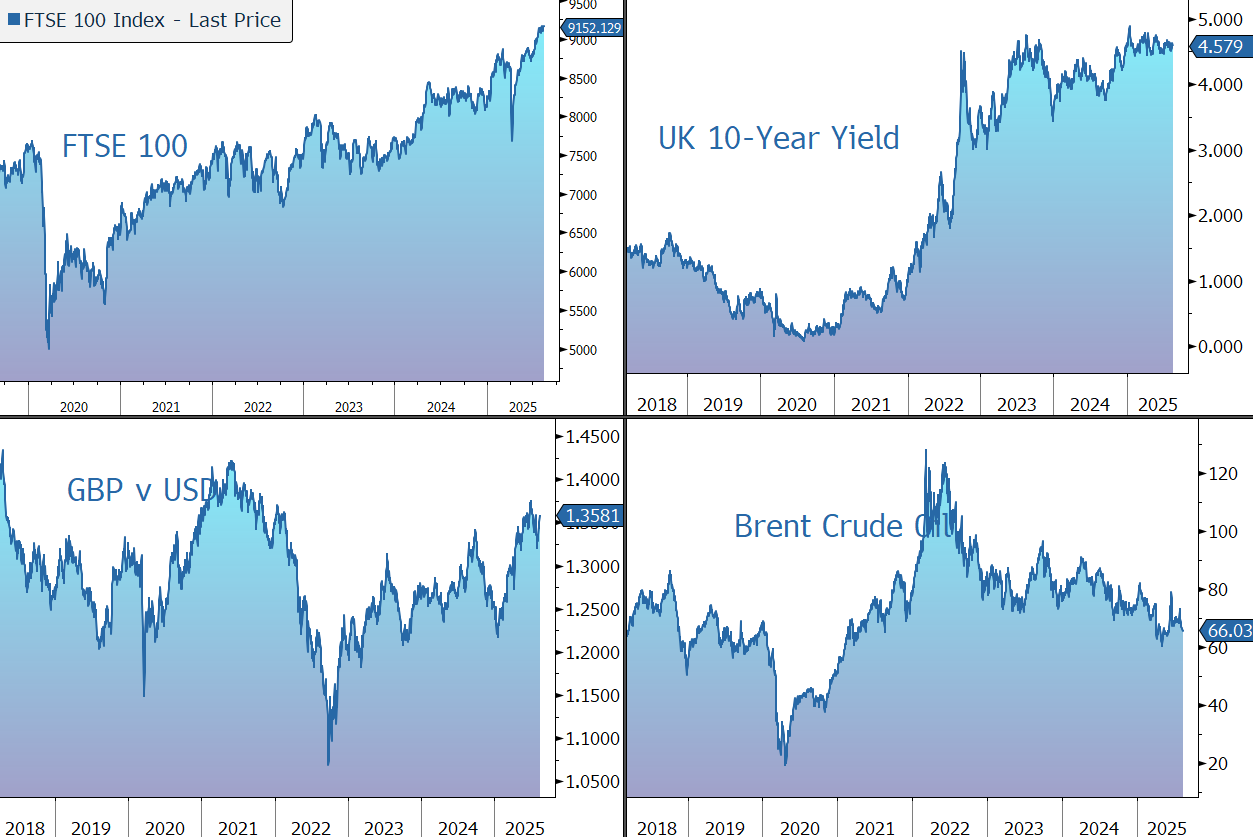

The FTSE 100 is currently little changed at 9,152. The pound rose – $1.3590 and €1.1625 – after the UK economy grew a faster-than-forecast 0.3% in the second quarter, raising the bar to further rate cuts from the Bank of England. The economy was expected to have shrunk by 0.1%. According to the RICS survey of estate agents, UK house prices are falling more widely than at any time in the past year.

Source: Bloomberg

Commodity News

Copper is an amazing metal: it is corrosion resistant, extremely malleable, and an exceptional conductor of heat and electricity, making it a key input for a wide range of technologies including power generation and transmission, motor vehicles, domestic appliances, and industrial machinery. Demand is forecast to grow by between 2% and 3% per annum through to 2030, driven by:

- emerging markets – urbanisation and industrialisation in India and Southeast Asian countries are expected to dominate copper consumption growth as the rate of Chinese demand growth begins to slow. A growing middle class in emerging economies is also boosting sales of copper-rich consumer goods such as electronic devices and cars.

- renewable energy – needed to tackle global warming. Solar and wind technologies need four to six times as much copper as conventional energy mainly owing to the need to connect larger numbers of smaller units to the grid.

- electric vehicles – take-up is being driven by stricter environmental standards to restrict emissions and reduce air pollution. Electric vehicles contain on average more than three times the amount of copper as conventional ones owing to their use in batteries, high-voltage wiring, windings, and rotors. Charging stations will also boost demand.

- AI – the sharp increase in demand for computing power is significantly impacting electricity consumption, particularly in data centres which will require robust power systems, efficient cooling, and high-speed connectivity.

At the same time, the outlook for supply is uncertain. The world’s largest copper mines have all been in production for decades and are in decline. There is plenty of copper ore, but it is of lower grade which means it is more expensive to mine. In addition, new discoveries of copper are declining – most of the good stuff has already been found. In recent years, only a handful of mines have come into production. Furthermore, the industry is increasingly being forced to take on technically complex projects in countries where foreign ownership and exploitation of natural resources are highly sensitive issues. Supply is also being undermined by past and ongoing reductions in maintenance activity and sustaining capital expenditure. Finally, inflation has pushed up costs throughout the supply chain, so that a higher copper price is needed to incentivise production.

Although we believe the long-term outlook for the copper price is positive, we expect periods of volatility and price weakness like we have seen over recent months driven by uncertainty over global economic growth and tariffs, particularly the US tariff exemptions on certain copper products. Refined copper was ultimately excluded from the 50% US import tariffs, a decision that has left traders holding large stockpiles of the metal domestically. Instead, the tariffs will apply to imports of semi-finished copper products such as wires and pipes, while sparing ore, cathodes, and concentrates, the most widely imported forms of copper in the US.

----

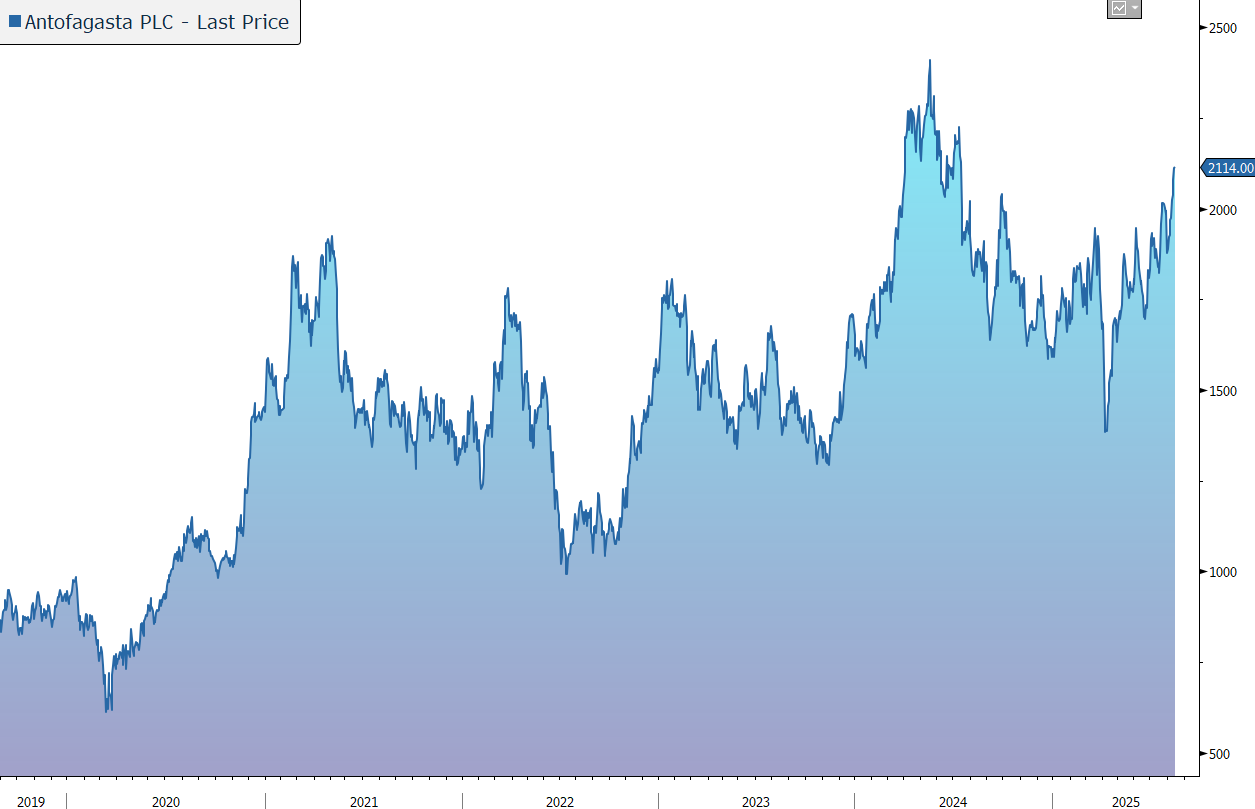

This morning, Antofagasta released results for the first half of 2025 which were in line with market expectations. A 60% increase in earnings was driven by higher production and materially lower costs. Guidance for the full year was reiterated and a dividend more than twice the level of last year was declared. In response the shares are little changed in early trading.

Antofagasta is a FTSE-100 listed mining company based in Chile focused on copper and its bi-products including gold. The company has a significant mineral resource base of more than 21bn tonnes of resources, including more than 6bn tonnes and 5bn tonnes at Los Pelambres and Centinela respectively. The target is to increases output by 30% over the medium-term. The shares provides a way to gain exposure to the copper price, albeit with the operational and political risks involved with the exploration and production.

In the six months to 30 June, copper production was 314,900 tonnes, 11% higher than last year mainly due to higher output from the group’s two concentrators (Centinela Concentrates and Los Pelambres). Copper sales volumes increased by 17%, while the average realised copper price rose by 3% to $4.55/lb.

Gold production rose by 36% to 91,200 ounces, reflecting higher output at both Centinela Concentrates and Los Pelambres. Gold sales rose by 53%, while the average realised gold price was up 41%.

Revenue rose by 29% to $3.8bn, driven by higher production and realised prices. Cash costs before and after by-product credits were $2.32/lb and $1.32/lb, 12% and 32% lower than last year due to increased production.

The group’s Cost and Competitiveness Programme generated savings and productivity improvements of $60m, 90% from operational efficiencies and throughput run time. This was in line with plan to deliver $100m of savings in the full year, and equivalent to 7c/lb of unit cash costs.

EBITDA increased by 60% to $2.2bn, with margins up 12 percentage points to 58.8%, at the top end of global pure-play copper producers and the highest level achieved since 2021.

Capital expenditure rose by 53% to $1,620m, with full year guidance of $3.9bn confirmed as spend increases in the second half. The group proceeded with key projects that provide a strong platform for future growth – full construction of the Centinela Second Concentrator now into its second year of activities. Initial groundworks have commenced at the Los Pelambres desalination plant expansion, and activities continue to advance along the route of the new concentrate pipeline.

Cash flow remains strong, up 22% to $1.8bn, despite an increase in working capital. The group’s balance sheet is very robust, with a net debt to EBITDA ratio at the end of the period of only 0.54x.

In line with its policy to pay out 35% of earnings as dividends, the company has today declared an interim dividend of 16.6c, 110% higher than last year, reflecting management’s confidence in the business.

Full-year production is still expected to be in the range of 660-700,000 tonnes. Given projected production for the full year, cash cost guidance, both before and after by-product credits, is also unchanged at $2.25-2.45/lb and $1.45-1.65/lb respectively.

Source: Bloomberg