Morning Note: Market news and an update from recruiter Page Group.

Market News

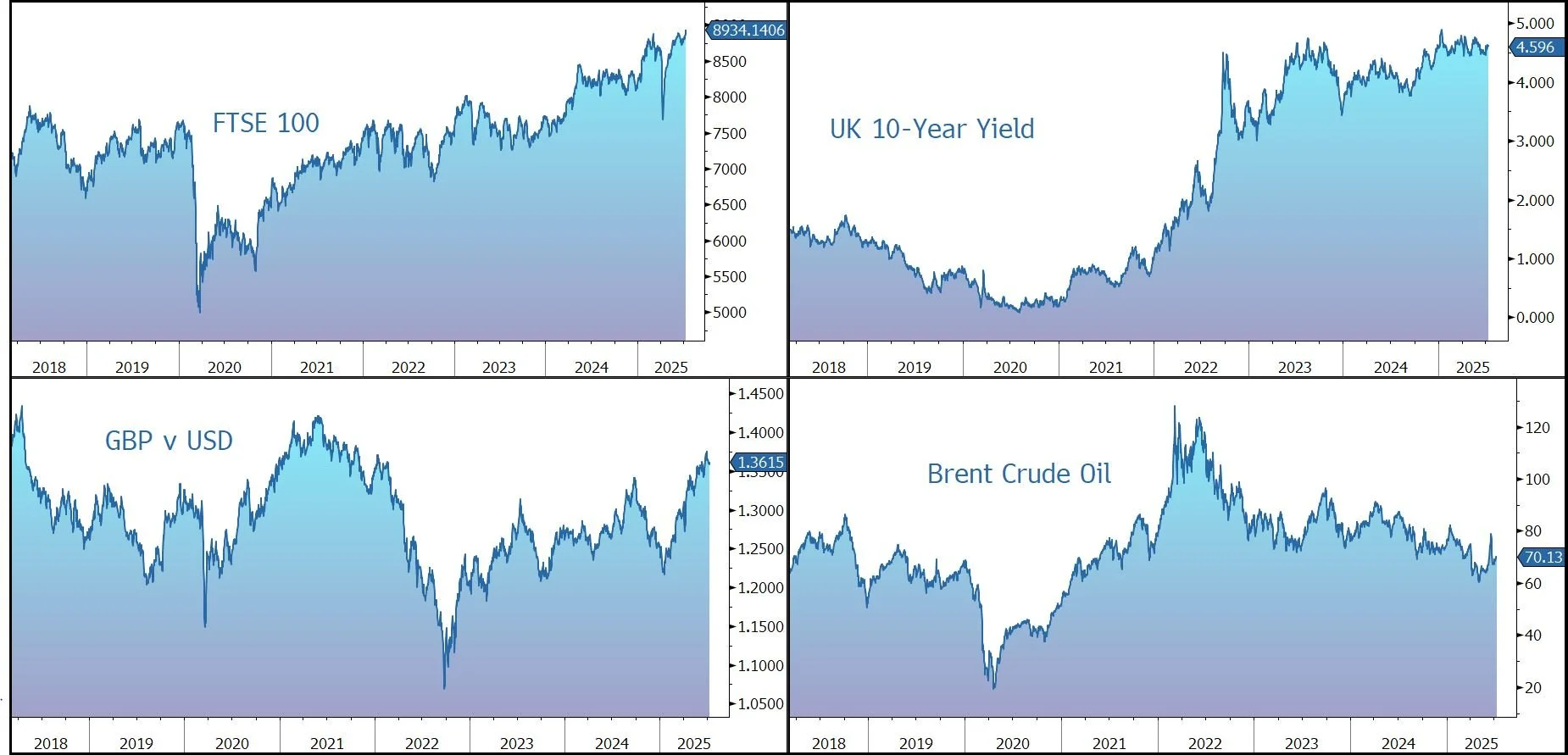

Federal Reserve officials are divided on the outlook for rates due to differing views on how tariffs might affect inflation, minutes of the June meeting showed. There is little support for interest rate cut later this month. The Treasury market rallied after an auction of 10-year notes drew strong demand, easing concerns that investors will balk at financing swelling US deficits. The 10-year currently yields 4.35%.

Brazilian assets fell after President Trump announced new tariff letters, including imposing 50% levy on goods from the country. The move risks a 1% hit to Brazil’s economy, Bloomberg Economics said.

The dollar slipped, while gold moved back above $3,300 an ounce. Bitcoin briefly topped $112k before drifting back. Brent Crude trades at around $70 a barrel as senior officials from Saudi Arabia, the UAE, and Kuwait backed OPEC+’s super-sized supply increase, saying the move was needed.

US equities rose last night – S&P 500 (+0.6%); Nasdaq (+0.9%) – driven higher by big tech as investors shrugged off the latest tariff moves.

In Asia this morning, markets were mixed: Nikkei 225 (-0.4%); Hang Seng (+0.7%); Shanghai Composite (+0.5%). A gauge of Chinese property shares surged 11% on speculation a high-level meeting will be held next week to support the sector.

The FTSE 100 is currently 0.9% higher at 8,934, while Sterling trades at $1.3610 and €1.1590. A closely watched gauge of demand from potential British homeowners climbed to its highest level in six months.

Source: Bloomberg

Company News

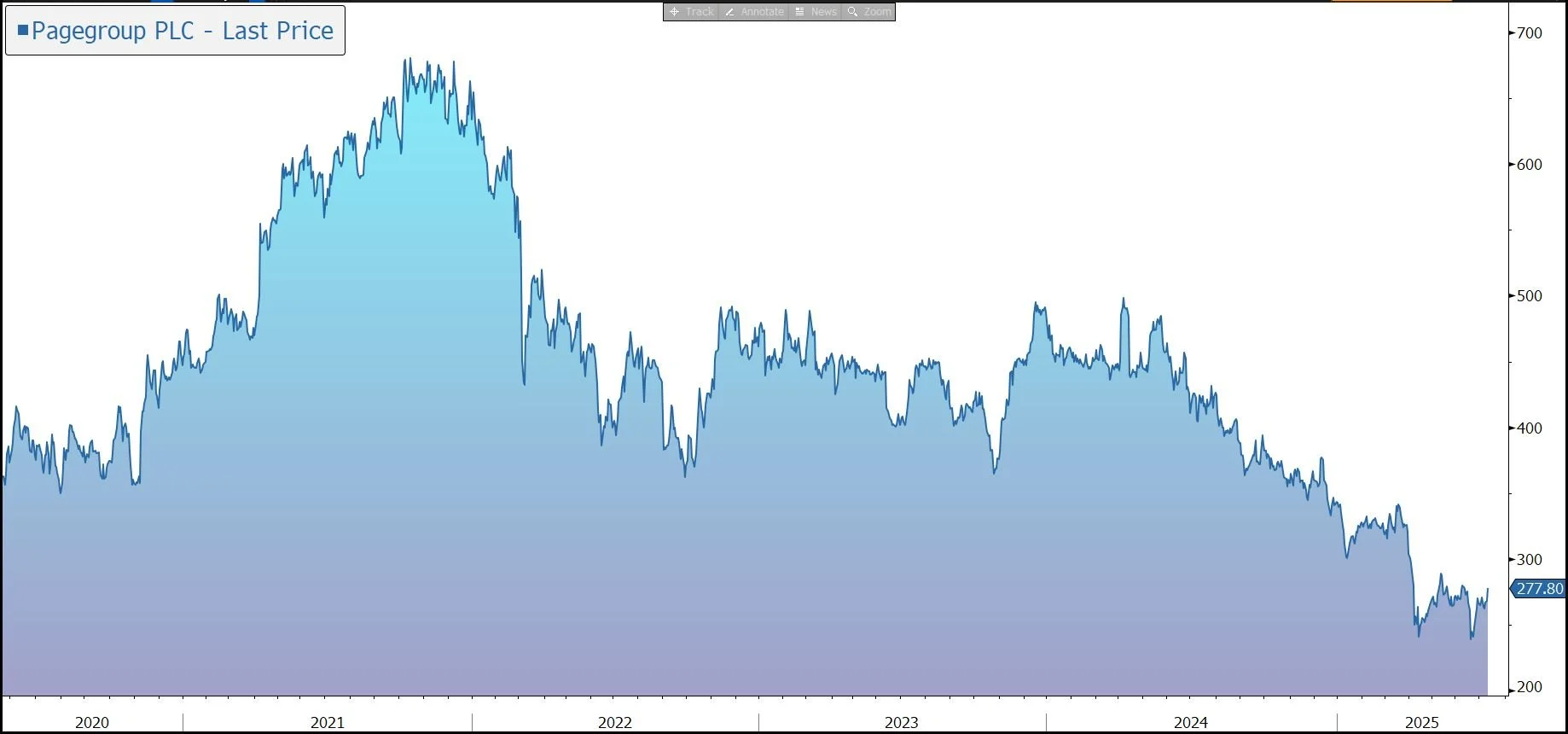

PageGroup (formerly Michael Page), the global recruitment company, has released its Q2 trading update which highlights ongoing weak performance amid market uncertainty. However, the group’s cost reduction programme is on track and full-year profit is expected to be broadly in line with current market consensus. In response, the shares have been marked up by 2% in early trading.

In the three months to 30 June 2025, gross profit fell by 10.5% in constant currency to £194.5m. This was a faster rate of decline than in the previous quarter, leaving profit in the first half down 9.7%.

The results are being driven by continued subdued levels of client and candidate confidence which is impacting decision making. The conversion of accepted offers to placements remained the most significant area of challenge, as ongoing macro-economic uncertainty extended time-to-hire. In addition, the levels of offers from clients to candidates remained relatively low, raising the opportunity for the current employer to counter-offer.

By geography, performance in the quarter was up in the Americas (+2.9%) and Asia Pacific (+0.6%) and down in EMEA (-17.1%) and the UK (-14.3%). The group saw a slight deterioration in activity levels and trading in Continental Europe, particularly in its two largest markets, France and Germany. However, the company saw some improvement in activity, trading, and customer confidence in Asia and the US.

The decline in permanent recruitment (-11.3%) outpaced temporary posts (-8.2%) as clients sought flexible options and permanent candidates remained reluctant to move jobs.

The cost reduction programme remains on track, with the group continuing to cut its headcount. Fee earners were down 133 (or 2.5%) to 5,163 during the quarter and the company continued to reallocate resources to the areas of the business with the most significant long-term structural opportunities, as well as ensuring it remained aligned to the activity levels the group is seeing in each of its markets. Non-operations headcount reduced by 3.2%.

Gross profit per fee earner, the group’s measure of productivity, declined by 3% compared to Q2 2024.

The group has a strong balance sheet, with net cash of £10m at the end of the quarter (vs. £57m a year ago), leaving plenty of flexibility.

Looking forward, the company expects 2025 operating profit to be broadly in line with current market consensus of c. £22m.

Source: Bloomberg